Arizona’s Remote Work Compliance Act Overview

Due to the remote work setting being among most companies’ business structures, Arizona has implemented the Remote Work Compliance Act that will be adhered by both employees and employers. This Act intends to address unique problems encountered in management of remote workforces like compliance with labor laws, safety standards and taxation obligations compliance among other challenges. The aim is to have equitable surroundings allowing businesses take advantage of flexible working situations but remain legally obligated.

Understanding the Key Provisions of the Act

An important foundation about regulations on remote work within Arizona is laid by the Arizona Remote Work Compliance Act. Some of its key points include:

- Employee Rights: Remote employees retain all the rights and protections under Arizona labor laws, including minimum wage, overtime, and health benefits.

- Workplace Safety: Employers must ensure that remote workspaces are safe, though this responsibility can be shared with employees to some extent. Regular check-ins and self-assessments might be required.

- Tax Compliance: Employers need to correctly allocate state taxes based on the remote employee’s location. This can be tricky when employees work from multiple states, but Arizona’s Act provides clear guidelines for such situations.

- Privacy Concerns: Remote work environments must also consider data privacy. Employers need to protect sensitive information by implementing secure systems and processes.

Surely, you do agree that, the Act helps in ensuring that there is orderliness and legality in remote work so as to prevent some of the problems common in such areas like no work during the agreed hours or ambiguity about payment of taxes.

Who Needs to Comply with Arizona’s Remote Work Regulations

For businesses operating within Arizona, following the Remote Work Compliance Act is crucial. Be it a completely virtual employee base or semi-conductor employees; here is the guide on how many people it should apply to:

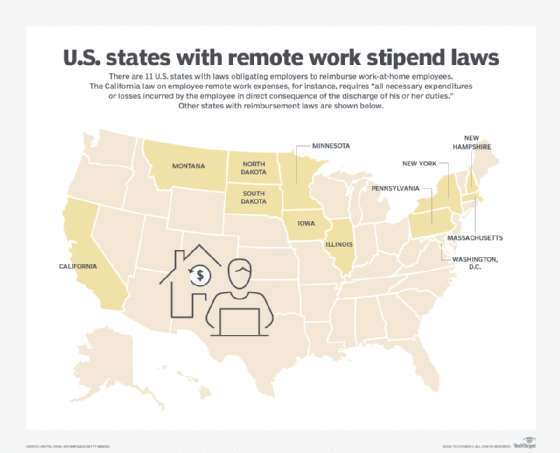

- Arizona-based Employers: Any company that has employees working remotely within Arizona, regardless of where the company’s headquarters is, must comply with this Act.

- Remote Employees Working from Arizona: Employees residing in Arizona and working for out-of-state companies are also subject to Arizona’s labor laws and protections under this Act.

- Out-of-State Employers: If a company based outside of Arizona hires Arizona residents to work remotely, they need to follow the state’s compliance regulations, especially regarding tax and labor laws.

These regulations apply even if an employer is located in another state but has employees living in Arizona. Knowing who qualifies for compliance helps prevent future legal blunders.

Impact of the Act on Employers and Employees

A major shift in expectations and responsibilities is already looming large for both employers and employees owing to The Arizona remote work compliance act. One of its implications for employers is that it requires an adjustment in the way they manage their staff- particularly with regards to compliance, timekeeping, as well as maintaining safety in the office even if it is no longer at a physical location.

The implications of the Act on both ends are listed below:

| For Employers | For Employees |

|---|---|

| Employers must now consider the safety and health standards of remote workspaces. This includes setting up guidelines for ergonomic setups and ensuring remote employees are working in safe conditions. | Employees gain the flexibility of working from home while still maintaining their rights, including minimum wage, overtime pay, and healthcare benefits as per Arizona labor laws. |

| Managing tax obligations becomes more complex, especially if employees work from multiple locations. Proper payroll allocation and tax filing are crucial to avoid fines. | Remote workers might face the need for self-assessments to ensure compliance with safety and health standards at their home office. |

| Employers need to protect sensitive company data in a remote environment, which may require additional cybersecurity measures and regular training. | Employees working remotely must ensure they adhere to the company’s cybersecurity policies and take responsibility for securing their home office setups. |

Indeed, for successful running of such operations, legal compliance must always been taken into consideration along side doing so smoothly by both party involved in it. The Act defines how remote work should happen in an organized manner making it easy for all individuals concern about what they entail as well as what they have to do.

How to Ensure Compliance with the Act

Though compliance with Arizona’s Remote Work Compliance Act may appear to be insurmountable, employers and employees can adopt reasonable measures to ensure they are within the bounds of the law. Below is a guide to assist in this regard:

- Understand Labor Laws: Employers should stay informed about Arizona’s labor laws, especially in relation to remote work. This includes everything from minimum wage requirements to overtime pay.

- Update Company Policies: Companies need to revise their employee handbooks or policies to reflect remote work regulations. This should include guidelines on working hours, breaks, and expectations for remote employees.

- Ensure Safe Work Environments: Although employees work remotely, employers should provide resources or guidelines on how to set up safe and ergonomic home workspaces. Regular self-assessments might also be helpful.

- Monitor Tax Obligations: Employers must accurately allocate taxes based on where remote employees live and work. Working with tax professionals can help prevent errors and penalties.

- Focus on Cybersecurity: Implementing robust cybersecurity protocols is crucial for protecting sensitive company information. This might include encryption software, VPNs, and regular cybersecurity training.

- Keep Accurate Records: Tracking working hours, breaks, and overtime is essential for staying compliant with Arizona labor laws. Employers may need to invest in time-tracking software to keep everything transparent.

Adopting these measures will make sure that both employers as well as employees are complying with Remote Work Compliance Act thus minimizing chances of penalties while at the same time creating an enabling environment for effective and safe work remotely.

Potential Penalties for Non-Compliance

If one doesn’t follow the Arizona Remote Work Compliance Act, it may result in dire consequences for corporations plus individuals alike. Labour laws enforcement is evidently spelt out within Arizona’s legislative framework, and remote work is not an exception here. Noncompliance has multiple repercussions such as; financial fines as well as legal actions.

Below are potential consequences that can occur in case organizations do not adhere to regulations:

- Fines and Penalties: Businesses that fail to adhere to Arizona labor laws, including wage regulations, can face steep fines. These fines often accumulate over time, especially if multiple violations occur.

- Back Payment of Wages: If remote employees are not paid according to the law, businesses may be required to compensate employees with back pay, including any overtime that was not properly accounted for.

- Tax Violations: Incorrect tax filings or failing to allocate state taxes based on where remote employees work can lead to penalties from the state or federal government.

- Legal Action: In cases of serious violations, employees might take legal action against employers, leading to costly lawsuits that could tarnish the company’s reputation.

This is very important for the firms because they can lose money or lose employees’ trust if they do not comply with such regulations. To avoid these setbacks, companies need to be proactive in their compliance.

Frequently Asked Questions about Arizona’s Remote Work Compliance Act

It is normal for the employers as well as the employees to ask various questions regarding the application of the Arizona Remote Work Compliance Act, given the difficulties posed by the remote work regulations. To clarify some common worries, here are frequently asked questions:

-

- Do remote employees have the same rights as in-office employees under this Act?

Yes, remote employees in Arizona retain all the rights of in-office employees, including minimum wage, overtime, and access to health benefits. The Act ensures that the location of the employee does not affect their legal rights under Arizona labor laws.

-

- Is there a requirement for employers to provide equipment for remote employees?

The Act does not mandate that employers provide specific equipment for remote work. However, it is recommended that employers ensure their remote workforce has the necessary tools to perform their duties effectively, which may include computers, secure internet connections, or ergonomic setups.

-

- How do employers ensure workplace safety for remote employees?

While the responsibility for maintaining a safe remote workspace largely falls on the employee, employers are encouraged to offer resources such as ergonomic guides and self-assessment tools. In some cases, regular check-ins may be conducted to ensure that the workspace complies with safety standards.

-

- Do out-of-state employers need to comply with Arizona’s Act if they hire Arizona residents?

Yes, if an employer hires a remote worker residing in Arizona, they must comply with the state’s labor and tax laws. This includes ensuring proper tax allocation and following Arizona’s minimum wage and overtime regulations.

-

- What happens if my business fails to comply with the Act?

Non-compliance can result in various penalties, including fines, legal action, and back payment of wages. It is essential to remain compliant to avoid these consequences and maintain a positive relationship with your employees.

Conclusion: Navigating Remote Work in Arizona

The Arizona Remote Work Compliance Act is an Act that the government of Arizona established to create a clear definition about working from home. Both employers and employees must comply with these regulations to ensure a productive, safe and legally sound remote workplace. Staying ahead of any compliance issues could save you from lawsuits in future whilst causing you to enjoy remote working flexibility.