Virginia Mileage Reimbursement Law for Employers and Employees

Virginia mileage reimbursement laws ensure that employees are fairly compensated when they use their personal vehicles for work-related activities. These laws help cover the expenses of fuel, wear and tear, and other associated costs. Both employers and employees benefit from understanding these regulations to avoid misunderstandings and disputes. The rules are not just about paying employees for miles driven but also ensuring compliance with federal and state guidelines.

Virginia follows the IRS mileage reimbursement rate as a general guideline, which is updated annually. This rate is designed to cover the reasonable cost of driving a personal vehicle for business purposes.

Who Qualifies for Mileage Reimbursement in Virginia

Not every employee automatically qualifies for mileage reimbursement in Virginia. Employees typically qualify if they are required to use their personal vehicle for work-related tasks, such as meeting clients, attending business events, or making deliveries. The key factor is that the vehicle use must be a necessary part of the job.

Employees who may qualify include:

- Salespeople required to travel between locations

- Delivery drivers using their own vehicle

- Employees attending off-site meetings

- Technicians providing services at different locations

However, employees who commute to and from their regular place of work do not qualify for mileage reimbursement, as commuting is generally considered a personal expense.

Employer Obligations for Mileage Reimbursement

Employers in Virginia have a responsibility to provide clear policies on mileage reimbursement. While the state does not mandate a specific reimbursement amount, most employers follow the IRS standard mileage rate to simplify the process. Employers are also responsible for maintaining accurate records of mileage reimbursements.

Key employer obligations include:

- Providing clear policies on what qualifies for reimbursement

- Ensuring reimbursements align with IRS guidelines

- Maintaining detailed records of employee mileage claims

- Ensuring timely reimbursement to avoid legal issues

Failure to reimburse employees properly can lead to disputes or even legal claims, making it important for employers to stay informed about the regulations.

Employee Rights to Mileage Reimbursement

In Virginia, employees have specific rights when it comes to mileage reimbursement. If your job requires you to use your personal vehicle for work tasks, you deserve to be compensated fairly. Knowing your rights can help you navigate any challenges you might face regarding reimbursement claims.

Key rights include:

- Right to Reimbursement: Employees have the right to be reimbursed for business-related mileage. This means if you’re traveling for work, you should receive compensation.

- Right to Clear Policies: Employees should have access to clear and written reimbursement policies from their employers. This ensures everyone knows how reimbursement works.

- Right to Fair Compensation: The amount reimbursed should be fair and typically aligns with the IRS mileage rate, which accounts for fuel, wear and tear, and other costs.

- Right to Appeal Decisions: If a reimbursement claim is denied, employees have the right to appeal the decision. Having a discussion with your employer can often resolve misunderstandings.

By understanding these rights, employees can confidently approach any mileage reimbursement discussions with their employers.

How to Calculate Mileage Reimbursement

Calculating mileage reimbursement can be straightforward if you follow a few simple steps. The key is to keep accurate records of your mileage and expenses. Here’s how you can do it:

- Track Your Mileage: Keep a log of every work-related trip. Note down the date, purpose, starting point, destination, and total miles driven.

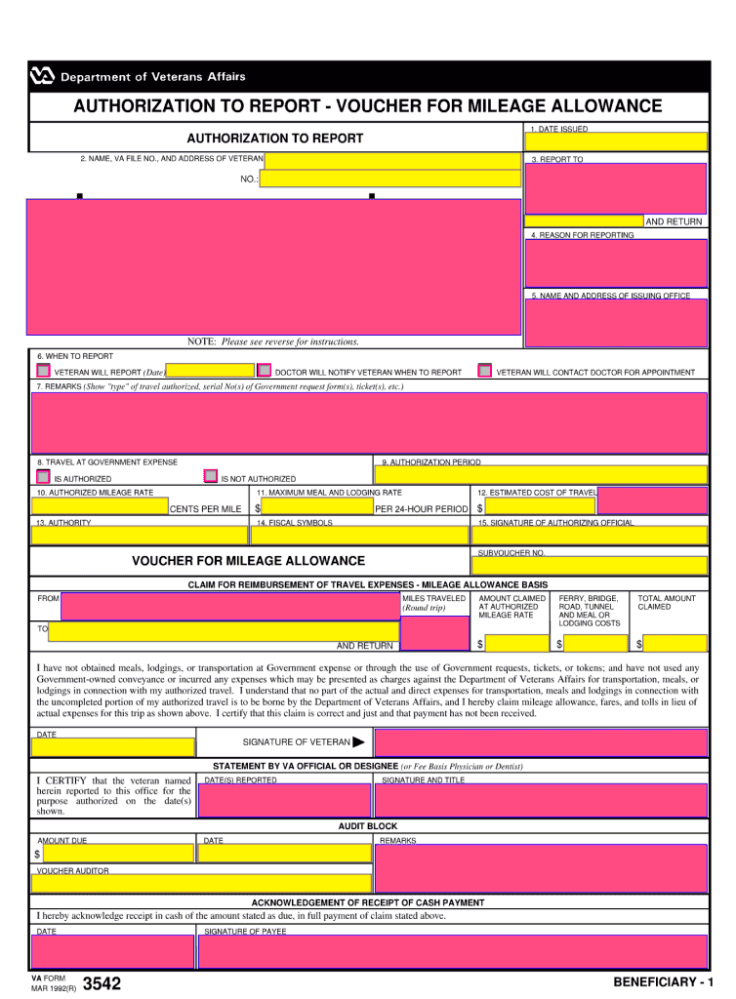

- Use the Current IRS Mileage Rate: For 2024, the standard mileage rate is X cents per mile (check the IRS website for the most recent rate). Multiply the total miles driven by this rate.

- Add Other Expenses: If you incurred other expenses (like parking or tolls) while traveling, keep those receipts and include them in your total claim.

Example: If you drove 100 miles for a business trip and the IRS rate is 65.5 cents, your reimbursement would be:

| Total Miles | IRS Rate | Reimbursement Amount |

|---|---|---|

| 100 | $0.655 | $65.50 |

Make sure to keep all your records and receipts organized to make the reimbursement process smoother.

Common Disputes Between Employers and Employees

Disputes over mileage reimbursement can arise for various reasons. Understanding these common issues can help both employers and employees address concerns before they escalate. Here are some frequent points of contention:

- Disagreement on Mileage Amount: Sometimes, employees and employers disagree on the total miles driven for work-related tasks. Accurate records are essential in these situations.

- Reimbursement Rate Conflicts: Employers may have different policies regarding reimbursement rates, leading to confusion. It’s crucial for employers to communicate their policies clearly.

- Timing of Reimbursements: Employees may feel frustrated if reimbursements are delayed. Timely payment is important for maintaining trust between employers and employees.

- Claims Denial: When an employer denies a reimbursement claim, it can lead to disputes. Open communication can help resolve misunderstandings.

To avoid these disputes, both parties should prioritize clear communication and maintain accurate records. Having a well-defined reimbursement policy can significantly reduce confusion and enhance workplace relationships.

Exceptions to Mileage Reimbursement Rules

While the Virginia mileage reimbursement laws are designed to protect employees and ensure they are compensated for work-related travel, there are exceptions. Understanding these exceptions can help both employers and employees navigate potential gray areas. Here are some key exceptions to consider:

- Commute Mileage: The miles driven from home to the workplace are generally not reimbursable. This is considered a personal expense, and employees won’t receive compensation for this travel.

- Travel for Personal Reasons: If an employee combines personal errands with business trips, only the mileage directly related to work is eligible for reimbursement. Employees need to keep detailed records to separate business and personal travel.

- Non-Work-Related Travel: Trips that don’t have a clear business purpose do not qualify for reimbursement. Employers are not required to cover costs for travel unrelated to work duties.

- Vehicle Type Restrictions: If an employee uses a vehicle not approved by the employer for business purposes, such as a recreational vehicle or motorcycle, the employer may refuse reimbursement.

Understanding these exceptions can help prevent misunderstandings and ensure both parties are aware of what qualifies for reimbursement.

Conclusion on Virginia Mileage Reimbursement

In conclusion, Virginia mileage reimbursement laws play a vital role in protecting employees who use their personal vehicles for work-related tasks. Knowing your rights and understanding your employer’s obligations can lead to a smoother reimbursement process. Both employees and employers benefit from maintaining clear communication and keeping accurate records.

As we’ve discussed, employees are entitled to fair compensation for their mileage, but there are exceptions that can complicate matters. Staying informed about these rules will help you navigate the reimbursement process more effectively. If you have any concerns about your mileage reimbursement, don’t hesitate to reach out to your employer for clarification.

Frequently Asked Questions

Here are some common questions regarding mileage reimbursement in Virginia:

- What is the current IRS mileage rate for reimbursement?

The IRS updates the mileage rate annually, so it’s best to check the IRS website for the most current rate. - How can I prove my mileage for reimbursement?

Keeping a detailed mileage log that includes dates, destinations, and purposes of trips can help substantiate your claims. - What should I do if my mileage reimbursement claim is denied?

If your claim is denied, ask your employer for clarification. You may also consider discussing it further to resolve any misunderstandings. - Are there any tax implications for mileage reimbursement?

Generally, mileage reimbursement is not considered taxable income, as long as it follows IRS guidelines.

These FAQs aim to clarify common concerns and help you navigate the complexities of mileage reimbursement in Virginia.