Debt Collection Laws in New Jersey Explained

Debt collection laws in New Jersey are designed to protect both consumers and creditors. These laws set guidelines for how debts can be pursued, ensuring that collection practices remain fair and lawful. If you’re dealing with debt or a collector, it’s crucial to understand your rights under state and federal laws. This knowledge can help you avoid harassment and ensure you’re treated fairly during the debt recovery process. Let’s dive into how these laws work, starting with the Federal Fair Debt Collection Practices Act (FDCPA).

Understanding the Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act (FDCPA) is a federal law that applies across the U.S., including New Jersey. This law was created to protect consumers from abusive debt collection practices. Under the FDCPA, debt collectors must adhere to strict guidelines when contacting individuals to collect debts. These rules include:

- No harassment: Collectors cannot use abusive language, threats, or repeated calls to intimidate you.

- Time restrictions: Debt collectors are only allowed to contact you between 8 AM and 9 PM unless you agree to another time.

- Written notice: You must receive a written notice of the debt within five days of the initial contact.

- Right to dispute: You have the right to dispute the debt within 30 days of receiving the notice.

- Cease communication request: If you send a written request asking the collector to stop contacting you, they must comply.

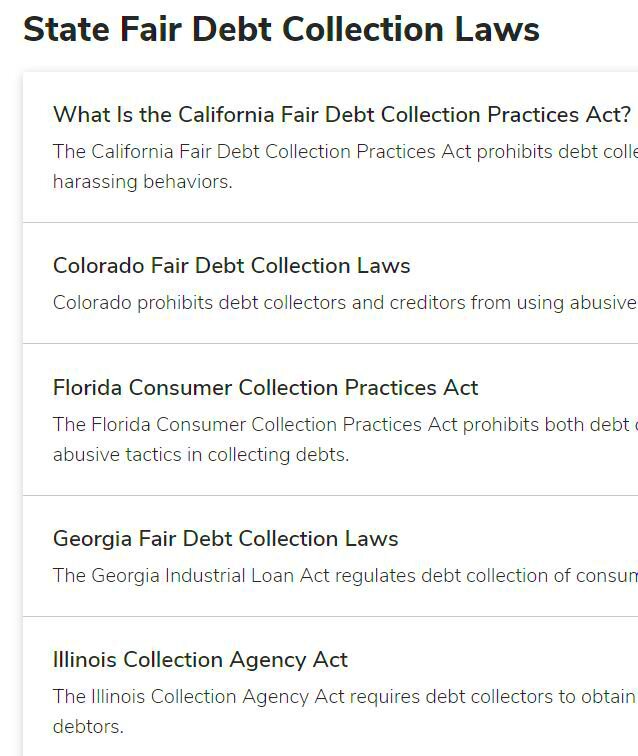

The FDCPA provides a critical layer of protection, but there are also state-specific laws in New Jersey that offer additional consumer safeguards.

New Jersey’s State-Specific Debt Collection Regulations

While the FDCPA is a federal law, New Jersey has its own set of debt collection regulations that enhance consumer protection. These rules are often stricter than federal guidelines and offer specific protections to residents of the state. Some key aspects of New Jersey’s debt collection regulations include:

- Licensing requirements: Debt collectors operating in New Jersey must be licensed by the New Jersey Department of Banking and Insurance. This ensures accountability and professionalism in the industry.

- Interest rate limitations: New Jersey law caps the interest rates that can be applied to certain types of debt, preventing creditors from charging excessively high rates.

- Statute of limitations: New Jersey has a specific timeframe for how long creditors can sue to collect unpaid debts. The statute of limitations varies depending on the type of debt but generally ranges from four to six years.

- Wage garnishment protections: In New Jersey, there are limits on how much of a debtor’s wages can be garnished to pay off a debt, providing some financial protection to individuals facing collection actions.

Understanding these state-specific regulations can empower you to better navigate the debt collection process, ensuring that collectors act within the bounds of the law.

What Rights Do Debtors Have in New Jersey?

In New Jersey, debtors have a number of rights designed to protect them from unfair debt collection practices. These rights ensure that debt collectors follow ethical and legal guidelines while attempting to collect outstanding debts. Some of the key rights for debtors include:

- Right to be free from harassment: Collectors cannot threaten, harass, or use abusive language while trying to collect a debt.

- Right to privacy: Debt collectors cannot disclose your debt to third parties such as friends, family members, or employers, except in specific legal cases.

- Right to receive information: You are entitled to a written notice explaining the amount you owe, the name of the creditor, and your options for disputing the debt within five days of the collector’s first contact.

- Right to dispute the debt: If you believe the debt is incorrect or not yours, you have the right to dispute it. The collector must stop collection efforts until they provide proof of the debt.

- Right to request no further contact: You can send a written request to the debt collector to cease communication. After this, the collector can only contact you to inform you of legal action.

By understanding these rights, New Jersey residents can ensure they are not subjected to unfair or illegal practices during debt collection.

How Collectors Can Legally Pursue Debts in New Jersey

Debt collectors in New Jersey must follow both state and federal laws when pursuing outstanding debts. While they are allowed to contact debtors and attempt to recover money, there are clear guidelines on what they can and cannot do. Here’s how they can legally pursue debts:

- Sending written notices: Collectors must send a written notice of the debt within five days of their initial contact. This notice must include the amount owed, the creditor’s name, and instructions on how to dispute the debt.

- Time restrictions for calls: Collectors can only call debtors between 8 AM and 9 PM unless the debtor agrees to a different time.

- Legal action: Collectors can file a lawsuit to recover the debt, but they must do so within New Jersey’s statute of limitations, which is generally four to six years depending on the type of debt.

- Garnishing wages: After obtaining a court judgment, debt collectors may garnish a portion of a debtor’s wages, but New Jersey law limits the amount that can be taken, typically no more than 10% of a debtor’s disposable income.

Debt collectors are required to operate within these legal frameworks to ensure they do not violate the rights of debtors. If they step outside these boundaries, they may be subject to penalties or lawsuits.

Steps to Take if You’re Facing Illegal Debt Collection Practices

If you believe a debt collector is violating your rights, it’s important to take immediate action. Illegal debt collection practices can cause stress and financial harm, but there are steps you can take to protect yourself:

- Document all interactions: Keep records of phone calls, letters, and any other communication with the debt collector. Note down dates, times, and the content of each conversation.

- Request written validation: If the debt collector hasn’t provided a written notice of the debt, ask for written validation. They must send proof of the debt within five days of your request.

- Send a cease communication letter: You can request that the debt collector stop contacting you by sending a formal letter. Once they receive this, they are only allowed to contact you about legal action.

- File a complaint: If you believe the collector is breaking the law, file a complaint with the New Jersey Division of Consumer Affairs or the Consumer Financial Protection Bureau (CFPB).

- Consider legal action: If the debt collector is engaging in illegal practices, you may be able to sue them. Many attorneys specialize in consumer rights and can help you navigate the process.

By taking these steps, you can ensure your rights are protected and hold debt collectors accountable for any unlawful behavior.

Debt Collection Statute of Limitations in New Jersey

The statute of limitations for debt collection in New Jersey sets a time limit on how long a creditor or debt collector has to file a lawsuit to recover unpaid debts. This time limit varies depending on the type of debt, but once it expires, the debt becomes “time-barred,” meaning collectors can no longer take legal action to collect it. However, it’s important to note that while collectors cannot sue, they can still attempt to collect the debt through other means, such as phone calls or letters. Here’s a breakdown of the statute of limitations for common types of debt:

| Type of Debt | Statute of Limitations |

|---|---|

| Credit card debt | 6 years |

| Medical debt | 6 years |

| Personal loans | 6 years |

| Auto loans | 4 years |

| Mortgages | 6 years |

The clock on the statute of limitations starts from the date of the last payment made on the debt. If a debtor makes a payment after the statute of limitations has expired, the clock may reset, allowing collectors to file a lawsuit. It’s important for debtors to be aware of these timelines and avoid inadvertently reviving old debts.

FAQs About Debt Collection in New Jersey

Debt collection can be confusing, so here are answers to some common questions about how it works in New Jersey:

- Can debt collectors call me at work?

Yes, but if you ask them not to or if your employer doesn’t allow it, they must stop contacting you at work. - What happens if a debt is past the statute of limitations?

Collectors cannot sue you to collect a debt that is past the statute of limitations, but they can still try to contact you for payment. - Can my wages be garnished for unpaid debts?

Yes, but only after a collector has obtained a court judgment. In New Jersey, wage garnishment is limited to 10% of your disposable income in most cases. - Can debt collectors charge interest on my debt?

Yes, but the amount of interest they can charge is regulated by both state and federal law. Some debts, such as credit card balances, may accrue interest based on the terms of the agreement. - What should I do if a debt collector is harassing me?

You can file a complaint with the New Jersey Division of Consumer Affairs or the Consumer Financial Protection Bureau (CFPB) and may consider legal action if the harassment continues.

Conclusion on Debt Collection Laws in New Jersey

Debt collection laws in New Jersey are designed to protect both creditors and consumers by establishing clear guidelines on how debts can be pursued. By understanding the Fair Debt Collection Practices Act (FDCPA) and New Jersey’s specific debt collection regulations, debtors can safeguard their rights. Whether you’re dealing with a debt collection lawsuit, harassment, or uncertain about your rights, staying informed is your best defense. If you’re ever in doubt, it’s wise to consult a consumer rights attorney to ensure that debt collectors are following the law and treating you fairly throughout the process.