Key Facts About North Dakota Property Laws

There are some ingrained rules and liabilities that go along with ownership of properties in North Dakota. It is necessary for either a first time buyer or someone experienced so that one can appreciate the basics. This state’s property laws are simple thus making it easier for the citizens to know what they are entitled to and what they should be doing.

In North Dakota, property is generally divided into two types: real property and personal property. Real property pertains to land and anything affixed to it while personal property includes movable items. Such distinction is important for diverse legal matters that may involve taxation, leasing or even inheritance.

Types of Property in North Dakota

North Dakota recognizes multiple types of property which are governed by specialized statutes. Here’s a quick overview:

- Residential Property: This includes single-family homes, townhouses, and condominiums. Buyers should be aware of zoning laws that dictate how properties can be used.

- Commercial Property: Properties used for business purposes fall under this category. Commercial properties can be complex, often requiring a thorough understanding of local regulations.

- Agricultural Property: Given North Dakota’s rural landscape, agricultural property is significant. This includes farmland and ranches, which are subject to different laws concerning land use and environmental regulations.

- Vacant Land: Undeveloped land can be an excellent investment, but buyers should research zoning and land use restrictions before purchasing.

Property Rights and Responsibilities

Being a property owner in North Dakota implies both rights and obligations. The following are the rights of property owners in this state:

- Use their property as they wish, within the limits of zoning laws.

- Sell, lease, or rent their property.

- Make improvements and modifications, provided they follow local regulations.

Но эти права накладывают обязанности. Собственники недвижимости должны:

- Pay property taxes on time.

- Maintain their property to meet safety and health standards.

- Respect neighbors’ rights and adhere to community standards.

Meanwhile there are legal issues relating to not carrying out these responsibilities which can result in penalties and loss of ownership rights. Hence, it is compulsory that an individual owning a piece of land remains updated concerning the regulations as well as laws within his/her locality so as to safeguard their expectations.

North Dakota Land Use Regulations

Land use regulations in North Dakota are designed to ensure that property is used safely and sustainably. These regulations can seem complex, but understanding them is vital for any property owner. They govern everything from zoning to building permits and environmental protections.

North Dakota’s regulations regarding land use can differ widely among counties and municipalities. Below are some essential things to note:

- Zoning Laws: These laws determine how land can be used. For instance, areas may be designated for residential, commercial, or agricultural use. Always check the zoning designation before purchasing property.

- Building Codes: If you plan to construct or renovate, you must adhere to local building codes. These codes ensure safety and may include regulations on structural integrity, plumbing, and electrical work.

- Environmental Regulations: North Dakota has rules to protect natural resources. If your property is near wetlands or rivers, additional regulations may apply.

In order to maintain compliance, property holders need to frequently contact their local planning department or zoning office. That is where you can learn about changes in law and how to obtain permits less painlessly.

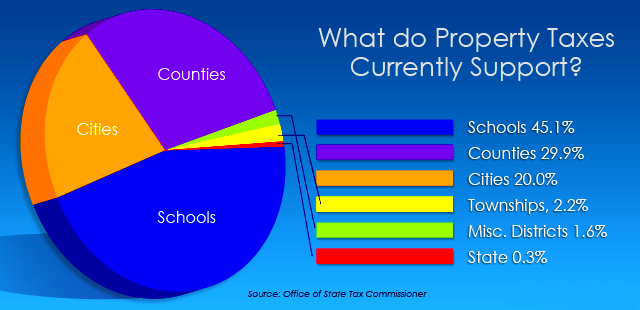

Property Taxes and Assessment Process

In North Dakota, it is very important for the owners of real estate to pay property taxes. The money from these taxes goes toward providing for basic needs of society like education, getting around or in emergencies. To be more economical and handle your finances more effectively, one must know that they are responsible for paying as well as assessing a tax on their properties.

Here is how the procedure regarding property tax looks like:

- Assessment: Property assessments are conducted by local governments, usually every few years. Assessors evaluate the property’s value based on factors like location, size, and improvements.

- Tax Rate: Each county sets a tax rate, which is applied to the assessed value of your property. The rate can vary significantly between areas, so it’s essential to be aware of your specific county’s rate.

- Payment Schedule: Property taxes are typically due annually or semi-annually. It’s vital to pay them on time to avoid penalties.

Approaching an evaluation can be done by property owners through a petition letter to their respective local assessment offices. Should it turn out favorably, this might reduce their rates of taxation significantly hence making it necessary for one to comprehend how things work in this field.

Buying and Selling Property in North Dakota

All in all, even if the actions of buying and selling houses in North Dakota seem easy, they have some significant steps and factors to regard. Any buyer or seller should be aware that with more knowledge about it, everything will go more easily.

WzЧто вам нужно знать:

- Finding a Real Estate Agent: A qualified real estate agent can be invaluable. They help navigate the market, provide insights on pricing, and manage paperwork.

- Making an Offer: Once you find a property, your agent will help you draft an offer. This document outlines the price you’re willing to pay and any contingencies, such as needing to sell your current home first.

- Home Inspections: Before finalizing a purchase, conducting a home inspection is crucial. This can reveal hidden issues that might affect your decision or negotiations.

- Closing Process: The closing process involves signing various documents and paying closing costs. Your real estate agent will guide you through this process to ensure everything is in order.

If you want to sell your property, make it look good on sale by staging it and pricing it well enough for people to buy them at the specified price. Such considerations are recommended to both buyers and sellers as a way of successfully working through North Dakota real estate market forces.

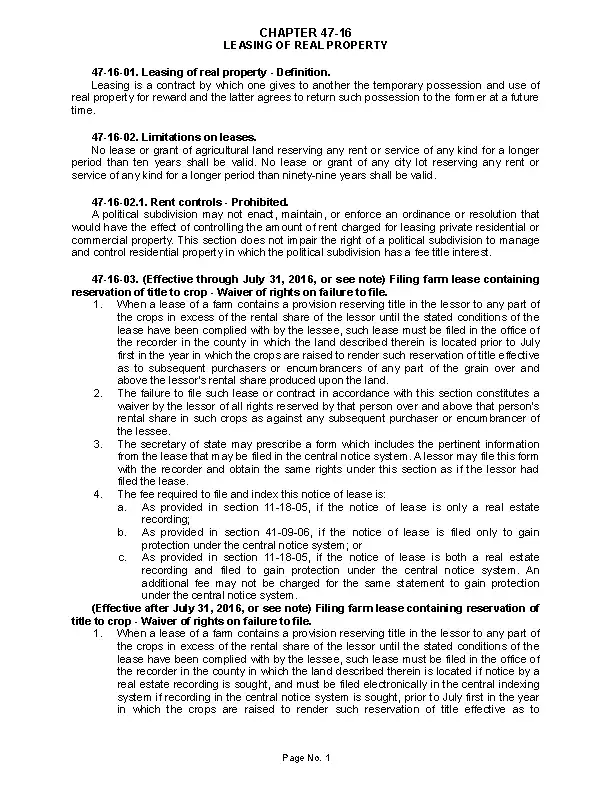

Disputes and Resolution in Property Matters

There are several causes of disagreement in the matter of property, such as fence disputes or rental lease related problems. Knowing how to deal with these quarrels is very important for both landlords and tenants. This is made possible by North Dakota’s legal systems that promote equity when solving such disputes.

Here are some typical sorts of disagreements and ways to resolve them:

- Boundary Disputes: These occur when property lines are unclear. To resolve these, property owners can consult surveyors to accurately determine the boundaries. Legal action may be necessary if an agreement can’t be reached.

- Landlord-Tenant Issues: Problems can arise regarding lease agreements, repairs, or eviction notices. Open communication often resolves these issues. If not, mediation services can help both parties reach an agreement.

- Contract Disputes: If either party fails to fulfill a contractual obligation, it can lead to a dispute. In such cases, reviewing the contract and seeking legal advice is advisable.

Mediation can resolve numerous disagreements and is less formal and typically quicker than litigation. But in case of a failed mediation, litigation should be considered. The process of managing these occurrences entails knowing what rights you have or options available.

Frequently Asked Questions

Many individuals often inquire about laws and practices regarding real estate properties. To clarify on some of the common worries, here are mostly asked questions:

- What is the difference between real and personal property? Real property includes land and anything attached to it, while personal property encompasses movable items.

- How are property taxes assessed? Local assessors evaluate property value based on factors like size and location. Property taxes are then based on this assessed value.

- Can I appeal my property tax assessment? Yes, if you believe your assessment is too high, you can file an appeal with your local assessment office.

- What should I do if I have a property dispute? Start with open communication. If that doesn’t work, consider mediation or consult a legal professional for advice.

Nevertheless, it is advisable to seek professional legal consultations for your specific case. This is because these frequently asked questions respond to certain general queries only. html>

Conclusion

Property laws in North Dakota can be like an enormous jungle, yet understanding the basic fundamentals empowers a prospective buyer or owner. This means that understanding one’s rights and obligations as well as dealing with disputes are critical pieces of information that everyone should have at their fingertips. Have in mind also that there are different rules for each county which means you need to always keep track of them.

In case you want to purchase, trade or have a better idea regarding your estate, reaching out to a local expert or lawyer is a great option. Your understanding of land usage laws, house taxes, and methods of solving disputes creates solid decisions when embarking on a real estate journey. North Dakota property rules are complex but having enough knowledge prepares one for decision-making.