What to Know About Virginia Independent Contractor Laws

Virginia independent contractor laws play a crucial role in defining the working relationships between businesses and their contracted workers. Understanding these laws is essential for both employers and independent contractors. It helps clarify rights, responsibilities, and the legal implications of the contractor status. With the rise of gig economy jobs, knowing these laws is more important than ever. In this post, we will break down key aspects of independent contractor laws in Virginia, making it easier for you to navigate this landscape.

Definition of Independent Contractors

So, what exactly is an independent contractor? An independent contractor is an individual who provides services to a business but operates independently rather than as an employee. This means they control how and when they work and often have the freedom to work for multiple clients simultaneously. Here are some key characteristics of independent contractors:

- Self-Employment: They are considered self-employed and are responsible for their own taxes.

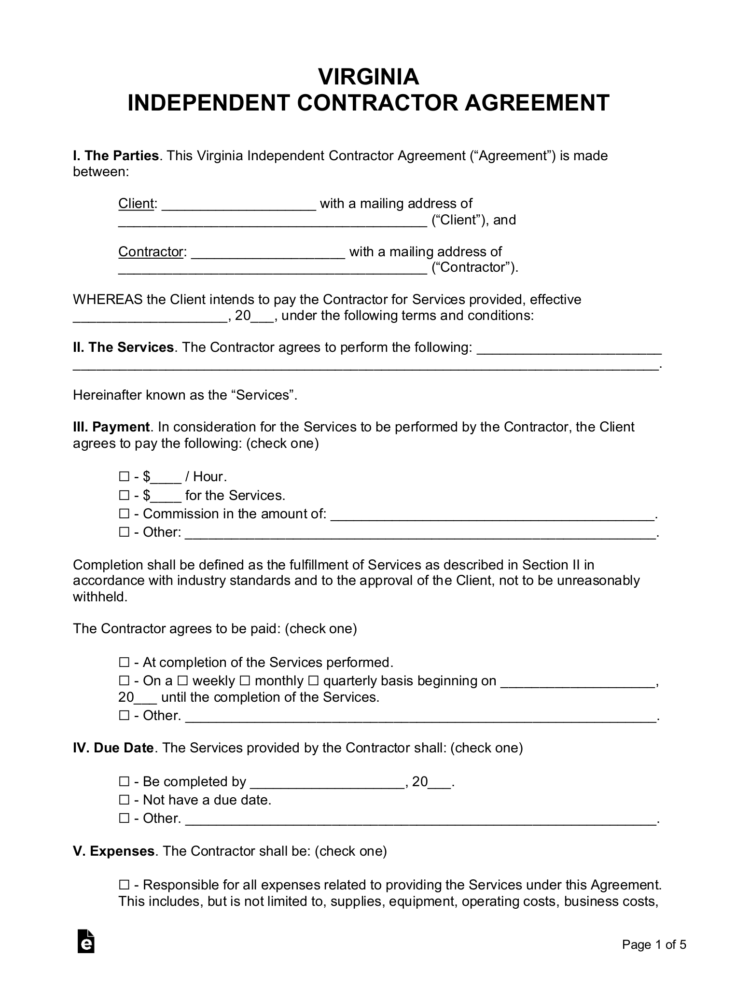

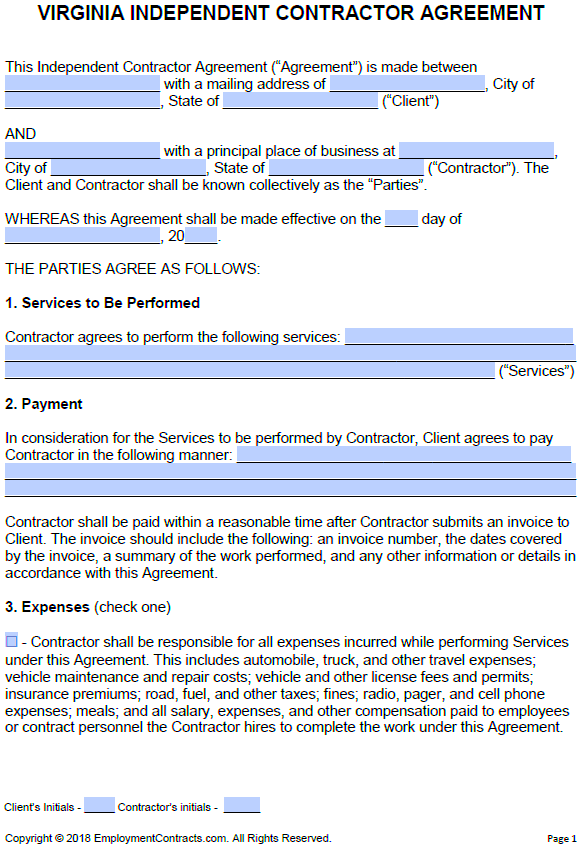

- Contractual Agreement: They usually work under a written contract that outlines the terms of their services.

- Control Over Work: They have the authority to determine how to complete their tasks.

- No Employee Benefits: Unlike employees, they do not receive benefits such as health insurance or paid time off.

Key Differences Between Independent Contractors and Employees

Understanding the distinctions between independent contractors and employees is vital for compliance with labor laws. Here are some key differences:

| Aspect | Independent Contractors | Employees |

|---|---|---|

| Control Over Work | Have control over how to perform tasks | Follow employer’s instructions on how to do the job |

| Tax Responsibilities | Responsible for paying their own taxes | Employers withhold taxes from their paychecks |

| Benefits | Do not receive employee benefits | Eligible for benefits like health insurance and retirement plans |

| Job Security | Work on a project basis; no job security | Typically have a stable job with ongoing employment |

Recognizing these differences can help both workers and employers understand their rights and obligations under Virginia law. Misclassifying an employee as an independent contractor can lead to legal issues, so it’s essential to be aware of these distinctions.

Legal Requirements for Independent Contractors in Virginia

When it comes to working as an independent contractor in Virginia, understanding the legal requirements is crucial. While independent contractors enjoy a level of freedom, they also have certain legal responsibilities to ensure compliance with state laws. One of the key requirements is having a written contract that outlines the terms of the work, including payment details, deadlines, and the scope of services provided. This contract serves as a foundation for the working relationship.

In addition to having a contract, independent contractors in Virginia must also:

- Register a Business: If you plan to operate under a business name, you’ll need to register that name with the Virginia State Corporation Commission.

- Obtain Necessary Licenses: Depending on the type of work you do, you may need specific licenses or permits to operate legally.

- Comply with Local Ordinances: Check your local laws and regulations, as they may impose additional requirements for your business.

- Insurance Coverage: Although not legally mandated, having liability insurance is advisable to protect against potential lawsuits or claims.

By following these legal requirements, independent contractors can operate more smoothly and avoid potential legal complications down the road.

Tax Implications for Independent Contractors

Tax responsibilities for independent contractors can be a bit different than for traditional employees, and it’s important to understand these differences. Since independent contractors are considered self-employed, they must handle their own taxes, which can seem overwhelming at first. Here’s what you need to know:

- Self-Employment Tax: Independent contractors must pay self-employment tax, which covers Social Security and Medicare taxes. This is generally 15.3% of your net earnings.

- Quarterly Estimated Taxes: Instead of having taxes withheld from your paycheck, you’ll need to make estimated tax payments quarterly. This helps prevent a large tax bill at the end of the year.

- Tax Deductions: You can deduct business expenses from your taxable income, including costs related to supplies, travel, and even part of your home if you have a home office.

It’s wise to keep accurate records of all income and expenses throughout the year. Consulting with a tax professional can also help you navigate the complexities of self-employment taxes and ensure you’re meeting all requirements.

Rights and Protections for Independent Contractors

Independent contractors in Virginia have specific rights and protections that are important to know. While they don’t receive the same benefits as employees, they are still entitled to certain protections under the law. Here are some key rights to be aware of:

- Contractual Rights: Independent contractors have the right to a written contract that clearly outlines the terms of their work and payment.

- Right to Fair Payment: They should be paid according to the terms of their contract. If a client fails to pay, the contractor can take legal action to recover the owed amount.

- Protection Against Discrimination: Independent contractors are protected from discrimination based on race, gender, age, and other protected categories.

- Intellectual Property Rights: Depending on the agreement, contractors may retain rights to their work unless otherwise stated in the contract.

It’s essential for independent contractors to be aware of their rights and to seek help if they believe those rights have been violated. Legal assistance can be beneficial for understanding complex situations and ensuring fair treatment.

Common Misclassification Issues

Misclassification issues are a significant concern for independent contractors and employers alike. Often, individuals may be incorrectly labeled as independent contractors when they should be classified as employees. This can lead to a range of legal and financial implications for both parties. Understanding the signs of misclassification is crucial.

Here are some common factors that contribute to misclassification:

- Control Over Work: If the employer controls how, when, and where the work is done, the worker might actually be an employee rather than an independent contractor.

- Tools and Equipment: If the employer provides the tools and equipment necessary to complete the work, this can indicate an employer-employee relationship.

- Exclusivity: If a contractor is required to work exclusively for one client, they may be misclassified. Independent contractors typically have multiple clients.

- Payment Structure: Employees often receive a regular paycheck, while independent contractors are usually paid per project or task.

Misclassification can lead to issues such as unpaid taxes, missed benefits, and even penalties for the employer. If you suspect you’ve been misclassified, it’s wise to consult with a legal professional to explore your options and protect your rights.

Frequently Asked Questions

As an independent contractor in Virginia, you might have several questions about your rights, responsibilities, and the overall legal landscape. Here are some frequently asked questions that can help clarify common concerns:

- What is the difference between an independent contractor and a freelancer?

While both terms often refer to self-employed individuals, a freelancer typically works on a project basis without long-term contracts, whereas an independent contractor may have a more formal agreement. - Do independent contractors need to register their business?

Yes, if they operate under a business name or if their work requires it, independent contractors should register with the Virginia State Corporation Commission. - Can independent contractors collect unemployment?

Generally, independent contractors are not eligible for unemployment benefits. However, during special circumstances, such as the COVID-19 pandemic, there were temporary provisions allowing some independent contractors to claim benefits. - What happens if my client refuses to pay me?

If a client refuses to pay as per the terms of your contract, you have the right to pursue legal action for recovery of funds owed.

Conclusion

Understanding Virginia independent contractor laws is essential for anyone navigating this type of work arrangement. From recognizing the legal requirements to being aware of tax implications and rights, knowledge empowers independent contractors to operate effectively and protect themselves. Misclassification is a common issue that can lead to significant consequences, so staying informed and consulting with professionals when needed is vital.

By grasping these key concepts, independent contractors can foster healthier working relationships with clients, ensure compliance with laws, and promote fair treatment within their industry. If you have more questions or need assistance, don’t hesitate to seek legal advice to guide you on your independent contracting journey.