Arizona Laws on Commission Payments After Termination

Payments of commission can seem like a double edged sword. They encourage staff members to exert themselves more and finalize negotiations on one side, while misunderstanding such payments often results in disagreements, particularly after quitting the job on the other side. Therefore it is essential for both employers as well as employees to comprehend the intricacies involved with commission payments in Arizona.

It’s not merely about compensation, but also about making a living. Once in a conversation with my friend who got aggrieved when after leaving her work no commission came through for her she poured all her efforts into it and was left doubting her value. This indicates the need for emotional and financial well-being through the need for clear commission payment.

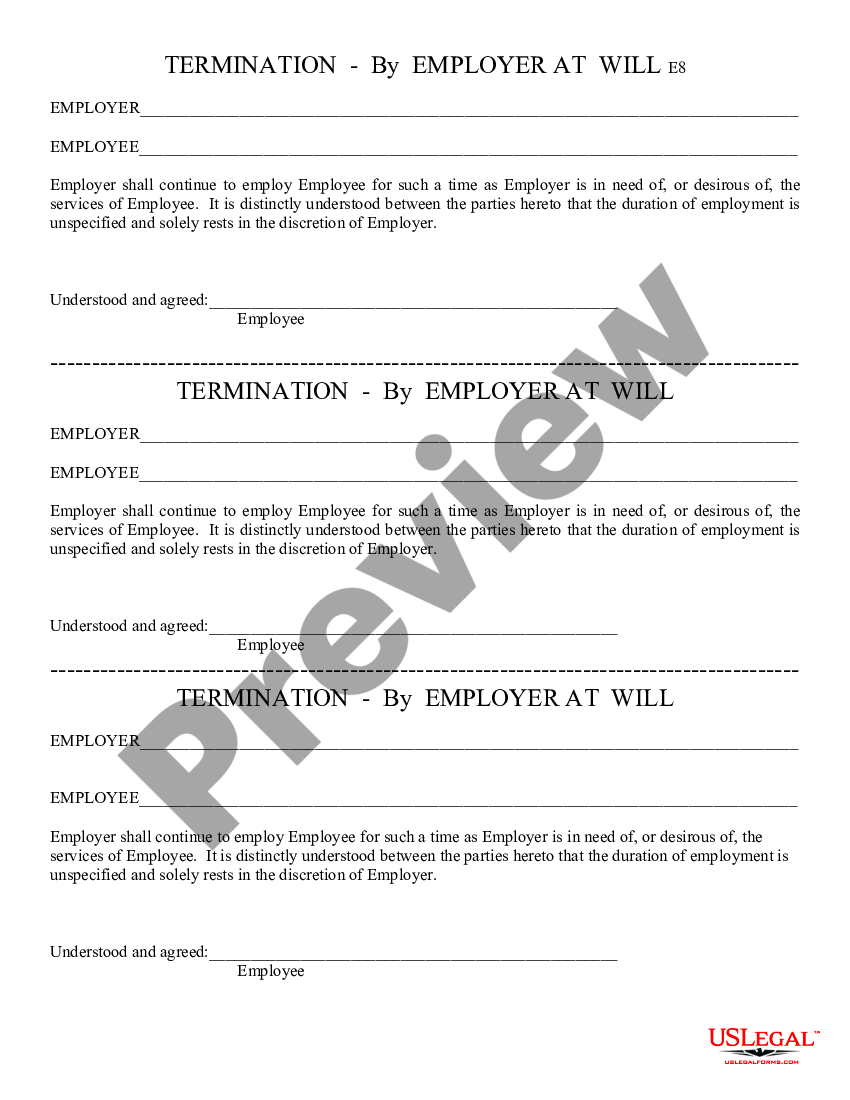

Legal Framework for Commission Payments

State laws alongside contracts manage the terrain concerning commission salaries in Arizona. These regulations must be comprehended by the businesses employing people so as to effectively deal with any disputes that may arise.

In accordance with Arizona Revised Statutes, commissions can be perceived as salaries that are safeguarded by payment regulations. Nevertheless, particularities may differ in line with distinct job agreements. Below are some of the essential aspects:

- Written Agreement: Having a written agreement specifying how commissions are calculated and paid is crucial.

- State Labor Laws: Arizona labor laws provide guidelines on how commissions should be treated, especially during employment termination.

- Dispute Resolution: Knowing how to resolve disputes legally can save time and heartache later.

Conditions for Commission Payments After Termination

After your termination, several factors may determine if you receive due commission payments or not. Well knowing these factors will change everything.

Generally speaking, if commissions have been accrued by the time of discharge, they belong to the worker. Below are critical points to remember:

- Timing of Earned Commissions: If a deal was finalized before leaving, you should be entitled to those commissions.

- Company Policy: Each company may have its policies regarding commission payments upon termination. Review these carefully.

- Contractual Obligations: Contracts often specify what happens to commissions when an employee leaves, so read the fine print.

With my past encounters, I have witnessed some people grapgle with their covenants due to the ambiguity thereof. It is said that information is strength and being aware of ones entitlements protects one from needless suffering.

Factors Affecting Commission Payments

Огромное количество причин могут маменькины дочки деньги получать не тогда, когда хочется и так, как им хочется. Знать о них помогут избежать спорных ситуаций в будущем и построить более комфортные трудовые отношения.

From what I have gathered, there are several colleagues who always worry about their commissions due to ambiguous conditions surrounding them. One of my friends missed out on a lot of money in this regard because of his failure to keep proper records of the transactions he had made. It opened our eyes as to how crucial it is for one to be aware. Listed below are some fundamental elements that can influence commission remuneration:

- Type of Commission Structure: The structure can be straight commission, salary plus commission, or tiered commission. Each has its implications.

- Performance Metrics: Companies may set specific targets that need to be met before commissions are paid out. Understanding these metrics is essential.

- Company Policies: Each organization may have unique policies regarding commission calculations and payment schedules.

- Market Conditions: Economic factors can influence sales and, consequently, commission payouts.

Never forget that talking openly with your boss will clarify things and guarantee a much more visible move.

Employer Obligations Under Arizona Law

In terms of paying commissions, employers in Arizona have certain legal obligations. Knowing this, employees can be empowered and fair workplaces can be promoted.

Additionally, employers should also note that they are restricted from arbitrarily failing to make commission payments. For instance, an employer once tried to deny payment after the end of an employee’s contract, stating that the said worker had not achieved specific “expectations.” The law is thus intended to guard these workers from such victimization. One of the major responsibilities here is:

- Timely Payment: Employers are required to pay any earned commissions promptly, even after termination.

- Written Policies: Employers must have clear written policies regarding commission structures and payments.

- Transparency: They should provide clear documentation on how commissions are calculated.

The purpose of these obligations is to make people working feel that they are important and safe in what they do. When these criteria are not satisfied, there is room for action on behalf of the workers.

Employee Rights and Remedies

Your professional life can be greatly influenced by knowing what rights you have as an employee in terms of receiving commissions. The power of knowledge is a shield that protects you.

Most workers do not know their rights until they encounter problems. I had a friend who discovered her rights in a bitter fight with her boss over unpaid commissions. The experience brought out clearly the need for knowledge. Below is a summary of the key entitlements and solutions:

- Right to Payment: If you’ve earned commissions, you have the right to receive them, regardless of your employment status.

- Access to Documentation: You have the right to request all relevant documents that show how your commissions were calculated.

- Right to File a Claim: If you believe your employer has wrongfully withheld commissions, you can file a complaint with the Arizona Department of Economic Security or pursue legal action.

The awareness of such rights is important in eliminating exploitation. This is a journey worth taking since it will guarantee that every effort is justly compensated.

Common Disputes Related to Commission Payments

Too many times, commission payments are triggered by disputes. There arises tension in-between the employers and workers thus resulting in emotional stress and financial strain. This process is all about comprehending the grievances entailed therein.

There was a moment in time whereby one of my dearest friends found herself in quite a predicament concerning her job and unpaid commissions. She had spent endless hours making numerous deals but unfortunately; when she left her position, her boss insisted those were still outstanding as the clients had not remitted their payments. Consequently, this resulted into several weeks of going to and fro without any conclusion adding to unnecessary stress.

She gave me some normal conflicts that can happen about commissions:

- Non-Payment Claims: Employees may assert that they are owed commissions for deals finalized before their termination, while employers may dispute the timing or completion of those deals.

- Calculation Discrepancies: Differences in how commissions are calculated can lead to arguments, especially if employees feel their earnings are not being calculated transparently.

- Contractual Confusion: Ambiguities in employment contracts regarding commission structures often spark disputes, making it crucial to have clear agreements.

- Unclear Company Policies: Employees may be caught off guard by vague company policies that change without notice, impacting their expected earnings.

Handling these disagreements in a timely manner can stop them from growing into large fights as long as the lines of communication are kept open.

FAQ on Arizona Commission Payment Laws

Understanding commission payment laws in Arizona can be very complex, but it should not be. The following frequently asked questions can be helpful in answering frequently asked questions about common concerns.

At times, a number of my friends have come to me with questions regarding their rights and it always felt good to reveal what I knew. The following are some of the commonly asked questions that came through:

- Are commissions considered wages?

- Yes, commissions are classified as wages under Arizona law and are therefore subject to labor regulations.

- Can my employer withhold commissions after I leave?

- If you earned those commissions before your termination, they should be paid to you.

- What if my employer has no written policy on commissions?

- While it’s best to have one, lack of a written policy doesn’t absolve your employer from paying earned commissions.

- What steps can I take if I’m owed commissions?

- You can request documentation from your employer, file a complaint with the Arizona Department of Economic Security, or consult a labor attorney.

By receiving this kind of knowledge, it is possible to overcome these obstacles wisely.

Conclusion on Commission Payments After Termination

After a termination, payments that are made to commissions can feel like complex puzzles on a book shelf. But acquiring knowledge on the laws and your rights can keep you confident and clear in what to do next.

Based on the stories I have heard, being updated is very important for workers. There are many quicksand in the field of commission payments but most are avertable through information. You should receive your dues when you made a commission whether you’re still working or not.

In my experience, I have realised that open communication as well as strong knowledge concerning contracts can really change everything. Asking doubts and claiming for your rights should never intimidate you. After all, it is not merely about money but also respect, acknowledgement and appreciation of one’s efforts.