Common Colorado Estate Law Questions Answered

When it comes to preparing for what lies ahead knowing the ins and outs of Colorado estate law is crucial. Estate law dictates how your belongings and assets are handled and distributed after you’re no longer here. Its not merely about drafting a will; it’s about making sure your desires are respected and your loved ones are well taken care of. Based on my observations a lot of individuals perceive estate planning as an overwhelming chore often postponing it. Nevertheless having a robust estate plan can bring tranquility and help avoid potential disputes among family members.

Key Aspects of Estate Planning

Estate planning goes beyond simply creating a will. Its about taking various steps to handle your estate according to your preferences. Here are some important factors to keep in mind.

- Creating a Will: This document outlines how you want your assets distributed. Without a will, Colorado’s intestacy laws will determine the distribution.

- Setting Up Trusts: Trusts can help manage your assets during your lifetime and specify how they should be distributed after your death.

- Designating Powers of Attorney: This allows someone to make financial or medical decisions on your behalf if you become incapacitated.

- Reviewing Beneficiary Designations: Ensure that your insurance policies and retirement accounts reflect your current wishes.

Based on what I’ve seen personally, a mistake that many people make is failing to keep their estate plan up to date. Changes in life like getting married, going through a divorce or welcoming new children into the family can have a big effect on how you should approach your estate planning.

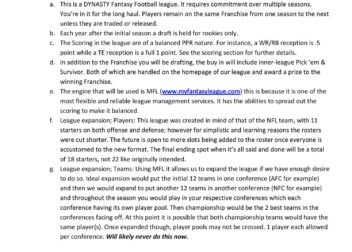

Understanding Wills and Trusts

Wills and trusts play roles in the realm of estate planning, with each serving a unique function. Let’s delve into their responsibilities.

- Wills: A will specifies how your assets should be distributed and appoints guardians for minor children. It goes through the probate process, where a court validates the will and oversees the distribution of your estate.

- Trusts: Trusts manage your assets during your lifetime and dictate their distribution after your death. Unlike wills, trusts generally avoid probate, saving time and potentially reducing costs. They can also be used to protect assets and provide for beneficiaries with specific needs.

In my opinion one of the advantages of having a trust is its adaptability. For instance if you have a child with special needs a trust can provide them with the necessary financial assistance without impacting their eligibility for government aid.

Probate Process in Colorado

While it may resemble something out of a courtroom show probate is an actual procedure that ensures your wishes are carried out after you pass away. In Colorado probate entails confirming the validity of your will if you possess one and managing the distribution of your assets. Here’s a brief overview of how this procedure unfolds,

- Filing the Will: The first step is to file your will with the probate court. If you don’t have a will, the court will follow Colorado’s intestacy laws to determine how your assets are distributed.

- Appointing an Executor: If your will names an executor, this person will manage the estate. If not, the court will appoint someone.

- Inventory and Appraisal: The executor must list and value all the estate’s assets. This includes real estate, personal property, and financial accounts.

- Paying Debts and Taxes: The estate must settle any outstanding debts and taxes before distributing assets to beneficiaries.

- Distributing Assets: Once debts and taxes are paid, the remaining assets are distributed according to the will or Colorado law.

Based on what I’ve seen dealing with probate can be quite a hassle. I remember assisting a friend with it and the toughest part was handling expectations and keeping all family members in the loop. With planning and open communication things can go much smoother.

How to Handle Estate Taxes

Estate taxes can be quite a load to bear, but with some careful strategizing, you can navigate them smoothly. Here’s a rundown on how to deal with estate taxes in Colorado.

- Understand the Estate Tax Threshold: Colorado does not have a state estate tax, but federal estate taxes may apply. As of 2024, the federal estate tax exemption is quite high, meaning many estates won’t be taxed.

- Valuation of Assets: Accurate valuation is crucial. Underestimating the value of assets can lead to unexpected tax liabilities. Engage a professional appraiser to ensure everything is assessed correctly.

- Tax Returns: The executor is responsible for filing the necessary federal estate tax returns. It’s important to work with a tax professional who understands estate laws to ensure compliance and minimize liabilities.

- Consider Estate Planning Strategies: Tools like gifting, trusts, and charitable donations can help reduce the taxable estate. For instance, setting up a charitable remainder trust can provide tax benefits while supporting causes you care about.

Within my family weve witnessed the impact of strategic planning. Through my personal encounter with estate planning I learned that taking steps in advance can preserve not just finances but also the cohesion of our family.

Dealing with Disputes and Challenges

Disputes over estates are sadly frequent and can lead to long lasting divisions among family members. Dealing with these difficulties calls for a mix of expertise and a tactful approach. Here are some ways to manage potential disagreements.

- Common Disputes: Disagreements often arise over the validity of the will, the distribution of assets, or the role of the executor. Understanding these common issues can help you prepare for or avoid conflicts.

- Mediation and Negotiation: Before heading to court, consider mediation. A neutral third party can help resolve disputes amicably, saving time and legal costs.

- Legal Representation: If disputes escalate, having an experienced estate attorney can be invaluable. They can help you navigate the legal system and advocate for your interests.

- Communication is Key: Open and honest communication with family members can often prevent disputes from arising. Involving everyone in the estate planning process can help manage expectations and reduce conflicts.

I have witnessed how disagreements can disrupt even the most carefully crafted arrangements. For example a disagreement within a family regarding a will resulted in lengthy legal battles and strained connections. This situation underscored the significance of communication and the advantages of seeking assistance in conflict resolution.

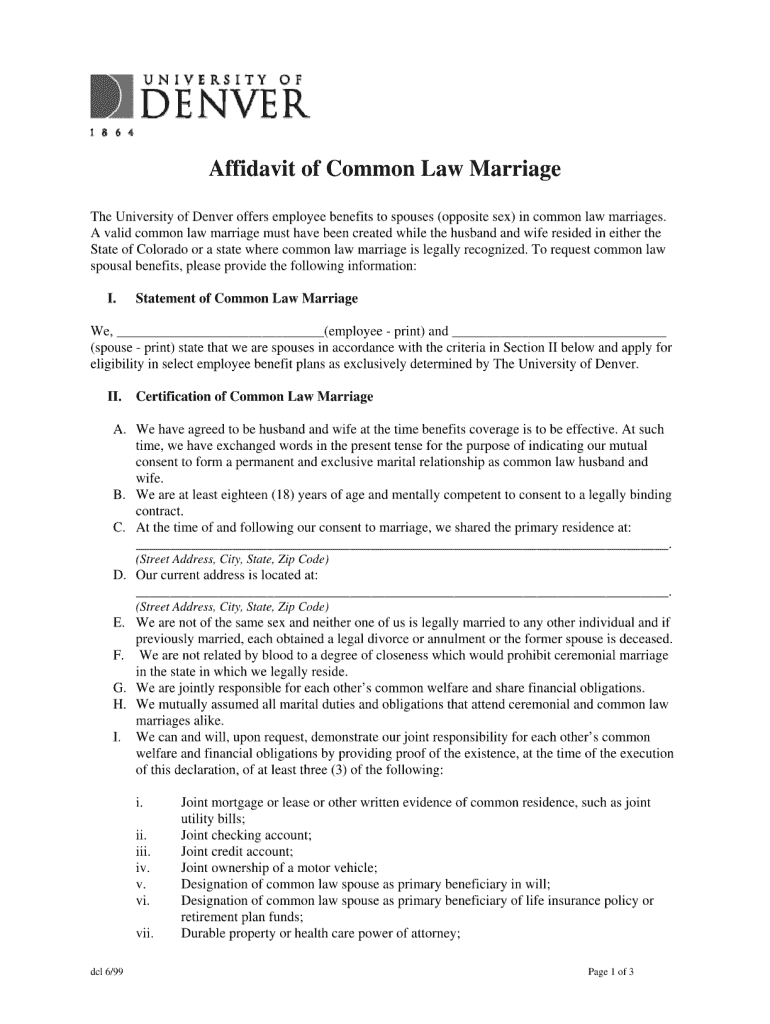

Choosing an Estate Attorney

Choosing an estate attorney may seem overwhelming, but it’s essential to ensure that your estate plan is managed correctly. An estate attorney goes beyond being a consultant; they serve as a reliable navigator during challenging choices. Here are a few suggestions to assist you in selecting the attorney for your needs.

- Specialization: Look for an attorney who specializes in estate law. This ensures they have the expertise to handle your specific needs, whether it’s drafting a will, setting up trusts, or navigating probate.

- Experience: Choose someone with a proven track record. An experienced attorney will be familiar with common pitfalls and have strategies in place to avoid them. I recall working with a seasoned attorney who made the process smooth because of their deep understanding of estate laws.

- Personal Fit: You should feel comfortable discussing personal matters with your attorney. A good rapport can make a big difference in how smoothly your estate planning goes.

- Client Reviews: Check online reviews or ask for references. Positive feedback from past clients can provide insight into the attorney’s reliability and effectiveness.

- Fees: Understand the fee structure. Some attorneys charge a flat fee, while others bill hourly. Clear communication about costs upfront can help avoid surprises.

Based on my experience searching for the right lawyer was similar to looking for a decent physician. It required some time and effort but having someone who genuinely comprehended my requirements and supported me throughout the process made it worthwhile.

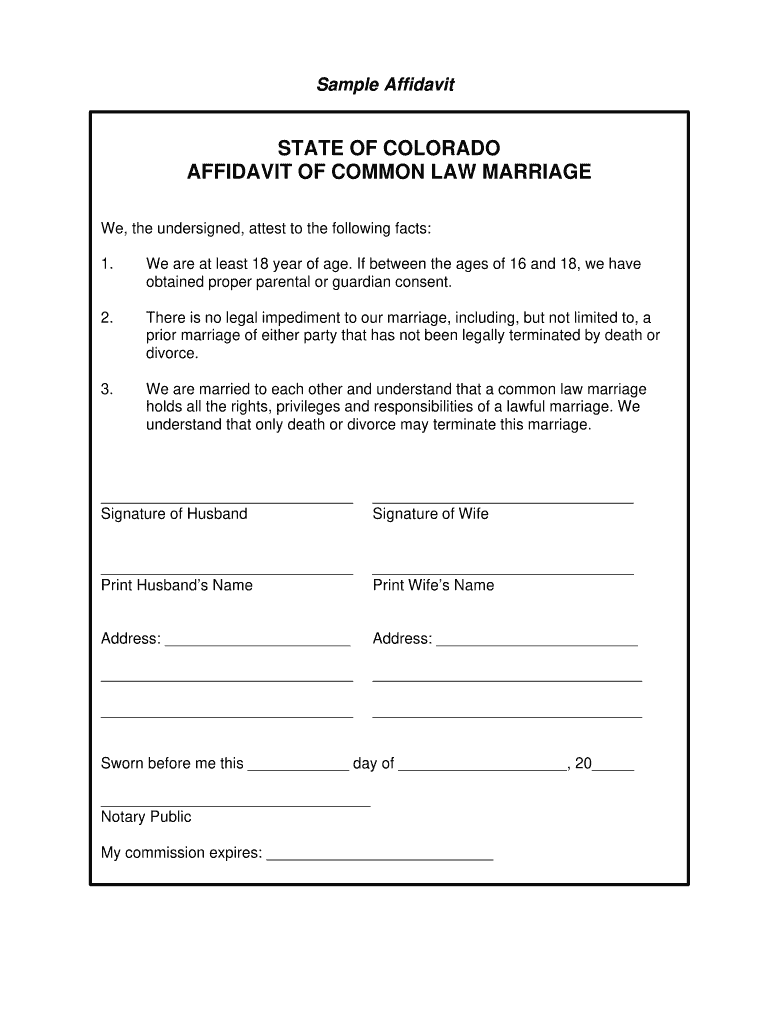

Important Documents to Prepare

Getting your paperwork in order is key when it comes to planning your estate. These papers make sure your intentions are spelled out and have legal weight. Here’s a list of important documents to keep in mind.

- Will: This document specifies how you want your assets distributed after your death. It also names guardians for minor children if applicable.

- Trusts: Trusts manage your assets during your lifetime and dictate their distribution after your death. They can help avoid probate and manage your estate more flexibly.

- Durable Power of Attorney: This document designates someone to make financial decisions on your behalf if you become incapacitated.

- Healthcare Power of Attorney: Similar to the durable power of attorney, but specifically for medical decisions. It ensures your healthcare wishes are honored when you can’t voice them yourself.

- Living Will: Also known as an advance directive, this document outlines your preferences for end-of-life care. It helps guide medical professionals and family members in critical situations.

- Beneficiary Designations: Update beneficiary designations on accounts like life insurance and retirement plans to reflect your current wishes.

Based on what I went through getting these papers ready in advance was a huge source of comfort. It gave me peace of mind to know that everything was sorted out and my loved ones wouldn’t have to deal with any unnecessary hassles.

FAQ

What happens if I die without a will in Colorado?

If you die without a will in Colorado the distribution of your assets will be governed by intestacy laws. Typically this means that a court will make a decision using formulas that may not align with your specific preferences.

Can I change my will after it’s been made?

Absolutely, you have the ability to modify or change your will whenever you are alive and mentally sound. Its wise to take a look at your will from time to time, particularly after significant life events such as getting married or welcoming a new child into the family.

How can I minimize estate taxes?

To reduce estate taxes you can consider establishing trusts donating to charity and utilizing the federal estate tax exemption. Seeking advice from a tax expert or estate planner can assist in customizing approaches to suit your circumstances.

What should I do if my family disagrees about the will?

Mediation can often help settle disagreements. If conflicts continue it might be time to get some legal guidance. Communicating your thoughts clearly and keeping a record of them can aid in avoiding or resolving disputes.

How do I choose the right estate attorney?

Seek out a lawyer well versed in estate matters, who possesses relevant expertise and whom you feel at ease with. Feedback and recommendations from reliable sources can prove valuable in guiding your choice.

Conclusion

Grasping and dealing with estate law in Colorado may appear daunting at first. Yet with an approach it can transform into a seamless journey. Having walked this road before I have witnessed the sense of security that comes from careful preparation. It goes beyond asset distribution; it’s about making sure your wishes are respected and your loved ones are taken care of. By selecting an attorney preparing key documents and addressing potential conflicts with care you pave the way for a smoother process and steer clear of undue stress. Keep in mind that meticulous estate planning is a present, for your future self and for those you hold dear.