Repo Laws in Tennessee and How They Affect Borrowers

When considering taking out a loan it’s tempting to envision the potential benefits and opportunities that come with it. However have you ever thought about what happens if things don’t go according to plan and you’re unable to make your repayments? This is where repossession laws come into play. In Tennessee these laws are in place to safeguard the interests of both lenders and borrowers although they can often appear quite intricate. Let’s simplify the key aspects of these laws and their impact on you.

Key Provisions of Repo Laws

Tennessees rules on repossession are based on the principle of fairness striving to protect the rights of both lenders and borrowers. Here are some important aspects to note.

- Repossession Without Court Order: In Tennessee, lenders can repossess property without a court order if the borrower defaults on their loan. This means if you miss payments, the lender has the legal right to take back the item.

- Notice Requirements: Lenders must provide written notice to borrowers about the repossession. This notice should include details about the amount owed and instructions on how to recover the repossessed property.

- Peaceful Repossession: Repossession must be conducted peacefully. This means that the lender or repossession agent cannot use force or threats to take the property.

- Redemption Rights: Borrowers have the right to redeem their property before it is sold. This involves paying the total amount owed plus any additional costs incurred during the repossession process.

- Sale of Repossessed Property: Once repossessed, the property can be sold to recover the owed amount. Any surplus from the sale must be returned to the borrower.

These rules are designed to safeguard your interests and help lenders recoup their losses. Being aware of these specifics can assist you in handling a challenging situation more effectively.

How Repo Laws Impact Borrowers

Having your belongings taken back can be quite overwhelming, but understanding the laws surrounding repossession can alleviate some of that stress. Here’s how these regulations impact those who borrow money:

- Financial Stress: Missing payments and facing repossession can create significant financial strain. The repossession process often adds extra fees and penalties to your debt, exacerbating the problem.

- Loss of Property: Losing your car, home, or other possessions can be devastating. It’s not just about the loss of the item but also the emotional toll it can take.

- Impact on Credit Score: Repossession can severely impact your credit score. This can make it harder to secure loans or credit in the future, affecting your financial stability long-term.

- Legal Consequences: If repossession isn’t handled correctly, there can be legal repercussions. For example, if a lender doesn’t follow the proper procedures, you may have grounds to challenge the repossession.

- Redemption and Recovery: The repo laws do provide an avenue for recovery. Understanding your rights to redeem your property can offer a chance to get back on track and resolve the issue without losing your belongings permanently.

Understanding the impact of repo laws on you can give you the ability to take action and make well informed choices. Its not just about being aware of the law but also grasping how it relates to your circumstances and what measures you can implement to safeguard yourself.

Steps for Borrowers During Repossession

Dealing with the possibility of having your belongings repossessed can be a daunting experience and it’s natural to feel a bit adrift during this time. However by taking some proactive measures you can navigate the situation more effectively. Here are some steps you can consider taking.

- Stay Calm and Assess the Situation: Take a deep breath and gather all relevant documents related to the loan and repossession. Understanding the situation clearly can help you make informed decisions.

- Review Your Loan Agreement: Check the terms of your loan agreement to understand what led to the repossession and any clauses about repossession and redemption. Knowing your contract inside out is crucial.

- Communicate with Your Lender: Reach out to your lender as soon as possible. Open a line of communication and explain your situation. Sometimes lenders are willing to work out a payment plan or delay repossession if you’re upfront about your difficulties.

- Understand Your Redemption Rights: In Tennessee, you have the right to redeem your property before it’s sold. This means you can pay off the debt and any additional fees to get your property back. Ensure you know the exact amount needed for redemption.

- Document Everything: Keep records of all communications with your lender and any payments made. This documentation will be useful if you need to contest the repossession or prove that you’ve met your obligations.

- Seek Legal Advice: Consult with a lawyer who specializes in repossession or consumer rights. They can provide you with personalized guidance and help you understand the best course of action.

- Consider Alternatives: If redemption isn’t feasible, explore other options such as negotiating a settlement or finding a way to mitigate the impact of repossession on your credit.

By following these actions you can improve your handling of the repossession journey and possibly discover a solution that aligns with your interests.

Legal Rights and Responsibilities

Knowing your legal rights and obligations when it comes to repossession is crucial for handling the situation smoothly. Here’s a summary of the important points you should be aware of:

- Right to Notice: Tennessee law requires that you receive proper notice before repossession. This notice should detail the amount you owe and provide instructions on how to reclaim your property. If you don’t receive this notice, it might be a point you can challenge.

- Right to Redemption: You have the legal right to redeem your property by paying off the full amount owed, including any repossession costs. This right allows you to reclaim your property before it’s sold at auction.

- Peaceful Repossession: Lenders must conduct repossession without using force or breaching the peace. This means that repossession agents cannot threaten or use physical force to take your property. If this happens, it could be illegal and worth contesting.

- Responsibility for Property: Even after repossession, you may still be responsible for any remaining debt if the sale of your property doesn’t cover the full amount owed. This deficiency can affect your credit score and finances.

- Responsibility for Fees: Be aware that repossession can come with additional fees, such as towing and storage costs. These fees are typically added to the amount you owe, increasing your overall debt.

Understanding these rights and obligations assists you in ensuring that the repossession procedure is carried out in a manner and adheres to legal limits.

How to Challenge a Repossession

If you think the way your property was taken back wasn’t right or you have a valid reason to dispute it here’s what you can do to fight against it.

- Review the Repossession Process: Check if the repossession was carried out according to the legal requirements. If there was no proper notice or if the repossession wasn’t peaceful, you might have grounds for a challenge.

- Gather Evidence: Collect all relevant documents and evidence, such as communication with your lender, notices received, and records of payments. This evidence will support your case if you decide to challenge the repossession.

- Consult with a Lawyer: Seeking advice from a lawyer who specializes in repossession or consumer law can be crucial. They can help you understand your legal options and represent you if necessary.

- File a Complaint: If you believe that your rights were violated, you can file a complaint with the Consumer Financial Protection Bureau or a local consumer protection agency. These organizations can investigate your complaint and offer assistance.

- Negotiate with Your Lender: Sometimes, you can resolve the issue directly with your lender. Discuss your concerns and try to negotiate a settlement or alternative arrangement. A cooperative approach may lead to a favorable outcome.

- Consider Legal Action: If all else fails, you might need to consider taking legal action against the lender. This could involve filing a lawsuit to recover your property or seek damages for any wrongful actions taken during repossession.

Fighting against a repossession can be a tough job, but knowing your choices and taking the appropriate actions can greatly impact the result. Consider reaching out for assistance to navigate this journey.

Preventing Repossession: Tips and Strategies

Facing repossession can be a daunting experience but there are steps you can take to lessen its impact. While it may not always be possible to prevent it completely here are some actionable suggestions and personal reflections on how to safeguard yourself against repossession.

- Stay Proactive with Payments: One of the most effective ways to prevent repossession is to stay on top of your payments. Set reminders for due dates or automate payments to ensure you never miss one. I’ve found that setting up automatic payments has saved me from the stress of remembering each date.

- Communicate Early: If you’re facing financial difficulties, don’t wait until you’re behind on payments. Reach out to your lender as soon as you know you might struggle. Most lenders are more willing to work with you if you approach them before missing payments.

- Negotiate a Payment Plan: Sometimes, lenders can offer temporary relief or a modified payment plan if you’re experiencing financial hardship. This could involve lowering your monthly payments or extending the term of the loan. When I faced a similar situation, negotiating a revised plan helped me manage my payments better.

- Seek Financial Counseling: Financial counselors can provide valuable advice on managing debt and budgeting. They can help you create a plan to get back on track and avoid future repossession. I once worked with a counselor who helped me regain control over my finances.

- Consider Refinancing: Refinancing your loan might provide better terms and lower payments. It’s worth exploring if you’re struggling with your current loan conditions. Refinancing helped a friend of mine reduce their monthly payments significantly.

- Understand Your Loan Terms: Familiarize yourself with the terms of your loan agreement. Knowing your rights and obligations can help you avoid mistakes that could lead to repossession.

By following these measures you can not only steer clear of having your belongings repossessed but also find a sense of tranquility. Its all about being ahead of the game and handling your finances in a manner that keeps you secure.

Finding Legal Help for Repo Issues

When facing the threat of repossession having the legal assistance can be a game changer. Here’s a guide on how to seek out the legal support you need for your repossession challenges.

- Consult with Specialized Attorneys: Look for attorneys who specialize in repossession or consumer rights. They have the expertise needed to navigate complex repossession laws and can offer tailored advice. I remember finding a lawyer who specialized in repossession, and their knowledge made a huge difference in my case.

- Seek Recommendations: Ask friends, family, or colleagues if they know any reputable attorneys. Personal recommendations can lead you to trustworthy professionals who have a track record of handling similar issues.

- Check Online Reviews: Research potential attorneys online. Look for reviews and ratings from previous clients to gauge their reputation and effectiveness. Online reviews helped me find a lawyer who was not only knowledgeable but also highly recommended.

- Utilize Legal Aid Services: If you’re unable to afford a private attorney, explore legal aid organizations. These services offer free or low-cost legal assistance to those in need. I once connected with a legal aid group that provided crucial support during a tough time.

- Schedule Consultations: Most attorneys offer free initial consultations. Use this opportunity to discuss your situation and see if the attorney is a good fit. During my consultations, I made sure to ask questions about their experience with repossession cases.

- Prepare Your Case: Before meeting with an attorney, gather all relevant documents and information about your repossession issue. Being organized can help your attorney provide more effective assistance.

Seeking assistance can help you navigate the repossession journey and potentially lead to a more favorable resolution of your concerns. Taking the time to find a lawyer who comprehends your requirements and can represent your interests is a wise decision.

FAQ About Repo Laws in Tennessee

The topic of repossession can be quite perplexing with many individuals sharing the same inquiries. Here’s a summary of commonly asked questions regarding repo regulations in Tennessee.

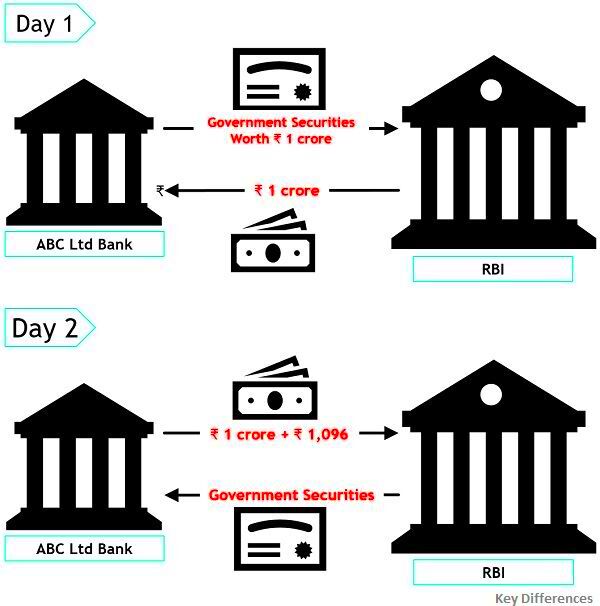

- What is repossession? Repossession occurs when a lender takes back property from a borrower who has defaulted on their loan. This typically happens without a court order, provided the repossession is conducted peacefully.

- How much notice must I receive before repossession? In Tennessee, you should receive written notice from your lender detailing the amount owed and instructions on how to reclaim your property before repossession occurs.

- Can I get my property back after repossession? Yes, you have the right to redeem your property by paying off the full amount owed, plus any additional repossession costs, before it is sold. This process is called redemption.

- What if the repossession wasn’t done properly? If you believe the repossession was carried out improperly, such as without proper notice or peacefully, you may have grounds to challenge it. Consult with a legal expert to explore your options.

- How does repossession affect my credit score? Repossession can significantly impact your credit score, making it harder to obtain credit in the future. It’s important to address any issues as soon as possible to mitigate long-term effects.

- What should I do if I’m struggling to make payments? Communicate with your lender as soon as possible to discuss your situation. You might be able to negotiate a payment plan or seek financial counseling to help manage your debt.

These frequently asked questions address some of the issues related to repossession. By grasping these responses you can better navigate the process and make choices regarding your circumstances.

Conclusion

Going through a repossession can be tough and really shake up your sense of security. It involves navigating the legal aspects and taking steps to manage the situation. While the process may seem overwhelming it is definitely not impossible. It’s all about regaining control staying well informed and reaching out for help when necessary. Having faced challenges myself I understand that keeping lines of communication open with lenders and seeking advice can often turn things around for the better. Remember that repossession isn’t the end of the line; it’s just an obstacle that you can overcome with the mindset and support. Stay updated be proactive and you’ll find a way to get through this tough period.