An Overview of Ohio’s Severance Pay Laws for Employees

Severance pay can be a puzzling concept for employees. I recall my cousin who had been with a company for more than ten years facing uncertainty when he was let go. He was unsure about his eligibility for severance pay and the thought of dealing with the complexities of legal language was daunting. In Ohio the regulations regarding severance pay have their own quirks. While not all employers are obligated to offer it, it’s commonly included in the employment agreement. Therefore it’s crucial to grasp the significance of severance pay and its functioning within this state.

Severance typically refers to a sum paid to a worker upon their separation from a company. However the details regarding the amount and timing of the payment vary based on several considerations. While it’s not always assured being aware of your entitlements when it is extended is crucial in securing what you rightfully deserve.

Who Qualifies for Severance Pay in Ohio?

Here are a few things that could impact your eligibility.

- Employment contract: If your contract includes a severance clause, then you’re likely entitled to severance pay.

- Company policy: Some companies have policies that provide severance based on years of service or other criteria.

- Voluntary resignation vs. termination: If you voluntarily quit, chances are you won’t receive severance. However, if you are laid off or terminated, there’s a higher likelihood that severance could be part of the exit package.

Its worth mentioning that severance packages are usually open to negotiation. Depending on your circumstances you might be able to get additional perks or a bigger compensation.

How Severance Pay is Calculated in Ohio

Severance pay isn’t a uniform thing. The way it gets determined varies based on multiple factors. For instance when my cousin got his severance it was linked to his length of service. However that’s not universally true. In Ohio businesses might employ approaches to figure out severance pay. But let me give you a rough overview.

- Length of employment: Many companies use a formula based on how long you’ve been with the company. For example, an employee might receive one week’s pay for every year they’ve worked.

- Position and salary: Your role within the company and your salary may also affect how much severance you get. Senior employees or those in executive roles often receive more.

- Company financial situation: Some companies may offer less severance (or none at all) if they are in financial trouble.

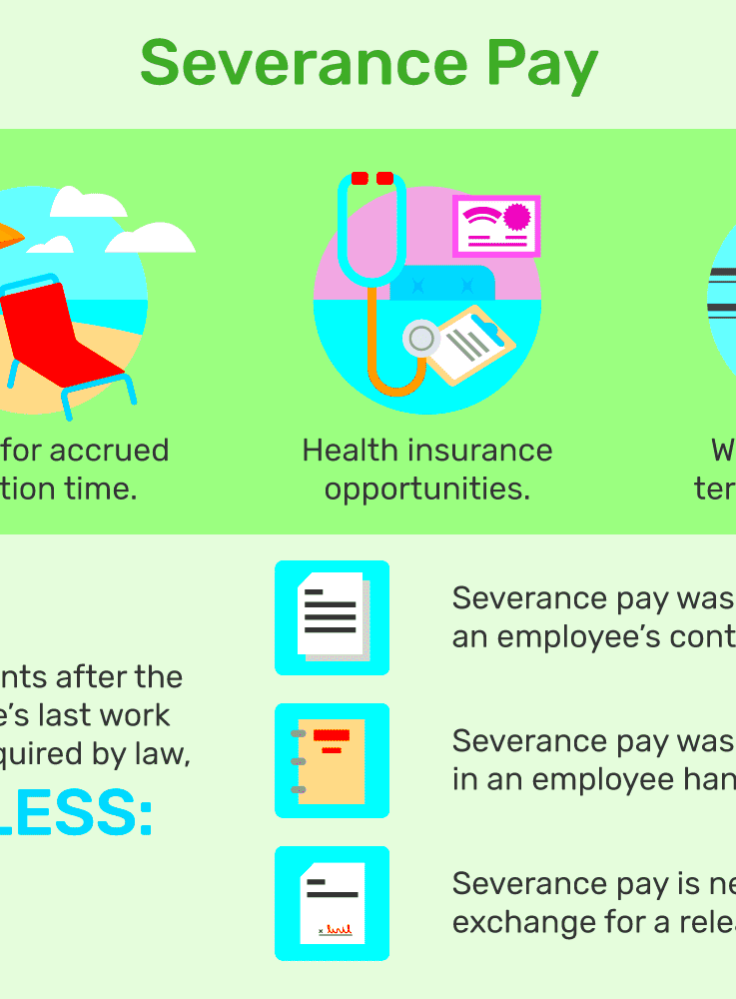

Furthermore severance can encompass more than a mere salary. In certain cases perks such as ongoing health insurance, assistance services or additional benefits may be included in the arrangement. Its essential to inquire about these extras since they can hold equal importance, as the monetary compensation.

Severance Agreements and Legal Considerations

Let me share my experience with reading a severance agreement. It can be quite a challenge, almost like deciphering an ancient text. When my uncle retired he found himself puzzled by the legal jargon in his severance package. It’s understandable to feel a bit lost but it’s essential to approach these agreements carefully. In Ohio a severance agreement usually specifies the conditions for an employees payment after departing from a company. But it’s not solely about the compensation. There are several legal aspects that you should keep in mind.

Here are a few key things to keep in mind:

- Non-compete clauses: Some severance agreements include a non-compete clause, meaning you can’t work for a competitor for a certain period. Make sure this doesn’t unfairly limit your future job prospects.

- Waiver of claims: You may be asked to sign a waiver saying you won’t sue the company for things like wrongful termination or discrimination. Be cautious—this is a big one, and it’s worth consulting an attorney before agreeing.

- Confidentiality agreements: Many severance agreements require you to keep the terms confidential. While this might seem straightforward, ensure you understand what you can and can’t share.

Always make sure to go through the details carefully. If anything seems suspicious, it’s wise to consult a lawyer before putting pen to paper. My uncle was fortunate to have a lawyer friend who assisted him in dealing with the complicated terms. Without that support he could have overlooked some significant advantages.

Employee Rights During Severance Negotiations

Receiving a package can make you feel like you’re out of control but believe me you have more power than you realize. I remember a friend of mine who worked at a company. She was caught off guard by her layoff but when they presented her with a severance offer she didn’t accept it immediately. Instead she negotiated and secured a deal for herself. So don’t hesitate to stand up for yourself during severance discussions.

Here are a few principles and tactics to remember:

- Right to negotiate: Just because an offer is made doesn’t mean you can’t ask for more. You can negotiate the amount, duration of benefits, or even additional perks.

- Time to review: In Ohio, employees are usually given time to review severance agreements. Don’t rush! Take that time to go over the details carefully and seek legal advice if necessary.

- Protection against unfair terms: If you feel pressured to sign, or if the terms seem unfair, you have the right to refuse or ask for changes. Employers might not like it, but they’ll usually respect a well-grounded argument.

Its important to keep in mind that you’re not going through this journey alone. Countless others have tread this path before you and enlisting the help of a lawyer can often play a crucial role in ensuring a fair outcome. It had a tremendous impact on my friends situation and it might just do the same for you.

Severance Pay and Unemployment Benefits in Ohio

When I initially learned about how severance pay and unemployment benefits are connected I found it somewhat puzzling. A family acquaintance had been laid off and believed she could immediately access unemployment benefits. However upon receiving severance her unemployment benefits were temporarily suspended. Ohio has guidelines regarding the impact of severance on unemployment benefits and grasping these rules can help you avoid unexpected situations.

Here’s how it generally works:

- Timing matters: If your severance is paid in a lump sum, it might delay your eligibility for unemployment benefits. Basically, if you receive severance covering a certain number of weeks, you won’t be eligible for unemployment during that time.

- Weekly payments: If severance is paid in weekly installments, it could reduce the amount of unemployment benefits you receive, or make you ineligible altogether until the severance period ends.

- No double-dipping: The state of Ohio doesn’t allow you to “double dip” by collecting both severance and unemployment for the same period.

On the bright side once your severance period ends you can start applying for unemployment benefits. Just remember to mention any severance pay you receive when submitting your unemployment claim to steer clear of any potential legal problems later on. It’s one of those seemingly small things that can have a significant impact.

FAQs About Ohio’s Severance Pay Laws

Severance pay can raise a lot of questions. I recall my cousins reaction when he was let go he had a flood of inquiries racing through his thoughts and was unsure about where to begin. To help ease any confusion here are some of the frequently asked questions I’ve come across concerning severance pay in Ohio.

Is severance pay mandatory in Ohio?

In Ohio, employers are not obligated to provide severance pay. Typically it is given at the employers discretion or outlined in an employment agreement. If you don’t have a contract in place the company is not legally required to offer you severance benefits.

Can I negotiate severance pay?

Absolutely! If you believe the severance offer falls short of your expectations it’s worth negotiating. I’ve noticed individuals hold back thinking they must accept whatever is presented to them. However let me assure you that requesting benefits, extra compensation or even prolonged healthcare coverage can often turn out to be advantageous for you.

Does severance affect my unemployment benefits?

In Ohio, your eligibility for unemployment benefits can be affected by severance. If you get a payment or weekly installments your unemployment benefits might be postponed or reduced until the severance period is over.

What should be included in a severance agreement?

A severance agreement should definitely include details about how the payment will be structured, any restrictions on working for competitors and whether you’re giving up any rights to take legal action against the company. It’s a good idea to have a lawyer review it before you sign on the dotted line.

Can my employer withhold severance if I don’t sign the agreement?

Severance pay is usually conditional upon you signing the agreement which commonly entails relinquishing any legal claims. If you decide against signing you might lose out on the severance package.

Conclusion

Severance pay in Ohio can be a bit complicated but knowing your rights and choices can really make a difference. Whether you’re looking at a severance package or trying to negotiate better terms being aware of the legal aspects can boost your confidence in navigating the process. My suggestion? Be patient, ask questions and seek guidance if necessary. You deserve to secure the best deal, for yourself when moving from one job to another.