Overview of Ohio Severance Laws

Ohio severance laws establish guidelines for employee payments and benefits when employment is terminated. This is a perplexing aspect, particularly for those who have just lost their jobs. Therefore, employees ought to be aware of the rights and what to expect during termination period; hence the necessity to decipher these laws. We will look at the mechanics of severance, its importance and its implications to you as a worker in Ohio in this section.

Key Definitions Related to Severance

In order to understand severance laws effectively, it is important to comprehend a few essential terms:

- Severance Pay: This is a monetary compensation provided to employees after they leave a job, typically based on their length of service.

- Severance Agreement: A legal document outlining the terms of severance pay, including any additional benefits, confidentiality clauses, or non-compete agreements.

- Termination: This refers to the end of an employee’s job, which can be voluntary (resignation) or involuntary (layoff or dismissal).

- At-Will Employment: Ohio is an at-will employment state, meaning that employers can terminate employees for almost any reason, as long as it is not illegal.

You need to comprehend these terms well so that you can know what your entitlements and possibilities are in such cases where dismissal is involved.

Eligibility Criteria for Severance Pay

In Ohio, not everyone is qualified to receive severance pay. Some of the main factors that determine if one is eligible are as follows:

- Length of Service: Most companies offer severance pay based on how long an employee has worked for them. For example, an employee may receive one week of pay for every year of service.

- Company Policy: Severance pay is often outlined in the company’s employee handbook or policies. Employers may have different policies regarding severance.

- Type of Termination: Employees who are laid off typically qualify for severance, while those who resign voluntarily or are terminated for misconduct may not.

Prior to presuming on that you qualify for any severance allowance, you have to go through your company’s policies and other conditions of your work. It is out of these reasons why different people are usually experiencing with different financial statuses after they resign from their job.

Severance Agreements and Their Importance

An essential document known as a severance agreement defines the terms and conditions around an employee’s leaving a company. Knowing its importance can give you strength in hard times. These agreements not only provide what is the severance pay amount but also include other benefits, confidentiality clauses, and responsibilities of both parties. Let’s now examine some of the necessary actions these agreements must include.

Here’s the reason severance agreements are important:

- Clarity: They provide clear terms, ensuring both the employee and employer understand their rights and obligations.

- Protection: Severance agreements often include non-disclosure clauses, which protect sensitive company information.

- Negotiation Opportunity: Employees can negotiate better terms, such as extended health benefits or references.

- Legal Safeguard: These documents can protect both parties from future legal disputes over the termination.

To sum it up, the severance agreement can be very helpful as it facilitates your shift to the new occupation you want while at the same time protecting your rights and interests.

Calculating Severance Pay in Ohio

Calculating severance pay can feel overwhelming, but knowing how it’s computed can give you an idea of what’s in store. Severance pay typically is determined by Ohio based on your long service, salary and firm policies. Here’s a breakdown of how to do it:

- Length of Service: Employers often use a formula of one or two weeks of pay for each year worked. For example, if you worked for 5 years and your weekly salary is $1,000, your severance might be:

- 1 week per year: $1,000 x 5 = $5,000

- 2 weeks per year: $1,000 x 10 = $10,000

- Company Policies: Check your employer’s handbook or HR department for any specific severance policies that could influence the calculation.

- Negotiations: Sometimes, you can negotiate your severance package based on your circumstances, skills, and contributions to the company.

Comprehending the factors responsible for the computation of severance packages can give you an upper hand in negotiating your exit pay.

Tax Implications of Severance Payments

On severance payment, being conscious of tax features is a must. Most individuals think severance pay is just like any other income and they are right in most cases. Yet, there are few details worth noting:

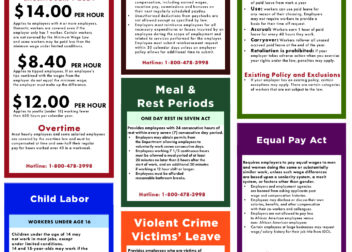

- Tax Withholding: Severance pay is subject to federal and state income tax withholding. Your employer will typically withhold a percentage from your severance payout.

- Tax Bracket Impact: Receiving a large severance payment may push you into a higher tax bracket for the year, affecting your overall tax liability.

- Health Benefits: If your severance package includes continued health benefits, those may also have tax implications. For example, if you receive health coverage through COBRA, you might have to pay premiums with after-tax dollars.

for carrying out a tax plan to follow. This will keep you from being caught off guard when tax time comes.

Legal Protections Under Ohio Severance Laws

Variety of labor laws exist as severance payment conditions in Ohio which assist in securing the fate of workers. These provisions are very important to comprehend especially for someone who finds themselves in an unexpected job loss situation. The regulations create a fair treatment for employees and also provide avenues through which they can seek redress in cases where their rights have been infringed.

In Ohio, the following are important legal safeguards pertaining to severance:

- Non-Discrimination: Employers cannot discriminate against employees based on race, gender, age, or any other protected characteristic when providing severance pay.

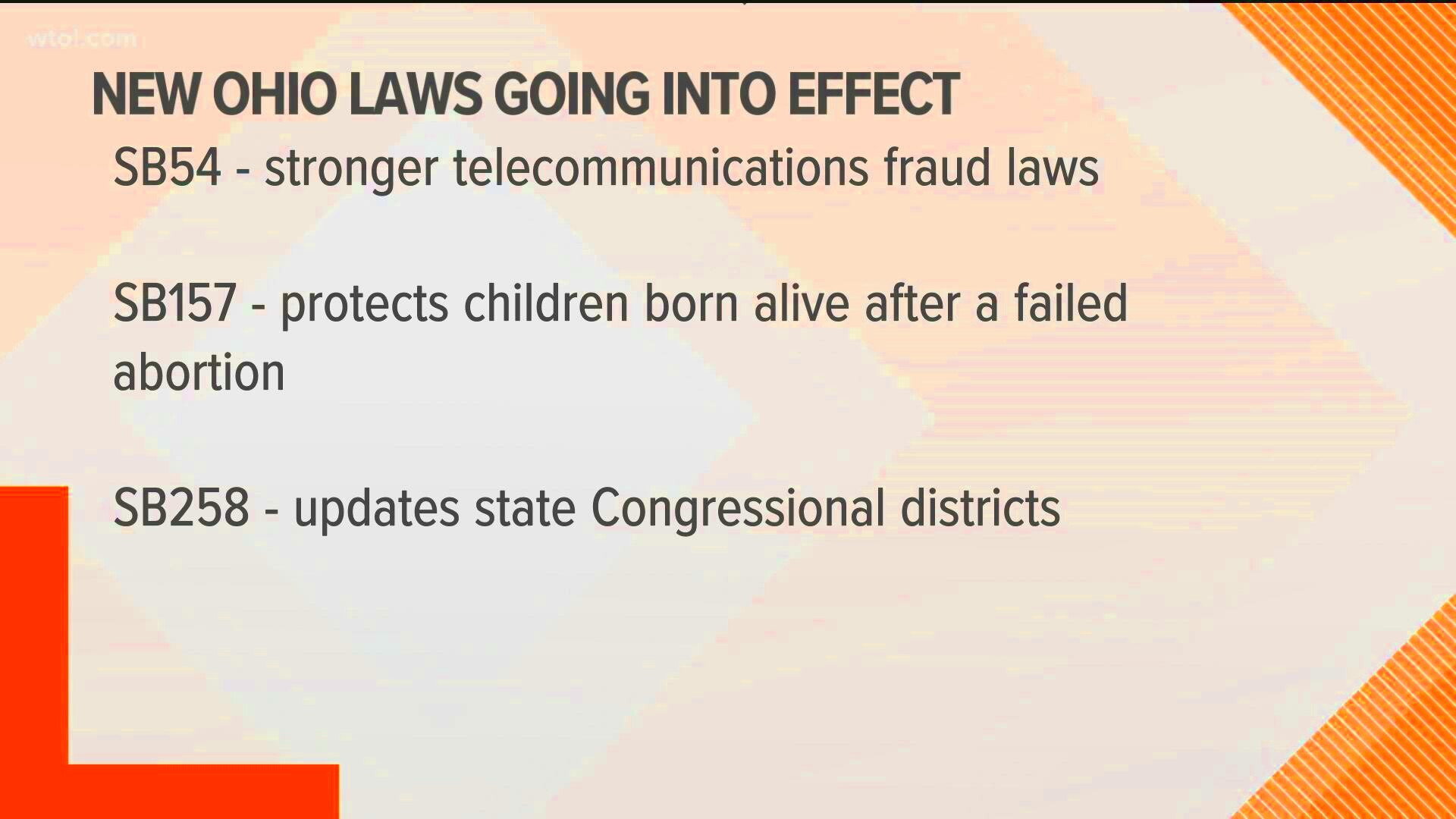

- Notification Requirements: Under the Worker Adjustment and Retraining Notification (WARN) Act, employers must notify employees about mass layoffs or plant closures, giving them a fair chance to prepare.

- Retaliation Protection: If an employee reports a violation of severance laws or workplace discrimination, they cannot be retaliated against by their employer.

- Right to Review: Employees may have the right to review severance agreements before signing, allowing them to seek legal advice if needed.

Knowing about these legal safeguards can help to fight for your rights and demand the pay you are entitled to when losing a job.

Steps to Take if Severance Pay Is Denied

Learning that your severance is not granted can lead to severe stress or mental distress. But, you’ve got options that will help you deal with the situation and get it resolved amicably. For those who find themselves in such a predicament, here is a helpful guide on what to do:

- Review Your Employment Contract: Check your employment agreement or any relevant company policies regarding severance pay. Understanding your rights is the first step.

- Gather Documentation: Collect any relevant documents, such as your termination notice, severance agreement, and communications with your employer.

- Contact HR: Reach out to your Human Resources department to discuss the denial. They may provide clarification or correct any misunderstandings.

- Negotiate: If appropriate, negotiate directly with your employer. Sometimes, a conversation can lead to a resolution.

- Seek Legal Advice: If your severance pay is still denied, consider consulting an attorney who specializes in employment law. They can help you understand your options and represent your interests.

Moreover, by taking these actions, one can enhance their likelihood of being awarded the severance pay they rightly deserve and help them traverse through these hard times.

Frequently Asked Questions

In Ohio regarding severance pay issues, many individuals are left wondering. These are some of the frequently asked questions together with their answers:

- What is severance pay? Severance pay is a form of compensation provided to employees upon termination, often based on their length of service and company policy.

- Am I entitled to severance pay? Not all employees are entitled to severance pay. Eligibility typically depends on company policies and the circumstances of your termination.

- Can I negotiate my severance package? Yes, many employees negotiate their severance packages. It’s worth discussing terms that work for you, especially if you have contributed significantly to the company.

- Are severance payments taxable? Yes, severance pay is generally subject to federal and state income taxes, just like regular income.

- What should I do if I didn’t receive a severance agreement? If you believe you are entitled to a severance agreement, contact your HR department for clarification and review your employment contract.

These Frequently Asked Questions may elucidate a few typical worries about severance remuneration in Ohio and assist you traversing the procedure.

Conclusion on Ohio Severance Laws

Ohio severance laws are important for workers who are losing their jobs. Thus, these laws offer vital safeguards and delineate employees’ rights with respect to severance remuneration. Being aware of what constitutes a severance agreement, how much severance pay is determined and the legal protection available can make you able to maneuver through the challenging waters of termination from employment. A situation in which an individual stays without severance pay may prompt him or her to go back and look through his/her contract or get a lawyer for guidance on how to protect himself/herself on this matter. Being cognizant about the laws means being ready for possible pitfalls and therefore receives the payout and dignity deserved during a hard moment.