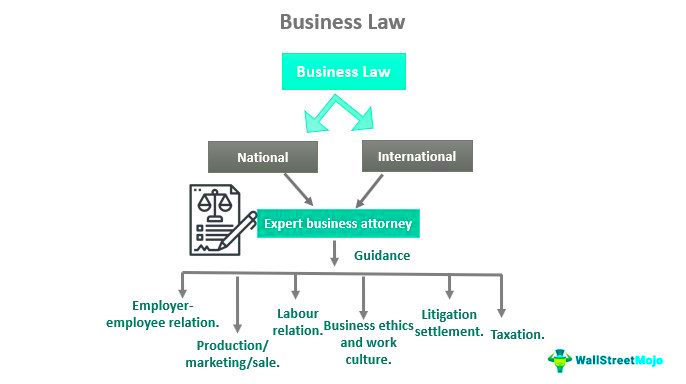

Iowa Business Laws Explained

Iowa business laws create a framework that governs how businesses operate within the state. These laws cover a wide range of topics, from business formation to taxation and employment regulations. Understanding these laws is essential for anyone looking to start or manage a business in Iowa. It helps ensure compliance, minimizes legal risks, and promotes a fair business environment.

Types of Business Entities in Iowa

When starting a business in Iowa, choosing the right business entity is crucial. Each type has its own legal implications, tax obligations, and operational structures. Here are the most common types:

- Sole Proprietorship: This is the simplest form, where one individual owns and operates the business. It offers complete control but also personal liability for debts.

- Partnership: A partnership involves two or more people sharing ownership. There are general partnerships and limited partnerships, each with different liability and management structures.

- Limited Liability Company (LLC): An LLC provides the benefits of limited liability while allowing flexibility in management and tax treatment.

- Corporation: Corporations are separate legal entities that protect owners from personal liability. They can be C-Corps or S-Corps, each having distinct tax structures.

Business Registration Process in Iowa

Registering a business in Iowa is a necessary step to ensure legal compliance. Here’s a simplified overview of the process:

- Choose a Business Name: Ensure your business name is unique and not already in use. You can check the availability on the Iowa Secretary of State’s website.

- Select a Business Structure: Decide on the type of entity that best fits your business goals, as outlined earlier.

- File Formation Documents: Depending on your chosen entity, you may need to file Articles of Incorporation (for corporations) or Articles of Organization (for LLCs) with the state.

- Obtain an Employer Identification Number (EIN): If you plan to hire employees or operate as a corporation or partnership, apply for an EIN through the IRS.

- Register for State Taxes: Depending on your business activities, you may need to register for state sales tax, withholding tax, or other applicable taxes.

- Obtain Necessary Licenses and Permits: Check local and state requirements to ensure you have all necessary licenses and permits to operate legally.

Following these steps can help you successfully register your business in Iowa and lay a strong foundation for its future.

Understanding Iowa Tax Laws for Businesses

Iowa tax laws can seem complex, but having a clear understanding is essential for business success. These laws dictate how much you owe the state based on your business activities and structure. Familiarizing yourself with Iowa’s tax landscape helps ensure compliance and avoid penalties. The main types of taxes that businesses in Iowa need to consider include income tax, sales tax, and property tax.

Here’s a brief overview:

- Corporate Income Tax: Corporations are taxed on their profits at a flat rate. Iowa has a graduated rate ranging from 5.5% to 9.8%, depending on the taxable income.

- Personal Income Tax: If you’re a sole proprietor or partner, business income is reported on your personal tax return, and you’ll pay personal income tax rates, which are also graduated.

- Sales and Use Tax: Most goods and some services are subject to a sales tax of 6%. However, there are exemptions, so it’s wise to understand what applies to your business.

- Property Tax: Businesses in Iowa are subject to property tax based on the assessed value of their real and personal property. This tax helps fund local services.

Keeping accurate records and filing taxes on time is crucial. You might also consider hiring a tax professional to help navigate these laws effectively.

Employment Laws Relevant to Iowa Businesses

Employment laws in Iowa are designed to protect both employers and employees, ensuring fair treatment and safety in the workplace. Understanding these laws is vital for maintaining a healthy work environment and avoiding legal issues. Here are some key employment laws you should be aware of:

- Minimum Wage: Iowa’s minimum wage is currently $7.25 per hour, but certain cities may have higher local minimum wages.

- Overtime Pay: Employees must receive overtime pay at one and a half times their regular rate for hours worked over 40 in a week.

- Workplace Safety: Employers are required to provide a safe work environment, adhering to OSHA regulations to prevent workplace injuries.

- Discrimination Laws: Iowa prohibits employment discrimination based on race, color, religion, sex, national origin, age, and disability. This ensures that hiring and employment practices are fair and equitable.

- Workers’ Compensation: Iowa mandates that businesses provide workers’ compensation insurance to cover employees injured on the job.

Staying updated on these laws and implementing proper HR practices can help you create a positive workplace and avoid costly legal battles.

Regulatory Compliance for Businesses in Iowa

Regulatory compliance refers to following the laws and regulations set by government agencies. For businesses in Iowa, this includes local, state, and federal regulations. Non-compliance can lead to hefty fines, legal issues, and even the closure of your business, so it’s crucial to understand and adhere to these regulations.

Here are some areas where compliance is vital:

- Licenses and Permits: Depending on your business type, you may need specific licenses or permits to operate legally. This could include health permits, building permits, or industry-specific licenses.

- Environmental Regulations: If your business has any impact on the environment, you must comply with Iowa’s environmental laws. This includes waste disposal, emissions, and hazardous materials handling.

- Health and Safety Regulations: Compliance with workplace safety standards is not just about legal obligations; it’s also about ensuring the well-being of your employees.

- Consumer Protection Laws: If your business involves selling goods or services, you must comply with laws that protect consumers, including accurate advertising and fair pricing practices.

Establishing a compliance program can help you keep track of changing regulations and ensure your business operates within the law. Regular training and audits are also beneficial for maintaining compliance.

Common Legal Issues Faced by Iowa Businesses

Running a business in Iowa comes with its own set of challenges, and legal issues are among the most significant hurdles. Whether you’re a new startup or an established company, understanding these common legal issues can help you navigate potential pitfalls. Here are some of the most frequent problems faced by Iowa businesses:

- Contract Disputes: Misunderstandings or disagreements over contracts can lead to legal disputes. It’s vital to have clear, well-drafted contracts and to understand your rights and obligations.

- Employment Issues: Conflicts can arise over employee rights, wrongful termination, or discrimination claims. Familiarizing yourself with Iowa’s employment laws is essential to avoid these issues.

- Intellectual Property Concerns: Protecting your business’s intellectual property—such as trademarks, copyrights, and patents—is crucial. Failing to do so can lead to infringement issues.

- Regulatory Compliance: As mentioned earlier, staying compliant with various laws and regulations is critical. Non-compliance can result in fines or legal actions.

- Liability Claims: Businesses can face liability claims from customers or clients. This could involve anything from product defects to workplace injuries.

Being proactive about these issues can save you time and money in the long run. Consider consulting with a legal professional to help you manage these challenges effectively.

FAQs about Iowa Business Laws

Having questions about Iowa business laws is completely normal, especially if you’re new to the state or starting a business. Here are some frequently asked questions that can provide clarity:

- What is the process for registering a business in Iowa? To register a business, you need to choose a business name, select a structure, file the necessary formation documents, and obtain any required licenses and permits.

- Are there any specific tax incentives for businesses in Iowa? Yes, Iowa offers various tax incentives, including property tax exemptions and tax credits for specific industries. Check with the Iowa Economic Development Authority for details.

- What employment laws should I be aware of? Key employment laws include minimum wage requirements, overtime pay regulations, and anti-discrimination laws. It’s crucial to stay updated on these to ensure compliance.

- How can I protect my intellectual property? Register trademarks and copyrights and consider patents for unique inventions. Consulting with an IP attorney can also be beneficial.

- What should I do if I face a legal issue? It’s always best to consult a legal professional who specializes in business law to get tailored advice for your specific situation.

Conclusion on Iowa Business Laws

Understanding Iowa business laws is vital for anyone looking to start or manage a business in the state. From navigating tax obligations to adhering to employment regulations and maintaining compliance, having a solid grasp of these laws can save you from potential legal troubles. Always remember that staying informed and proactive is the key to a successful business operation. Whether you’re facing common legal issues or simply seeking to understand your obligations, consulting with a legal professional can provide valuable guidance. Equip yourself with knowledge, and you’ll be well on your way to running a thriving business in Iowa!