Mississippi Estate Planning Laws: What to Know

When one talks about estate planning, it looks like a complicated thing considering different rules in place that are there to help with this aspect. In Mississippi, these laws help to determine what will happen to your assets after your death. The point is to make sure that your desires are fulfilled and there are no difficulties for the family members left behind. It becomes necessary for an individual to know these laws in order to come up with a plan that meets his/her requirements and safeguards the future of his/her family.

Key Components of an Estate Plan in Mississippi

Key Components that are Required for Effective Estate Planning

In other to have satisfactory estate plan, certain options must be taken into account. The essential components are as follows:

- Will: A legal document stating how your assets will be distributed.

- Trust: An arrangement allowing you to place your assets in a trust for management and distribution.

- Power of Attorney: Designates someone to make financial decisions on your behalf if you become incapacitated.

- Healthcare Directive: A document outlining your medical wishes if you can’t express them yourself.

- Beneficiary Designations: Ensure your accounts and policies name beneficiaries to bypass probate.

They perform together these elements to make certain that your demands are obeyed, thus enabling easy administration of your property by your relatives after you have died.

Importance of Wills in Mississippi Estate Planning

A will is among the most imperative aspects of estate planning. Several reasons explain why having a valid will in Mississippi is very important:

- Asset Distribution: A will clearly outlines who receives your assets, reducing the chance of disputes among family members.

- Appointment of Executors: You can designate someone to manage your estate, ensuring your wishes are followed.

- Guardianship for Minors: If you have children, a will allows you to name guardians, providing peace of mind.

- Minimizing Probate Issues: While a will still goes through probate, it can help streamline the process and clarify your intentions.

To keep it brief, a will acts as an unparalleled instrument towards safeguarding all that you have worked for; thus this gesture shall bring solace to your family members when times are hard.

Trusts and Their Role in Estate Planning

Trusts are truly amazing within the world of estate planning because they allow individuals to manage their assets according to personal preference even after death. When you establish a trust in Mississippi, it aids in achieving some of your financial objectives and at the same time provides for your family members’ needs. Trusts can operate while you are still alive but wills can only take effect when the testator dies.

This post will focus on crucial aspects of trusts that are related to Mississippi:

- Types of Trusts: There are several types of trusts, including revocable trusts, irrevocable trusts, special needs trusts, and testamentary trusts. Each serves different purposes based on your unique situation.

- Asset Management: Trusts allow a designated trustee to manage your assets according to your instructions, making them beneficial if you become incapacitated.

- Avoiding Probate: Assets held in a trust generally do not go through probate, allowing for a quicker and less costly distribution to your beneficiaries.

- Tax Benefits: Certain trusts can provide tax advantages, helping to preserve more wealth for your heirs.

Trusts in general have been revealed to provide reassurance and ensure your financial bequest is managed according to your desires; this makes them necessary components of all-inclusive plans for estates.

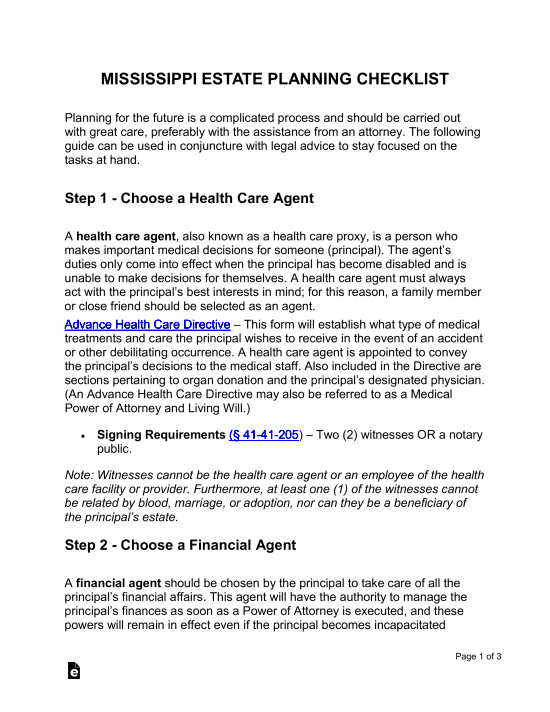

Power of Attorney and Healthcare Directives in Mississippi

It is really important to think about the way your affairs will be managed in case you become incapacitated when planning for future. Power of Attorney (POA) together with health care directives are important tools available to Mississippians whose trusted persons can act on their behalf.

Let’s take a closer look at these vital records:

- Power of Attorney: This legal document allows you to designate a trusted individual to handle financial matters, such as paying bills, managing investments, or conducting business transactions.

- Types of POA: You can choose a general POA, which grants broad authority, or a limited POA, which is specific to certain tasks or timeframes.

- Healthcare Directive: Also known as a living will, this document outlines your medical treatment preferences in case you cannot communicate them. It ensures your healthcare wishes are honored.

- Durable vs. Non-Durable: A durable POA remains in effect even if you become incapacitated, while a non-durable POA is only effective when you are competent.

Having these documents safeguards not just your interests but also gives you and your family peace because they will, at all times, respect your wishes when situations become tough.

Probate Process in Mississippi: What to Expect

It’s human nature to be anxious when going through the probate process because it seems too complicated; however, knowing what to expect may help reduce such worries. Probate refers to the administration and distribution of property following death in Mississippi. This entails confirming a will (if any) and ensuring that assets are properly passed over to beneficiaries.

The following outlines some primary actions of the probate process within Mississippi:

- Filing the Will: If there’s a will, it must be filed with the probate court. If there isn’t a will, the estate will be treated as intestate, meaning assets will be distributed according to state law.

- Appointment of Executor: The court will appoint an executor or personal representative to manage the estate, following the guidelines laid out in the will.

- Inventory of Assets: The executor will compile a comprehensive list of the deceased’s assets, including property, bank accounts, and personal belongings.

- Paying Debts and Taxes: Before distributing assets, the estate must settle any outstanding debts, taxes, and administrative expenses.

- Distribution to Beneficiaries: Once all debts are settled, the executor can distribute the remaining assets according to the will or state law.

In several months the probate process takes, it may be that personal interests are met and dear ones provided for when a proper plan is drawn. The involved parties will feel less overwhelmed if they know what to expect.

Tax Implications of Estate Planning in Mississippi

When it comes to estate planning, understanding the tax implications is crucial. In Mississippi, various taxes can affect how your assets are distributed after your death. Planning ahead can help you minimize these tax burdens and preserve your wealth for your beneficiaries. Here’s what you need to know about estate taxes in Mississippi.

In the beginning, it should be noted that there is no state inheritance tax in Mississippi. This implies that the beneficiaries of your estate will not be liable to pay any state taxes on the property they receive from you. Nevertheless, it is also important to take into account some other federal estate taxes:

- Federal Estate Tax: As of 2024, estates valued at over $13.9 million are subject to federal estate tax. It’s important to know that the tax rate can go as high as 40% on amounts exceeding this threshold.

- Gift Tax: The IRS allows you to give up to $17,000 per recipient annually without triggering the gift tax. Gifts exceeding this amount may require you to file a gift tax return.

- Income Tax: If your estate includes income-generating assets, those may also have tax implications during the estate administration process.

To steer through these tax repercussions expertly, collaborating with an estate organizing advocate could be extremely useful. They could assist you design your property blueprint so as to reduce taxation and cater for distribution of your belongings in a manner that fits with your wishes.

Choosing an Estate Planning Attorney in Mississippi

Choosing the best estate planning lawyer is basic in ensuring that you receive what you had wished for plus protecting your assets. The number of lawyers you can choose from is huge making it hard to find the one you can trust. Below are some things to consider when picking on an attorney in Mississippi.

Commence your search for a solicitor with expertise in estate planning. Here are some guidelines to aid you in choosing wisely:

- Experience: Look for an attorney with significant experience in estate planning, particularly in Mississippi laws.

- Reputation: Read online reviews and ask for referrals from friends or family. A good reputation often indicates reliability and expertise.

- Consultation: Schedule an initial consultation to discuss your needs. Many attorneys offer free consultations, allowing you to gauge their approach and personality.

- Fees: Understand the fee structure upfront. Some attorneys charge a flat fee for estate planning services, while others may bill hourly. Make sure you’re comfortable with the costs involved.

- Communication: Choose an attorney who communicates clearly and promptly. This is important for a smooth planning process.

The selection of a proper estate planning lawyer consumes time but in the end helps you and your beloved ones to evade many problems. This is an investment towards inner tranquility.

FAQs About Mississippi Estate Planning Laws

If you’re new to the process, estate planning might raise a number of queries. The following are some commonly asked questions about Mississippi’s estate planning laws that will help acquire a deeper insight into this crucial subject.

- What is the difference between a will and a trust? A will outlines how your assets will be distributed after your death, while a trust allows you to manage your assets during your lifetime and beyond.

- Do I need an attorney for estate planning? While it’s not legally required, hiring an experienced attorney can help you navigate complex laws and ensure your documents are valid.

- Can I change my will after it is created? Yes, you can update or change your will at any time, as long as you follow the proper legal procedures.

- What happens if I die without a will in Mississippi? If you die intestate (without a will), your assets will be distributed according to Mississippi’s intestacy laws, which may not align with your wishes.

- How often should I review my estate plan? It’s a good idea to review your estate plan every few years or after significant life events, like marriage, divorce, or the birth of a child.

By comprehending these typical inquiries, you become equipped to take rational choices in your estate planning expedition. Always keep in mind that it’s too soon not to initiate planning for what lies ahead!

Conclusion on Mississippi Estate Planning

In reiteration, estate planning in Mississippi is really important because it helps manage your assets according to your own will and also relieves your family members from excessive strain in hard situations. You can make a personalized plan by recognizing different parts of an estate plan such as wills, trusts, powers of attorney and health care directives etc. For instance being familiar with tax consequences or probate procedure can help you navigate through the maze that comes with estate planning. Keep in mind that the choice of a proper estate planning legal representative is vital when doing this task. Finally, on taking positive action now, you will have inner peace knowing that you did everything so that your legacy gets secured forevermore.