Delaware Business Incorporation Laws Explained

Delaware is one of the most popular states for business incorporation in the United States, thanks to its business-friendly laws. Whether you’re a small startup or a large corporation, Delaware provides a flexible legal framework that appeals to many. From liability protections to tax advantages, understanding the basics of Delaware’s incorporation laws can help you make an informed decision when setting up your business.

Benefits of Incorporating in Delaware

Incorporating in Delaware offers several advantages, which is why many companies, including large corporations, choose this state as their legal home. Here are some of the key benefits:

- Business-Friendly Legal System: Delaware’s Court of Chancery specializes in business law, providing fast and expert resolutions to corporate disputes.

- Favorable Tax Structure: Delaware does not impose corporate income taxes on companies that do not operate within the state. This can lead to significant tax savings for businesses.

- Privacy Protections: Delaware allows businesses to keep their owners’ identities private, offering a layer of confidentiality to company owners and stakeholders.

- Flexible Corporate Structure: Delaware laws allow businesses to customize their corporate structure and operations, providing flexibility in management decisions.

- Investor Confidence: Many investors prefer Delaware corporations due to the established and predictable legal environment, making it easier to raise capital.

Types of Business Entities in Delaware

Delaware allows the formation of several different types of business entities, each with its own set of rules and benefits. Choosing the right structure depends on your business goals and needs:

| Entity Type | Key Features |

|---|---|

| C Corporation | A C Corporation is a legal entity separate from its owners, providing limited liability and the ability to issue shares. It is subject to double taxation. |

| S Corporation | An S Corporation offers limited liability but allows profits and losses to pass through to owners’ personal tax returns, avoiding double taxation. |

| Limited Liability Company (LLC) | An LLC provides limited liability to its owners and offers flexible taxation options, allowing it to be taxed as a partnership or corporation. |

| Non-Profit Corporation | A Non-Profit Corporation is created for charitable, educational, or religious purposes and enjoys tax-exempt status under specific conditions. |

| General Partnership | A General Partnership involves two or more owners sharing profits, liabilities, and management responsibilities. |

Choosing the right entity will impact how your business is taxed, the legal protections it enjoys, and how it is managed.

Steps for Incorporating a Business in Delaware

Incorporating a business in Delaware is a straightforward process, but there are specific steps you must follow to ensure everything is legally compliant. Here’s a simple breakdown of the steps involved:

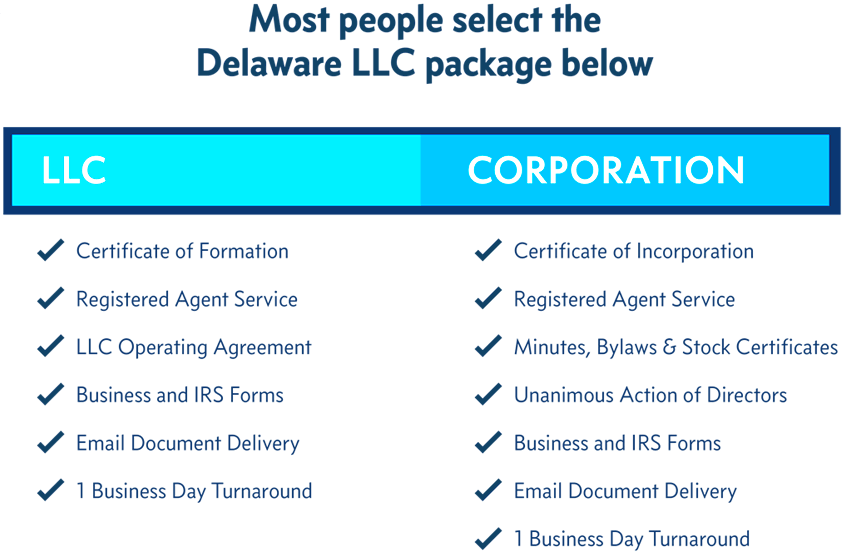

- Choose Your Business Structure: First, decide on the type of entity that best suits your business needs, whether it’s a C Corporation, S Corporation, or LLC.

- Pick a Business Name: Your business name must be unique and not in use by any other company registered in Delaware. It’s important to check availability on the Delaware Division of Corporations’ website.

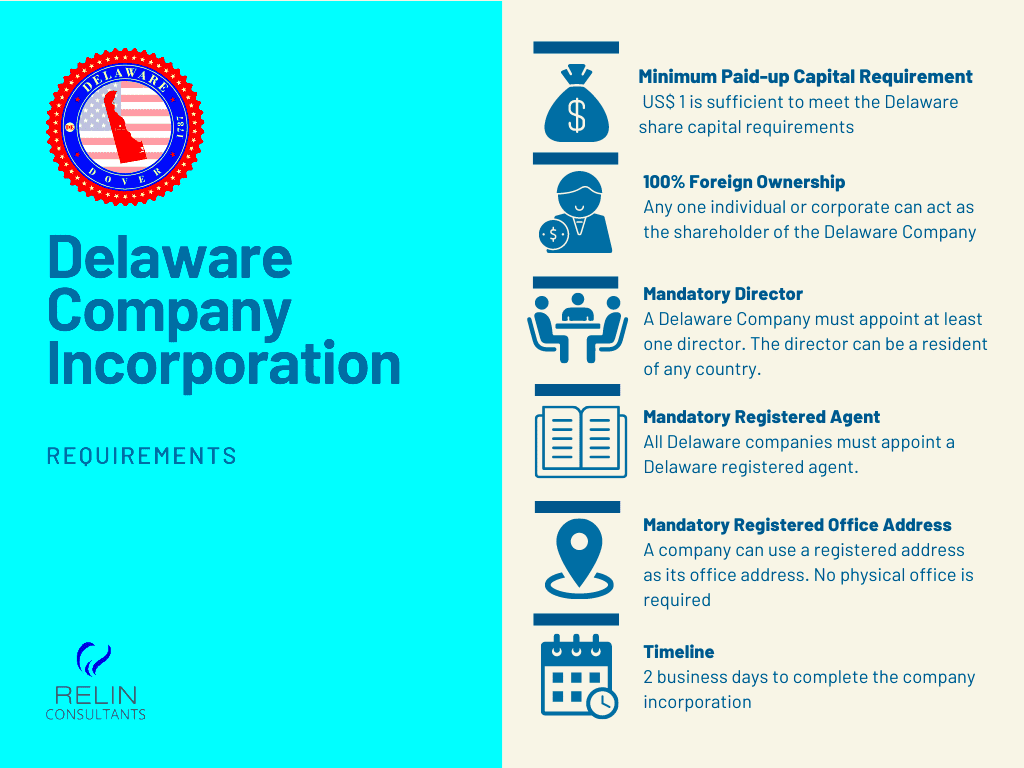

- Appoint a Registered Agent: A registered agent is required to receive legal documents on behalf of your company. The agent must have a physical address in Delaware.

- File the Certificate of Incorporation: You’ll need to file the Certificate of Incorporation (or Certificate of Formation for LLCs) with the Delaware Division of Corporations. This document outlines basic information about your company, such as its name, purpose, and the number of shares (for corporations).

- Pay Filing Fees: There are fees associated with filing the incorporation documents. These fees vary based on the type of business entity and the amount of authorized shares.

- Create Corporate Bylaws: While not required to file with the state, drafting corporate bylaws will establish how your business is governed, including procedures for meetings and the rights of shareholders.

- Obtain an Employer Identification Number (EIN): Apply for an EIN with the IRS. This number is essential for tax purposes and opening a business bank account.

Understanding Delaware Corporate Compliance Requirements

After incorporation, maintaining compliance with Delaware’s corporate laws is crucial to keep your business in good standing. Here are some key compliance requirements to be aware of:

- Annual Franchise Tax Report: Delaware requires corporations to file an Annual Franchise Tax Report and pay franchise taxes. The tax amount depends on the type of entity and the number of authorized shares.

- Annual Registered Agent: You must maintain a registered agent with a physical address in Delaware. If your agent changes, you must update this information with the state.

- Annual Meetings: Delaware corporations are required to hold annual shareholder and director meetings. Minutes of these meetings should be recorded and kept as part of your corporate records.

- Business Licenses: Depending on the nature of your business, you may need to obtain specific state or local licenses to operate legally in Delaware.

- Filing Amendments: If there are any significant changes to your business, such as a change in your company’s name, stock structure, or business purpose, you’ll need to file the appropriate amendments with the state.

Staying compliant with Delaware’s corporate laws helps you avoid penalties, fines, and the risk of losing your corporation’s good standing.

Tax Considerations for Delaware Corporations

One of the main reasons businesses incorporate in Delaware is the state’s favorable tax structure. However, understanding the tax requirements for Delaware corporations is crucial. Here’s a quick overview of key tax considerations:

- No Corporate Income Tax for Out-of-State Operations: Delaware does not impose corporate income taxes on businesses that do not operate within the state. If your business is based outside of Delaware, you may not be subject to Delaware state income taxes.

- Franchise Taxes: Delaware corporations are subject to franchise taxes, which are calculated based on the number of authorized shares or an alternative method based on a company’s assumed par value capital. It’s important to calculate this properly to avoid unexpected tax burdens.

- Personal Income Tax for Owners: Shareholders who receive dividends from Delaware corporations may be subject to personal income taxes in their state of residence, even if the corporation itself does not pay Delaware income taxes.

- Sales Tax Exemption: Delaware does not impose a state sales tax, which can be beneficial for businesses that sell goods or services.

- Federal Tax Obligations: Even though Delaware offers tax advantages, corporations are still required to pay federal taxes, including income taxes, Social Security, and Medicare contributions for employees.

Understanding these tax considerations helps business owners plan and structure their operations effectively while staying compliant with state and federal tax laws.

Frequently Asked Questions about Delaware Business Incorporation

Incorporating a business in Delaware can raise various questions for new entrepreneurs. Here are answers to some of the most common questions:

-

- Do I need to live in Delaware to incorporate a business there?

No, you do not need to be a resident of Delaware to incorporate your business. Many out-of-state and even international businesses choose Delaware for its favorable laws.

-

- How long does it take to incorporate in Delaware?

Incorporating in Delaware can take as little as one day if you opt for expedited services. Standard processing typically takes a few days to a week.

-

- What is a registered agent, and do I need one in Delaware?

A registered agent is a person or entity authorized to receive legal documents on behalf of your business. Yes, Delaware law requires that every business entity has a registered agent with a physical address in the state.

-

- What are the ongoing requirements for maintaining a Delaware corporation?

You must file an Annual Franchise Tax Report, pay franchise taxes, maintain a registered agent, and comply with corporate governance rules, such as holding annual meetings and keeping minutes.

-

- Is it expensive to incorporate in Delaware?

The cost of incorporating in Delaware can vary. Filing fees, franchise taxes, and registered agent fees should be considered when calculating the overall expense. Generally, costs range from a few hundred to several thousand dollars, depending on your business structure and the number of shares authorized.

Conclusion on Delaware Business Incorporation Laws

Delaware’s business incorporation laws offer flexibility, privacy, and tax advantages, making it a popular choice for businesses of all sizes. Whether you’re a startup or an established company, Delaware’s legal and corporate framework can provide the support your business needs to thrive. Ensuring compliance with the state’s requirements and understanding its benefits will help you make the most of incorporating in Delaware.