Oklahoma Child Support Laws for 2024

Oklahoma child support laws are designed to ensure that children receive adequate financial support from both parents, even if the parents are separated or divorced. The laws consider both parents’ income, living arrangements, and the child’s needs to calculate fair support payments. Whether you are the parent paying or receiving child support, it’s essential to understand how the laws work in 2024, especially with any recent changes.

Child support can cover various expenses, including education, healthcare, and basic living needs. Being informed about these laws will help you meet your obligations or understand what you are entitled to for your child’s welfare.

How Child Support Amounts Are Determined in Oklahoma

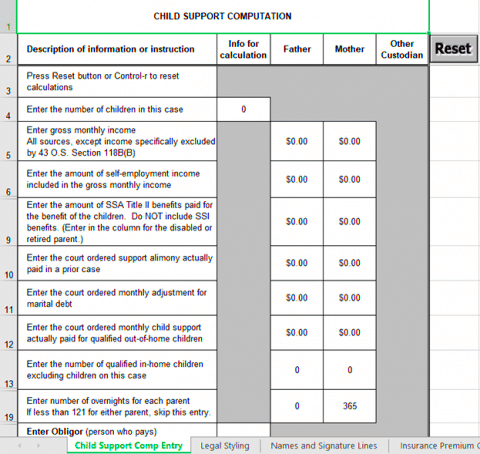

In Oklahoma, child support is calculated based on a formula that takes several factors into account. This formula ensures that support is fair and considers the needs of the child and the financial situation of both parents. The key factors include:

- Gross monthly income of both parents

- Number of children needing support

- Custody arrangement, including the number of overnight stays with each parent

- Childcare expenses, if any

- Health insurance costs related to the child

The Oklahoma Child Support Guidelines use these factors to calculate the basic support amount. Once this base amount is determined, it may be adjusted for other considerations like the cost of medical insurance, child care, or any special needs the child may have.

It’s important to note that even if one parent has limited income, the court may still require some level of support, reflecting the principle that both parents should contribute to their child’s upbringing.

Key Changes in Oklahoma Child Support Guidelines for 2024

For 2024, Oklahoma has introduced some key updates to its child support guidelines. These changes are intended to provide more clarity and fairness in calculating support amounts, especially in more complex situations. Some of the significant updates include:

- Revised income brackets to better reflect the cost of living changes since the last guideline update

- Adjustments for shared custody arrangements, ensuring that parents with nearly equal custody have a more balanced support obligation

- Updated provisions for medical expenses, making it easier to include insurance premiums and out-of-pocket costs in the support calculation

- More flexible modification rules that allow parents to request changes to their support order if their financial situation changes significantly

These updates are aimed at making child support calculations more reflective of current economic realities. It’s important for parents to stay informed about these changes, especially if they plan to modify their existing child support arrangements in 2024.

Responsibilities of Parents Under Oklahoma Child Support Laws

Both parents have responsibilities when it comes to child support in Oklahoma. While one parent usually makes payments, the other parent has obligations as well. These responsibilities are designed to ensure that the child’s financial needs are met and that both parents contribute, even if their roles are different. Understanding these duties can prevent legal issues and ensure that the child’s best interests are prioritized.

Key responsibilities for parents include:

- Paying child support on time: The parent required to pay must do so by the due date, as late payments can lead to penalties or legal consequences.

- Providing accurate financial information: Both parents must report their income accurately during the calculation process. Misleading or false information can result in unfair support amounts or legal action.

- Ensuring child’s health insurance: Oklahoma requires that health insurance, if reasonably affordable, be provided for the child. This responsibility often falls on the parent with better access to employer-sponsored plans.

- Not using child support for personal expenses: The parent receiving support is expected to use these funds for the child’s needs, such as food, housing, healthcare, and education.

Failing to fulfill these responsibilities can lead to legal enforcement actions, and it can negatively affect the parent-child relationship. It’s essential for both parents to cooperate and meet their legal obligations.

Enforcement of Child Support Orders in Oklahoma

Oklahoma has strict measures in place to enforce child support orders and ensure that payments are made. If a parent fails to make payments, various enforcement tools can be used to collect the owed amount. The state prioritizes the child’s well-being, and non-payment is treated seriously, with several methods available to recover overdue support.

Common enforcement methods include:

- Wage garnishment: The most common method, where child support is directly deducted from the paying parent’s paycheck.

- Tax refund interception: Oklahoma can withhold state and federal tax refunds to cover child support arrears.

- License suspension: The state can suspend the delinquent parent’s driver’s license or professional licenses until payments are made.

- Bank account liens: Oklahoma courts may place a lien on the non-paying parent’s bank accounts, allowing funds to be seized to cover missed payments.

- Contempt of court charges: In extreme cases, a parent who refuses to pay child support can be held in contempt of court, facing fines or even jail time.

If you are having trouble making payments, it’s better to seek a modification (discussed below) rather than fall behind, as enforcement actions can severely impact your finances and freedom.

Modifying a Child Support Order in Oklahoma

Changes in life circumstances often make it necessary to modify a child support order. Whether due to job loss, a significant change in income, or a shift in the child’s needs, Oklahoma allows for the modification of child support orders under certain conditions. It’s important to understand when and how you can request a modification to avoid legal penalties for non-payment.

Parents can request a modification when:

- There’s a substantial change in income: If either parent’s income has increased or decreased significantly, a recalculation may be warranted.

- The child’s needs have changed: Increased medical expenses or educational costs can lead to a need for higher support.

- A change in custody arrangements: If the child starts spending more time with one parent, this could impact the amount of support required.

To modify a support order, you will need to file a motion with the court, providing evidence of the change in circumstances. Both parents will then present their cases, and the court will determine if the modification is justified. It’s important to act promptly if you need a change, as falling behind on payments can result in enforcement actions before a modification is approved.

How to Calculate Child Support Payments

Calculating child support payments in Oklahoma involves using a formula that takes into account both parents’ income, child-related expenses, and custody arrangements. The calculation is designed to ensure that the child’s financial needs are met while fairly distributing the financial burden between the parents. Understanding the process can help you estimate your potential payments or what you may be entitled to receive.

The main factors in calculating child support include:

- Gross monthly income: The combined income of both parents is used as a base. This includes wages, salaries, bonuses, and sometimes unemployment benefits or other income sources.

- Custody arrangements: The number of overnight stays each parent has with the child can affect the final support amount. Generally, the parent with more custody time receives child support.

- Health insurance and childcare costs: Any expenses directly related to the child, such as medical insurance premiums and childcare, are considered in the calculation.

To get an estimate, you can use the Oklahoma Child Support Calculator, which is available online. It’s important to input accurate information to get a reliable estimate. Once calculated, the amount may be adjusted for special circumstances, such as extraordinary medical expenses or educational costs.

Common Mistakes to Avoid in Child Support Cases

Child support cases can be complex, and mistakes can lead to financial difficulties or legal issues. Whether you are the paying or receiving parent, avoiding common errors will help ensure a fair and smooth process.

Some of the most common mistakes include:

- Not providing accurate income information: Underreporting or failing to include all sources of income can lead to incorrect support amounts and possible legal penalties.

- Ignoring modification options: If your financial situation changes, it’s important to request a modification rather than fall behind on payments. Failing to do so can result in enforcement actions.

- Using child support for personal expenses: For receiving parents, it’s critical to use the payments for the child’s needs, such as housing, food, and education. Misusing these funds can lead to legal disputes.

- Missing court dates or deadlines: Failing to attend court hearings or submit required paperwork can lead to unfavorable rulings or delays in the process.

Avoiding these mistakes will help ensure that your child support case is handled fairly and efficiently, and that your child’s needs are met.

Frequently Asked Questions About Oklahoma Child Support Laws

Child support laws can be confusing, and many parents have questions about their rights and obligations. Below are some common questions related to Oklahoma child support laws, along with their answers.

Q: How long do child support payments last?

A: In Oklahoma, child support typically continues until the child turns 18. If the child is still in high school at that time, support may continue until they graduate or turn 19, whichever comes first.

Q: Can child support be modified if my income changes?

A: Yes, if there is a significant change in either parent’s income, you can request a modification of the child support order. You’ll need to file a motion with the court and provide evidence of the change in circumstances.

Q: What happens if I miss a child support payment?

A: Missing a payment can lead to enforcement actions such as wage garnishment, tax refund interception, or even the suspension of your driver’s license. It’s important to communicate with the court if you’re having trouble making payments.

Q: Do both parents have to provide health insurance for the child?

A: Usually, the parent with the more affordable or employer-provided health insurance will be required to cover the child. However, both parents may be required to share any uncovered medical expenses.

Final Thoughts on Oklahoma Child Support Laws for 2024

Oklahoma child support laws aim to balance the financial responsibilities between both parents while ensuring the child’s well-being is prioritized. Understanding these laws is critical, whether you’re calculating payments, requesting modifications, or ensuring enforcement of support orders. In 2024, several updates have been made to reflect current economic realities and custody arrangements, which will impact how support is calculated and adjusted.

Parents need to stay informed about changes in the law, especially if their circumstances shift, such as income changes or custody modifications. The state provides tools like the child support calculator to help parents estimate payment amounts, but both parties should ensure all financial information is accurate and transparent. Additionally, enforcement measures are in place to ensure that payments are made consistently, and non-compliance can result in severe consequences like wage garnishment or even jail time.

While the process can seem overwhelming, having a clear understanding of your rights and responsibilities under Oklahoma’s child support laws will help you navigate the system more effectively. If you need assistance, consulting with a family law attorney or using state resources can help ensure that your child’s financial needs are fully met.