Key Points of Georgia Tax Laws

Georgia’s tax laws are designed to generate revenue for state and local governments while providing a fair system for residents and businesses. Understanding these laws is essential for anyone living or working in Georgia. They encompass various tax types, including income, sales, property, and corporate taxes. This overview will highlight key aspects of Georgia’s tax laws, helping you navigate your financial responsibilities in the state.

Types of Taxes in Georgia

Georgia has several types of taxes that contribute to its revenue system. Here’s a quick rundown of the main tax categories:

- Individual Income Tax: Tax on the income earned by residents and non-residents.

- Corporate Income Tax: Tax imposed on the profits of corporations operating in Georgia.

- Sales and Use Tax: Tax on retail sales of goods and certain services.

- Property Tax: Tax based on the value of real estate properties.

- Excise Taxes: Taxes on specific goods like fuel, alcohol, and tobacco.

Individual Income Tax Regulations

Georgia’s individual income tax system applies to residents who earn income within the state. Here’s a breakdown of the key regulations:

- Tax Rates: Georgia has a progressive income tax rate that ranges from 1% to 5.75%. The more you earn, the higher your tax rate. The tax brackets are as follows:

| Income Range | Tax Rate |

|---|---|

| $0 – $750 | 1% |

| $751 – $2,250 | 2% |

| $2,251 – $3,750 | 3% |

| $3,751 – $5,250 | 4% |

| Over $5,250 | 5.75% |

- Filing Status: Residents can file as single, married filing jointly, married filing separately, or head of household.

- Deductions: Georgia allows standard deductions that vary based on filing status. In addition to the standard deduction, taxpayers can claim certain itemized deductions if they choose.

- Credits: Various tax credits are available to reduce your overall tax liability, such as the Low-Income Credit and the Child and Dependent Care Credit.

Staying informed about these regulations can help you manage your tax responsibilities effectively.

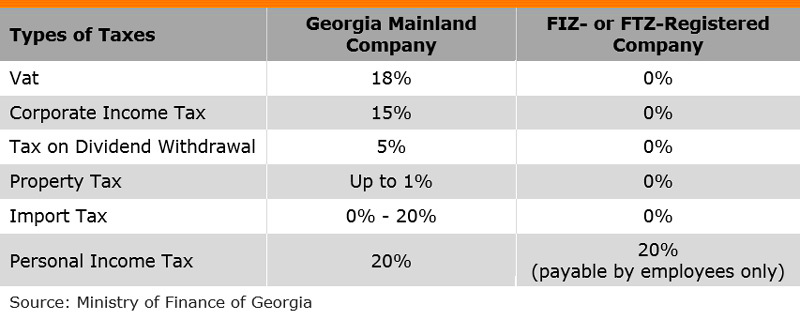

Corporate Income Tax in Georgia

Corporate income tax in Georgia is an essential aspect of the state’s revenue system. If you own a business or are thinking about starting one, understanding this tax is crucial. Georgia imposes a flat corporate income tax rate on businesses operating within its borders. This tax is based on the net income of the corporation and has specific regulations and deductions that can impact your overall tax burden.

Here are some important details about corporate income tax in Georgia:

- Flat Tax Rate: Georgia has a corporate income tax rate of 5.75%. This means that all corporations, regardless of their size, pay the same percentage on their net income.

- Net Income Calculation: Corporate net income is calculated as total revenue minus allowable deductions. It’s important to keep accurate records to ensure you are reporting the correct amount.

- Deductions: Corporations can deduct various expenses, such as operating costs, wages, and certain business expenses, which can reduce taxable income.

- Filing Requirements: Corporations must file their tax returns by the 15th day of the third month following the end of their fiscal year. For most corporations that operate on a calendar year, this means the deadline is March 15.

Understanding corporate income tax can help you plan your business finances better and ensure compliance with Georgia’s tax laws.

Sales and Use Tax Overview

Sales and use tax in Georgia is crucial for funding state and local services. This tax applies to most retail sales, leases, and rentals of tangible personal property. If you’re a business owner or a consumer, knowing how sales and use tax works can save you money and prevent legal issues.

Here’s what you need to know about sales and use tax in Georgia:

- State Sales Tax Rate: The base state sales tax rate in Georgia is 4%. However, local jurisdictions may impose additional sales taxes, leading to varying rates across the state.

- Taxable Items: Sales tax applies to the sale of tangible personal property, such as clothing, electronics, and furniture. Certain services and items, like groceries and prescription medications, are typically exempt.

- Use Tax: If you purchase taxable items from out-of-state vendors without paying sales tax, you are required to pay a use tax. This rate is the same as the sales tax rate and helps maintain fairness in taxation.

- Filing Requirements: Businesses must collect and remit sales tax to the state. Monthly, quarterly, or annual filing may be required, depending on the volume of sales.

Understanding sales and use tax is vital for compliance and helps you avoid unexpected expenses.

Property Tax Guidelines

Property tax in Georgia is a significant source of funding for local governments, schools, and public services. If you own property in the state, it’s essential to understand how property tax is assessed and what your responsibilities are.

Here are the key points regarding property tax in Georgia:

- Assessment Rate: The state assesses property at 40% of its fair market value. Local taxing authorities then apply their millage rates to determine the final tax amount.

- Property Types: Property tax applies to residential, commercial, and industrial properties, as well as personal property like vehicles and boats.

- Exemptions: Several exemptions can reduce your tax liability, including homestead exemptions for homeowners, senior citizen exemptions, and exemptions for disabled veterans. It’s important to check eligibility for these exemptions.

- Appeals Process: If you disagree with your property assessment, you have the right to appeal. Typically, this process involves contacting your county’s board of tax assessors and providing evidence for your case.

Understanding these guidelines can help you manage your property tax responsibilities and make informed decisions about property ownership in Georgia.

Tax Credits and Deductions Available

Understanding tax credits and deductions in Georgia can significantly reduce your tax burden. These financial incentives are designed to help residents and businesses by lowering the amount of taxable income or directly reducing the amount of tax owed. Knowing which credits and deductions apply to you can lead to substantial savings.

Here are some key tax credits and deductions available in Georgia:

- Low-Income Tax Credit: This credit is available for individuals and families whose income falls below certain thresholds, helping to ease the tax burden on low-income taxpayers.

- Child and Dependent Care Credit: If you pay for childcare so you can work or look for work, you may be eligible for this credit, which can cover a percentage of your childcare expenses.

- Georgia Film Tax Credit: This credit is aimed at film and television productions operating in Georgia, allowing them to recover a percentage of their expenditures on production costs.

- Ad Valorem Tax Exemption: Certain businesses can qualify for exemptions from local ad valorem taxes, which can lower operational costs significantly.

Additionally, individuals can claim standard deductions on their federal and state returns, which reduce the amount of taxable income. For 2023, the standard deduction for a single filer in Georgia is $5,400, while married couples filing jointly can claim $10,800. By maximizing your eligible credits and deductions, you can keep more money in your pocket!

Frequently Asked Questions about Georgia Tax Laws

Navigating tax laws can be tricky, and many people have questions about Georgia’s tax system. Here are some common queries and their answers to help clarify things for you:

- What is the deadline for filing taxes in Georgia? Generally, the deadline for individual income tax returns is April 15. If this date falls on a weekend or holiday, the deadline extends to the next business day.

- How do I check my tax refund status? You can check your refund status online through the Georgia Department of Revenue’s website by entering your Social Security number and other required information.

- Are there penalties for late payment? Yes, if you do not pay your taxes on time, Georgia may impose penalties and interest on the unpaid amount.

- Can I amend my tax return? Yes, if you need to make changes to a previously filed return, you can submit an amended return within three years of the original filing date.

If you have more specific questions, it’s always a good idea to consult with a tax professional who understands Georgia’s tax laws.

Conclusion on Georgia Tax Laws

Georgia’s tax laws are vital for the state’s funding and provide a framework for residents and businesses to contribute fairly. Understanding these laws helps you navigate your tax obligations more effectively, from income and sales taxes to property taxes and available credits. By staying informed and taking advantage of deductions, you can manage your finances better and ensure compliance.

As you navigate Georgia’s tax landscape, remember that staying updated on changes in tax laws is crucial. Whether you’re a business owner or an individual taxpayer, knowledge is your best tool for making informed decisions. If you have questions or need assistance, don’t hesitate to reach out to a tax professional for guidance!