California Commission Payment Protection Law Overview

The Commission Payment Protection Law in California is an important law aimed at protecting the rights of employees who receive commissions as part of their pay. It ensures that dedicated workers, especially those in sales positions, get the full amount they are entitled to, even if there are disagreements with their employers. I recall a conversation with a sales rep who faced difficulties when his commission payments were postponed. His frustration underscores the significance of these kinds of laws. This legislation tackles these problems head on offering support for employees and establishing guidelines for employers.

Key Provisions of the Law

The California Commission Payment Protection Law has several important provisions designed to safeguard employees here are the key highlights.

- Timely Payment of Commissions: Employers must pay commissions on or before the agreed-upon date, as stipulated in the employment agreement.

- Written Agreements: All commission agreements must be documented in writing, outlining how commissions are earned, calculated, and paid.

- Final Paychecks: If an employee leaves the company, either voluntarily or involuntarily, the employer must include any earned but unpaid commissions in the final paycheck.

- Dispute Resolution: The law provides mechanisms for employees to resolve disputes over unpaid commissions through mediation and legal channels.

These measures safeguard employees from facing difficulties with their earned income. Thinking back on this, I remember a case where a client was unjustly refused her commissions and the clear guidelines of the law played a role in helping her obtain what she deserved.

Who Benefits from Commission Payment Protection?

This legislation is advantageous for a diverse group of workers especially individuals in positions where their pay is largely determined by commissions. This encompasses

- Sales Representatives: Individuals working in sales who depend on commissions to supplement their income.

- Real Estate Agents: Professionals in real estate whose earnings are commission-driven.

- Financial Advisors: Advisors whose compensation includes commission-based components.

Moreover this safeguard extends to any worker whose pay scheme involves commissions making sure they receive fair and timely compensation. I remember encountering a seasoned sales professional who appreciated this legislation after experiencing setbacks in his commission disbursements. You could sense his relief highlighting the importance of the law in ensuring stability for employees.

How Commission Payments Are Protected

The California Commission Payment Protection Law has strong measures in place to safeguard commission payments and ensure fair treatment for employees. Here’s how the law guarantees that employees get their rightful commissions.

- Clear Written Agreements: The law mandates that commission agreements be documented clearly. This written agreement must detail how commissions are calculated, when they are paid, and any other relevant terms. This clarity helps prevent misunderstandings and disputes.

- Prompt Payment: Employers are required to pay commissions on or before the agreed-upon date. If the date is missed, employees have a right to seek recourse, ensuring they don’t face unnecessary delays in receiving their hard-earned money.

- Final Pay Inclusion: Upon termination, whether voluntary or involuntary, employers must include all earned but unpaid commissions in the employee’s final paycheck. This provision is crucial in preventing employees from losing out on money they have rightfully earned.

I remember a situation where a sales rep was devastated because his company postponed his commission payments. However, due to this law he managed to get the money he was owed quickly. These regulations play a role in promoting fairness and providing employees with financial security.

Employer Responsibilities Under the Law

In California employers have important duties to fulfill in accordance with the Commission Payment Protection Law. Its crucial to grasp these responsibilities to ensure a workplace setting.

- Documentation: Employers must provide a clear, written commission agreement outlining the terms of compensation. This document should be comprehensive and accessible to employees.

- Timely Payment: Employers must adhere to the payment schedule outlined in the commission agreement. Delays or discrepancies in payments are not acceptable under the law.

- Final Pay Compliance: Upon an employee’s departure, employers must ensure that all outstanding commissions are included in the final paycheck. Failure to do so can lead to legal complications.

I recall guiding a business owner who was uncertain about his obligations. By providing him with information on these responsibilities I helped prevent possible legal complications and ensured that his employees were treated justly. Employers who remain up to date and adhere to regulations not only steer clear of conflicts but also create a workplace atmosphere.

What Happens if Employers Violate the Law?

When employers do not adhere to the Commission Payment Protection Law there can be various repercussions. Here’s a breakdown of the usual outcomes.

- Legal Action: Employees have the right to take legal action against employers who violate the law. This may involve filing a complaint with the California Labor Commissioner or pursuing a lawsuit for unpaid commissions.

- Penalties and Fines: Employers found in violation of the law may face monetary penalties and fines. These financial repercussions are intended to encourage compliance and deter wrongful practices.

- Reputational Damage: Legal disputes and non-compliance can damage an employer’s reputation. Word of mouth and public records can impact a company’s standing in the industry.

In a noteworthy incident a business encountered penalties for not paying commissions. The consequences both financially and in terms of reputation served as a wake up call for them. This situation highlighted the importance of employers following the law to prevent facing severe consequences.

Recent Changes and Updates to the Law

The Commission Payment Protection Law in California has adapted to tackle new challenges and strengthen employee safeguards. The latest revisions demonstrate a dedication to promoting equity and openness in commission remuneration. Here are key updates worth mentioning.

- Enhanced Reporting Requirements: Recent amendments require more detailed reporting of commission structures and payment schedules. This change aims to increase transparency and help employees better understand their compensation.

- Stricter Penalties for Non-Compliance: The law now imposes higher fines and stricter penalties for employers who fail to adhere to the payment deadlines. These measures are designed to discourage violations and promote timely payments.

- Broadened Scope: Updates have expanded the definition of commission-based roles to include a wider range of employees. This ensures that more workers benefit from the law’s protections, reflecting the diverse nature of modern employment.

I recall having a conversation about these alterations with a small business proprietor who was worried about how they would affect his work. Once I provided a thorough clarification he came to understand that the modifications were intended to strike a balance between equity and the practical demands of running a business. In the end these adjustments assist both workers and companies in managing the intricacies of commission payments more efficiently.

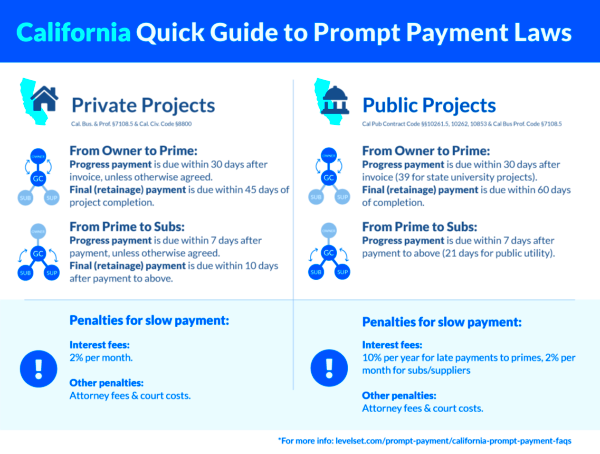

How the Law Compares to Other States

When looking at California’s Commission Payment Protection Law and how it stacks up against similar laws in other states there are notable similarities and differences worth considering. Grasping these nuances can offer insights.

| Aspect | California | New York | Texas |

|---|---|---|---|

| Payment Schedule | Strict deadlines; written agreements required | Flexible but must adhere to written agreements | Less regulated; fewer specific requirements |

| Final Pay Inclusion | Mandatory inclusion of commissions in final paycheck | Commissions included if stipulated in agreement | Commission payment rules less defined |

| Penalties | Higher fines and penalties for violations | Moderate fines; less stringent enforcement | Limited penalties; enforcement varies |

In my view the strict rules in California offer a more solid safety net than states with looser laws. This contrast shows that Californias strategy is designed to better safeguard employees demonstrating a greater dedication to protecting workers rights.

Frequently Asked Questions

Both workers and bosses often wonder about the ins and outs of Californias Commission Payment Protection Law. Here are some responses to the questions that come up often.

- What should be included in a commission agreement? A commission agreement should detail how commissions are calculated, the payment schedule, and the criteria for earning commissions. It should be clear and comprehensive to avoid disputes.

- What if an employer fails to pay commissions on time? Employees can file a complaint with the California Labor Commissioner or seek legal advice to recover unpaid commissions. Employers may face penalties for delays.

- Are there any exceptions to the law? The law generally applies to all employees with commission-based compensation, but specific exceptions may exist based on employment agreements or industry standards. Consulting a legal expert can provide clarity on individual cases.

Looking back on my discussions with clients I’ve realized that addressing these frequently asked questions can really help ease worries and clear up any misunderstandings. It’s always a good idea for both workers and companies to be aware of their rights and obligations according to the law.

Conclusion

The Commission Payment Protection Law in California is a vital protection for workers who receive commissions. It requires agreements, prompt payments and the inclusion of all earned commissions in final paychecks to ensure that employees are treated fairly for their efforts. Based on my experiences I have witnessed how this law can greatly impact an employees financial security and peace of mind. For businesses following these rules not only helps steer clear of issues but also creates a more positive and trustworthy work environment. Whether you are an employee or an employer grasping and honoring these guidelines is crucial, to ensuring timely and compensation for everyone involved.