Understanding Tennessee Inheritance Laws

Let’s say you want to draft your will in Tennessee or you need to comprehend what it means to die intestate, conversely, then you have to understand the significant elements of these laws in order not only to uphold your wishes but also protect your family. Anyone who wants intel on how to estate plan or what they need when their family member dies must learn Tennessee inheritance laws as they are the ones that govern how assets will be shared postmortem (Meengs). In addition, one should be aware of their entitlements so that they do not get into unnecessary conflicts.

Key Concepts in Inheritance Laws

Just like we always prepare for an event or situation that will occur, let us first understand some important terms before looking at the Tennessee laws in depth.

- Intestate Succession: This refers to the distribution of assets when someone dies without a will.

- Testate Succession: This applies when a person dies with a valid will.

- Probate: The legal process through which a deceased person’s will is validated and their assets distributed.

- Executor: The person appointed to carry out the terms of the will.

Grasping such terminologies helps set a base for understanding the operation of inheritance in Tennessee.

Types of Wills Recognized in Tennessee

The state of Tennessee acknowledges various kinds of wills, each one having its own particularities inception and effects:

| Type of Will | Description | Requirements |

|---|---|---|

| Attested Will | A written document signed by the testator and witnessed by at least two individuals. | Must be in writing and signed by the testator and two witnesses. |

| Holographic Will | A handwritten will that does not require witnesses. | Must be signed by the testator and the material provisions must be in the testator’s handwriting. |

| Oral Will (Nuncupative Will) | A verbal declaration of the testator’s wishes, typically valid under specific conditions. | Only valid for personal property and must be witnessed by two individuals who are not beneficiaries. |

Different wills serve different purposes and might be more suitable based on individual circumstances. Consulting with a lawyer is essential to find out what would fit your needs best regarding estate planning.

Intestate Succession in Tennessee

In Tennessee, if a person dies without having made a valid will, the process of redistributing their estate is done in accordance with the laws of intestate succession. This means that there is a definite order of priority on who gets what and this aids in doing justice to the survived relations by enabling them to have equal shares in the property left behind by the decedent. It is important to know how this works in case your friend passes away without leaving behind any written testament.

In Tennessee, the order of inheritance is this way:

- Surviving Spouse: If there is a spouse, they generally inherit the majority of the estate, along with children.

- Children: If there are no surviving parents, siblings, or descendants of siblings, the children inherit equally.

- Parents: If there is no surviving spouse or children, the estate goes to the deceased’s parents.

- Siblings: If there are no spouse, children, or parents, siblings will inherit the estate.

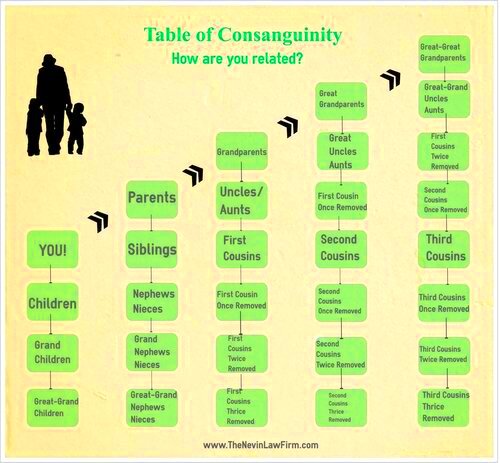

- Extended Family: If none of the above relatives exist, the estate may pass to more distant relatives, like grandparents or aunts and uncles.

The order prevailing is important for understanding, particularly when there exists complicated familial interactions or possibly disconnected heirs.

Rights of Spouses and Children

All the rights for inheritance by spouses and children are clearly stated in Tennessee. These rights indicate that some close relatives are given priority when distributing estates, which is consistent with the state’s commitment to family relations.

Here’s a clear explanation of their entitlements:

- Surviving Spouse Rights: The surviving spouse is entitled to a significant portion of the estate, which can include a share of any community property.

- Children’s Rights: Children inherit equally if there is no surviving spouse, ensuring fair treatment among siblings.

- Elective Share: A spouse can claim an elective share, which guarantees them a minimum percentage of the estate, regardless of what is stated in a will.

In gauging matters of lineage, it is chiefly requisite to comprehend these prerogatives; particularly where a will is either objected to or lacks altogether.

Probate Process in Tennessee

In Tennessee, probate is a legal process that confirms the will and manages distribution of properties. The Tennessee probate court will ensure that such person’s wishes are granted if there happens to be a will. Otherwise, an administrator will be appointed by the court to administer the estate according to intestate succession laws.

Below is a simple overview of the probate procedure:

- Filing the Will: The executor files the will with the probate court to initiate the process.

- Notifying Heirs: All potential heirs and beneficiaries must be notified of the probate proceedings.

- Inventorying Assets: The executor is responsible for identifying and valuing the deceased’s assets.

- Paying Debts and Taxes: Any outstanding debts and taxes must be settled before distributing assets.

- Distributing Assets: Finally, the remaining assets are distributed to beneficiaries as per the will or intestate laws.

Probate duration can be long as well as intricate, occasional months or even years for its conclusion. Thus, it is advisable to consult a lawyer in order to have the process run without difficulties and within the law.

Tax Implications on Inheritance

In Tennessee, comprehending the tax ramifications related to inheritance is very important. A number of individuals think that inheritance is free from taxes; however, certain factors should be taken into account. Although there is no state inheritance tax in Tennessee, heirs may still encounter other tax obligations.

–When it comes to inheritances, tax implications are important. Let’s take a look at some of them:

- Federal Estate Tax: If the deceased’s estate exceeds the federal exemption threshold (currently around $12 million), the estate may be subject to federal estate tax before distribution to heirs.

- Income Tax: Generally, inherited property or assets are not considered taxable income. However, if the inherited assets generate income (like dividends or rental income), that income will be taxable.

- Capital Gains Tax: If beneficiaries sell inherited property, they may be liable for capital gains tax based on the property’s value at the time of the deceased’s death rather than the original purchase price.

Taxes might bring about some uncertainties especially after death but if you understand how they work then you will be able to prepare yourself for them and save yourself from the burdens they may cause on your finances when an individual close to you dies.

Frequently Asked Questions about Inheritance Laws

Inheriting can be a tricky business, and quite naturally, people have questions. The following are answered queries that can help you in understanding Tennessee inheritance laws:

| Question | Answer |

|---|---|

| What happens if someone dies without a will? | The estate will be distributed according to Tennessee’s intestate succession laws. |

| Can a will be contested? | Yes, interested parties can contest a will based on factors like lack of capacity or undue influence. |

| How long does the probate process take? | It can take several months to a few years, depending on the complexity of the estate. |

| Are there any estate taxes in Tennessee? | Tennessee does not impose a state inheritance tax, but federal estate tax may apply for large estates. |