Texas Business Regulations Explained

TX aureates along with its brisk commerce, thespians or corporations from different regions of the United States have been invited to settle here. Nevertheless, establishing an enterprise and running it in Texas is associated with dealing with a maze of regulations that one must be aware of so as to comply with and evade legal entanglements. This article will analyze significant aspects of Texas business regulations ranging from licensing requirements to tax obligations for proper operation of your business.”

Understanding Business Licensing Requirements in Texas

The essential licenses and permits are imperative for any business in Texas. Business structure and industry often determine the kind of license you require. This is a summary of the principal licensing groups:

- State Licenses: Many professions in Texas require state licenses, such as contractors, health professionals, and real estate agents.

- Local Permits: Depending on your city or county, you may need local permits for zoning, health, or safety compliance.

- DBA Registration: If you’re operating under a name different from your legal business name, you must file a “Doing Business As” (DBA) certificate.

You should check with the Texas Secretary of State and local authorities for all necessary licenses to operate legally.

Exploring Business Taxes in Texas

Texas is known as one of the best tax states for businesses, but it’s important to grasp your tax responsibilities. The following are some of the primary taxes that business owners in Texas must be conscious of.

| Tax Type | Description |

|---|---|

| Franchise Tax | This is a tax on the revenue of businesses operating in Texas, applicable to most entities. |

| Sales and Use Tax | A tax on the sale of goods and services. Businesses must collect this tax from customers. |

| Property Tax | Tax on real and personal property owned by businesses, collected by local governments. |

Not like Massachusetts, which has no payroll tax but similar past raw upward governance, Texas firms must mind their payables to evade penalties under such taxes. In order to guarantee compliance and enhance your tax plan, reach out to a tax consultant for assistance.

Complying with Employment Laws in Texas

Being a business owner in Texas makes it very important that you understand and adhere to the laws governing employment so as to ensure equity at the workplace and avoid problems with the law. Employment laws in Texas regulate different areas of work including the hiring practices, workplace safety, among others. This knowledge will assist you in developing a strong and compliant workforce.

Below are a few crucial employment statutes in Texas that all entrepreneurs need to know about:

- Wage and Hour Laws: Texas follows the Fair Labor Standards Act (FLSA), which sets minimum wage and overtime pay regulations. Make sure to pay employees at least the state minimum wage and compensate them for overtime work.

- Workplace Discrimination: Texas prohibits discrimination based on race, color, religion, sex, national origin, age, disability, and genetic information. Ensure your hiring and workplace practices are inclusive and fair.

- Workers’ Compensation: Texas does not require all employers to provide workers’ compensation insurance, but it’s a good practice to protect your employees in case of work-related injuries.

Through continuing instruction and well-defined guidelines, you will maintain adherence to these regulations; thereby ensuring an amicable atmosphere within which your workers can perform their duties.

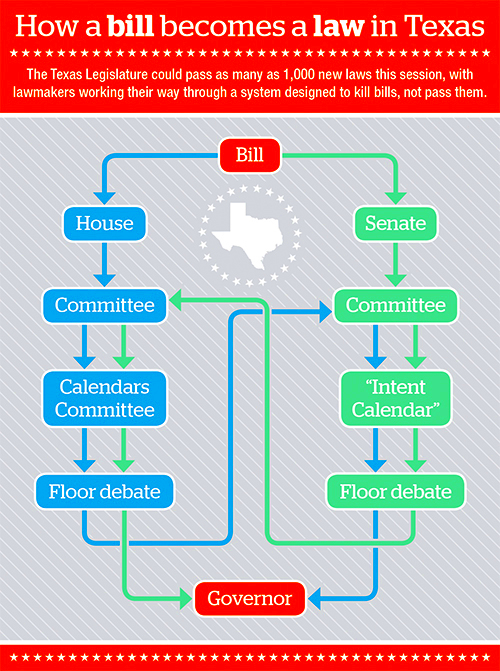

Navigating Business Entity Formation in Texas

In Texas, it is important for every entrepreneur to choose the appropriate business structure. Several legal requirements are involved in the formation process and every type of business entity has its own advantages and disadvantages. Knowing what you have gives you an edge in determining which option suits your business best.

In Texas, the most frequently seen kinds of business entities are:

| Entity Type | Description |

|---|---|

| Sole Proprietorship | A simple structure where one individual owns and operates the business, with complete control but personal liability. |

| Partnership | A business owned by two or more individuals who share profits, losses, and management responsibilities. |

| Limited Liability Company (LLC) | A flexible structure that offers liability protection for owners while allowing pass-through taxation. |

| Corporation | A separate legal entity that provides the highest level of liability protection but involves more regulations and formalities. |

One must choose the class of entity to be used before the right forms are submitted with the Texas Secretary of State’s office, and some local permits may also be required. Consulting an attorney is advisable so that she can guide you in filling out the formation requirements accurately.

Examining Health and Safety Regulations for Texas Businesses

In every business unit, it’s very fundamental that a safe working environment be maintained. The state of Texas is home to some laws governing health and safety measures targeting the various hazards at work. These regulations are meant to ensure the safety of employees, which in return will promote their well-being as well as save you from incurring unnecessary expenses due to violating them.

Health and safety regulations that are important to consider include:

- Occupational Safety and Health Administration (OSHA): Employers must comply with OSHA standards, which require maintaining a safe workplace, providing proper training, and keeping records of workplace injuries.

- Emergency Action Plans: Businesses with ten or more employees must develop an emergency action plan outlining procedures for emergencies like fires or natural disasters.

- Hazard Communication Standard: Employers must inform employees about hazardous chemicals they may encounter and provide safety data sheets.

To comply with these regulations, regular audits and safety training can be helpful. Not only does a safe workplace safeguard your workers, but it also contributes to increased productivity and better morale.

Understanding Environmental Regulations Affecting Texas Businesses

In Texas, environmental regulations are important for preservation of natural resources and at the same time they help businesses to prosper. Whether your business is a small retail outlet or a huge manufacturing plant, it is important that you know about the environmental laws which may affect your operations. Compliance with these regulations not only protects the environment but also improves the reputation of your business.

As a matter of fact, there are some critical environmental rules that you should know if you are running a business in Texas:

- Clean Air Act: This federal law, along with Texas regulations, aims to control air pollution. Businesses may need to obtain permits if their operations emit pollutants.

- Clean Water Act: This act regulates discharges of pollutants into waters, requiring businesses to obtain permits if their activities impact water bodies.

- Waste Management Regulations: Businesses must follow regulations regarding the disposal of hazardous and non-hazardous waste to prevent contamination of land and water.

In addition, Texas has its own environmental agencies such as the Texas Commission on Environmental Quality (TCEQ) which is responsible for enforcing state regulations. Your dedication to sustainability can be demonstrated through regular audits and environmental education programs that are meant to guarantee adherence.

Frequently Asked Questions about Texas Business Regulations

Beginning and operating a business in Texas may come up with various questions, especially related to regulations. Here are some typical FAQs that could assist in solving your problems:

| Question | Answer |

|---|---|

| Do I need a business license in Texas? | Yes, most businesses need a license. Check with the Texas Secretary of State and local authorities for specific requirements. |

| What are the tax obligations for Texas businesses? | Businesses may need to pay franchise tax, sales tax, and property tax, depending on their structure and operations. |

| How do I form an LLC in Texas? | You’ll need to file a Certificate of Formation with the Texas Secretary of State and obtain any necessary permits. |

| What are my obligations regarding workplace safety? | Employers must comply with OSHA standards and create a safe work environment, including providing safety training and emergency plans. |

Conclusion on Texas Business Regulations

If you want your business to function legally and effectively in Texas, then you have to get acquainted with Texas business regulations which can be overwhelming. This includes understanding what licenses are needed as well as abiding by environmental and labor laws. The information is critical because all regulations contribute to creating a conducive environment for businesses and fostering growth.

As someone starting their entrepreneurship journey in Texas, it is wise to note that compliance entails more than just steering clear of penalties; but rather establishing trust amongst clients and workers. A more prosperous and sustainable enterprise can be realized by delving into these guidelines and adhering to them following which an individual would invest both time and resources. Chicago natives or any other citizens from around this part of US should not hesitate to make use of these seasoned professionals who understand the details of Texas business legislation whenever they become unsure about anything.