What You Need to Know About Business Law in Cedar Rapids

To be honest I used to think of business law as this massive rule book that no one really wants to dive into. However the truth is grasping these laws can be a game changer for your venture. When I assisted a friend in launching a café in Cedar Rapids I came to appreciate the importance of being aware of the local legal requirements. From starting up your business to making sure you adhere to all the regulations having this insight can bring you a sense of reassurance. Consider it as the bedrock of your enterprise a sturdy base ensures that your business can thrive.

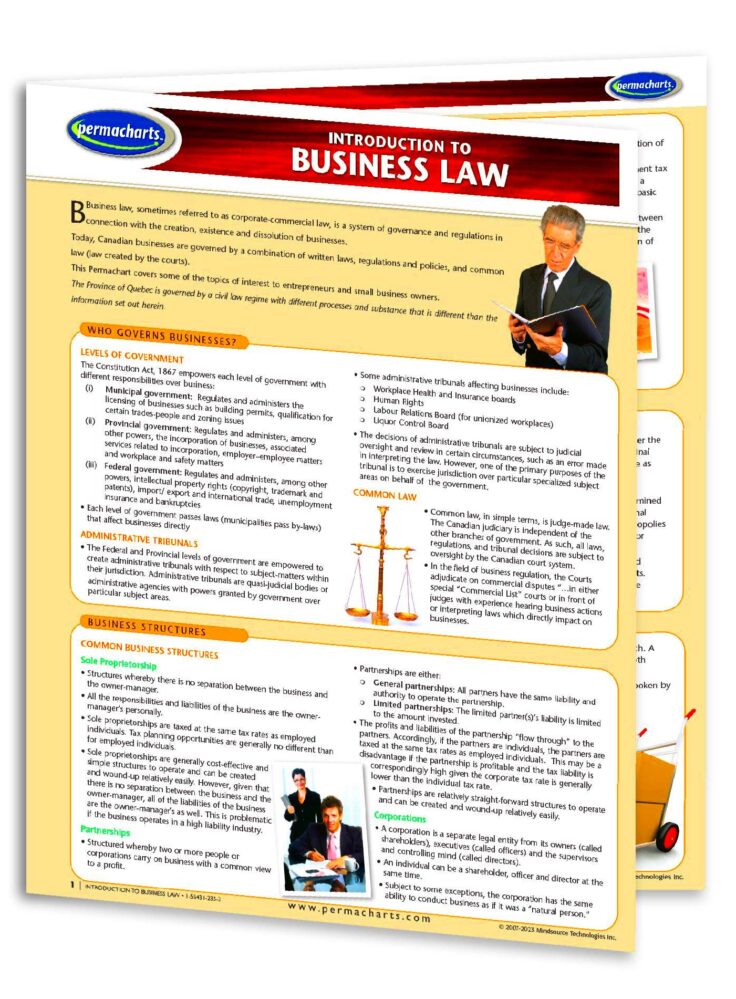

Key Business Structures and Their Legal Requirements

When I first came across the various options for structuring a business I found myself a bit puzzled. Sole proprietorship, LLC, corporation? It’s quite overwhelming! Each of these structures comes with its advantages and disadvantages particularly in Cedar Rapids. Allow me to share some insights, I’ve gained.

Sole Proprietorship: This is the simplest form. My friend chose this for her café, and it was easy to start—no complex paperwork. But here’s the catch: she’s personally responsible for everything, including debts. It’s like wearing two hats, one as the owner and one as the business.

Limited Liability Company (LLC): When I started my side gig, I went with an LLC. Why? Because it protects your personal assets. If something goes wrong, they can’t come for your home or car. But setting it up requires a bit more paperwork, and you have to pay an annual fee.

Corporation: I haven’t ventured into this area, but corporations are for bigger businesses. You have shareholders, a board, and way more legal obligations. It’s not for the faint-hearted, but it offers serious legal protection and tax benefits.

Selecting the appropriate framework is similar to choosing the suitable footwear for a stroll. It impacts various aspects, including your tax obligations, level of authority and the extent of risk you undertake.

Understanding Contracts and Agreements

I still vividly recall the moment I signed my first business contract. It felt as though I was relinquishing my existence. However when you really dissect it contracts are merely arrangements that assist both parties in comprehending their entitlements and obligations. In Cedar Rapids as in any other place contracts play a role in the functioning of businesses. They bring clarity to matters and believe me they save you from a lot of troubles, later on.

Here are some insights I’ve gained regarding agreements.

- Written is always better: You’d think verbal agreements are enough, especially when you trust someone. But I’ve learned the hard way that written contracts are your safety net. If things go wrong, it’s your proof of what was agreed upon.

- Be clear about payment terms: This is where things can get tricky. My friend once had a vendor who delayed payments because the terms weren’t clear. Now, we both make sure to specify the exact amounts, due dates, and penalties for late payments.

- Don’t skip the fine print: It’s tempting to skim through, but those small details can hide big responsibilities. Once, I almost missed a clause that would’ve held me liable for way more than I expected.

Contracts serve as guides for how businesses interact with each other. When both parties are aware of their destination it minimizes confusion and ensures that everyone is aligned.

Employment Law Considerations for Cedar Rapids Businesses

I recall a time when a friend of mine launched a little store in Cedar Rapids. She felt a mix of excitement and anxiety as she prepared to bring on her first employee. One night we spent together discussing the essentials of employment regulations. That experience taught me valuable lessons and now I feel compelled to share insights that every business owner in Cedar Rapids should have regarding employment laws.

When you bring someone on board as an employee there are specific guidelines you need to adhere to. Its not solely about compensating them for their work; there are regulations regarding working hours, overtime and safety measures. For instance.

- Minimum Wage: You must pay at least the Iowa state minimum wage, but some cities may require more.

- Overtime Pay: If your employees work more than 40 hours a week, you need to compensate them accordingly. No shortcuts here!

- Workplace Safety: Keeping your workers safe isn’t just about being a good boss—it’s the law. The Occupational Safety and Health Act (OSHA) ensures businesses follow safety guidelines.

Dealing with discrimination and harassment can be quite challenging. A friend of mine had to educate her employees about what behavior is deemed acceptable in a work setting. These matters cannot be brushed aside as doing so could result in legal issues. It’s crucial to uphold fairness in treating individuals regardless of their age, gender or background to foster a work environment and ensure your company stays compliant with the law.

Taxes and Legal Obligations for Local Businesses

Taxes the mere mention of them can send shivers down our spines. I recall assisting my cousin with his tax returns for his modest IT venture in Cedar Rapids and let me tell you it was like navigating through a labyrinth. If you’re embarking on a journey taxes are an inescapable part of the process but they don’t have to be a source of stress. Here’s what I learned along the way.

In Cedar Rapids similar to other parts of Iowa, companies are accountable for various kinds of taxes.

- Sales Tax: If your business sells goods or services, you’re required to collect sales tax from customers. The Iowa state sales tax rate is 6%, but certain localities, including Cedar Rapids, might add an additional percentage.

- Income Tax: Whether you’re running a sole proprietorship or an LLC, you need to pay state income tax on your earnings. For corporations, things get more complex with federal and state corporate taxes.

- Employee Taxes: This was a big one for my cousin. When you have employees, you’re responsible for withholding federal and state taxes, along with paying unemployment insurance. Missing this can land you in trouble with the IRS.

The real struggle arises when it comes to submitting these on time. There are specific cut offs to keep in mind quarterly payments for certain taxes and annual ones for others. However what I’ve come to understand is that maintaining organized records plays a significant role in overcoming this challenge. My cousin has now started using software to manage all his financials and it has brought him great peace of mind. When tax season rolls around he no longer finds himself frantically searching for receipts or figures.

How Business Disputes Are Handled

Conflicts are bound to happen in the world of business. For instance I witnessed a close friend have a falling out with a supplier over a matter of late deliveries. What began as a concern escalated into a heated argument. That experience made me recognize the significance of understanding how business disputes are resolved, in Cedar Rapids.

In Cedar Rapids the resolution of disputes often stems from agreements misinterpretations or challenges involving clients or staff. Here are some methods commonly used to settle these conflicts.

- Negotiation: In my friend’s case, the first step was simply sitting down with the supplier and talking things through. Often, clear communication can solve issues before they escalate. It’s not about winning but finding a solution both sides can agree on.

- Mediation: If talking doesn’t work, mediation is a popular next step. A neutral third party helps both sides reach an agreement. It’s less formal and less expensive than going to court, which was a relief for my friend.

- Litigation: Now, if nothing else works, you may have to take the issue to court. Litigation can be long and costly, and honestly, it’s something most businesses try to avoid. My friend thankfully didn’t have to go that far.

The main point here is to have contracts in place, communicate clearly and when issues arise, attempt to resolve them without immediately resorting to legal action. In my friends situation they found a resolution through mediation allowing both parties to move forward without any lingering animosity.

Licensing and Permits for Businesses in Cedar Rapids

When I assisted a relative in setting up a shop in Cedar Rapids I was taken aback by the sheer number of licenses and permits needed. Initially it seemed daunting but once you dissect the process it becomes clearer. Every business regardless of size must adhere to regulations and obtaining the necessary licenses is a crucial aspect of that. It’s akin to ensuring you possess the keys before opening any doors.

In Cedar Rapids businesses typically need to obtain various licenses and permits. Here are some ones that are commonly required.

- General Business License: Most businesses need a general business license to operate legally in Cedar Rapids. It’s essentially your business’s “permission slip” from the city.

- Zoning Permits: Before setting up shop, make sure your location is zoned for your type of business. My cousin learned this the hard way when he tried to open a café in an area not zoned for commercial food establishments.

- Health Permits: If you’re opening a restaurant or food-related business, you’ll need a health permit. The local health department ensures that your business meets all sanitation and safety standards.

- Sales Tax Permit: If you’re selling goods, you need to collect sales tax from your customers. This requires a sales tax permit, which is crucial to avoid penalties down the line.

Obtaining these licenses might seem like a hassle, but once you get through the process you’re paving the way for your business to thrive. Just like my relative you’ll experience a wave of relief once everything is sorted out. Knowing that you’re running things, legally and efficiently.

FAQ About Business Law in Cedar Rapids

Do I need a business license for an online business in Cedar Rapids?

Absolutely, even if you run your business on the internet you might still require a regular business license based on the specifics of your activities. Its wise to verify with the authorities to make sure you meet all the requirements.

What happens if I don’t get the required permits?

Running your business without the licenses and permits can result in fines or even shutting down your operations. Cedar Rapids enforces these regulations strictly so it’s wise to adhere to the law.

How do I resolve a business dispute in Cedar Rapids?

Disagreements can be resolved through various methods like talking it out finding a middle ground or taking legal action. Openly discussing matters at the beginning can often stop problems from getting worse. If that approach doesn’t succeed you can consider getting help to navigate mediation or legal processes.

What are the main tax obligations for Cedar Rapids businesses?

In Cedar Rapids businesses need to follow state sales tax employee tax and corporate income tax regulations. Staying on top of deadlines and keeping thorough records can help you avoid penalties and reduce stress during the tax season.

Conclusion on Navigating Business Law in Cedar Rapids

Launching and managing a venture is akin to setting off on an adventure—it brings with it a mix of thrills obstacles and valuable lessons along the way. Through my experiences I’ve learned that grasping the nuances of law goes beyond being a mere requirement; it serves as a safeguard for your enterprise and a catalyst for its growth. Cedar Rapids has its regulations and adhering to them positions you on the path to achievement.

From choosing the business structure to managing contracts and keeping track of licenses and taxes every choice you make influences the path of your venture. While certain legal aspects might appear overwhelming initially the right support and a touch of perseverance will lead you through. As I’ve observed with friends and family members a knowledgeable entrepreneur stays one step ahead.