Understanding the Good Funds Law and Its Impact

The Good Funds Law is designed to ensure secure and reliable financial transactions, particularly in the real estate industry. It requires that all funds used in a transaction are verified and cleared before the closing process. This law helps prevent fraud and protects all parties involved in the transaction. Understanding the Good Funds Law is essential for anyone buying or selling property, as it plays a critical role in safeguarding the financial aspects of real estate deals.

What the Good Funds Law Means

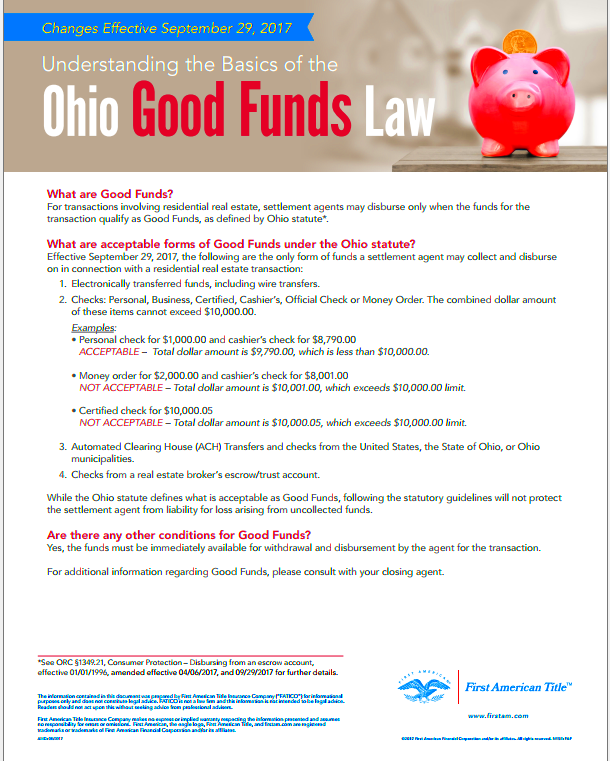

The Good Funds Law refers to legislation that mandates that all funds used in a real estate transaction must be “good funds,” meaning they are immediately available for use and not subject to further verification or clearance. This law typically applies to title companies, escrow agents, and attorneys handling real estate closings. The purpose is to protect both buyers and sellers by ensuring that the funds are valid and available when the transaction is finalized.

Key Points of the Good Funds Law:

- Only certain types of funds are considered “good” under this law, such as wire transfers, cashier’s checks, and certified checks.

- Personal checks or other forms of payment that could take time to clear are generally not accepted.

- The law varies by state, but the general aim is to prevent delays or complications during property transfers.

This law serves as a protective measure to reduce risks for both parties involved in the transaction, minimizing the chance of fraudulent activities or delayed payments.

How the Good Funds Law Ensures Transaction Security

The Good Funds Law enhances transaction security by requiring that the funds be fully available before closing. This ensures that the seller can receive the payment without any delays or risks of bounced checks, and the buyer can take possession of the property without any financial uncertainty. By eliminating the use of funds that take time to clear, the law reduces potential disputes over payment.

Ways the Good Funds Law Secures Transactions:

- Prevents Fraud: By requiring verified funds, the law reduces the risk of fraudulent payments.

- Minimizes Delays: Transactions are more likely to proceed smoothly since only cleared funds are accepted.

- Provides Assurance: Both parties gain confidence knowing that the financial part of the transaction is secure.

In essence, the Good Funds Law acts as a safeguard, ensuring that real estate deals are financially sound and free from unnecessary risks, creating a smoother experience for everyone involved.

Key Requirements of the Good Funds Law for Real Estate Transactions

The Good Funds Law establishes specific requirements to ensure that real estate transactions are financially secure. These requirements help protect both buyers and sellers from potential fraud or payment issues. One of the main requirements is that funds used in the transaction must be verified and cleared before closing. This prevents any party from using unverified payments like personal checks that could bounce or take time to clear.

Types of Accepted Funds:

- Wire Transfers: These are considered the most reliable because the funds are transferred directly and immediately between banks.

- Certified Checks: These checks are guaranteed by the issuing bank, making them a secure option.

- Cashier’s Checks: Issued by the bank itself, these checks are treated as guaranteed funds.

Personal checks and other forms of payment that take time to clear are generally not accepted under the Good Funds Law.

Another key requirement is that the funds must be in the hands of the escrow agent or title company before the transaction can be finalized. This ensures that the seller receives payment immediately upon closing and the buyer can take ownership of the property without delays.

Additional Considerations:

- Some states have specific thresholds for the types of funds that can be used based on the amount of the transaction.

- The timeline for delivering funds to the escrow agent may vary by jurisdiction, so parties must be aware of these deadlines to avoid delays in closing.

Impact of the Good Funds Law on Buyers and Sellers

The Good Funds Law has a significant impact on both buyers and sellers, primarily by ensuring smoother and more secure transactions. For buyers, the law ensures that their funds are properly verified, which reduces the risk of payment issues that could cause delays in taking ownership of the property. Buyers can rest assured that the transaction will proceed smoothly if they provide acceptable forms of payment.

For sellers, the law provides peace of mind by guaranteeing that they will receive the agreed-upon funds once the transaction is finalized. There is no risk of bounced checks or delayed payments since only verified funds are used. This makes the closing process faster and more efficient.

Benefits for Buyers:

- Prevents disputes over payment due to the requirement of verified funds.

- Allows for quicker closing, as funds are ready and available.

Benefits for Sellers:

- Ensures prompt payment upon completion of the sale.

- Reduces the risk of fraudulent payments or insufficient funds.

Overall, the Good Funds Law helps both parties in the transaction by reducing risks, speeding up the process, and ensuring that financial obligations are met on time.

Penalties for Violating the Good Funds Law

Violating the Good Funds Law can result in serious consequences, depending on the nature and extent of the violation. The penalties are designed to ensure compliance and protect the integrity of real estate transactions. Common violations include accepting unverified funds, failing to properly clear funds before closing, or using payment methods that are not allowed under the law.

Possible Penalties for Violating the Law:

- Fines: Individuals or companies that violate the Good Funds Law may face significant monetary penalties. These fines can vary by state and the severity of the violation.

- License Suspension or Revocation: Title companies, escrow agents, and real estate professionals who consistently violate the Good Funds Law may face the suspension or revocation of their professional licenses.

- Legal Action: In some cases, violating the Good Funds Law could lead to lawsuits from affected parties, especially if the violation causes financial harm.

These penalties serve as a deterrent, ensuring that all parties involved in a real estate transaction adhere to the legal requirements. To avoid these consequences, it is essential to follow the guidelines set by the Good Funds Law and ensure that all funds are properly verified before closing a deal.

Common Challenges Under the Good Funds Law

While the Good Funds Law offers numerous benefits, it also presents some challenges, particularly for those unfamiliar with its requirements. One of the most common challenges is ensuring that all funds meet the necessary standards before closing. Buyers and sellers must be careful about the types of payment they use, as personal checks or unverified funds can cause delays in the transaction.

Common Issues Faced:

- Misunderstanding Payment Methods: Many buyers are unaware that personal checks or uncertified funds cannot be used, leading to last-minute payment complications.

- Delays in Wire Transfers: While wire transfers are considered secure, processing delays can occur, especially if done on weekends or holidays.

- State-Specific Rules: The Good Funds Law varies from state to state, and navigating these differences can be confusing for buyers, sellers, and real estate professionals.

Another challenge is the time frame in which funds must be received and cleared by the escrow agent. If funds are not cleared on time, the closing could be postponed, causing frustration for both parties.

Possible Solutions:

- Using certified or cashier’s checks to avoid issues with clearance.

- Ensuring wire transfers are initiated early to account for any possible delays.

- Consulting with a real estate attorney or escrow agent familiar with the state’s specific Good Funds Law requirements.

By addressing these challenges early in the process, buyers and sellers can help ensure a smooth and successful transaction.

Conclusion on the Good Funds Law and Its Importance

The Good Funds Law plays a vital role in protecting both buyers and sellers during real estate transactions. By requiring that all funds be verified and immediately available, the law helps prevent fraud, ensures timely payments, and creates a smoother closing process. Whether you are buying or selling property, understanding and complying with this law is essential for ensuring that the financial aspects of the transaction are handled securely.

The importance of the Good Funds Law cannot be overstated. It reduces the risks associated with unverified payments and helps ensure that both parties fulfill their obligations promptly. Real estate transactions involve large sums of money, and this law helps safeguard those financial interests, providing peace of mind for everyone involved.

Ultimately, the Good Funds Law promotes trust and reliability in real estate dealings, making it a cornerstone of secure and efficient property transactions.

FAQs About the Good Funds Law

What types of payments are considered “good funds”?

Good funds typically include wire transfers, cashier’s checks, certified checks, and in some cases, cash. Personal checks or any form of payment that takes time to clear are not considered good funds under the law.

Do all states follow the same Good Funds Law?

No, the Good Funds Law can vary by state. While the basic principles are similar, some states may have specific requirements or exceptions regarding the types of funds and the amount involved in the transaction.

What happens if funds don’t clear before closing?

If the funds are not cleared by the time of closing, the transaction may be delayed. In some cases, the buyer or seller could face penalties, and the escrow agent may refuse to proceed until the funds are verified.

Can I use a personal check for a real estate transaction?

No, personal checks are typically not accepted because they take time to clear, and there is a risk that they may bounce. It’s best to use wire transfers or certified checks to comply with the Good Funds Law.

What should I do if there’s a delay in my wire transfer?

Contact your bank immediately to track the status of the transfer. You should also notify the escrow agent or title company to ensure they are aware of the delay and make arrangements if necessary.