Massachusetts Conflict of Interest Laws and Disclosure Guidelines

The laws in Massachusetts regarding conflicts of interest aim to uphold fairness and transparency in both the public and private domains. As someone engaged in writing I find these regulations to be an intriguing mix of thoroughness and practicality. Whether you hold a position, work in the private sector or are simply curious about how these rules affect everyday business dealings grasping the nuances of these laws is essential to promote conduct and avoid conflicts that could erode public confidence.

At their essence these regulations aim to avoid instances where personal motives could impact professional duties. The laws in Massachusetts address various situations including financial stakes in government contracts and connections that could influence decision making. Their purpose is to uphold the integrity of individuals in authority by ensuring that their choices are driven by the welfare of the public rather than self interest.

For instance if a worker in the government has a personal stake in a business that is competing for a contract this creates a situation. The law requires transparency and sometimes stepping back from making decisions to prevent any favoritism. This framework plays a role in ensuring that public funds are distributed fairly and without improper sway.

Defining Conflict of Interest in Massachusetts

In Massachusetts a conflict of interest occurs when someone personal interests be it financial, family related or something else could hinder their capacity to prioritize the well being of the public or their workplace. This definition goes beyond matters to encompass instances where personal connections may influence decisions in a professional setting.

Personal Story: I remember a situation where a city worker was discovered to be involved with a contractor. While there was no tangible benefit involved the perception of favoritism brought about intense scrutiny and eventually prompted stricter disclosure requirements. This case serves as a reminder that even perceived conflicts of interest can have lasting impacts.

The laws in Massachusetts are designed to tackle these issues through mandates for transparency. Public officials are obligated to disclose any financial holdings or connections that might sway their actions. This openness fosters trust among the public and safeguards against biased decision making.

Key Elements of Conflict of Interest Regulations

The conflict of interest regulations in Massachusetts are thorough and well defined. They encompass important aspects aimed at avoiding conflicts and upholding conduct.

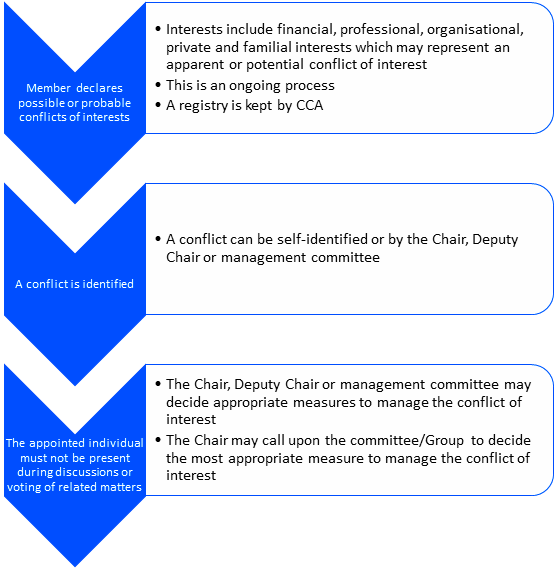

- Disclosure Requirements: Individuals in positions of power must disclose any financial interests or relationships that could create a conflict. This includes ownership in businesses that may have dealings with the government.

- Recusal Policies: If a potential conflict is identified, individuals may be required to recuse themselves from relevant decision-making processes. This is crucial to maintaining impartiality.

- Enforcement Mechanisms: The state has established enforcement bodies to investigate potential violations. Penalties for non-compliance can include fines, reprimands, or even legal action.

- Education and Training: Regular training is mandated for public officials to ensure they understand and comply with conflict of interest laws. This proactive approach helps in preventing conflicts before they arise.

Self Reflection: I’ve noticed how these factors come together to establish a strong foundation for ethical behavior. They not tackle conflicts but also promote an environment of honesty. The focus on teaching and development for instance aids people in identifying and handling potential conflicts before they escalate into problems.

Grasping these factors aids in maneuvering through the intricacies of conflict of interest regulations to uphold both adherence and integrity in every professional engagement.

Disclosure Requirements for Public Officials

In Massachusetts the rules regarding disclosure for public officials play a role in promoting transparency and accountability. These regulations aim to avoid conflicts of interest by requiring officials to disclose any personal or financial interests that could sway their professional choices. Through my experience with systems I’ve recognized the importance of these disclosures in preventing abuse of authority.

Public servants are expected to meet several important obligations.

- Annual Statements of Financial Interests: Every year, officials are required to file detailed statements disclosing their financial interests, including assets, income sources, and debts. This provides a snapshot of their financial status and potential areas of conflict.

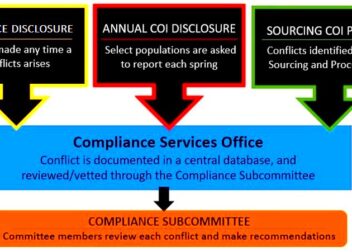

- Immediate Disclosure of Conflicts: If a new conflict arises, officials must disclose it immediately. This ensures that any potential issues are addressed promptly and transparently.

- Disclosure of Outside Employment: Any outside employment or business interests must be reported, particularly if they could potentially intersect with official duties.

Story from My Life: I recall helping out a city council member who had to deal with these disclosure rules. It was eye opening to witness the level of detail and caution needed to meet all the requirements. Although the process is thorough it plays a role in maintaining public confidence and ensuring that decisions are made fairly.

In the grand scheme of things these transparency rules play a vital role in upholding the honesty of government positions and making sure that public servants prioritize the well being of the people they serve.

Implications for Private Sector Employees

In Massachusetts private sector workers also face scrutiny when it comes to potential conflicts of interest. While the rules are slightly different from those that apply to public officials they still have an impact on upholding ethical conduct in the business world. Recognizing these aspects is crucial for both employees and companies to steer clear of conflicts and ensure a fair workplace.

Here are some important aspects to consider:

- Disclosure of Financial Interests: Employees must disclose any financial interests or investments that could affect their job performance or create a conflict of interest with their employer’s business interests.

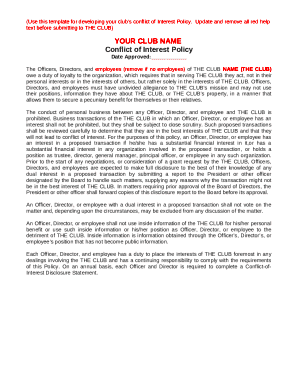

- Company Policies: Many companies have internal policies requiring employees to disclose any potential conflicts. These policies often go beyond legal requirements to ensure a clear and ethical working environment.

- Impact on Career: Failure to disclose conflicts can have serious implications for an employee’s career, including disciplinary action or termination. Maintaining transparency is crucial for career advancement and professional integrity.

Self Reflection: I remember a time when I had to counsel a client from the industry dealing with a conflict of interest. It was a challenge to maneuver through the companys rules and legal obligations. However it served as a valuable reminder of how being transparent can greatly enhance ones professional image and advancement.

In the world maintaining conflict of interest guidelines is essential not for steering clear of legal problems but also for nurturing an environment of honesty and reliability in the workplace.

Enforcement and Penalties for Non-Compliance

In Massachusetts enforcing conflict of interest laws plays a role in ensuring adherence and preserving public confidence. The state has set up systems to look into and punish breaches highlighting the importance of following these rules. Through witnessing different enforcement procedures I’ve come to realize how crucial these actions are for upholding the legal system and discouraging misconduct.

Typically enforcement and penalties are organized in the following way.

- Investigation Procedures: When a potential violation is reported, state agencies or relevant bodies conduct thorough investigations. This may involve gathering evidence, interviewing witnesses, and reviewing financial records.

- Penalties for Violations: Depending on the severity of the violation, penalties can range from fines to suspension or removal from office. In some cases, legal action may be pursued.

- Public Disclosure of Violations: In many instances, the outcomes of investigations are made public. This transparency helps to maintain public trust and deter others from similar misconduct.

Personal Insight: I have collaborated with clients who encountered challenges over supposed breaches. While the journey was frequently intimidating it underscored the significance of upholding conflict of interest regulations and the repercussions of non compliance.

The enforcement of conflict of interest laws and the penalties for violating them play a role in discouraging misconduct and promoting ethical behavior among public officials and private sector employees.

Recent Changes to the Law

The recent changes to Massachusetts conflict of interest laws show a shift towards greater transparency and ethical standards in both the public and private sectors. These updates aim to tackle concerns and respond to the evolving landscape of governance and business conduct. Having closely monitored these developments I notice that they often bring about tighter rules and more nuanced instructions.

Here are some of the notable changes:

- Enhanced Disclosure Requirements: Recent amendments have increased the scope of disclosure requirements. Public officials must now report a broader range of financial interests, including indirect investments and interests held by family members.

- Stricter Penalties: The penalties for non-compliance have been made more severe. This includes higher fines and extended periods of ineligibility for certain positions if violations are found.

- Expanded Definitions: The definitions of what constitutes a conflict of interest have been expanded. This includes new categories of relationships and financial interests that must be disclosed, reflecting a more comprehensive approach to identifying potential conflicts.

- Increased Public Access: There is now greater public access to disclosure records. This transparency aims to foster public trust and allow for more informed scrutiny of officials’ financial dealings.

Reflection: I recall the initial conversations about these changes within the legal community. The goal was obviously to enhance transparency and accountability in the system. Take the broader definitions for example they prompted numerous public officials and private sector workers to reevaluate their financial disclosures. Although this proved to be a hurdle at first it eventually resulted in improved transparency and ethical conduct.

Its essential for individuals impacted by conflict of interest laws to stay updated on these changes since adherence now necessitates more thorough and proactive steps.

How to Ensure Compliance

Navigating the complexities of Massachusetts conflict of interest laws may appear challenging at first. However with a solid grasp of the rules and a methodical strategy it becomes more manageable. Adhering to these regulations goes beyond steering clear of issues; it also plays a crucial role in nurturing an environment of honesty and openness. Based on my insights I’ve discovered that taking steps and conducting assessments can have an impact.

Here are some steps to ensure compliance:

- Regular Review of Disclosures: Conduct periodic reviews of financial disclosures and potential conflicts. This helps in identifying and addressing issues before they become problematic.

- Education and Training: Engage in regular training sessions on conflict of interest laws. This helps in understanding the nuances of the regulations and staying updated on any changes.

- Seek Legal Advice: Consulting with a legal expert can provide clarity on complex situations and ensure that all potential conflicts are appropriately managed.

- Document Everything: Keep detailed records of all disclosures and actions taken in response to potential conflicts. This documentation can be invaluable if questions about compliance arise.

Personal Insight: I’ve noticed that companies that focus on training and conduct regular checks tend to face fewer challenges related to conflicts of interest. For example in a previous role I witnessed a firm establish a thorough process for monitoring and handling potential conflicts. This not only enhanced their adherence to regulations but also minimized legal vulnerabilities.

By embracing these approaches people and businesses can better navigate the intricacies of conflict of interest regulations and uphold a strong commitment to ethical conduct.

Frequently Asked Questions

Answering queries regarding Massachusetts conflict of interest laws can offer insights. These frequently asked questions touch on key elements of adherence and implementation assisting public officials and private sector workers in gaining a clearer understanding of their duties.

- What qualifies as a conflict of interest? A conflict of interest arises when personal or financial interests could influence your professional decisions or actions. This includes direct financial interests or relationships that could affect your impartiality.

- How often do I need to update my disclosures? Updates should be made annually and whenever there is a significant change in your financial interests or relationships that could affect your role.

- What are the penalties for not complying with the law? Penalties can include fines, suspension, or even removal from office. Severe violations may also result in legal action.

- How can I report a potential conflict of interest? You can report potential conflicts to the relevant ethics commission or oversight body. It’s important to disclose issues promptly to avoid complications.

- What steps should I take if I realize I have a conflict of interest? If you identify a conflict, you should disclose it immediately and, if necessary, recuse yourself from related decision-making processes.

From what I’ve seen having clarity on these matters has empowered numerous clients to manage their duties more effectively. Its always wise to inquire and seek support instead of jeopardizing adherence.

These frequently asked questions offer a basic overview of conflict of interest regulations giving practical guidance and addressing common issues.

Conclusion

Grasping the intricacies of Massachusetts conflict of interest laws is crucial to uphold honesty and openness in both the public and private realms. While these rules are extensive their purpose is to safeguard against personal interests interfering with professional duties. With measures like increased transparency obligations and stringent consequences for violations this system seeks to foster an equitable and transparent setting.

Looking back on my journey, I’ve witnessed the importance of being aware of laws and handling them carefully. Whether you’re a government worker, a corporate employee or simply curious about the moral aspects of business and leadership following these regulations not safeguards you legally but also builds trust and reliability. It’s essential to keep in mind that staying compliant involves reviewing things regularly, educating yourself continuously and being transparent. By doing you contribute to upholding fairness and responsibility in society.