BWW Law Group Foreclosure Sales Process

Foreclosure sales hold importance for both homeowners and prospective buyers. If a homeowner fails to meet their mortgage obligations the lender may start foreclosure actions to recoup the outstanding amount. This procedure results in the sale of the property typically via an auction. Knowing how this works is essential whether you’re dealing with foreclosure or seeking to acquire a property through an auction.

Foreclosure sales go through different phases, each carrying its own significance. This journey can be challenging for homeowners while offering distinct prospects for potential buyers. Homeowners should be aware of the effects of foreclosure on their finances and consider possible solutions. On the hand buyers who grasp the intricacies of these sales can make choices and potentially acquire a property at a cost.

Based on my observations I’ve witnessed the profound impact foreclosure can have on families. It goes beyond a legal issue; it’s an emotional rollercoaster. Staying informed can help alleviate the pressure and result in more favorable outcomes for everyone involved.

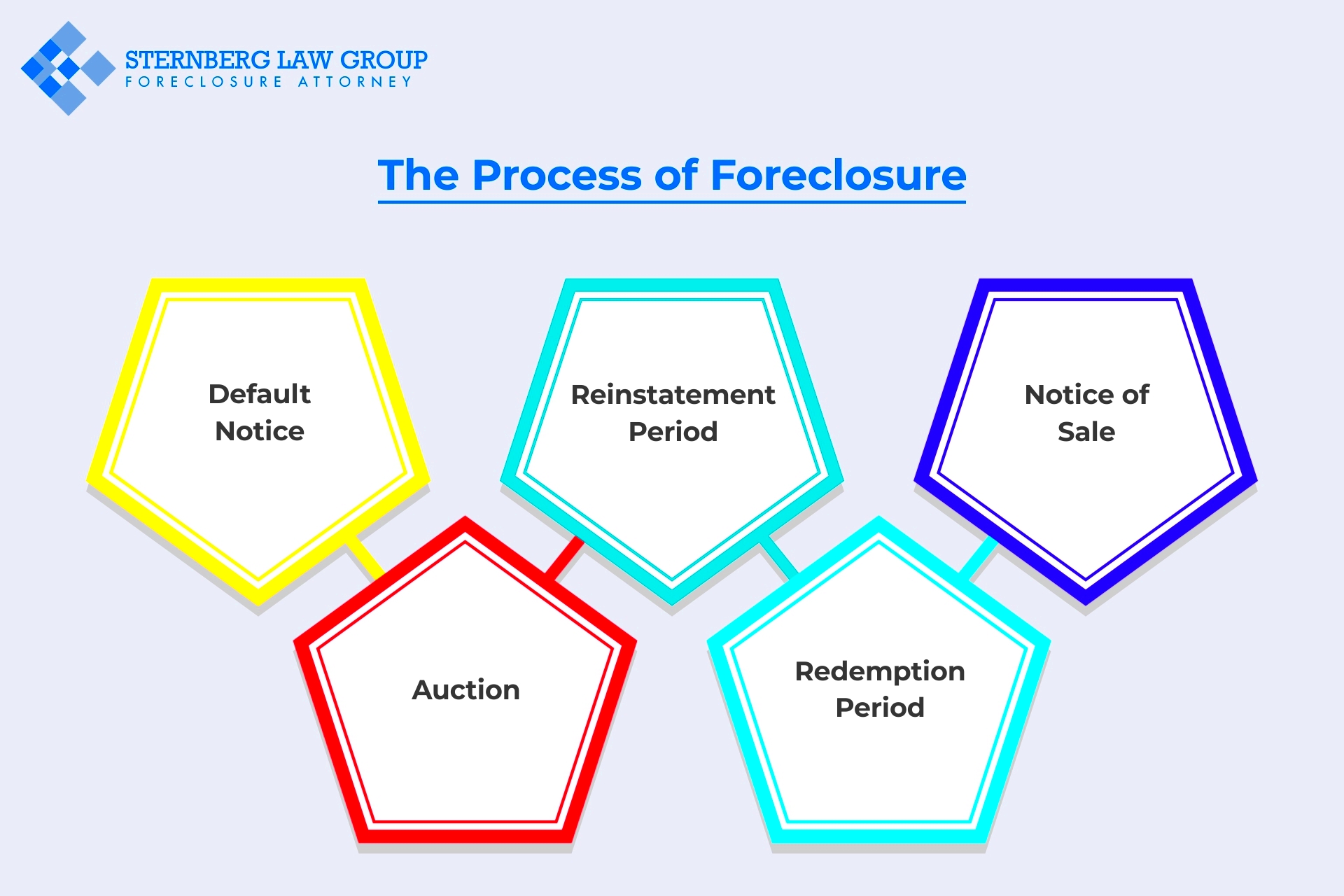

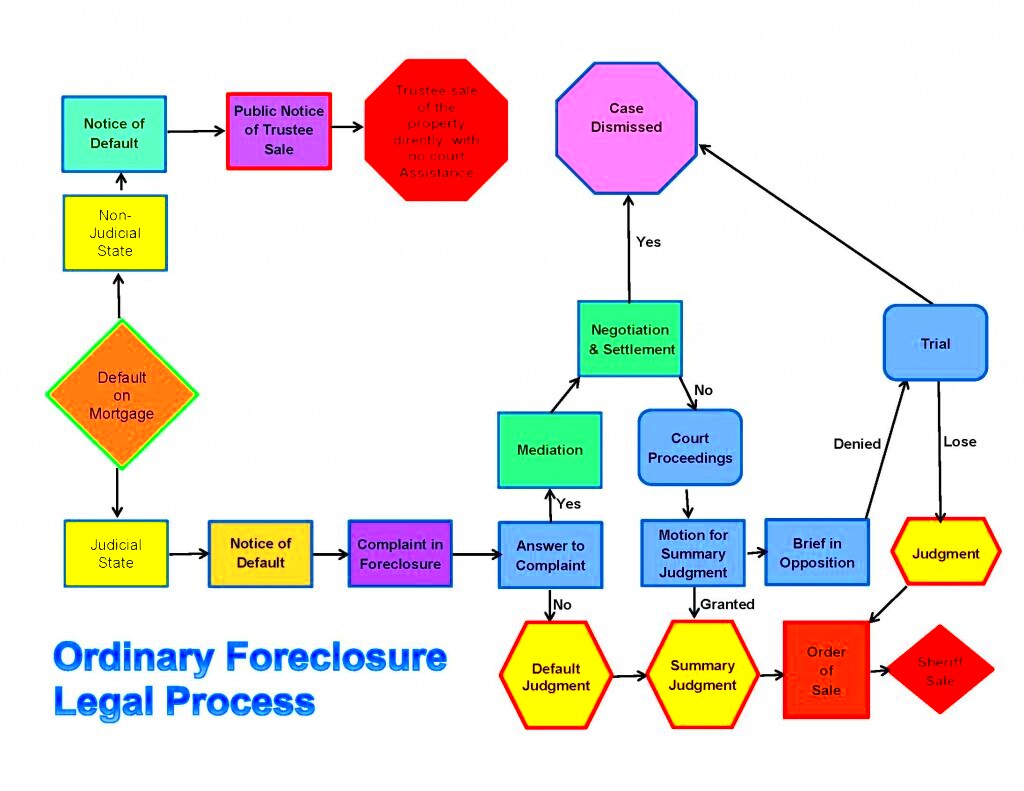

Steps in the Foreclosure Process

The process of foreclosure usually happens in steps.

- Pre-Foreclosure: The homeowner misses mortgage payments, and the lender issues a notice of default. This period often involves attempts to resolve the issue outside of court.

- Foreclosure Filing: If no resolution is reached, the lender files a foreclosure lawsuit. The court then schedules a foreclosure auction.

- Auction: The property is auctioned to the highest bidder. If no one bids or the bids are insufficient, the property may revert to the lender.

- Post-Foreclosure: The winning bidder or lender takes possession of the property, and the previous homeowner must vacate.

Based on my encounters with foreclosure situations I’ve noticed that grasping every aspect can greatly influence the result. Its crucial for homeowners to take action and seek counsel promptly to consider all possibilities before getting to the auction phase.

Role of BWW Law Group in Foreclosure Sales

BWW Law Group is involved in the foreclosure sales process. They act on behalf of lenders during foreclosure cases making sure that all legal obligations are fulfilled and that everything runs smoothly.

Their responsibilities include:

- Filing Foreclosure Notices: They handle the legal paperwork required to start the foreclosure process.

- Representing Lenders: They act on behalf of lenders throughout the foreclosure process, from filing to the auction.

- Ensuring Compliance: They ensure that all legal procedures are followed correctly, minimizing the risk of errors.

Engaging BWW Law Group can simplify the foreclosure procedure from a standpoint. Their knowledge aids in steering clear of challenges and ensuring a seamless progression of the process. In my observation their participation tends to lead to a foreclosure process that is more structured and effective, for both lenders and prospective purchasers.

Legal Considerations for Homeowners

If you’re a homeowner dealing with foreclosure it’s really important to grasp the legal aspects involved. Foreclosure isn’t a matter; it’s also a fight that can have an impact on your future. When you get a notice of default it’s crucial to be aware of your rights and choices. You may feel swamped by the situation but taking actions can assist in safeguarding your interests.

Here are some key legal considerations:

- Review Your Mortgage Agreement: Examine the terms of your mortgage to understand your obligations and any clauses related to foreclosure.

- Know Your Rights: Each state has its own foreclosure laws. Familiarize yourself with these to ensure you’re treated fairly.

- Seek Legal Advice: Consulting a foreclosure attorney can provide clarity and help you explore options like loan modifications or bankruptcy.

- Understand the Timeline: Foreclosure processes vary by state, so knowing the timeline can help you make informed decisions.

Based on what I’ve witnessed I understand the importance of homeowners staying informed and taking action. The pressure of facing foreclosure can be intense but having access to information and assistance can really make a difference. It’s similar to sailing through waters being aware of the path can help you stay buoyant.

Understanding the Auction Process

How to Prepare for a Foreclosure Sale

Getting ready for a foreclosure sale can be quite a challenge. Whether you’re a homeowner navigating the process or a buyer looking to seize an opportunity at an auction being well prepared is crucial. I’ve witnessed how careful planning can significantly impact these situations, with a lot on the line.

To get ready in a way, consider following these steps

- Research the Property: For buyers, thorough research is crucial. Inspect the property, review its history, and assess its condition. Homeowners should understand their property’s market value to gauge what to expect.

- Understand the Auction Details: Know the date, time, and location of the auction. Familiarize yourself with the bidding process and any registration requirements.

- Get Your Finances in Order: Ensure you have your finances sorted out. Buyers should arrange for pre-approval or proof of funds, while homeowners might want to explore financial counseling or assistance options.

- Consult with Professionals: Speak with a real estate agent or attorney who specializes in foreclosures. Their insights can provide valuable guidance and help you navigate the process more smoothly.

From what I’ve seen getting ready can really help reduce the pressure that comes with foreclosure sales. It’s similar to studying for an important test being familiar with the subject and having a strategy in place can transform a task into something more manageable. This level of readiness can greatly influence the result whether you’re on the selling or buying end.

Common Challenges and How to Address Them

Purchasing a property through a foreclosure sale can present its own set of difficulties. Being aware of these challenges and having strategies to tackle them can assist you in navigating the process smoothly. In my experience overcoming these obstacles often involves a combination of careful planning and hands on execution.

Here are a few obstacles that people often face and some strategies to overcome them:

- Legal Complications: Foreclosures involve complex legalities. Engaging a knowledgeable attorney can help clarify issues and ensure compliance with all legal requirements.

- Property Condition: Properties in foreclosure might be neglected. Buyers should factor in repair costs and consider conducting a thorough inspection before bidding.

- Emotional Stress: The emotional strain of foreclosure can be overwhelming for homeowners. Seeking support from friends, family, or counseling services can provide much-needed relief.

- Uncertain Outcomes: The outcome of foreclosure sales can be unpredictable. For buyers, having a backup plan and setting a firm budget can help mitigate risks.

In my view tackling these hurdles directly and taking action can have an impact. It’s similar to navigating through challenges during a trip being well prepared and flexible is crucial for reaching your goals.

Frequently Asked Questions

When it comes to foreclosure sales people tend to have a lot of questions. To assist you in navigating the process more smoothly here are some common inquiries along with their responses.

- What happens if I don’t attend the auction? If you don’t attend, you won’t have the opportunity to bid. For homeowners, missing the auction means the property may be sold to the highest bidder or revert to the lender.

- Can I negotiate the terms of a foreclosure sale? Negotiating terms can be challenging, as foreclosure sales are often conducted on a strict timeline. However, discussing options with a legal advisor might provide some flexibility.

- What should I do if I win the bid at auction? If you win, you’ll need to complete the purchase according to the auction’s terms. This typically involves paying the remaining balance and handling any additional legalities.

- How can I protect my rights during a foreclosure? Homeowners should seek legal counsel to explore all available options and ensure their rights are protected throughout the process.

From what I gather having clarity on these matters can help alleviate doubts and anxiety. Being aware of what lies ahead and how to navigate different situations can make the journey smoother and less overwhelming.

Conclusion

Foreclosure sales can be a rollercoaster ride emotionally speaking whether you’re a homeowner dealing with foreclosure or a bidder at an auction. By grasping the ins and outs of the process getting well prepared and tackling common hurdles head on you can navigate this challenging landscape more smoothly. From what I’ve learned the secret is staying informed and taking action. If you’re facing foreclosure reach out for guidance early on and explore all available options. On the hand if you’re looking to buy conduct thorough research and approach the auction with a plan in mind. Keep in mind that although foreclosure sales may seem intimidating being knowledgeable and well prepared can turn the experience into something manageable and even beneficial.