Adjusting Commission Pay Laws in California

In California, commission compensation is essential in a variety of professions especially for sales and related sectors. It acts as a motivation for workers to give in their best during the sales process. For instance, commission pay enables one to acquire other sums of money for every product sold or bought by them. This arrangement could be advantageous to the employer and the employee by guiding towards hard work on the side of employees while at the same increasing returns of the company hence increasing its profitability. Nevertheless, it is important for both employers and employees to understand how law regulates commission pay, so that they can both follow it as per make sure of fairness towards each other.

Key Elements of California Commission Pay Laws

In California, commission pay is regulated by specific statutes that all organizations must ensure they comply with. The following are some important components:

- Written Agreement: Employers must provide employees with a clear, written commission agreement outlining how commissions are calculated and paid.

- Payment Timing: Commissions must be paid according to the agreed-upon schedule, typically upon the sale’s completion.

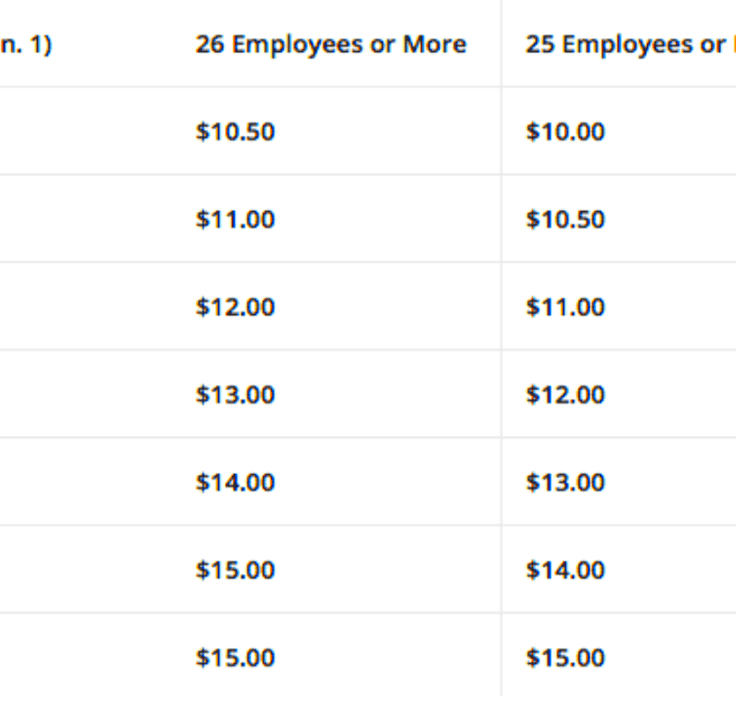

- Minimum Wage Consideration: Employers must ensure that commission pay, when combined with base pay, meets California’s minimum wage standards.

- Commission Structure: Employers can choose various commission structures, including percentage-based, tiered, or flat-rate commissions.

- Termination and Commission Payment: Employees are entitled to receive any earned commissions, even if their employment ends before payment.

Determining the Commission Structure

Selecting the from the most suitable commission structure for both the employer and employee is paramount. Some of the most popular structures include:

| Commission Structure | Description |

|---|---|

| Percentage-Based Commission | Employees earn a percentage of the sales they make. This is the most common structure. |

| Tiered Commission | Commission rates increase as sales goals are met, incentivizing higher performance. |

| Flat Rate Commission | Employees earn a fixed amount for each sale, regardless of the sale’s total value. |

In calculations for commission structure, factors such as industry norms, incentive needs by employees, financial ability of the organization are very important.Try engaging workers when it comes down to what they prefer so that there can be an improvement in the atmosphere under which they work and end results.

Impact of California Labor Laws on Commission Pay

How a commission is established and administered is greatly influenced by California labor statutes. They are designed to promote workers’ rights and therefore equitable payment schemes. It’s important for employers as well as those that work for them to realize that these laws have an impact on the structure of commissions. California labor statutes dictate things ranging from minimum wage compliance, to the timing of commissions, thus giving rise to commission structures throughout the state.

The following are some essential effects of California labor regulations on commission compensations:

- Minimum Wage Compliance: Employers must ensure that commissions, when combined with base wages, meet California’s minimum wage requirements. This means that if a salesperson’s commissions don’t add up to the minimum wage, employers may need to supplement their income.

- Accurate Payment Timelines: Labor laws dictate when commissions should be paid. Employers are obligated to pay commissions according to the terms specified in the written agreement, often immediately after a sale is finalized.

- Written Agreements Requirement: To comply with California law, employers must provide a written agreement outlining the commission structure. This ensures transparency and helps prevent disputes over commission payments.

- Final Paychecks: Upon termination, employees are entitled to receive any earned but unpaid commissions, further safeguarding their financial interests.

Employers’ Responsibilities Regarding Commission Pay

The state of California imposes various obligations on employers when it comes to handling commission payment. Employers need to understand these responsibilities well in advance in order to avoid legal complications. The main responsibilities include:

- Drafting Clear Commission Agreements: Employers must create detailed written agreements that outline how commissions are calculated, the payment schedule, and any conditions that must be met for commission eligibility.

- Ensuring Compliance with Labor Laws: Staying informed about California labor laws is critical. Employers must ensure that their commission structures comply with minimum wage laws and other relevant regulations.

- Timely Payments: Employers must pay commissions promptly and according to the terms specified in the agreement. Delays can lead to disputes and potential legal repercussions.

- Training for Management: Providing training for management on commission pay laws can help ensure that policies are implemented correctly and consistently.

Employee Rights Under California Commission Pay Laws

In California, employees have a unique set of rights regarding commission payment and understanding these laws is essential in order to receive equitable treatment at work places. Below are some major rights in details:

- Right to a Written Agreement: Employees have the right to receive a clear and detailed written commission agreement, which outlines how their commissions will be calculated and paid.

- Right to Earned Commissions: Employees are entitled to receive any commissions they have earned, even if their employment ends before payment is made.

- Right to Fair Compensation: When commissions are included, total earnings must meet California’s minimum wage requirements, ensuring that employees are compensated fairly.

- Right to Address Disputes: Employees have the right to raise any concerns or disputes regarding commission payments without fear of retaliation from their employer.

Acknowledging these rights give workers the strength in self-advocacy and fairness while they work. A clear commission pay system enhances communication between workers and bosses, thus benefiting them both.

Common Disputes Related to Commission Pay

Considerable disagreements occasionally take place between workers and bosses with regards to commission payments. It is vital that one understands such frequent issues in order to avert misinterpretation and encourage an affirmative environment at work. Several causes may lead to quarrels, for example, structure of commission, payment schedule or comprehension of the written contract.

Listed below are usual quarrels that can arise:

- Unclear Commission Agreements: If the commission agreement lacks clarity, employees might believe they are entitled to more than what employers intended. This often leads to disagreements over commission amounts and eligibility.

- Payment Timing Issues: Disputes may arise if commissions are not paid according to the agreed-upon schedule. Delays in payment can create frustration and distrust.

- Calculation Discrepancies: Employees may question how their commissions are calculated, especially if the calculation method is not explicitly outlined. Misunderstandings regarding percentage rates or tiers can lead to conflict.

- Commission Eligibility After Termination: There can be disagreements about whether employees are entitled to commissions on sales that were finalized after their termination, creating tension during exit processes.

Open communication and proactive clarification of commission structures can help prevent these conflicts, resulting in a more peaceful workplace.

FAQ About Commission Pay Laws in California

The complex nature of commission payment laws often leaves both employees and employers asking questions about them. Below are the frequently asked questions regarding California’s commission payment laws:

- What must be included in a commission agreement?

A commission agreement should include the commission rate, payment schedule, and any conditions for earning commissions. - Are commissions considered wages?

Yes, in California, commissions are considered part of an employee’s wages and are subject to the same labor laws. - When should commissions be paid?

Commissions should be paid according to the timeline specified in the written agreement, typically upon the completion of the sale. - Can an employer change the commission structure?

Yes, but they must inform employees of any changes and provide a revised written agreement. - What happens to unpaid commissions if an employee is terminated?

Employees are entitled to any earned but unpaid commissions, even after their employment ends.

Conclusion on Adjusting Commission Pay Laws

In order for companies and employees to take part in the government of California, it is necessary they have knowledge of how commission compensation operates. Organizations can set fair payment methods by being aware of the essential parts of commission systems as well as adhering to labor regulations. In order to avoid misunderstandings and keep everybody on board, open communication and unambiguous written contracts must be provided.

In this ever-changing world of workforce, it is important to keep up with the modifications in commission pay laws so that everyone adheres to them in a fair manner. Thus, both sides should collaborate towards putting in place commission structures which are not only performance-related but also take into account employee’s rights and user needs. Knowing the laws inside out will help both employers and employees be able to handle everything surrounding commissions without any doubts.