Vape Sales Restrictions and Regulations in Arkansas

Vaping has gained traction as an option to conventional smoking but the market for vape sales in Arkansas is subject to strict oversight. In the past years Arkansas has introduced a range of regulations to promote the responsible and safe sale of vape products. These rules encompass age limits and licensing obligations with the goal of safeguarding both consumers and public health.

Having closely followed the changes in vaping laws I can say that Arkansas takes a measured and practical stance. The regulations in the state aim to strike a balance between the convenience of vaping and the necessity of preventing misuse and access by minors. If you’re curious about how these rules impact retailers and consumers let’s explore the details.

State Regulations on Vape Sales

Arkansas has put in place a series of guidelines to regulate the sale of vaping items. These regulations are part of a larger initiative to manage the distribution of nicotine products and prevent their improper use. The states legislation addresses different facets of vape sales such as

- Licensing Requirements: Vape shops must obtain a special license to operate, which involves compliance with state laws and regulations.

- Product Standards: Vape products must meet specific safety standards to be sold in the state.

- Record-Keeping: Retailers are required to maintain detailed records of their sales to ensure transparency and accountability.

Based on what I’ve seen these rules play a role in establishing a marketplace that safeguards both consumers and businesses. The states meticulous oversight guarantees that only products make it to store shelves minimizing potential hazards linked to vaping.

Age Restrictions for Purchasing Vapes

An important part of the rules governing vape sales in Arkansas is the age limit. To keep young people from getting their hands on nicotine products the state has implemented age restrictions. Lets break it down,

- Minimum Age: The legal age to purchase vape products is 21. This is in line with federal regulations and reflects a growing recognition of the need to protect young people from nicotine addiction.

- Verification Requirements: Retailers must check identification to verify the age of buyers. This includes checking government-issued ID cards or driver’s licenses.

- Penalties for Non-Compliance: Retailers who sell vape products to minors face significant penalties, including fines and potential loss of their operating license.

From what I have seen these age limits are essential to protect the well being of younger people. They also encourage retailers to act responsibly as they have a role in upholding these regulations. By allowing only individuals of age to buy vapes Arkansas seeks to minimize the likelihood of nicotine dependency among its youth.

Licensing Requirements for Vape Retailers

Establishing a vape store in Arkansas is not as simple as launching a regular retail venture. The state has implemented a thorough licensing procedure to make certain that sellers adhere to all the required rules and regulations. This procedure aims to guarantee that only responsible and law abiding enterprises are permitted to offer vape products for sale.

Based on my experience handling state regulations can sometimes be akin to finding your way through a labyrinth. Nonetheless these licensing stipulations play a role in upholding a secure and controlled marketplace. Lets delve into the specifics of what vape retailers need to comply with.

- Application Process: Retailers must submit a detailed application to the Arkansas Department of Finance and Administration. This includes information about the business, its owners, and its operational plans.

- Background Checks: The state conducts background checks on business owners and key personnel to ensure that they have no criminal history related to drug or nicotine sales.

- Fees and Renewals: There are initial licensing fees that must be paid, as well as annual renewal fees to keep the license active. Timely renewal is essential to avoid any interruptions in business operations.

While these standards may appear strict their aim is to safeguard the public and uphold the credibility of the vaping sector. Having witnessed the positive impact of these rules in maintaining stability I view them as essential for ensuring the sale of vape products in a safe and responsible manner.

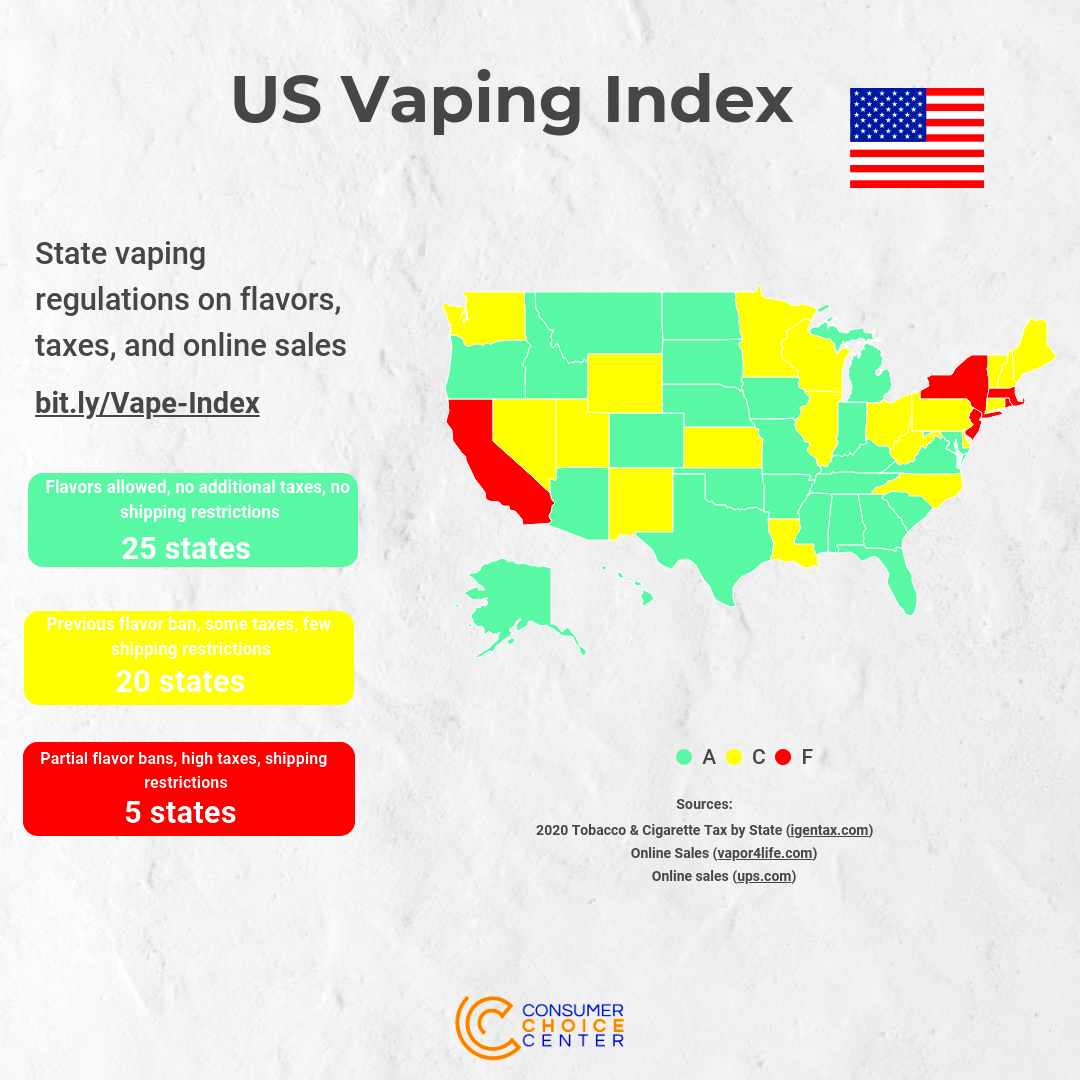

Taxation and Fees Related to Vape Sales

In Arkansas taxes and fees are important for controlling vape sales. They not only bring in money for the state but also discourage people from overindulging. It’s crucial for both existing and potential vape store owners to grasp these financial responsibilities.

Looking back on my journey of starting a venture navigating through taxes and charges was an essential part. Here are some key things to keep in mind regarding vape taxation in Arkansas.

- Excise Tax: Arkansas imposes an excise tax on vape products, which is calculated based on the volume or value of the products sold. This tax helps to regulate the market and ensure that products remain within a manageable price range.

- Sales Tax: In addition to the excise tax, retailers must also collect standard sales tax on vape products. This is a common practice across many states and helps fund various state services.

- Additional Fees: There may be additional fees associated with the licensing and regulation of vape businesses, including administrative costs and compliance fees.

In my view keeping up with these financial responsibilities is essential for keeping things running smoothly. Being aware of and handling these taxes and charges plays a role in ensuring that a vape business operates effectively and stays in line with state regulations.

Restrictions on Vape Advertising and Marketing

In Arkansas the promotion and advertising of vape products is subject to strict regulations to prevent false claims and safeguard vulnerable groups, particularly young people. These measures are in place to promote honesty in advertising methods and to ensure that the marketing of vape products does not promote usage among minors.

Looking back on the hurdles of promoting products in a controlled setting I’ve come to see that following these rules is not just a duty but also a chance to establish a reputable brand. Let me outline the main advertising limitations for vape items in Arkansas.

- Bans on Targeting Minors: Advertisements must not be directed at minors or appear in media where a significant portion of the audience is underage. This includes restrictions on placement in schools, youth-oriented websites, and social media platforms.

- Prohibition of Misleading Claims: Marketing materials cannot make false claims about the health benefits of vaping. All advertising must be factual and cannot imply that vape products are safe or beneficial compared to traditional cigarettes.

- Regulations on Promotional Items: Free samples and giveaways of vape products are often restricted to prevent the distribution of nicotine products to underage individuals.

Navigating the challenges of advertising restrictions is crucial to uphold ethical standards in the vaping industry. These guidelines play a role in preventing marketing practices from taking advantage of consumers or deceiving the public. By doing so they encourage a more responsible way of promoting vape products.

Compliance with Federal Laws on Vape Sales

Selling vape products in Arkansas involves considering not state regulations but also federal laws that impact the marketing and sale of these products. Navigating this intricate landscape can be tricky but grasping federal requirements is vital for every vape retailer.

With my experience in the regulatory field I have witnessed the interplay between federal laws and state regulations when it comes to establishing a robust system for vape sales. Allow me to provide an overview of important federal rules that impact vape retailers in Arkansas.

- FDA Regulations: The U.S. Food and Drug Administration (FDA) oversees the regulation of tobacco products, including vapes. This means that vape products must comply with FDA standards concerning ingredients, packaging, and labeling.

- Age Verification: Federal law mandates that retailers must verify the age of purchasers to prevent sales to individuals under 21. This requirement is strictly enforced to curb underage use of nicotine products.

- Tax Compliance: Federal tax laws also apply to vape sales. Retailers need to ensure they are complying with federal tax obligations, including those related to excise taxes on nicotine products.

Based on what I’ve seen navigating the balance between federal and state regulations can feel like a challenge. Nevertheless these rules are put in place to safeguard public health and ensure the responsible sale of vape products. Keeping things in check not only helps steer clear of issues but also fosters a level playing field for all companies involved.

Enforcement and Penalties for Violations

In Arkansas the rules regarding vape sales are enforced rigorously. The state has put in place different systems to make sure that companies follow the regulations and that any breaches are dealt with swiftly. Familiarizing oneself with these enforcement actions and consequences can assist store owners in maneuvering through the legal terrain more efficiently.

Looking back at the process of enforcing rules I’ve noticed that the repercussions for not following them can be rather harsh. Let me give you a rundown of how the enforcement and penalty system operates.

- Inspections: State authorities conduct regular inspections of vape retailers to ensure compliance with all applicable laws. These inspections can be both routine and unannounced.

- Fines and Penalties: Retailers found in violation of regulations may face significant fines. Repeat offenders or those with serious violations might also face harsher penalties, including suspension or revocation of their license.

- Legal Actions: In extreme cases, legal action may be taken against businesses that repeatedly violate laws or engage in illegal activities. This can include court proceedings and additional financial penalties.

I believe that having a grasp of the enforcement environment enables companies to uphold adherence and steer clear of expensive blunders. Staying updated and taking action in advance is always preferable to facing the consequences of breaches.

FAQ

What are the main federal regulations affecting vape sales in Arkansas?

Key regulatory aspects involve the FDA’s supervision of ingredient and labeling standards, age verification protocols and adherence to federal tax regulations concerning nicotine products.

How can retailers ensure they comply with state and federal laws?

Retailers must keep themselves informed about the latest state and federal regulations, keep detailed records and routinely assess their compliance procedures. Seeking advice from professionals and participating in industry seminars can prove valuable.

What are the penalties for not following vape sales regulations?

Penalties may involve financial penalties, temporary or permanent loss of licenses and legal proceedings in more severe situations. Adhering to regulations is essential to prevent facing these serious repercussions.

How can consumers verify the legality of vape products?

Shoppers have the option to verify a retailers license check the product labels for adherence to FDA guidelines and confirm that the item is sourced from a trustworthy provider.

Conclusion

To sum up our conversation about the regulations on vape sales in Arkansas it’s evident that the states approach aims to strike a balance between making products accessible and promoting responsible usage. With licensing requirements, adherence to federal laws, well defined tax structures and strict enforcement these rules establish a system designed to safeguard public health and uphold market integrity. While navigating these regulations might appear challenging, particularly for newcomers they play a crucial role in ensuring that vape products are marketed responsibly and ethically. Based on my experiences I’ve found that staying updated on state and federal laws is not merely about avoiding penalties; it’s also about fostering a safer and more regulated marketplace, for all parties involved.