Arizona Laws on Commission Payments After Termination

In Arizona the regulations regarding commission payments aim to ensure transparency and equity for both employers and employees. Having dealt with different employment laws I recognize how perplexing these rules can be. Positions that rely on commissions tend to be intricate due to the nature of pay tied to performance. This can result in conflicts particularly when employment comes to an end. It’s essential to comprehend the subtleties of these laws to guarantee that everyone involved is aware of their rights and responsibilities.

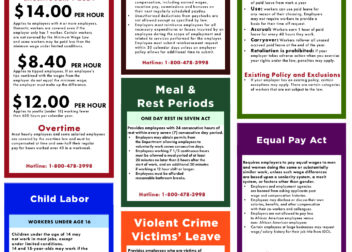

In Arizona the rules regarding commission payments are mainly regulated by state labor laws. These regulations outline the timing and manner of commission payments to ensure that employees receive fair compensation for earned commissions, regardless of whether they depart from the company or are let go.

Key aspects of these laws include:

- Commission Agreements: It’s important to have a clear, written agreement outlining how commissions are calculated and paid. This protects both the employee and the employer.

- Payment Timing: The law specifies when commissions must be paid. For example, if an employee earns a commission during their tenure, it generally needs to be paid according to the terms outlined in their agreement.

- Dispute Resolution: In cases where there is a disagreement about commission payments, the law provides mechanisms for resolving such disputes.

Grasping these factors can aid in avoiding misinterpretations and making sure that both sides are aligned. Based on my personal encounters effective communication and keeping records of agreements play a significant role in preventing disputes.

What Happens to Commissions After Termination

When an employee departs from a company be it on their own accord or not one of the key concerns that arises is what happens to their accrued commissions. Having witnessed these scenarios play out firsthand I can assure you that having well defined agreements and clarity in this aspect can have a notable impact.

In Arizona the way commissions are dealt with after termination depends on a few different factors.

- Earned Commissions: If an employee has earned commissions before their termination, these should be paid out according to the terms of the employment agreement. Generally, these commissions should be paid on the next regular payday following termination.

- Commission Agreement Terms: The specifics of how commissions are handled after termination should be outlined in the commission agreement. This agreement should clarify if commissions are due even after employment ends.

- Legal Obligations: Arizona law mandates that if commissions were earned before termination, they must be paid. Failure to do so could lead to legal disputes and potential penalties for the employer.

Based on my observations I’ve noticed that companies that are open about their commission payments and keep thorough records tend to have fewer conflicts. For workers having a grasp of their commission terms can aid in making sure they get what they deserve even if they part ways with the organization.

Legal Requirements for Commission Payments

In Arizona there are rules in place regarding commission payments aimed at safeguarding employees and promoting fairness. While navigating these regulations can be tricky grasping their significance is vital for both employers and employees. Based on my observations I’ve witnessed the importance of following these legal obligations to steer clear of potential conflicts and repercussions.

Here’s what you should know regarding the obligations concerning commission payments in Arizona.

- Written Agreements: Arizona law does not mandate written commission agreements, but having one is highly recommended. A clear, written agreement helps define how commissions are calculated, when they are paid, and what happens if employment ends.

- Timely Payments: Employers must pay earned commissions on the regular payday, even if the employee has left the company. This is essential to comply with state wage payment laws.

- Final Paychecks: When an employee is terminated, any commissions earned up to the termination date should be included in their final paycheck. This ensures that the employee receives all compensation they are entitled to.

I believe that effective communication and proper record keeping are essential for a smooth workflow. Employers need to make sure that their commission agreements are detailed while employees should monitor their commissions and periodically review their contracts. Taking this approach helps avoid misinterpretations and promotes a fair work environment.

Employer Obligations Regarding Commission Payments

When it comes to paying commissions as a company being fair and open about it is not only a requirement but also essential for upholding trust and fostering a positive workplace atmosphere. Based on what I’ve witnessed firsthand I can say that it’s crucial for employers to grasp and meet their responsibilities in this regard to prevent conflicts and nurture a dedicated workforce.

Here’s a summary of the key points that employers should consider when it comes to commission payments.

- Clear Commission Agreements: Employers should provide a written agreement that clearly outlines how commissions are calculated, the timing of payments, and the process for handling disputes. This document serves as a reference point and helps prevent misunderstandings.

- Timely Payments: Arizona law requires that earned commissions be paid on the next regular payday after they are due. This means if a commission is earned before an employee leaves, it should be included in their final paycheck or paid separately as stipulated in the agreement.

- Accurate Record-Keeping: Maintaining detailed records of all commission payments is essential. These records should include calculations, dates, and the reasons for any adjustments. Accurate documentation helps resolve disputes and demonstrate compliance during audits.

- Fair Treatment: Ensure that the commission structure is applied consistently across all employees. Any changes to the commission plan should be communicated clearly and documented to avoid confusion.

Through my own experiences I’ve discovered that addressing commission matters with employees can help avoid numerous problems. When employers are open about the process of calculating and disbursing commissions it often leads to a more positive work environment.

Employee Rights and Recourse

Being aware of your rights when it comes to commission payments as an employee can give you the confidence to advocate for fair compensation for your efforts. In my view having a clear understanding of these rights is essential for handling any disagreements that may arise and safeguarding your own best interests.

Here’s what you should understand about your rights and options regarding commission payments:

- Right to Earned Commissions: If you have earned commissions as per your agreement, you have the right to receive them even if your employment ends. Arizona law ensures that these payments are made on the next regular payday or as outlined in your agreement.

- Access to Agreements: You have the right to request a copy of your commission agreement. This document should detail how commissions are calculated, payment schedules, and procedures for handling disputes.

- Filing a Complaint: If you believe you are owed commissions that have not been paid, you can file a complaint with the Arizona Industrial Commission or seek legal advice. Documentation of your earned commissions and communication with your employer will be crucial in such cases.

- Legal Recourse: In cases where an employer fails to pay earned commissions, you may have the option to pursue legal action. Consulting with an employment lawyer can provide guidance on how to proceed and ensure that your rights are protected.

I believe that workers who stay aware of their entitlements and maintain thorough documentation of their income are more prepared to manage conflicts efficiently. Its wise to have conversations with your boss and seek legal counsel if necessary.

Common Disputes and How to Resolve Them

Conflicts regarding commission payments can be tough and demanding yet being aware of problems and having strategies to resolve them can greatly impact the situation. In my view dealing with disagreements swiftly and justly preserves working relationships and ensures that all parties are aligned.

Here are some typical disagreements related to commission payments along with suggestions for settling them.

- Disagreement Over Calculation: Disputes often arise over how commissions are calculated. Ensure that you have a clear, written commission agreement that outlines the calculation methods. If a dispute occurs, refer to this document to clarify the terms.

- Timing of Payments: Sometimes, there are disagreements about when commissions are due. Make sure that payment schedules are clearly defined in the commission agreement and that both parties understand and agree to these terms.

- Unpaid Commissions: If commissions are not paid as agreed, it’s essential to document all communications and attempts to resolve the issue. Contact your employer to discuss the matter and seek resolution. If necessary, escalate the issue to the relevant labor board or seek legal counsel.

- Termination Disputes: When an employee is terminated, disputes can arise over commissions earned before leaving. Ensure that your commission agreement addresses what happens in the event of termination and follow the agreed-upon procedures for final payments.

From what I have seen dealing with conflicts usually requires talking openly and being ready to tackle problems head on. Keeping detailed documentation and staying composed can assist in achieving a fair outcome and preventing extended disputes.

Recent Changes in Arizona Law

Staying updated on legal changes is crucial for employers and employees alike particularly when it comes to matters like commission payments. Having witnessed the effects of legal updates firsthand in my work I recognize the importance of being aware of the latest developments. The recent revisions to Arizonas commission payment laws highlight a growing focus on fairness and transparency.

Lets take a look at some of the recent updates to Arizona laws regarding commission payments.

- Updated Payment Deadlines: Recent changes have clarified and tightened the deadlines for commission payments. Employers are now required to adhere to stricter timelines to ensure that commissions are paid on time, even after an employee’s departure. This change aims to protect employees and prevent unnecessary delays.

- Enhanced Documentation Requirements: Employers must now provide more detailed documentation regarding commission structures and payments. This includes clear records of how commissions are calculated and when they are paid, making it easier to resolve disputes and ensuring transparency.

- New Dispute Resolution Procedures: Arizona has introduced new procedures for handling disputes related to commission payments. These procedures provide a more structured approach for addressing issues and seeking resolution, helping both parties navigate disagreements more effectively.

- Revised Commission Agreements: The law now emphasizes the importance of written commission agreements. These agreements must be comprehensive and include specific details about how commissions are earned, calculated, and paid. This update aims to minimize misunderstandings and legal conflicts.

In my view these shifts indicate a shift towards more equity and transparency in the professional setting. Keeping abreast of these developments and adjusting accordingly can assist in preventing complications and promoting a workplace.

Practical Tips for Employers and Employees

Handling commission payments can be tricky, but with some straightforward advice, employers and employees can navigate these situations more smoothly. From what I’ve seen taking a approach can help save time, minimize conflicts and foster a workplace atmosphere.

Here are some useful suggestions for managing commission payments.

- Maintain Clear Agreements: Employers should create detailed, written commission agreements that outline how commissions are calculated, paid, and handled in the event of termination. Employees should review these agreements carefully and seek clarification if needed.

- Keep Detailed Records: Both employers and employees should keep thorough records of all commission-related transactions. This includes documentation of earnings, payment schedules, and any adjustments. Good record-keeping can help resolve disputes quickly and accurately.

- Communicate Regularly: Open communication between employers and employees is key. Regular updates about commission earnings, changes in policies, and payment schedules can prevent misunderstandings and ensure that everyone is on the same page.

- Seek Legal Advice: If there are any doubts or disputes regarding commission payments, seeking legal advice can be beneficial. Consulting with a legal expert can provide clarity and guidance on how to proceed and ensure compliance with the law.

- Stay Informed: Both parties should stay informed about changes in the law and industry practices. This can help in understanding new requirements and adapting to any updates that might affect commission payments.

Based on what I have seen these approaches not only aid in handling commission payments more efficiently but also establish a basis of trust and openness. Taking action and staying informed can greatly help in preventing disputes and ensuring fairness in dealings.

FAQ

Q1: What should be included in a commission agreement?

A commission agreement needs to spell out how commissions will be calculated when theyll be paid and how any disputes will be resolved. It should also address what happens to commissions if someone leaves their job and include information about potential changes.

Q2: How soon should commissions be paid after termination?

In Arizona commissions that are earned prior to termination should be disbursed on the upcoming regular payday or in accordance with the terms outlined in the commission agreement. Employers must adhere to these deadlines to ensure compliance with state laws.

Q3: What can I do if my employer doesn’t pay my commissions?

If your company doesn’t pay the commissions you’ve earned make sure to keep a record of all your conversations and efforts to sort out the problem. You have the option to lodge a complaint with the Arizona Industrial Commission or seek counsel to pursue your case and safeguard your rights.

Q4: Are there any recent changes to Arizona’s commission payment laws?

Absolutely the recent updates involve adjustments to payment due dates, stricter documentation criteria, revised processes for resolving disputes and modified standards for commission agreements. The goal of these changes is to promote equity and openness in commission payments.

Q5: How can I ensure my commission payments are handled correctly?

Ensure that you have a well documented commission agreement in place, maintain thorough records and establish regular communication with your employer. If any issues or disagreements arise seek legal counsel to resolve them swiftly and efficiently.

Conclusion

Commission payments can be tricky to handle but with the knowledge and approach both employers and employees can navigate this process smoothly. Staying updated on legal changes having clear agreements and fostering communication are essential steps for ensuring a commission payment process. I’ve witnessed how proactive actions and a deep understanding of commission laws can prevent disputes and create a work atmosphere. Its important to be well prepared and informed as it not ensures compliance but also builds trust and strengthens professional relationships. By following these guidelines you can manage your commission payments more effectively and steer clear of unnecessary conflicts.