Understanding How Common Law Indemnity Works in Florida

When dealing with disputes the idea of indemnity frequently comes into play. In Florida common law indemnity holds importance in specific legal situations. While this concept may appear intricate grasping it can greatly influence the way responsibilities and obligations are handled between parties. Picture yourself in a conflict worrying about who should take on the costs. Common law indemnity might provide a solution by offering a method to address these matters. Lets explore in more detail how this principle operates in the Sunshine State.

Defining Common Law Indemnity

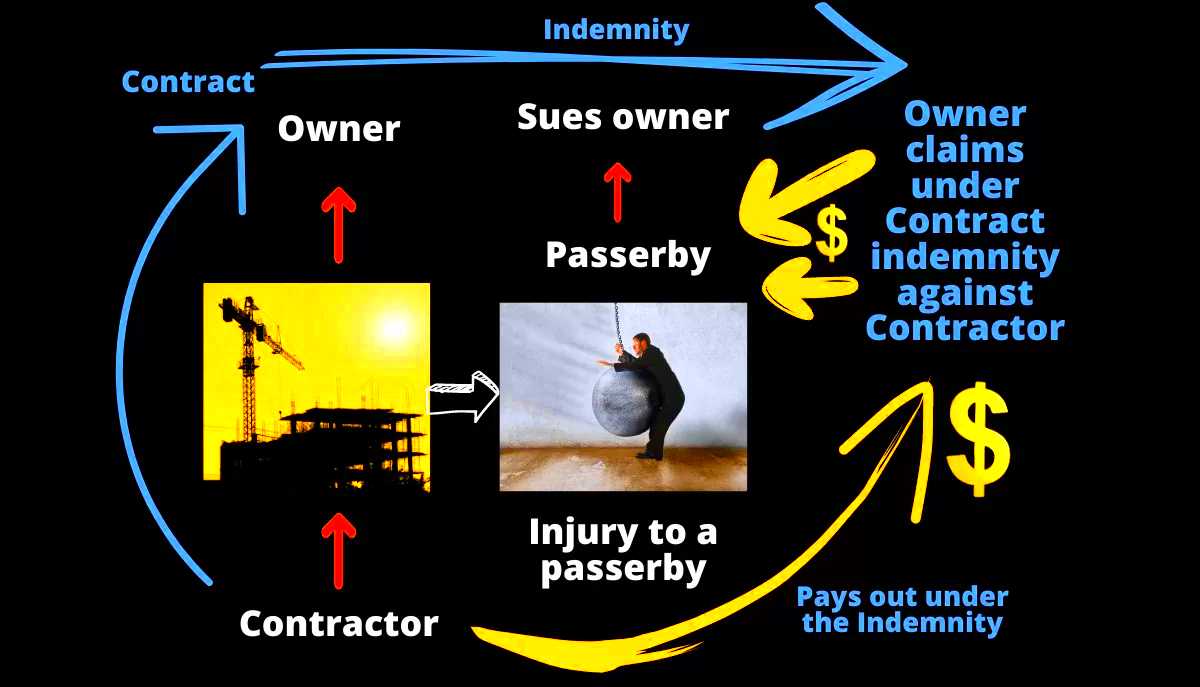

Indemnity is a rule that lets one party pass on the financial responsibility of a liability to another party. Think of it as a cushion for those who end up covering expenses that should really be shouldered by someone else. Let me explain it in more detail.

- What It Is: Common law indemnity is a way for one party to be compensated by another for damages or losses incurred, especially when the second party is deemed to be primarily responsible.

- Where It Comes From: This principle has its roots in common law, evolving over time through judicial decisions rather than written statutes.

- Application: It typically applies in scenarios where there is a contractual or legal relationship between parties, and one is found to be more liable than the other.

To illustrate if a business is held liable for a flaw in a product it acquired from a vendor common law indemnity could enable the business to request compensation from the supplier. The focus is on justice and making sure that the party genuinely responsible for the wrongdoing bears the expenses.

Key Principles of Common Law Indemnity

To understand how common law indemnity works, it’s important to grasp a few key principles that shape its operation.

- Primary and Secondary Liability: The principle relies on the idea of primary versus secondary liability. The party with primary responsibility bears the main liability, while the secondary party, who is found to be less at fault, may seek indemnity.

- No Fault Required: Unlike some legal doctrines, common law indemnity does not require the indemnitor (the party seeking reimbursement) to be at fault. It’s about who should ultimately bear the cost.

- Legal and Contractual Context: This principle often applies in both legal and contractual contexts. For instance, in construction disputes, a subcontractor might seek indemnity from a general contractor if a problem arises from the subcontractor’s work.

- Equitable Remedy: Indemnity is considered an equitable remedy, meaning it aims to achieve fairness between the parties involved. It’s not just about following rules but ensuring that justice is served.

These guidelines establish a structure for assessing and determining indemnity claims. Gaining insight into these core concepts can help you navigate the intricacies of legal conflicts related to indemnity more effectively.

How Common Law Indemnity Applies in Florida

In the bright state of Florida the concept of common law indemnity plays a role that can shed light on the intricacies of legal conflicts. Imagine a situation where a property owner faces a lawsuit because of a botched installation carried out by a contractor. This is where common law indemnity steps in providing a way for the property owner to seek compensation from the contractor who bears the responsibility. The implementation of this principle is subtle, showcasing Floridas approach to striking a balance, between fairness and legal responsibility.

In Florida common law indemnity usually works like this

- Liability Shifts: If a party ends up paying damages because of another’s negligence or fault, they can seek indemnity to recover those costs. For instance, a business sued for a product defect might turn to its supplier for indemnity.

- Contractual Relationships: Many indemnity claims arise from contractual relationships. Florida courts often look at the terms of the contract to determine if indemnity is warranted, especially if the contract specifies the indemnity obligations.

- Legal Precedents: Florida’s legal precedents play a significant role in shaping how indemnity claims are evaluated. Cases that have come before the courts provide a roadmap for how similar situations might be handled in the future.

It’s worth mentioning that although common law indemnity provides a way to address issues it’s not a one size fits all answer. The details of each situation and the dynamics between the parties involved will play a role in determining how indemnity is enforced.

Examples of Common Law Indemnity in Practice

To really understand the ins and outs of common law indemnity lets take a look at some examples from Florida that highlight how it comes into play. These real life situations can help shed light on the concept and showcase its real world impact.

- Construction Disputes: Imagine a contractor hired to remodel a house. If the contractor’s work leads to a structural failure, the homeowner might be held liable if the failure causes damage. The homeowner could then seek indemnity from the contractor, arguing that the contractor should bear the primary responsibility.

- Product Liability: Consider a retailer who sells a defective appliance. If the consumer sues the retailer for damages, the retailer might seek indemnity from the manufacturer of the appliance, who is actually responsible for the defect.

- Insurance Claims: An insurance company that pays out a claim for damage caused by a third party might use common law indemnity to recover the costs from the party responsible for the damage.

These instances illustrate the significance of common law indemnity in transferring financial liability and ensuring that the party truly at fault is held responsible. Each situation presents its own distinct circumstances and connections adding an element of creativity and precision to the use of indemnity.

Legal Requirements for Seeking Indemnity in Florida

In Florida seeking indemnity involves more than just making a request. There are certain legal criteria that need to be fulfilled. Navigating through these criteria can resemble piecing together a jigsaw puzzle, but grasping them is crucial for a claim.

Lets take a moment to delve into the key points you should be aware of.

- Proving Primary Liability: The party seeking indemnity must demonstrate that they are not primarily responsible for the damages or losses. Essentially, they need to show that the fault lies with another party.

- Contractual Basis: If indemnity is based on a contract, the terms of the contract must be clear and specific. Florida courts will examine these terms closely to determine if indemnity is justified.

- Timely Filing: There are statutes of limitations that dictate how long you have to file a claim for indemnity. Failing to file within the required timeframe can result in the claim being barred.

- Documenting Expenses: The party seeking indemnity must provide evidence of the expenses or damages incurred. Proper documentation is crucial to substantiate the claim and show that the indemnity amount is reasonable.

Grasping these prerequisites can greatly impact the result of an indemnity claim. It involves adhering to criteria and putting forth a persuasive argument that resonates with Floridas legal system.

Challenges in Pursuing Common Law Indemnity Claims

Seeking a common law indemnity claim in Florida can be a bit like finding your way through a complex maze full of twists and turns. Although this principle provides a route to transfer financial responsibilities there are numerous obstacles that often come up. Let’s take a closer look at some of these challenges and their potential impact on your case.

- Proving Liability: One of the biggest challenges is proving that the other party is primarily responsible. This can be particularly difficult in complex cases where fault is not clear-cut. For instance, in a construction defect case, determining whether the defect was due to poor workmanship or material failure can be intricate.

- Documenting Costs: To claim indemnity, you need to show detailed documentation of the costs or damages you’ve incurred. Gathering and presenting this evidence can be time-consuming and requires meticulous record-keeping.

- Legal and Contractual Complexities: Understanding and interpreting contracts can be daunting. Often, indemnity clauses are embedded within complex legal documents. Misinterpreting these terms can lead to denial of the claim or prolonged disputes.

- Statute of Limitations: There are strict deadlines for filing indemnity claims. If you miss these deadlines, your claim could be dismissed, no matter how valid it might be.

Navigating these hurdles calls for thoughtfulness and frequently the guidance of legal experts. Its essential to tackle your case with a well defined plan and a comprehensive grasp of the legal and factual elements at play.

How to Navigate the Indemnity Process

Starting the journey can feel like a task but by taking the approach you can simplify the process and boost your odds of achieving a positive outcome. Here’s a breakdown to assist you in finding your way through.

- Assess the Situation: Begin by evaluating the circumstances that led to the indemnity claim. Identify the primary party at fault and gather all relevant documents and evidence that support your claim.

- Review Contracts: Examine any contracts or agreements related to the dispute. Look for indemnity clauses and understand their implications. If needed, consult with a legal expert to interpret these terms accurately.

- Document Everything: Collect and organize all records of expenses, damages, and communications related to the indemnity claim. Proper documentation is essential for substantiating your claim.

- Seek Legal Advice: Consider consulting with a lawyer who specializes in indemnity claims. They can provide valuable guidance, help you navigate legal complexities, and represent your interests effectively.

- File the Claim: Prepare and file your indemnity claim within the statutory deadlines. Ensure that all necessary documents are included and that the claim is properly articulated.

- Follow Up: Stay engaged with the process by following up on your claim. Respond promptly to any requests for additional information or documentation from the involved parties or the court.

By carefully adhering to these procedures you can streamline the process and enhance your chances of achieving a positive result.

Frequently Asked Questions

When it comes to the topic of common law indemnity there are often questions that come up. To shed light on some of the common concerns here are a few frequently asked questions.

- What is the difference between indemnity and insurance? Indemnity involves shifting the financial burden from one party to another based on liability, while insurance provides a pre-arranged financial safety net for a range of risks.

- Can I claim indemnity if I am partially at fault? Yes, common law indemnity can still apply if you are partially at fault, as long as you can prove that the primary responsibility lies with another party.

- How long do I have to file an indemnity claim? The statute of limitations for filing an indemnity claim in Florida varies depending on the nature of the claim, but it’s generally around four years from the date of the incident.

- What if the indemnity claim is denied? If your claim is denied, you have the option to appeal the decision or negotiate a settlement. Seeking legal advice can help you understand your options and next steps.

- Do I need a lawyer to file an indemnity claim? While it’s possible to file a claim without a lawyer, having legal representation can significantly improve your chances of success, especially in complex cases.

These responses aim to clarify the intricacies of indemnity claims shedding light on their key elements and providing you with more assurance as you navigate the process.

Conclusion

As I think about the complexities of common law indemnity it becomes evident that this legal concept goes beyond simply transferring financial burdens; it’s rooted in fairness and upholding justice in challenging conflicts. Whether you’re a homeowner facing construction challenges a business dealing with product liabilities or an individual entangled in contractual complexities grasping the workings of indemnity in Florida can offer valuable insight. Although the path may appear overwhelming with the mindset and some determination you can navigate through the maze of laws hopefully emerging with the outcome you rightfully deserve.