Adjusting Commission Pay Laws in California

The commission pay laws in California aim to guarantee that workers are fairly compensated for their efforts. These regulations specify the way commission payments should be organized recorded and managed. Having dealt with different employment matters I recognize the importance of both employers and employees being knowledgeable about these rules. Whether you work as a salesperson or run a company being aware of the details of commission pay laws can assist you in steering clear of miscommunication and potential legal issues.

Commission based compensation is a prevalent approach in sectors such as sales where income is tied to performance. In California these regulations are shaped by state and federal laws that seek to safeguard workers rights while offering employers some leeway. The main points to note are

- Written Agreements: Employers must provide a clear, written commission agreement that outlines how commissions are calculated, paid, and any conditions attached.

- Payment Timeliness: Commissions must be paid in accordance with the agreement and within the required payroll periods.

- Record Keeping: Employers are required to keep accurate records of commission calculations and payments.

Grasping these fundamentals is essential to uphold compliance and create a just workplace.

Understanding Commission Pay Agreements

Commission pay agreements go beyond being a formality; they play a role in the employer employee relationship. In my view a properly crafted agreement can help prevent conflicts and miscommunications between employers and employees. These agreements outline the process of earning calculating and distributing commissions and it’s crucial for them to be precise and unambiguous to prevent any confusion.

Here are some key elements to include in a commission payment agreement.

- Commission Structure: This section should specify whether commissions are based on sales volume, profit margins, or other metrics.

- Payment Schedule: Clearly outline when and how commissions will be paid—monthly, quarterly, or upon reaching specific sales targets.

- Draw Against Commission: If applicable, explain how advances on commissions are handled and how they affect future earnings.

- Termination Clause: Describe what happens to unpaid commissions if the employee leaves the company or is terminated.

Creating a clear and thorough commission pay agreement not only ensures adherence to Californias regulations but also fosters trust between employers and their staff.

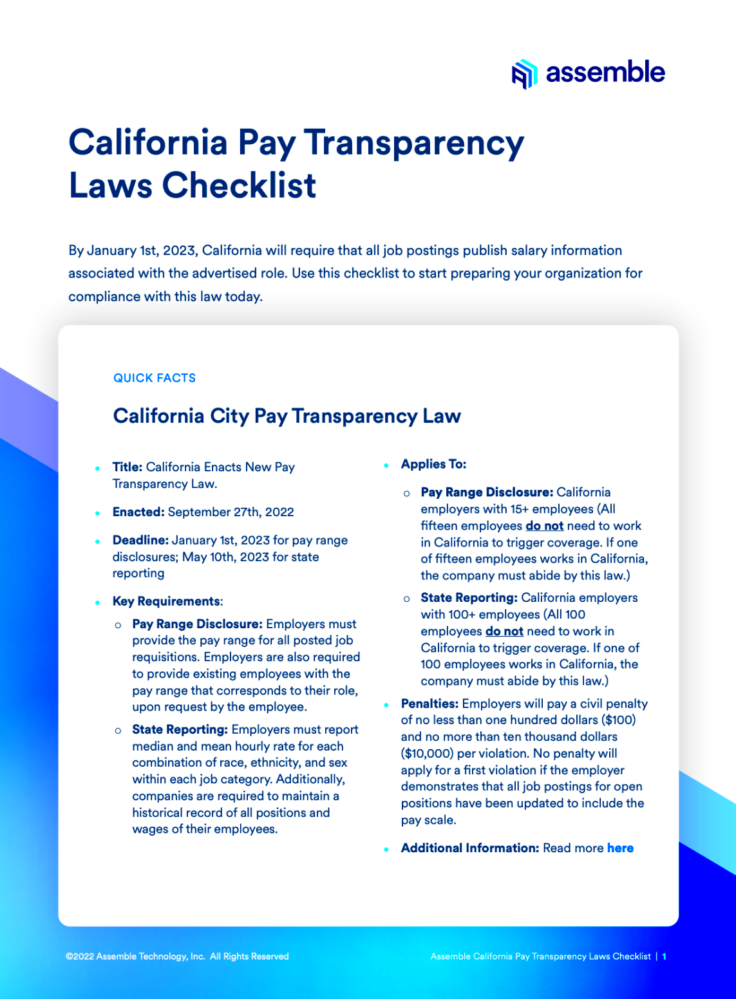

Recent Changes to Commission Pay Laws

Staying updated on changes to commission pay laws can be tough but it’s crucial for maintaining compliance and promoting fairness. The recent revisions to Californias commission pay laws show the states dedication to strengthening worker safeguards. In my view these adjustments are a reaction to shifting business practices and the demand for increased transparency in compensation.

Some significant updates include:

- Increased Clarity in Agreements: New regulations mandate that commission agreements must be more explicit about how commissions are calculated and paid.

- Enhanced Record-Keeping Requirements: Employers are now required to maintain more detailed records of commission earnings and payments.

- Updated Dispute Resolution Procedures: The state has introduced more streamlined processes for resolving disputes related to commission pay, making it easier for employees to seek redress.

The aim of these adjustments is to safeguard workers and guarantee that they are fairly compensated for their efforts. Companies ought to assess their commission contracts and procedures to comply with these updated obligations and prevent possible legal complications.

Legal Requirements for Commission Pay

In California there are rules regarding commission pay to promote fairness and transparency. While navigating these rules may appear challenging it’s important for both employers and employees to grasp their significance. Based on my experience being knowledgeable about these regulations and ensuring that all practices comply with state laws is essential, in preventing disputes and legal issues.

In California there are key legal obligations regarding commission compensation that you should be aware of.

- Written Commission Agreements: Employers must provide a written agreement that details how commissions are calculated, the payment schedule, and any conditions affecting the commission. This agreement should be signed by both parties to ensure clarity and avoid misunderstandings.

- Timely Payment: Commissions must be paid in accordance with the agreement and within the regular payroll periods. Delays or failure to pay commissions as agreed can lead to legal issues and disputes.

- Accurate Record Keeping: Employers are required to maintain detailed records of all commission calculations and payments. This includes documenting the basis for commission earnings and any adjustments made.

- Compliance with Minimum Wage Laws: Even with commission pay, employers must ensure that the total compensation meets California’s minimum wage requirements. If commission earnings fall short of the minimum wage, the employer must make up the difference.

Following these guidelines contributes to creating a workplace that is just and open, avoiding conflicts and nurturing confidence between employers and their staff.

How Commission Pay Disputes Are Resolved

Disagreements regarding commission payments can be quite demanding and tough. Having observed different conflicts throughout my professional journey I believe that addressing these matters successfully necessitates a grasp of the processes and choices at hand. Being familiar with the ways in which disputes are settled can play a role in achieving an equitable and prompt resolution.

Typically commission pay disputes are resolved through the following steps.

- Internal Resolution: Many disputes are resolved internally through discussions between the employee and employer. It’s often helpful to address concerns directly and review the commission agreement to clarify any misunderstandings.

- Mediation: If internal resolution fails, mediation can be a useful step. This involves a neutral third party who helps both sides reach an agreement. Mediation is often less formal and quicker than litigation.

- Arbitration: Arbitration is a more formal process where a neutral arbitrator reviews the dispute and makes a binding decision. It’s often faster than going to court and can be less costly.

- Legal Action: As a last resort, employees may take legal action to resolve commission disputes. This involves filing a claim with the Labor Commissioner or pursuing a lawsuit, which can be time-consuming and expensive.

Grasping these choices aids in selecting the most effective way to settle conflicts while safeguarding your rights during the procedure.

Impact on Employers and Employees

The influence of commission pay regulations on both companies and workers is significant and diverse. Based on my personal observations I have witnessed how these rules impact job environments, pay systems and workplace dynamics. Its crucial for both businesses and employees to recognize these implications in order to fulfill their responsibilities effectively and prevent misunderstandings.

Here’s how commission payment regulations affect both sides:

- For Employers:

- Compliance Costs: Ensuring compliance with commission pay laws can involve additional administrative work and costs, such as updating agreements and maintaining detailed records.

- Risk Management: Employers who fail to comply with these laws may face legal challenges, penalties, and damage to their reputation.

- Motivational Tool: On the positive side, well-structured commission plans can motivate employees and drive sales performance, benefiting the business.

- For Employees:

- Fair Compensation: Commission pay laws ensure that employees are fairly compensated for their performance and that agreements are honored.

- Job Satisfaction: Clear and fair commission structures can enhance job satisfaction and performance, as employees feel their efforts are recognized and rewarded.

- Legal Protection: Employees have legal avenues to address any disputes or discrepancies in their commission pay, providing a sense of security and fairness.

In general, these regulations are essential for creating a fair and harmonious workplace that brings advantages to both employers and workers.

Steps to Ensure Compliance

Navigating commission pay laws can be quite challenging. However by being proactive you can streamline the process for both employers and employees. Based on my experiences I believe that having procedures in place and conducting reviews are crucial for staying compliant. By adhering to a few key steps you can reduce risks and create a fair and transparent workplace.

Here are some actionable measures to make sure you adhere to commission payment regulations.

- Draft Clear Commission Agreements: Start by creating a detailed written agreement that outlines how commissions are calculated, paid, and any conditions attached. Make sure that the agreement is signed by both parties and kept up-to-date with any changes in the law or business practices.

- Maintain Accurate Records: Keep comprehensive records of all commission calculations, payments, and related communications. This documentation should be readily accessible and reflect the terms outlined in the commission agreement.

- Regularly Review Policies: Periodically review your commission pay policies and agreements to ensure they comply with current laws and regulations. This can help you identify any necessary adjustments before they become issues.

- Provide Training: Educate your HR team and managers about the legal requirements for commission pay and how to handle disputes. Regular training ensures everyone involved is aware of their responsibilities and the latest legal updates.

- Consult Legal Experts: When in doubt, seek advice from legal professionals who specialize in employment law. Their expertise can help you navigate complex issues and ensure that your practices are legally sound.

By following these actions, you not only ensure legal compliance, but also foster trust and equity within your work environment.

Resources for Further Information

Its essential to keep up with the laws and regulations regarding commission payments but finding trustworthy information can be tricky. Based on my experience having the resources at hand can greatly enhance your comprehension and implementation of these laws. Luckily there are multiple helpful sources out there to assist you in staying informed.

Here are a few materials you might want to check out for more details.

- California Department of Industrial Relations: This official website provides comprehensive information on labor laws, including commission pay requirements. It’s a great starting point for understanding the legal framework and accessing relevant forms and guidelines.

- Legal Consultation Services: Many law firms offer specialized services and consultations for employment law issues. Consulting with an attorney who has experience with commission pay laws can provide tailored advice and support.

- Industry Associations: Associations related to your industry may offer resources, training, and updates on commission pay practices. Engaging with these groups can provide insights into industry-specific standards and trends.

- Online Legal Resources: Websites like Nolo or FindLaw provide articles, guides, and legal advice on various employment law topics, including commission pay. These resources can offer practical tips and explanations.

- Professional Networking Groups: Connecting with other professionals in your field can provide valuable insights and shared experiences regarding commission pay practices and compliance.

By using these tools you can keep yourself updated and make sure that your commission payment methods are current and in line with legal requirements.

Frequently Asked Questions

When it comes to laws regarding commission pay it’s normal to have inquiries and worries. Based on my insights tackling questions can help shed light on uncertainties and offer a clearer grasp of the rules. Below are some questions often asked along with their responses to assist you in navigating the intricacies of commission compensation.

- What should be included in a commission pay agreement? A commission pay agreement should include details on how commissions are calculated, the payment schedule, any draw or advance policies, and terms related to termination or changes in employment. It’s important that both employer and employee clearly understand and agree to these terms.

- Can commissions be paid less frequently than regular wages? No, commissions must be paid according to the agreed schedule, and it should align with regular payroll practices. Delays in payment can lead to legal issues and affect employee satisfaction.

- What happens if an employee disputes their commission payment? If there is a dispute, it should first be addressed internally between the employer and employee. If unresolved, the employee may seek mediation, arbitration, or legal action, depending on the severity of the issue.

- How can an employer ensure they are meeting minimum wage requirements with commission pay? Employers must ensure that the total earnings, including commissions, meet or exceed California’s minimum wage requirements. If commission earnings fall short, the employer must make up the difference to comply with wage laws.

- Are there any recent updates to commission pay laws I should be aware of? Yes, recent updates may include changes in documentation requirements, payment schedules, or dispute resolution procedures. Regularly reviewing legal resources or consulting with a legal expert can help you stay updated on any changes.

By tackling these commonly asked questions we can dispel doubts and make sure that both employers and employees are in the loop regarding commission payment procedures.

Conclusion

Grasping and adhering to commission payment laws in California goes beyond mere rule compliance; it involves nurturing a fair and open workplace. Whether it’s crafting agreements maintaining precise records or handling disputes efficiently every action is vital for sustaining a healthy employer employee dynamic. Having traversed these challenges personally I’ve learned that being well informed and proactive can avert numerous issues and foster an uplifting work environment. By dedicating time to ensure adherence and comprehending the nuances of commission payments both employers and employees can relish in a more harmonious and productive work journey.