Commercial Lease Laws in Connecticut What You Should Know

When entering the realm of leases it feels like starting a fresh chapter in your business adventure. Whether you’re opening a cozy café or a busy retail shop grasping the fundamentals of a commercial lease is essential. It’s not solely about locating the perfect spot; it’s also about making sure that the lease conditions align with your objectives and safeguard your investment.

Commercial leases in Connecticut have distinct features that differentiate them from leases. Typically they are longer, more intricate and carry higher risks. Understanding these key aspects is crucial to steer clear of challenges and ensure a leasing process. Pay attention to details such as the duration rent increase provisions and obligations for repairs and upkeep.

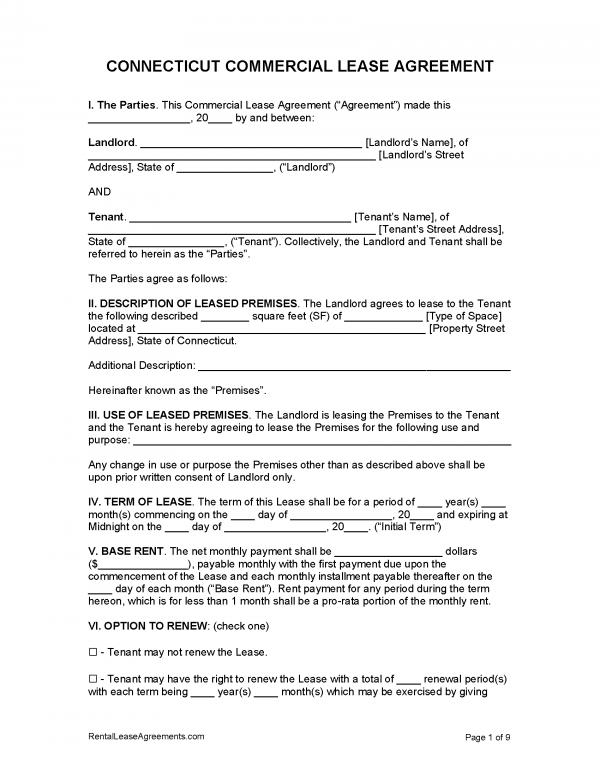

Key Terms in Connecticut Commercial Leases

Dealing with the terminology in commercial leases can be quite a challenge, similar to picking up a foreign language. However, you dont have to rely on a reference book to grasp these important concepts. Lets simplify them for you:

- Base Rent: This is the fixed amount you pay for the space, often excluding additional costs like utilities and maintenance.

- Triple Net Lease (NNN): In this type, tenants pay base rent plus their share of property taxes, insurance, and maintenance costs.

- Rent Escalation: This clause allows the landlord to increase the rent periodically, often tied to inflation or increases in operating costs.

- Security Deposit: An amount paid upfront to cover potential damages or unpaid rent, typically refundable at the end of the lease.

- Termination Clause: Specifies the conditions under which either party can end the lease early.

Grasping these concepts can greatly impact your lease negotiations. Consider it as a blueprint for your lease guiding you through the details and safeguarding your business priorities.

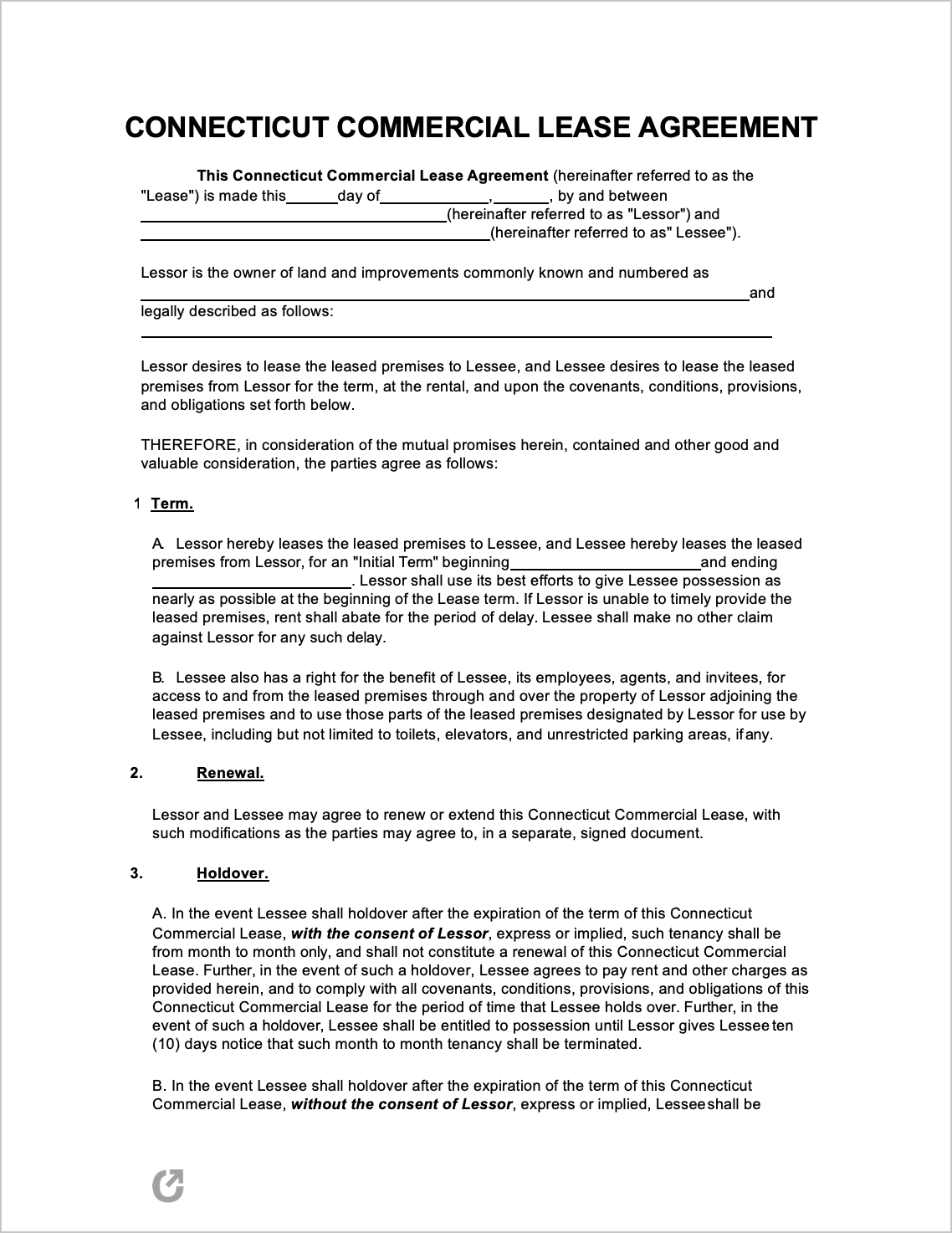

Lease Duration and Renewal Options

When it comes to a lease there are two key factors to keep in mind the length of the lease and the renewal options. It’s not solely about how long the lease is but also how well it aligns with your overall business plan. The lease duration can vary anywhere, from a short term agreement lasting a year to a more extended commitment spanning several years.

When negotiating, think about:

- Lease Term: Short-term leases provide flexibility but might come with higher rent rates. Long-term leases offer stability but less room to adjust if your business needs change.

- Renewal Options: These clauses allow you to extend the lease under agreed terms. It’s like having a safety net if your business is thriving and you want to stay put.

- Rent Reviews: Some leases include provisions for rent reviews at certain intervals. This means your rent might adjust based on market rates.

Think about how your business plans to grow and whether the length of the lease fits in with your aspirations. By grasping these factors well you can make choices and choose a lease that aligns with your companys future.

Security Deposits and Rent Payments

When it comes to deposits and rent payments things can get a bit tricky if not managed properly. It may appear simple on the surface but it has the potential to turn into a complex situation. So let’s break it down and navigate through it together, shall we?

When entering into a lease agreement for a commercial space, it’s common to be asked to provide a deposit. This deposit serves as a cushion for the landlord in case of any property damage or unpaid rent. Here’s a brief overview of how it works:

- Amount: Typically, the security deposit equals one to three months’ rent. It’s a significant amount, so be prepared.

- Usage: The deposit can be used to cover damages beyond normal wear and tear or unpaid rent. It’s not a free pass to leave the place in disarray!

- Refund: Upon lease termination, the landlord must return the deposit, minus any legitimate deductions. Ensure you document the property’s condition to avoid disputes.

When it comes to paying rent its important to know the details about when and how the payments are expected. Here are a few typical practices to keep in mind.

- Payment Schedule: Monthly, quarterly, or another agreed interval. Ensure you know the due dates to avoid late fees.

- Methods: Payments are usually made via check, bank transfer, or sometimes online. Confirm the accepted methods with your landlord.

From my perspective I encountered a situation where there was confusion regarding the return of a deposit. Effective communication and proper record keeping played a role in resolving the issue. Taking the time to establish clear expectations from the outset can save you a lot of trouble down the road.

Tenant and Landlord Responsibilities

Grasping the concept of responsibilities is akin to coordinating a performance where everyone must be in harmony for everything to run seamlessly. In the context of a lease both the tenant and landlord have specific functions and obligations.

Tenants usually have responsibilities that involve.

- Rent Payments: Ensuring timely payments as agreed in the lease.

- Maintenance: Taking care of routine maintenance and minor repairs. For instance, if a light bulb goes out, it’s usually your job to replace it.

- Compliance: Adhering to local regulations and lease terms, such as zoning laws or restrictions on modifications.

Conversely landlords have the duty to

- Major Repairs: Handling significant repairs like plumbing or HVAC systems.

- Property Upkeep: Maintaining the property’s overall condition, including structural repairs.

- Lease Enforcement: Ensuring the lease terms are followed and addressing tenant issues as they arise.

I remember an instance where a landlord took their time addressing a repair, causing some annoyance. However having clear responsibilities in place expedited the resolution. Maintaining communication and being aware of your duties can help avoid situations.

Dispute Resolution Methods

Conflicts are an aspect of every lease deal but the way you approach them can have a significant impact. Consider dispute resolution approaches like instruments in your toolbox to uphold peace.

Common methods include:

- Mediation: An impartial mediator helps both parties reach a mutually agreeable solution. It’s like having a referee in a game, ensuring fair play.

- Arbitration: A neutral arbitrator makes a binding decision after hearing both sides. It’s less formal than court but more definitive than mediation.

- Legal Action: If mediation or arbitration doesn’t resolve the issue, you might need to go to court. This is often a last resort and can be time-consuming and costly.

In my personal experience with leasing we encountered a disagreement regarding a maintenance matter. We chose to resolve it through mediation which was quick and friendly. Generally it’s more effective to tackle disputes with an attitude focused on finding solutions rather than being confrontational.

Breaking a Commercial Lease Early

Ending a business lease ahead of schedule can be tricky and potentially expensive. Life throws surprises our way and despite our plans we may find ourselves needing to terminate a lease early. Whether it’s a shift in direction or unexpected events understanding the ins and outs can help you avoid rough waters.

Here’s what you need to consider:

- Lease Terms: Review your lease for any early termination clauses. These clauses outline the conditions under which you can exit the lease early, often including penalties or notice requirements.

- Notice Period: Typically, you must provide advance notice to your landlord. This period is usually outlined in your lease agreement and might range from 30 to 90 days.

- Termination Fee: Some leases include a termination fee, which can be a fixed amount or a percentage of the remaining rent. This is compensation for the landlord’s inconvenience and potential loss of rental income.

- Finding a Replacement: In some cases, you might be required to find a new tenant to take over the lease. This can ease the financial burden and might be seen as a favorable gesture by your landlord.

I recall an instance where I had to terminate a lease because my company was moving. By keeping the lines of communication open with the property owner and familiarizing myself with the lease agreement I was able to work out a smoother way to exit. Its beneficial to tackle these kinds of situations honestly and being open to finding a resolution.

Recent Changes in Connecticut Lease Laws

Staying updated with changes in the law can be as challenging as keeping up with the latest Bollywood blockbuster—ever changing and sometimes unexpected. The recent revisions to Connecticut lease laws show a move towards increased transparency and equity in commercial leasing. Here are the key highlights of the updates.

- Disclosure Requirements: Landlords must now provide more detailed disclosures about lease terms and potential costs. This includes clearer information on maintenance responsibilities and any additional fees.

- Rent Control Provisions: While not widespread, some areas have introduced limited rent control measures to protect tenants from steep rent increases, particularly in high-demand areas.

- Accessibility Regulations: New laws emphasize making commercial spaces more accessible to individuals with disabilities, ensuring that businesses accommodate all customers.

- Electronic Lease Agreements: The acceptance of electronic signatures for lease agreements is now more widespread, streamlining the leasing process and reducing paperwork.

Through my experiences, I’ve realized the importance of keeping up with these changes. They influence the way leases are negotiated and handled and staying informed has allowed me to adjust smoothly to new regulations.

FAQs

Q1: What should I do if I can’t afford the rent anymore?

If youre having difficulty with your rent the first step is to talk to your landlord. They may be able to provide some temporary help or make adjustments. Its also worth checking your lease for any clauses about ending it early or getting legal advice for more options.

Q2: Can I negotiate my lease terms before signing?

Of course! Lease agreements can usually be negotiated. Talking to your landlord about the rent, lease length and other details prior to signing can help ensure that the lease aligns with your requirements and preferences.

Q3: How do I handle a dispute with my landlord?

To address the problem initiate a conversation with your landlord. If that proves ineffective seeking mediation or arbitration can assist in resolving conflicts without resorting to legal proceedings. It’s also wise to maintain documentation of all interactions for future reference.

Q4: Are there penalties for breaking a lease early?

Yes breaking a lease early may come with consequences like fees for terminating the agreement or forfeiting your security deposit. Nonetheless you might be able to lessen these expenses by discussing options with your landlord or locating a new tenant to take over the lease.

Breaking a Commercial Lease Early

Breaking a lease early is like hitting a bump in the road during a long trip. It involves not just financial consequences but also the emotional strain it can cause. Life is full of surprises and there are times when business requirements or personal situations force us to terminate a lease before its scheduled end. Knowing the process can assist you in handling this challenging scenario with greater ease.

Here’s a snapshot of what you might face:

- Review the Lease: Check for any clauses that allow early termination and understand the penalties involved. This could include a termination fee or the requirement to find a replacement tenant.

- Provide Notice: Adhere to the notice period specified in your lease. Failing to do so could lead to additional penalties or legal issues.

- Negotiate: Communicate openly with your landlord. Sometimes, negotiating a compromise or a lease amendment can ease the process.

- Document Everything: Keep records of all communications and agreements related to breaking the lease. This documentation can protect you in case of disputes.

Based on what I’ve seen dealing with an early lease termination openly and with a positive attitude can really change things. Its usually best to face these situations directly and have a good grasp of your lease responsibilities.

Recent Changes in Connecticut Lease Laws

Staying informed about the latest developments in Connecticut lease laws is akin to refreshing your toolbox for a more seamless operation. These changes are designed to create a fairer environment for both tenants and landlords by improving equity and openness in commercial lease agreements.

Here’s what’s new:

- Enhanced Disclosure: Landlords are now required to provide more comprehensive details about lease terms, including potential extra costs. This change ensures tenants are fully aware of their financial commitments.

- Rent Control Measures: Although not widespread, some areas have introduced limited rent control to prevent excessive rent hikes, offering a bit more stability for tenants.

- Accessibility Requirements: New regulations emphasize making commercial properties accessible to all, promoting inclusivity in business environments.

- Electronic Agreements: The legal acceptance of electronic signatures simplifies the leasing process and reduces the need for physical paperwork.

Based on what I have seen keeping track of these updates not only ensures you stay compliant but also gives you an edge when it comes to negotiating lease agreements. Being aware of the legal environment makes sure you are ready and safeguarded throughout your leasing process.

FAQs

Q1: What should I do if I can’t afford the rent anymore?

Talk to your landlord about your money problems. They might give you some help or change the payment schedule. Checking the lease for ways to end it early and getting legal advice could also be useful.

Q2: Can I negotiate my lease terms before signing?

A2 Absolutely the terms of a lease are usually open to negotiation. Talking to your landlord about aspects like rent, the length of the lease and other conditions can assist in customizing the lease to suit your requirements more effectively.

Q3: How do I handle a dispute with my landlord?

Step one is to talk to your landlord about the problem directly. If that doesn’t work out you might want to explore mediation or arbitration as a way to settle things more officially. It’s a good idea to keep track of all your conversations and interactions with them to strengthen your position.

Q4: Are there penalties for breaking a lease early?

Absolutely, penalties may involve charges for ending the lease early or forfeiting your security deposit. Nevertheless, discussing the situation with your landlord or seeking a new tenant could potentially lessen these expenses.

Conclusion

Managing the complexities of commercial leases calls for a mix of thoughtful preparation and flexibility. It is essential to grasp the details of your lease agreement and keep abreast of any legal developments as every aspect contributes significantly to a seamless leasing process. With an informed and self assured approach to these matters you can navigate your commercial lease more effectively and safeguard your business interests.