What You Need to Know About Per Diem Laws in California

What is Per Diem?

Per diem refers to a daily payment provided to workers to help with costs incurred while traveling like accommodation, food and other incidentals. The purpose of this payment is to make handling expenses easier and minimize the requirement for thorough reimbursement requests. Rather than having to submit receipts for each meal or hotel booking employees are given a fixed sum of money daily, depending on the destination and type of their trip.

Typically there are kinds of per diem allowances

- Standard Per Diem: A fixed amount provided to cover all expenses.

- Itemized Per Diem: An allowance that may be divided into specific categories, such as meals and lodging.

In California the amount for daily expenses is determined by factors such as where you are and why you are traveling. This makes sure that workers get a fair sum that takes into account the varying costs of living in different places.

Overview of California Per Diem Laws

The per diem laws in California aim to guarantee that workers are reimbursed adequately for their travel costs incurred during work trips. In contrast to certain states California does not set a specific per diem rate at the state level. Instead it adheres to federal regulations that can be modified according to the travel destination.

Here’s a quick overview of how it works:

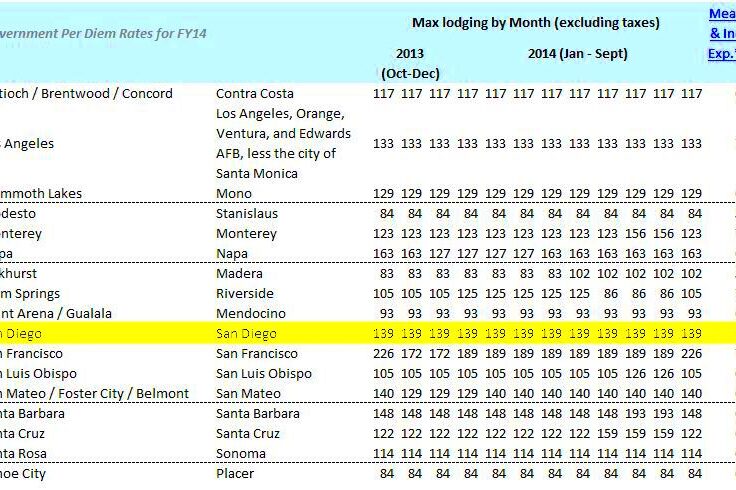

- Federal Per Diem Rates: California typically aligns with the federal per diem rates set by the General Services Administration (GSA). These rates vary by city and region to reflect local living costs.

- Employer Policies: Employers are required to adhere to these rates but can choose to offer higher amounts if they wish. It’s important for employees to understand their company’s policy regarding per diem rates and reimbursement procedures.

- Reimbursement vs. Per Diem: California law distinguishes between per diem allowances and expense reimbursements. While per diem is a set daily rate, reimbursements require receipts and proof of actual expenses.

From my perspective having well defined per diem policies can greatly minimize confusion and disagreements. It makes sure that both employers and employees have a mutual understanding of what is included and what is not. Whether you are a traveler or an employer overseeing travel costs knowing these regulations is crucial for a seamless experience.

How Per Diem Rates are Set

Have you ever thought about how the amount for travel is decided? Its not a case of applying the same rule to everyone. In California the daily rates are determined by considering federal guidelines and local living expenses. This way the allowance is in line with the real costs that employees may incur during their trips.

Here’s a breakdown of the process:

- Federal Guidelines: The General Services Administration (GSA) sets per diem rates for different regions across the United States. These rates are updated regularly to keep pace with changes in living costs. California generally follows these federal guidelines, though rates can vary by city.

- Local Adjustments: While the federal rates provide a baseline, local adjustments may be made to reflect the high cost of living in certain areas. For instance, a business trip to San Francisco will likely have a higher per diem rate compared to a trip to a smaller city.

- Employer Policies: Employers have the flexibility to set their own per diem rates, which can be higher or lower than the federal rates. It’s important for employees to be aware of their company’s specific per diem policies to avoid any confusion.

From what I’ve seen it’s interesting to note the differences in rates across cities. A friend of mine mentioned that her company’s daily allowance barely covered a meal in pricey Los Angeles but was more than sufficient in areas. Knowing how these rates are determined aids both employers and employees in handling travel costs more effectively.

Types of Per Diem Allowances in California

Per diem allowances in California are not a solution. There are different categories tailored to address specific aspects of work related travel each with its own purpose. Understanding these distinctions is key to ensuring that travel costs are properly reimbursed.

Here’s a rundown of the main types:

- Meal Allowances: This covers the cost of breakfast, lunch, and dinner. Depending on the location, rates can vary to account for different costs of dining out. For example, a meal allowance in San Diego will differ from one in San Francisco.

- Lodging Allowances: This is provided for hotel stays. The rate depends on the city and the standard of accommodation. In high-demand areas, such as Silicon Valley, lodging rates might be higher to reflect the cost of staying there.

- Incidentals: This includes small, unexpected expenses like tips or minor supplies. Incidentals are often a set amount and are intended to cover minor out-of-pocket costs that employees might encounter during their trip.

Different kinds of allowances are designed to support various aspects of travel making it more convenient for employees to handle their costs without the need to keep track of every single receipt. I recall a time when I had to go on trips for work and having a detailed breakdown of allowances really simplified and eased the process of managing my budget.

Per Diem Reimbursement for Employees

Getting reimbursed for daily expenses can be a bit of a hit or miss. In California the guidelines for per diem and expense reimbursement aim to streamline things but they can also be confusing if not properly grasped.

Here’s a breakdown of how reimbursement for daily expenses usually functions

- Daily Allowance: Employees receive a fixed amount per day to cover their travel expenses. This amount is not subject to receipts or detailed documentation, which simplifies the process for both parties.

- Expense Reimbursement: If employees incur expenses beyond the per diem rate, they might be able to claim reimbursement. However, this requires detailed receipts and documentation. It’s essential to keep track of all expenses to ensure proper reimbursement.

- Policy Differences: Companies can have different policies regarding per diem and expense reimbursement. Some might offer a lump sum for the entire trip, while others might reimburse based on actual expenses. Employees should always review their company’s travel policy to understand what’s covered.

Based on my experiences being well informed about the workings of per diem has spared me from quite a few inconveniences. Its always a good idea to discuss with your employer the specifics of what is included in your travel expenses to prevent any unexpected surprises down the line. Having a grasp of the particulars can greatly impact how effectively you handle travel budgets.

Common Misconceptions about Per Diem

The concept of per diem can be quite perplexing due to the prevalence of myths that can cause misunderstandings. I’ve noticed both coworkers and friends grappling with these false notions, so lets set the record straight on a few of them.

Here are some misconceptions and the truths that debunk them.

- Per Diem is the Same as Expense Reimbursement: Many people mistakenly believe per diem is just another form of expense reimbursement. While both cover costs incurred while traveling, per diem provides a set daily allowance, whereas expense reimbursement requires detailed receipts and proof of actual costs.

- Per Diem Covers All Expenses: Some assume that per diem should cover every possible expense, including luxury items. In reality, per diem is meant to cover essential costs like meals and lodging, not extravagant expenses.

- Unused Per Diem Must be Returned: Another misconception is that if employees don’t spend the full per diem amount, they have to return the leftover money. In most cases, per diem is given as a flat rate and doesn’t need to be accounted for precisely, meaning any unused funds generally do not need to be returned.

Miscommunications often result in frustration, particularly when it comes to handling travel expenses. In my opinion being transparent and familiarizing oneself with your employers guidelines can prevent these frequent stumbling blocks and simplify the management of travel costs.

Legal Requirements for Per Diem Documentation

It’s important for both employers and employees to grasp the legal aspects of per diem documentation. There’s usually some uncertainty regarding what should be recorded and what can be omitted. Drawing from my experiences and insights here’s a helpful guide to navigate through these guidelines.

Here are the key legal requirements:

- No Receipts Needed for Per Diem: One of the biggest benefits of per diem is that it typically doesn’t require detailed receipts or proof of individual expenses. The per diem rate is set to cover estimated daily costs, so employees generally don’t need to provide receipts for meals or lodging.

- Documentation for Reimbursements: While per diem itself doesn’t need receipts, if employees are reimbursed for expenses beyond the per diem, proper documentation is necessary. This includes keeping receipts and providing details of the expenses incurred.

- Compliance with Federal and State Laws: Employers must ensure that their per diem rates comply with federal and state laws. This means staying updated with changes in federal per diem rates and understanding any specific state regulations that may apply.

Throughout my career grasping these documentation standards has been crucial. It not only aids in ensuring adherence but also streamlines the management of travel costs. Staying informed about federal and state rules is wise to steer clear of any legal complications.

FAQs about Per Diem Laws in California

Wondering about the details of per diem regulations in California? You’re in good company! Check out these commonly asked questions that many folks have along with simple explanations to help clarify things.

- What is the current per diem rate for California? The per diem rate for California varies depending on the location. For the most accurate and up-to-date rates, check the General Services Administration (GSA) website, as they set the federal per diem rates used across the state.

- Do I need to keep receipts for per diem expenses? No, per diem allowances typically do not require receipts. The idea is to provide a set amount of money to cover estimated expenses without needing detailed proof of each expense. However, if you’re claiming additional expenses beyond the per diem, receipts will be necessary.

- Can employers set their own per diem rates? Yes, employers can set their own per diem rates, which can be higher or lower than the federal rates. It’s important for employees to be familiar with their company’s per diem policy to understand what they’re entitled to.

- What happens if I spend less than the per diem amount? Generally, if you spend less than the per diem amount, there’s no need to return the excess funds. The per diem is designed to cover typical expenses, and any unused portion is typically considered a part of the allowance.

These frequently asked questions serve as a convenient source of information to address any lingering uncertainties regarding per diem regulations. Based on my own experiences having this level of understanding can greatly simplify the process of handling travel costs making it more manageable and less overwhelming.

Conclusion

Grasping the nuances of per diem laws in California can significantly impact how you manage your travel costs. Understanding how per diem rates are determined, addressing common misconceptions and being aware of legal obligations can assist both employees and employers in navigating the intricacies of business travel seamlessly. Based on my experiences I have witnessed how a well comprehended per diem policy can alleviate the burden of travel expenses and prevent unnecessary conflicts. Whether you are an employer establishing policies or an employee journeying for work being knowledgeable about these aspects can result in smoother and more hassle free experiences. So when you embark on a trip for work you will feel better equipped and more self assured in managing your travel expenses.