Michigan Lien Law Explained for Property Owners

Michigan lien law provides property owners with important protections and responsibilities regarding their real estate. A lien is a legal claim against a property to secure payment for a debt or obligation. Understanding how these laws work can help you avoid potential issues with your property. In Michigan, the lien law applies to various situations, including construction projects, unpaid bills, and disputes over ownership. It’s essential to familiarize yourself with these laws to protect your rights and make informed decisions.

Types of Liens in Michigan

In Michigan, several types of liens can affect property owners. Here are the most common ones:

- Construction Liens: These are filed by contractors, subcontractors, or suppliers who have not been paid for work or materials provided for a property improvement.

- Mortgage Liens: A mortgage lien is created when a property owner borrows money to purchase a home. The lender has a claim on the property until the loan is repaid.

- Tax Liens: Tax liens are imposed by the government when property taxes are not paid. The government can take action to collect the owed taxes, potentially leading to foreclosure.

- Judgment Liens: These liens occur when a court issues a judgment against a property owner. The creditor can place a lien on the property to secure payment of the judgment.

How Liens Affect Property Owners

Liens can significantly impact property owners in several ways:

- Property Sales: A lien can complicate the sale of a property. Potential buyers may be hesitant to purchase a home with outstanding liens.

- Financing: Liens can affect your ability to secure financing. Lenders typically require that any existing liens be resolved before approving a new loan.

- Legal Consequences: Ignoring a lien can lead to legal action, including foreclosure. It’s crucial to address any liens promptly to avoid severe repercussions.

- Credit Impact: Unresolved liens may negatively affect your credit score, making it harder to obtain loans or favorable interest rates in the future.

By understanding how liens work and their potential effects, property owners can take proactive steps to protect their interests and manage any issues that arise.

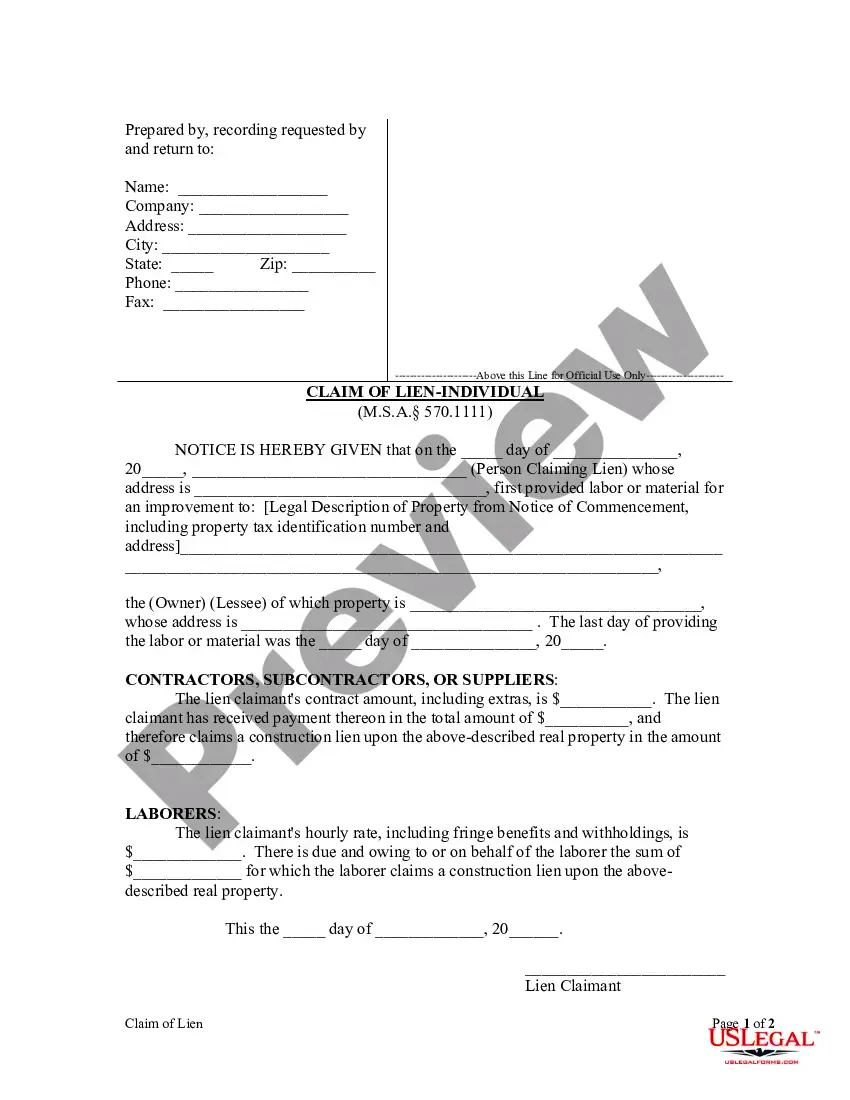

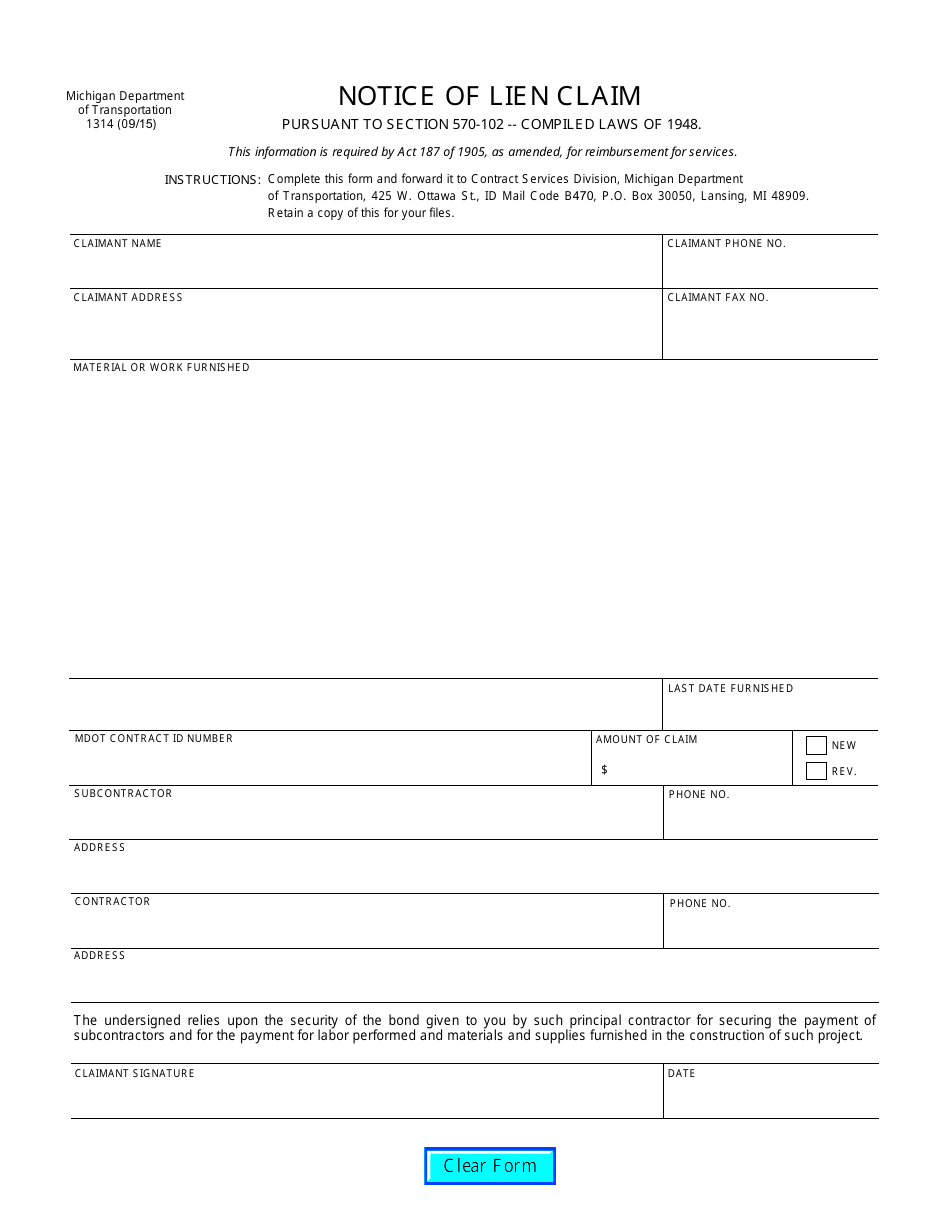

Process of Filing a Lien

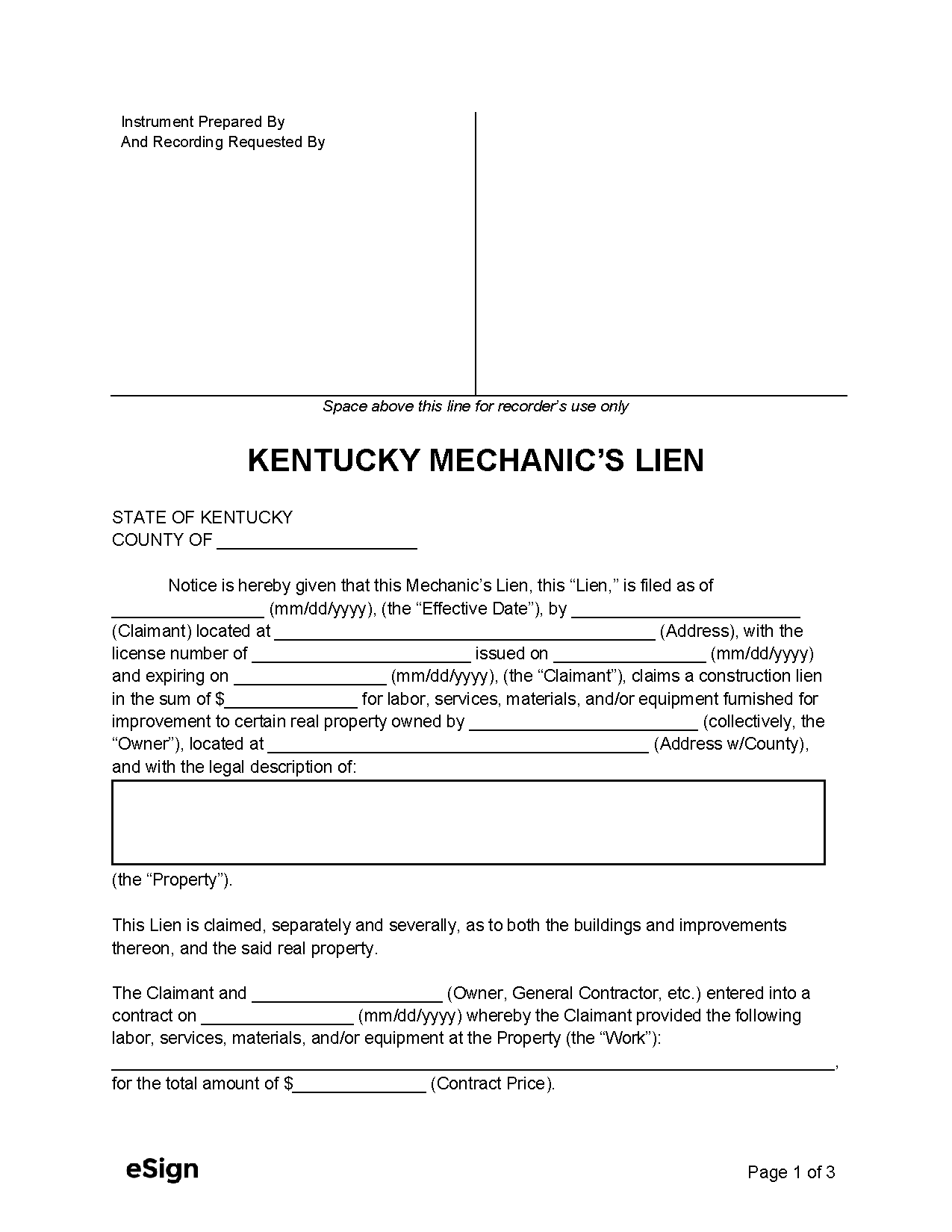

Filing a lien in Michigan is a crucial step for contractors, suppliers, or anyone owed money for work or services rendered. Understanding the process helps ensure that your rights are protected. Here’s a simple overview of how to file a lien:

- Determine Eligibility: Make sure you have the right to file a lien. Generally, this applies to contractors, subcontractors, and suppliers who have provided labor or materials for property improvements.

- Gather Necessary Information: You will need the following information:

- Property owner’s name and address

- Description of the work or materials provided

- Amount owed

- Property description (including legal description)

- Complete the Lien Form: You can obtain the lien form from the county clerk’s office or online. Fill it out with accurate information.

- File the Lien: Submit the completed lien form to the county clerk’s office where the property is located. There may be a small filing fee.

- Notify the Property Owner: After filing, send a copy of the lien to the property owner via certified mail. This ensures they are aware of the lien against their property.

By following these steps, you can effectively file a lien and protect your financial interests.

Disputing a Lien

Sometimes, you may find yourself facing a lien that you believe is unjustified. Disputing a lien can be daunting, but knowing your rights and the process can help. Here are steps to consider:

- Review the Lien: Carefully examine the lien document. Check for inaccuracies in the property description, amount claimed, or the filing process itself.

- Gather Evidence: Collect any relevant documentation that supports your case. This can include contracts, payment receipts, and correspondence with the lien filer.

- Contact the Lien Filer: Reach out to the person or company that filed the lien. Sometimes, a simple conversation can resolve misunderstandings or lead to a settlement.

- File a Counterclaim: If discussions don’t work, consider filing a counterclaim in court. This legal action formally disputes the lien and allows you to present your evidence.

- Seek Legal Assistance: It’s wise to consult a lawyer specializing in lien disputes. They can guide you through the process and represent your interests in court.

Disputing a lien may seem challenging, but understanding your options can lead to a resolution that protects your property and rights.

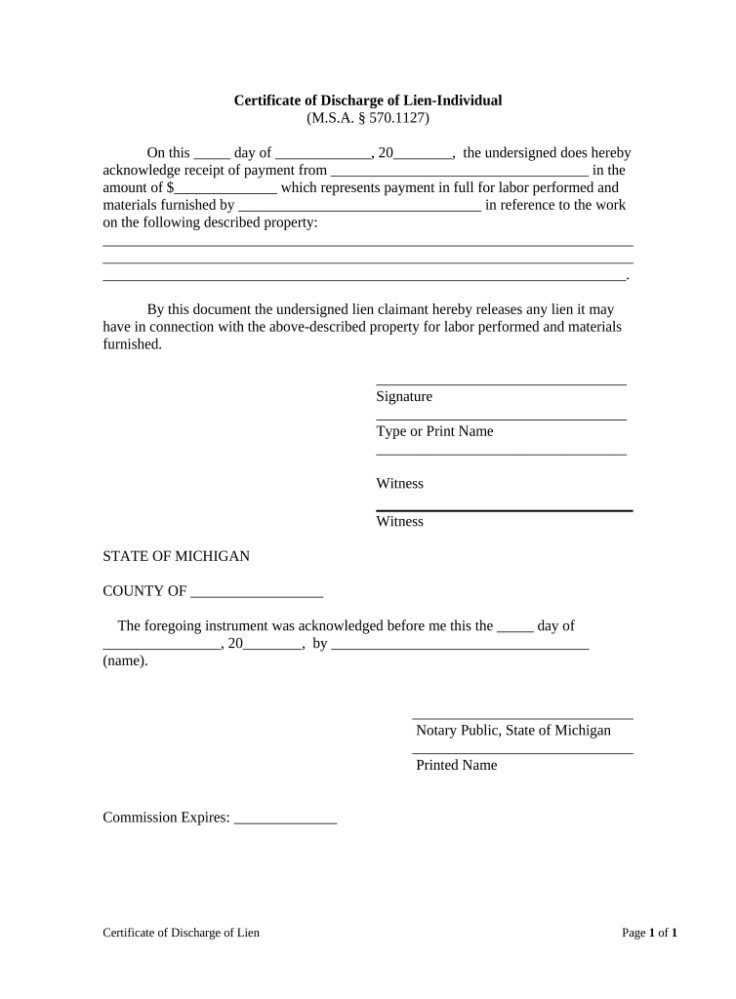

Removing a Lien from Your Property

If you find a lien on your property, removing it should be a top priority to protect your ownership rights and facilitate any future transactions. Here’s how to go about it:

- Understand the Lien Type: Determine whether the lien is valid or can be contested. Different types of liens may have different removal processes.

- Pay the Debt: If the lien is valid, paying off the owed amount is often the quickest way to remove it. Once paid, ask for a lien release.

- Obtain a Lien Release: After settling the debt, request a lien release from the lien holder. This document proves that the lien has been satisfied.

- File the Lien Release: Submit the lien release document to the county clerk’s office to officially remove the lien from public records.

- Challenge Invalid Liens: If you believe the lien is invalid, follow the dispute process discussed earlier to contest it legally.

Removing a lien can take time, but taking these steps can help you regain clear ownership of your property and avoid potential complications down the line.

Key Deadlines and Requirements

When dealing with liens in Michigan, it’s crucial to be aware of the key deadlines and requirements involved in the process. Missing these can lead to significant complications, so here’s what you need to know:

- Filing Deadline for Construction Liens: In Michigan, a construction lien must be filed within 90 days of the last date work was performed or materials were supplied. If you miss this deadline, you may lose your right to file a lien.

- Notice Requirements: Before filing a construction lien, you must send a notice to the property owner. This notice must be sent within 20 days of your first work or material delivery.

- Claim of Lien Content: Your lien claim must include:

- The property owner’s name and address

- A detailed description of the property

- The amount owed

- A description of the work or materials provided

- Legal Actions: If a lien is disputed, you generally have 3 years from the date the lien is filed to initiate a lawsuit to enforce the lien. Failing to do so may result in losing your right to the lien.

Understanding these deadlines and requirements is essential for protecting your rights and ensuring that you can effectively navigate the lien process.

Seeking Legal Help for Lien Issues

Navigating lien issues can be complicated, and sometimes it’s best to seek legal help. A qualified attorney can guide you through the intricacies of lien law and protect your interests. Here are some reasons to consider hiring a lawyer:

- Expert Guidance: A lawyer specializing in lien laws can help you understand your rights and obligations, ensuring you follow the proper procedures.

- Representation in Disputes: If you find yourself in a dispute over a lien, an attorney can represent you in negotiations or court, increasing your chances of a favorable outcome.

- Documentation Assistance: Preparing and filing lien documents can be complex. A lawyer can ensure that everything is filled out correctly and filed on time, minimizing the risk of errors.

- Protecting Your Property: A legal professional can help you remove or challenge liens effectively, safeguarding your property and your financial interests.

Finding the right legal help can make a significant difference in managing lien-related issues, giving you peace of mind and clarity in a challenging situation.

Frequently Asked Questions

When it comes to liens, property owners often have many questions. Here are some frequently asked questions to help clarify common concerns:

What is a lien?

A lien is a legal claim against a property to secure payment for a debt or obligation. It can affect your ability to sell or finance the property.

How long does a lien last in Michigan?

In Michigan, a lien typically remains in effect for 5 years unless it is paid off or removed through legal means.

Can I file a lien without a contract?

Generally, having a contract is crucial for filing a lien, but in some cases, a verbal agreement or proof of work done may suffice.

What happens if a lien is not paid?

If a lien remains unpaid, the lienholder may initiate foreclosure proceedings, which could result in the loss of your property.

How do I find out if there is a lien on my property?

You can check for liens by visiting your county clerk’s office or using their online records search to see if any liens are filed against your property.

By understanding these common questions, you can better navigate the complexities of liens and protect your property rights.

Conclusion

Navigating Michigan lien law can be challenging, but understanding the various types of liens, the processes involved, and key deadlines is crucial for property owners. By staying informed and proactive, you can effectively protect your rights and interests. Whether you are facing a lien, need to dispute one, or want to remove it, knowing when to seek legal help can make a significant difference in the outcome. Ultimately, being aware of your options will empower you to manage your property confidently and securely.