What You Need to Know About Connecticut Business Law

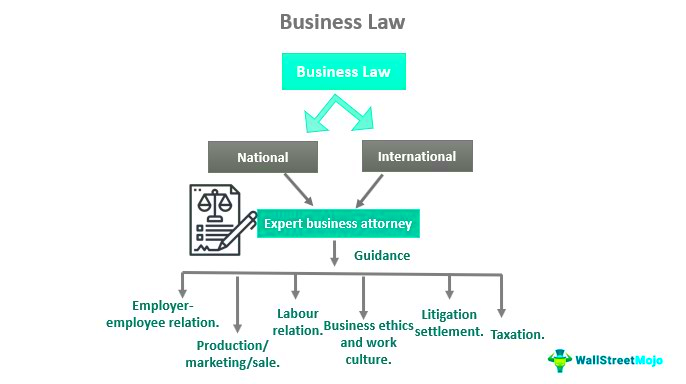

Connecticut business law encompasses the rules and regulations that govern the creation and operation of businesses in the state. It covers various aspects such as business formation, taxation, employee rights, and consumer protection. Understanding these laws is essential for entrepreneurs and business owners to ensure compliance and protect their interests. By being aware of the legal framework, businesses can make informed decisions and navigate the complexities of operating in Connecticut.

Types of Business Structures in Connecticut

When starting a business in Connecticut, one of the first decisions you’ll face is choosing the right business structure. Each type has its own legal implications, tax responsibilities, and liability issues. Here are the common types:

- Sole Proprietorship: This is the simplest form of business, where one individual owns and operates the business. The owner is personally liable for all debts and obligations.

- Partnership: In a partnership, two or more individuals share ownership and responsibilities. Partnerships can be general or limited, affecting liability and management roles.

- Limited Liability Company (LLC): An LLC combines the benefits of a corporation and a partnership. Owners have limited liability for debts while enjoying pass-through taxation.

- Corporation: A corporation is a separate legal entity, providing limited liability to its owners. It involves more regulations and requires formal management structures.

Choosing the right structure is crucial, as it impacts taxes, liability, and the ease of raising capital.

Key Regulations for Starting a Business in Connecticut

Starting a business in Connecticut requires compliance with several key regulations. Here’s what you need to know:

- Business Registration: All businesses must register with the Connecticut Secretary of State. This includes filing necessary documents based on the chosen structure.

- Licenses and Permits: Depending on the business type, you may need specific licenses or permits. Check with local and state authorities to ensure compliance.

- Tax Identification: Obtain a federal Employer Identification Number (EIN) from the IRS and register for state taxes with the Connecticut Department of Revenue Services.

- Insurance Requirements: Certain types of insurance, such as workers’ compensation and liability insurance, may be necessary to protect your business.

By following these regulations, you can establish a solid foundation for your business and avoid potential legal issues down the road.

Tax Obligations for Connecticut Businesses

Understanding tax obligations is essential for any business owner in Connecticut. Taxes can impact your bottom line, so it’s crucial to stay informed about what you owe and when. Connecticut has a range of taxes that businesses may be subject to, including income tax, sales tax, and property tax. Let’s break down the key tax obligations you’ll need to consider.

- Business Income Tax: Connecticut imposes a corporate income tax on the profits of corporations. The current rate is 7.5%, but it can vary based on income levels. Partnerships and sole proprietors report business income on personal tax returns.

- Sales and Use Tax: Most goods and services sold in Connecticut are subject to a sales tax of 6.35%. If you sell taxable items, you must register for a sales tax permit and collect this tax from customers.

- Property Tax: Businesses may also be liable for local property taxes on real estate and personal property. Rates vary by municipality, so it’s important to check with your local tax assessor.

- Employer Taxes: If you have employees, you must withhold state income tax from their wages and contribute to unemployment insurance and workers’ compensation funds.

By staying on top of these tax obligations, you can help ensure your business runs smoothly and avoid costly penalties.

Employment Laws and Regulations in Connecticut

Connecticut has specific employment laws designed to protect both employees and employers. Understanding these laws is essential for maintaining a fair workplace and avoiding legal issues. Here’s a closer look at some key regulations.

- Minimum Wage: As of 2024, Connecticut’s minimum wage is $15 per hour. Employers are required to pay at least this amount, with specific rules for tipped employees.

- Overtime Pay: Non-exempt employees must be paid overtime for hours worked over 40 in a week at a rate of 1.5 times their regular pay.

- Family and Medical Leave: Connecticut offers paid family and medical leave to employees who need time off for specific health-related reasons or to care for family members.

- Anti-Discrimination Laws: Employers are prohibited from discriminating against employees based on race, gender, sexual orientation, disability, and other protected characteristics.

Being familiar with these employment laws not only helps you stay compliant but also fosters a positive work environment.

Intellectual Property Protection in Connecticut

Intellectual property (IP) protection is vital for businesses looking to safeguard their ideas and creations. Whether you run a small startup or a larger corporation, understanding how to protect your IP can give you a competitive edge in the market. Here’s an overview of the main forms of IP protection available in Connecticut.

- Trademarks: Trademarks protect brand names, logos, and slogans. Registering your trademark with the U.S. Patent and Trademark Office gives you exclusive rights to use it in commerce.

- Copyrights: Copyrights protect original works of authorship, such as writings, music, and art. Registration with the U.S. Copyright Office is recommended for legal protection and enforcement.

- Patents: If you invent a new product or process, you can apply for a patent. This gives you exclusive rights to your invention for a specific period, usually 20 years.

- Trade Secrets: Protecting trade secrets involves keeping valuable business information confidential, such as recipes or proprietary processes. Implementing non-disclosure agreements (NDAs) can help safeguard this information.

By understanding and utilizing these IP protections, you can secure your innovations and strengthen your business’s market position.

Dispute Resolution and Litigation in Business

Disputes are an unfortunate reality in the business world. Whether they arise between partners, employees, or clients, knowing how to handle them is crucial for maintaining a healthy business environment. Connecticut provides various methods for resolving disputes, and understanding these options can save you time, money, and stress.

- Negotiation: This is the simplest method, where parties discuss their issues directly to reach a mutually acceptable solution. It’s informal and can often resolve disputes quickly.

- Mediation: In mediation, a neutral third party helps facilitate a discussion between the disputing parties. The mediator doesn’t decide the outcome but helps guide the conversation to find common ground.

- Arbitration: Arbitration is a more formal process where an arbitrator reviews the evidence and makes a binding decision. This can be faster and less expensive than litigation.

- Litigation: If other methods fail, litigation may be necessary. This involves taking the dispute to court, where a judge or jury will make a decision. Litigation can be costly and time-consuming, so it’s often seen as a last resort.

Choosing the right method depends on the nature of the dispute, the relationship between the parties, and the desired outcome. By being prepared, you can effectively navigate disputes when they arise.

Frequently Asked Questions About Connecticut Business Law

As you explore Connecticut business law, you may have questions. Here are some common inquiries that many business owners have:

- What types of business structures are recognized in Connecticut?

Connecticut recognizes several structures, including sole proprietorships, partnerships, LLCs, and corporations. - How do I register my business?

You need to file the appropriate forms with the Connecticut Secretary of State and obtain necessary licenses and permits. - What are my tax obligations?

Businesses must consider income tax, sales tax, property tax, and employer taxes. Each type has specific requirements. - What employment laws should I know?

Key laws include minimum wage, overtime pay, family and medical leave, and anti-discrimination laws. - How can I protect my intellectual property?

You can use trademarks, copyrights, patents, and trade secrets to protect your creations and innovations.

These FAQs provide a starting point for understanding the legal landscape in Connecticut. Always consult a legal professional for specific advice tailored to your situation.

Conclusion and Final Thoughts

Understanding Connecticut business law is essential for anyone looking to start or operate a business in the state. From knowing the various business structures to being aware of tax obligations, employment laws, and dispute resolution options, having this knowledge can help you navigate the legal landscape more effectively.

By staying informed and compliant, you not only protect your business but also foster a positive working environment and build trust with clients and employees. Remember, legal issues can arise at any time, so being proactive and seeking advice when needed is always a good strategy. With the right foundation in place, your business can thrive in Connecticut’s dynamic environment.