A Guide to North Carolina’s Car Repossession Laws

Going through car repossession can be an overwhelming and bewildering situation. In North Carolina the regulations regarding repossession aim to safeguard both lenders and borrowers although they can be quite intricate. Its essential to grasp these laws if you find yourself at risk of losing your vehicle. Having seen friends and family deal with repossession firsthand I understand the significance of being knowledgeable and ready for such circumstances.

Reasons for Car Repossession

Vehicle repossession usually happens when a borrower doesn’t fulfill the conditions of their loan contract. Here are some key reasons that could lead to a cars repossession.

- Missed Payments: The most common reason for repossession is missing several monthly payments. If you fall behind on payments, the lender may start the repossession process.

- Default on Loan Terms: If you breach other terms of your loan agreement, such as failing to maintain insurance or not keeping the car in good condition, the lender may take action.

- Bankruptcy: In some cases, declaring bankruptcy can trigger repossession, especially if the bankruptcy proceedings don’t cover the car loan.

- Fraudulent Activity: If the lender discovers fraudulent information on your loan application, they may repossess the vehicle.

Based on what I’ve encountered maintaining an dialogue with lenders can help avoid repossession. If you’re having difficulty keeping up with payments it might be worth reaching out to discuss your circumstances. This could potentially result in finding a resolution such as a temporary payment arrangement.

The Repossession Process Explained

In North Carolina the process of reclaiming property involves a few important stages. Lets take a closer look at how it usually unfolds.

- Default Notice: Before repossession occurs, the lender usually sends a notice informing you of the default and the potential for repossession if payments aren’t made.

- Repossession: If payments aren’t made, the lender may send a repossession agent to take back the vehicle. North Carolina law allows repossession without court action as long as it’s done peacefully.

- Storage: After the vehicle is repossessed, it’s often taken to a storage facility. You may have to pay storage fees to retrieve your vehicle.

- Sale of the Vehicle: The lender will eventually sell the vehicle at an auction to recover the owed amount. If the sale doesn’t cover the full debt, you may still owe the difference.

I believe that grasping these steps can ease some of the anxiety linked to repossession. While it’s a challenging circumstance being aware of the procedure can empower you to make choices and potentially explore solutions before things escalate to this point.

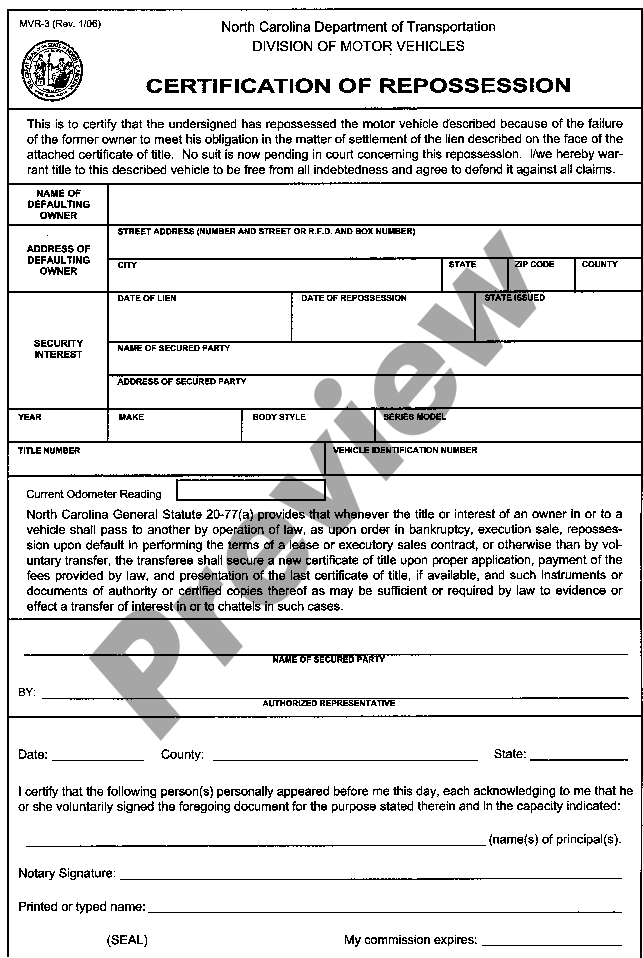

Legal Requirements for Repossession

In North Carolina the rules for repossessing a vehicle are set to make sure the process is fair. Knowing these rules can make it easier for you to deal with the situation. Based on what I have seen and experienced these laws are more than just formalities they are essential, for safeguarding your rights.

Here are the important legal obligations for repossession in North Carolina.

- Peaceful Repossession: Repossession must be carried out peacefully. This means that repossession agents cannot use force or breach the peace when taking back the vehicle. If they do, you might have grounds for legal action.

- Notice of Default: Before a vehicle can be repossessed, the lender must send a notice of default. This notice must outline the amount owed and provide a period during which you can remedy the default by making the necessary payments.

- Right to Cure: You have the right to “cure” the default, which means you can pay the overdue amount plus any additional fees to prevent repossession. This right typically extends up until the repossession occurs.

- Post-Repossession Notice: After repossession, the lender is required to send a notice informing you of the sale date of the vehicle and how you can redeem it if possible. This notice must be sent within a reasonable timeframe.

Based on what I’ve been through I’ve found that grasping these legal matters can really come in handy. It may be overwhelming but knowing your rights can greatly impact how you handle things.

Rights of the Car Owner During Repossession

If you’re a car owner dealing with the possibility of repossession it’s crucial to be aware of your rights. These rights are in place to safeguard you against treatment and to ensure that the repo process is carried out correctly. Based on what I’ve seen being informed about these rights can empower you to assert yourself during a challenging situation.

Here’s a rundown of your rights when it comes to repossession.

- Right to Remain in the Vehicle: You have the right to remain in your vehicle as long as it’s not being repossessed illegally. If the repossession agent is acting unlawfully, you can refuse to hand over the keys.

- Right to Be Notified: You are entitled to receive a notice of repossession, which should include information about how you can reclaim your vehicle and the steps to take if you want to dispute the repossession.

- Right to Redemption: You have the right to redeem your vehicle by paying off the entire outstanding balance, including any repossession and storage fees, before the car is sold at auction.

- Right to Contest Unfair Practices: If you believe that the repossession was conducted improperly or your rights were violated, you have the right to challenge these actions in court.

Looking back on tales shared by pals who’ve faced this situation knowing these rights well can be quite empowering. Staying updated and confident during the repossession journey is essential.

Steps to Take After a Car Repossession

Once your vehicle is repossessed the actions you take next can greatly influence your financial and legal circumstances. Based on my own experiences and those of people I know addressing this situation proactively can aid in a smoother recovery process.

Here’s what you should do:

- Contact the Lender: Reach out to the lender immediately to find out the exact amount owed, including any additional fees for repossession and storage. This will help you understand your financial position.

- Review the Repossession Notice: Carefully read any notices you receive from the lender regarding the repossession and the sale of the vehicle. This will provide you with information on how to reclaim the vehicle or the process for contesting the repossession.

- Explore Redemption Options: If you’re able to, consider paying off the outstanding balance to redeem your vehicle. This may include covering the costs associated with repossession and storage.

- Consider Legal Advice: Consult with a legal professional to discuss your options, especially if you believe the repossession was unlawful or if you’re facing a potential deficiency balance (the amount still owed after the sale).

- Check Your Credit Report: After repossession, check your credit report for any inaccuracies related to the repossession. Correcting any errors promptly can help mitigate the impact on your credit score.

I believe these actions are essential when dealing with the aftermath of a repossession. It’s a tough spot to be in but with the strategy and assistance you can find your way through and make progress in addressing the challenges you face.

How to Challenge a Repossession

Dealing with the repossession of your car can be overwhelming, but understanding how to contest it can bring some comfort. Based on my own insights and stories from friends I’ve learned that there are options to challenge a repossession if you feel it was carried out unfairly or unlawfully. This guide aims to assist you in navigating through this challenging situation.

Here are steps to challenge a repossession:

- Review Your Loan Agreement: Start by thoroughly reviewing your loan agreement. Look for any clauses that might have been violated by the lender or any errors in the repossession process. Often, discrepancies in the terms can be grounds for a challenge.

- Verify the Repossession Process: Ensure that the repossession was carried out according to North Carolina laws. For instance, the repossession must be peaceful, and proper notice must be given. If the lender did not follow these legal requirements, you might have a case.

- Collect Evidence: Gather any documentation or evidence that supports your claim. This can include communication with the lender, payment records, and any notices received. Strong evidence can help build your case.

- File a Complaint: You can file a complaint with the lender’s customer service department or the North Carolina Attorney General’s Office. Sometimes, formal complaints can prompt a review and possibly a resolution.

- Seek Legal Advice: Consulting with an attorney who specializes in repossession law can provide valuable insights. They can help you understand your rights and guide you through the process of challenging the repossession effectively.

From what I’ve seen knowing the rules and actively collecting proof can greatly boost your odds of successfully contesting a repossession. While it can be a challenging time being well informed and proactive can really impact the outcome.

Preventing Car Repossession

To avoid having your car repossessed and to safeguard your financial well being it’s important to take proactive measures. Based on my own experiences and the insights of others I’ve come to realize that being proactive can save you from the burden of repossession. Here are some tips to assist you in retaining your vehicle:

Here’s how to prevent car repossession:

- Communicate with Your Lender: If you’re struggling with payments, contact your lender as soon as possible. Many lenders are willing to work with you to create a payment plan or defer payments if you’re facing temporary financial difficulties.

- Review Your Budget: Assess your monthly budget to ensure you’re allocating enough funds for your car payment. Prioritizing your car payment can help you avoid missing payments.

- Consider Refinancing: Refinancing your car loan may lower your monthly payments. If you can secure a better interest rate or extend the loan term, it can make your payments more manageable.

- Set Up Automatic Payments: Setting up automatic payments can help ensure you never miss a due date. Many banks offer this service, which can help you stay on track with your payments.

- Seek Financial Counseling: If you’re struggling with debt overall, consider speaking with a financial counselor. They can provide strategies for managing your finances and preventing future issues.

Based on what I’ve seen and been through myself I believe that implementing these precautionary steps can have an impact. The key is to proactively address issues and keep the channels of communication open with your lender.

FAQ

What should I do if I receive a repossession notice?

To begin with take a close look at the notice to grasp the specifics such as the outstanding amount and the timelines involved. Reach out to your lender right away to explore your choices and inquire about potential arrangements to avoid repossession.

Can I stop repossession if I pay the overdue amount?

What happens if my car is repossessed and sold for less than I owe?

If your car is sold for an amount lower than what you still owe you might have to cover the gap. This is referred to as a deficiency balance. Its crucial to talk about this with your lender and think about getting legal counsel if necessary.

Can I contest a repossession in court?

Absolutely you have the right to challenge a repossession in court if you think it was carried out wrongfully or illegally. Collect supporting information, get legal guidance and present your argument to effectively dispute the repossession.

How can I avoid repossession in the future?

To prevent your belongings from being taken back stay in touch with your lender go over your finances think about refinancing look into setting up payments automatically. Getting financial advice can also assist you in maintaining your well being.

Conclusion

Facing a car repossession can be a stressful ordeal but being aware of the process and your rights can greatly impact the situation. Through my own encounters and tales shared by friends I’ve come to realize that reaching out and staying informed are crucial. Whether you aim to contest a repossession prevent it from occurring or navigate the aftermath taking steps can assist you in regaining control. Keep in mind that you dont have to go through this alone seeking legal counsel and support can offer you the guidance you require. Maintain an outlook and take well thought out actions to safeguard your future and overall well being.