Key Points of Georgia Foreclosure Laws

The foreclosure process in Georgia is an important topic for homeowners to understand. Foreclosure occurs when a lender takes back a property after the borrower fails to make mortgage payments. In Georgia, the process is typically non-judicial, meaning it doesn’t require court involvement. This makes it faster compared to some other states.

The process starts when the lender sends a notice of default after missed payments. If the borrower does not respond or rectify the situation, the lender can initiate foreclosure proceedings. The lender must then provide the borrower with a notice of sale, which includes details about the auction date.

Understanding this process can help homeowners be proactive in addressing any issues with their mortgage and exploring options before it’s too late.

Types of Foreclosure in Georgia

In Georgia, there are primarily two types of foreclosure: judicial and non-judicial.

- Judicial Foreclosure: This process involves court action. It’s less common in Georgia but can occur if a borrower contests the foreclosure or if the lender prefers to go through the courts.

- Non-Judicial Foreclosure: This is the most common method in Georgia. The lender follows the guidelines set by state law without involving the court system. It’s generally faster and more straightforward.

Understanding these types can help homeowners know what to expect and how to respond if they find themselves facing foreclosure.

Key Timelines in Georgia Foreclosure

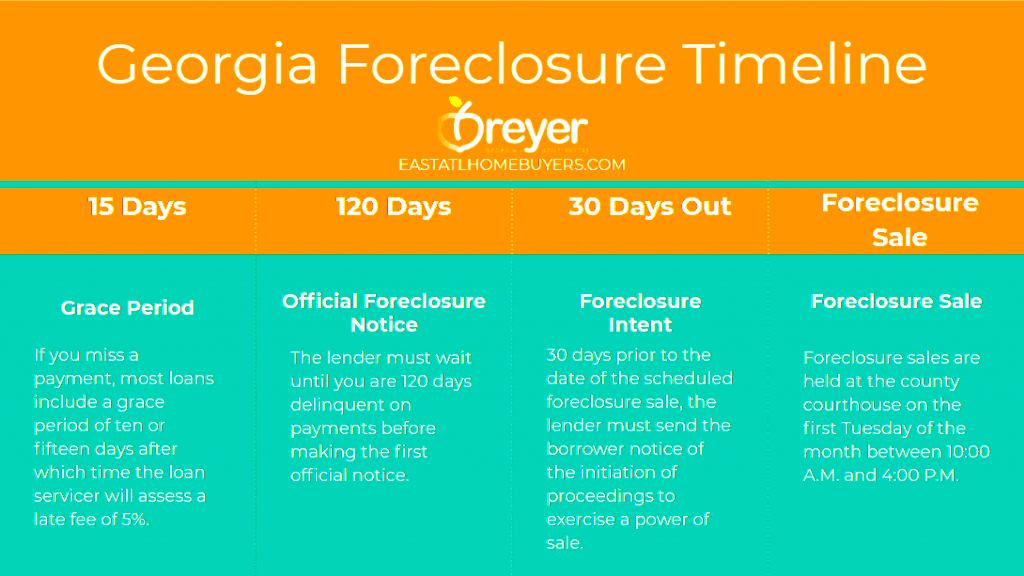

The foreclosure timeline in Georgia is crucial for homeowners to understand. Here’s a simplified breakdown:

| Event | Timeframe |

|---|---|

| Missed Payment | 30 days |

| Notice of Default Sent | After 30 days of missed payment |

| Notice of Sale Issued | At least 30 days before the sale |

| Foreclosure Sale | Typically occurs on the first Tuesday of the month |

This timeline shows how quickly a foreclosure can proceed in Georgia. Homeowners need to act fast if they find themselves in this situation, whether that means seeking legal advice or looking into loan modifications.

Borrower Rights During Foreclosure

When facing foreclosure in Georgia, borrowers have rights that can help protect them during this challenging time. It’s essential to understand these rights so you can take appropriate action and potentially prevent losing your home. These rights can provide borrowers with some breathing room and options to consider.

Firstly, borrowers have the right to receive clear communication from their lenders. This includes receiving notice of default and notice of sale, which must be sent before any foreclosure action is taken. The notices should provide specific details about the missed payments and the process ahead.

Additionally, borrowers can request a loan modification or other assistance programs to help them catch up on missed payments. Some key rights include:

- Right to Cure: Borrowers can pay the amount owed to bring the loan current before the foreclosure sale.

- Right to Challenge: Borrowers can challenge the foreclosure in court if they believe it’s unjust or if proper procedures were not followed.

- Right to Be Informed: Lenders must inform borrowers of their options, including potential alternatives to foreclosure.

Understanding these rights can empower homeowners to navigate the foreclosure process more effectively and advocate for themselves during this tough time.

Defenses Against Foreclosure in Georgia

Defending against foreclosure in Georgia is possible, and knowing your options can make a big difference. If you find yourself facing foreclosure, several defenses might help you delay or stop the process. These defenses can range from legal arguments to issues related to your mortgage agreement.

Here are some common defenses that borrowers may use:

- Improper Notice: If the lender failed to provide the required notice of default or notice of sale, it could invalidate the foreclosure.

- Failure to Follow Procedures: Lenders must follow specific procedures during the foreclosure process. If they don’t, it may provide grounds for a defense.

- Loan Modification Denials: If you applied for a loan modification and it was wrongfully denied, you might have grounds to contest the foreclosure.

- Fraud or Misrepresentation: If the lender engaged in fraudulent practices or misrepresented the terms of the loan, this could also be a valid defense.

Consulting with a legal expert can help borrowers understand which defenses apply to their situation and how best to pursue them.

Impact of Foreclosure on Credit Score

Foreclosure can have a significant negative impact on your credit score, which can affect your financial future for years to come. When a lender reports a foreclosure to the credit bureaus, it usually results in a drop in your credit score, making it more difficult to secure loans or credit in the future.

Here are some key points to consider regarding the impact of foreclosure on your credit score:

- Score Reduction: A foreclosure can decrease your credit score by 100 points or more, depending on your previous score and overall credit history.

- Duration on Credit Report: A foreclosure can stay on your credit report for up to seven years, which can hinder your ability to obtain credit or loans during that period.

- Future Borrowing: After a foreclosure, you may face higher interest rates or may be unable to qualify for certain types of loans.

- Time to Rebuild: Rebuilding your credit score after a foreclosure takes time. You will need to consistently make timely payments on other debts to gradually improve your score.

Being aware of these impacts can help borrowers make informed decisions about their finances and take proactive steps to mitigate the damage to their credit scores.

Alternatives to Foreclosure for Homeowners

If you’re a homeowner facing the possibility of foreclosure, it’s essential to know that you have options. Exploring alternatives can help you keep your home or minimize the financial fallout. Instead of letting foreclosure be the only option, consider these alternatives to help you navigate this tough situation.

Here are some common alternatives:

- Loan Modification: This involves negotiating with your lender to change the terms of your loan, such as lowering your interest rate or extending the loan term. It can help make your payments more manageable.

- Forbearance Agreement: In a forbearance agreement, the lender allows you to pause or reduce your mortgage payments for a certain period. This can provide temporary relief while you get back on your feet.

- Repayment Plan: If you’ve missed a few payments, you may be able to set up a repayment plan with your lender to catch up over time without facing foreclosure.

- Short Sale: A short sale occurs when you sell your home for less than what you owe on the mortgage. Your lender must approve this option, but it can be a way to avoid foreclosure.

- Deed in Lieu of Foreclosure: In this scenario, you voluntarily transfer ownership of the property to the lender. It can be less damaging to your credit than a foreclosure.

Exploring these options early can give you a better chance of protecting your financial future and finding a solution that works for you.

FAQ on Georgia Foreclosure Laws

When it comes to foreclosure laws in Georgia, homeowners often have many questions. Here are some frequently asked questions to help clarify common concerns:

- How long does the foreclosure process take in Georgia? The process can take as little as 60 days from the notice of default to the foreclosure sale, depending on various factors.

- Can I stop a foreclosure after it has started? Yes, you may have options to stop foreclosure, such as filing for bankruptcy or negotiating with your lender.

- What happens to my credit score after foreclosure? A foreclosure can significantly lower your credit score and remain on your credit report for up to seven years.

- Do I have to go to court for foreclosure in Georgia? Typically, no. Georgia is a non-judicial foreclosure state, meaning lenders can proceed without court involvement.

- What is a notice of sale? It’s a document that provides information about the foreclosure auction, including the date, time, and location.

Understanding these common questions can help ease some of the stress that comes with facing foreclosure and empower homeowners to take action.

Conclusion on Georgia Foreclosure Laws

Understanding Georgia foreclosure laws is crucial for homeowners facing financial difficulties. By knowing your rights, the foreclosure process, and the available alternatives, you can make informed decisions during a challenging time. Remember, you are not alone, and there are resources available to help you navigate this situation.

Whether it’s negotiating with your lender, seeking legal advice, or exploring options like loan modifications or short sales, taking proactive steps can help protect your home and financial future. Always consider reaching out to professionals who specialize in foreclosure assistance to ensure you have the best support and guidance throughout this process.

With the right information and resources, you can find a way forward and work towards a more secure financial situation.