Commission Pay Enforcement After Termination in California

There are many jobs in California that deal with commission pay, especially in sales and service industries. It refers to an employee’s earnings depending on what they sell or bring into the company. Unlike a fixed salary, commissions can vary hugely based on performance which can motivate employees to perform better. Since commission payment involves both congratulations and disputes due to employment status changes, it is important for both employees and employers to understand this system.

Key Regulations Governing Commission Pay

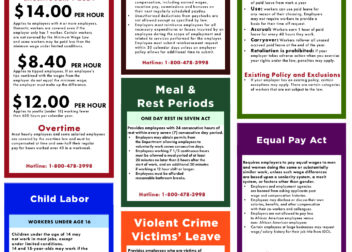

California has specific laws governing commission payments meant to safeguard employees. Here are a few notable regulations worth knowing:

- Labor Code Section 2751: This law requires employers to provide written agreements to employees regarding commission structures.

- Final Paycheck Laws: Upon termination, employees must receive their final paycheck, which includes any earned commissions.

- Wage Theft Protections: California law protects employees from wage theft, ensuring they receive all payments due to them.

Employers have to follow these rules or they will find themselves having problems; it is important that workers know what their entitlements are so that payment remains justifiable.

What Happens to Commission Pay After Termination

Whatever the situation is between the employee and employer, it is very important for employees to know how commission payment is done. The following should be anticipated:

- Earned Commissions: Any commissions earned before termination must be paid out. This includes commissions for sales completed before the termination date.

- Commission Agreements: Review your commission agreement. Some agreements may specify how commissions are calculated post-termination.

- Pending Sales: If there are pending sales at the time of termination, the employer may or may not be obligated to pay commissions based on the agreement.

Base on this the status of your data training should be remembered. Moreover, commission earnings must be communicated to the employer. A legal counsel must handle disputes so that payment is made on time.

Calculating Final Commission Payments

Final commission payment calculation can feel hard when an employee quits his job. Normally, commissions are tied to the performance in sales and some light has to be shed on what is rightfully yours. California law requires that any earned commissions be paid out by employers and such may involve different types of calculations.

Let’s take a little closer look at this in a simpler way. That’s the most straightforward way to determine total commission disbursements:

- Review Your Agreement: Start by reviewing your commission agreement. It should outline how commissions are calculated and any terms regarding payouts upon termination.

- Identify Earned Commissions: Look at all sales you completed before your termination date. Make a list of these transactions.

- Calculate Commissions: Use the agreed-upon percentage from your sales to calculate the total commissions. For example, if you sold $10,000 worth of products and your commission rate is 5%, your commission would be $500.

- Consider Pending Sales: If there are pending sales that will close after your termination, check your agreement to see if you are entitled to those commissions.

By having all this information organized, it can help ensure that when your final paycheck comes you have the proper amount on hand. In case of any doubt regarding the amount due, it may be time to consult an attorney.

Legal Rights of Employees Regarding Commission Pay

It is important to know what your commission pay legal rights are especially for states like California with their strong worker protections. Below are some of the primary rights that every employee ought to recognize:

- Written Agreement: Employees have the right to receive a written agreement that details the commission structure, including how commissions are earned and calculated.

- Final Paychecks: Upon termination, California law mandates that employees receive their final paychecks, which must include all earned commissions.

- Protection from Wage Theft: Employees are protected from wage theft, meaning employers cannot withhold earned wages or commissions unlawfully.

- Right to Sue: If an employer fails to pay earned commissions, employees have the right to pursue legal action to recover those funds.

This is crucial for workers’ comprehension of their entitlements as well. Informedness enables an individual to speak up because such people will be in position to ensure that they are compensated appropriately.

Common Disputes Over Commission Payments

There are many occasions when disputes may arise regarding commission payments arguably creating a rift between employees and employers. The following are some of the common problems that might trigger these arguments:

- Misinterpretation of Agreements: Employees and employers may have different interpretations of commission agreements, leading to disputes about what is owed.

- Delayed Payments: Sometimes, there may be delays in processing final commissions, causing frustration for former employees waiting for their payments.

- Payout for Pending Sales: Disagreements can occur regarding whether employees are entitled to commissions for sales that close after their termination.

- Changes in Commission Structures: Employers may change commission structures or rates without proper notification, leading to disputes over what was originally agreed upon.

In order to prevent such issues from happening, it is important that the commission agreement is well understood and there is clear communication among parties involved. In case any conflict erupts, seeking advice from an attorney may prove useful in examining your choices concerning resolution.

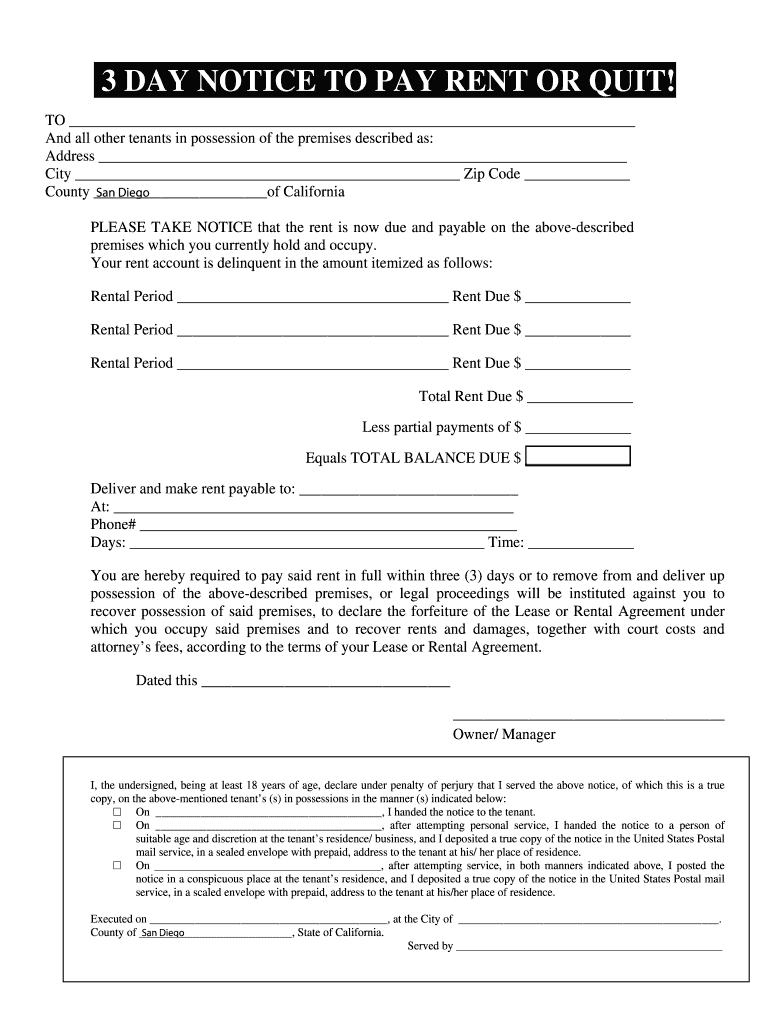

Steps to Take If You Face Issues with Commission Pay

Disagreements regarding commission payment can result in displeasure and anxiety. Nevertheless, you can use certain means to settle the matter efficiently. In case there are concerns that might arise, here is a useful guide that can assist you in going through any obstacles that may come your way:

- Review Your Commission Agreement: Start by carefully reading your commission agreement. This document should outline how commissions are calculated and what you’re entitled to, which is crucial in resolving disputes.

- Document Everything: Keep detailed records of your sales, any communications regarding commission pay, and your pay stubs. This documentation will support your case if you need to escalate the matter.

- Communicate with Your Employer: Approach your employer or HR department to discuss the issue. Be clear and professional in your communication, presenting your evidence and asking for clarification on any discrepancies.

- Seek Mediation: If direct communication doesn’t resolve the issue, consider seeking mediation. This involves a neutral third party who can help both sides come to an agreement.

- Consult a Lawyer: If all else fails, consulting an employment lawyer who specializes in commission disputes can provide guidance on your rights and possible legal actions you can take.

Taking the time to address commission pay concerns properly brings about a peaceful settlement most times.

FAQs About Commission Pay Enforcement

Commission pay can be intricate; thus, a lot of workers inquire about their abilities and execution. Some of the most asked questions include:

- What should be included in a commission agreement?

A commission agreement should detail the commission rate, payment schedule, and conditions for earning commissions, including how they are calculated. - Can an employer withhold commission payments?

No, employers cannot withhold earned commissions. If you’ve completed the necessary sales, you have the right to receive payment. - How long does an employer have to pay commissions after termination?

Employers are required to issue final paychecks, including commissions, promptly after termination, typically within the next pay period. - What if I believe my employer is violating commission laws?

If you suspect violations, gather documentation and consider consulting with a labor attorney or contacting the California Labor Commissioner’s Office.

Having a good knowledge of these FAQs can assist employees sail through the murky waters of commission pay regulation.

Conclusion on Commission Pay Enforcement in California

In California, it is essential for both workers and business owners alike to have a grasp of their entitlements in terms of commission payments. Employees are shielded from unfair practices which could deny them payment for their commissions earned due to the time set out for greater clarification. As such, they must know how to calculate the amount of commission, grasp legal rights as well as familiarize themselves with normal disputes so as to represent themselves adequately.

In case of any issues, resolving them proactively would include making contact with the employers or obtaining legal counsel. Ultimately, the best way of ensuring equitable treatment with regard to commission pay in California is by being informed and ready.