How Family Law and Trusts Interact

Family law can be quite intricate but fundamentally it revolves around addressing matters that impact family dynamics. This encompasses a range of issues, such as marriage and divorce, child custody and inheritance. When I began exploring family law I found myself feeling daunted, by the wide array of subjects. However it soon became evident that the purpose of family law is to safeguard the rights and obligations of family members promoting equity and fairness.

Let me give you a brief overview of what falls under the umbrella of family law.

- Marriage and Divorce: Legal aspects of entering and exiting a marriage.

- Child Custody and Support: Determining where children will live and how financial responsibilities are shared.

- Adoption: Legal procedures for adopting a child.

- Inheritance and Wills: Rules for distributing assets after a person’s death.

Through my work I’ve witnessed the profound impact that family law can have on individuals lives. Every case is distinct presenting its own challenges and emotional complexities. Grasping these fundamentals aids in maneuvering through the turbulent terrain of family conflicts and legal matters.

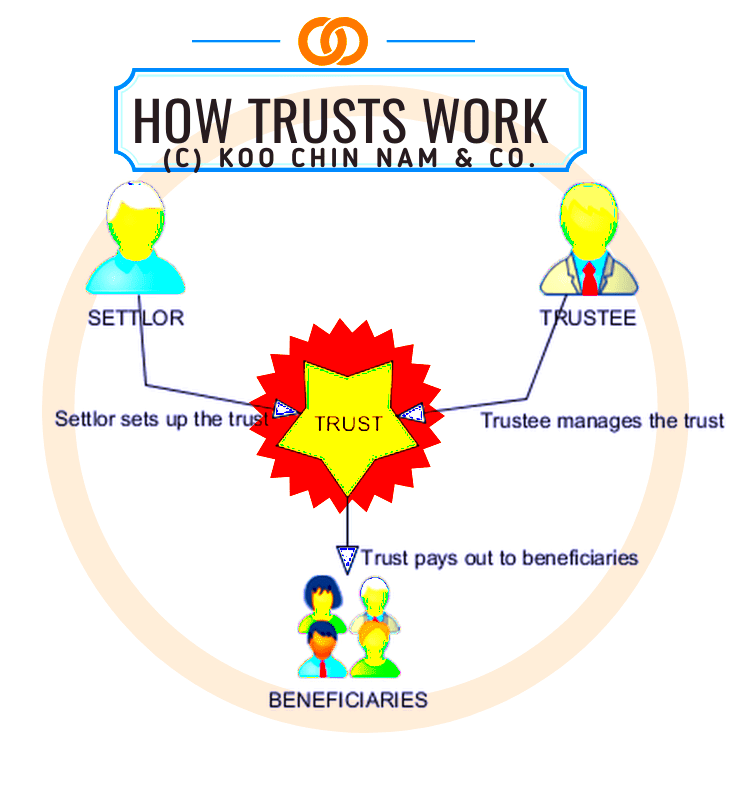

Key Principles of Trusts

Trusts may appear to be an idea reserved for the rich but they are actually important in the estate plans of many individuals. In simple terms a trust is a setup where one party the trustee manages assets on behalf of another party the beneficiary. When I learned about trusts I was struck by how they offer not financial protection but also reassurance for families.

Here are some key principles of trusts:

- Trustee: The person or institution responsible for managing the trust assets.

- Beneficiary: The person or entity that benefits from the trust.

- Trust Document: The legal document outlining the terms of the trust.

- Revocable vs. Irrevocable: Revocable trusts can be altered or dissolved, while irrevocable trusts generally cannot be changed once established.

From what I’ve seen establishing a trust can be a choice fueled by emotions. Many people do it out of a wish to take care of their family and friends even after they’re gone. It serves as a mechanism to handle and safeguard belongings in a manner that reflects individual beliefs and aspirations.

How Trusts Fit into Family Law

The intersection of trusts and family law is intriguing, particularly in matters of estate planning and settling family conflicts. Its fascinating to observe how familial relationships shape the establishment and administration of trusts. For instance a trust could be set up to support children from a prior marriage or to navigate intricate family circumstances.

Here’s how trusts can fit into family law:

- Estate Planning: Trusts are often used to manage and distribute assets according to one’s wishes, potentially avoiding lengthy probate processes.

- Divorce Settlements: Trusts can play a role in dividing assets fairly between spouses.

- Child Support and Custody: A trust might be used to ensure that children receive financial support or that their needs are met, regardless of custody arrangements.

- Family Disputes: Trusts can sometimes become points of contention, especially if their terms are not clearly understood or if family members feel unfairly treated.

When it comes to incorporating trusts into family law it’s essential to strike a balance between legal aspects and personal considerations. The goal is to come up with solutions that reflect the values of the family while also adhering to legal requirements. I’ve witnessed numerous families reap the rewards of this meticulous approach, which aids in easing potential disputes and offering clarity during difficult situations.

Types of Trusts Relevant to Family Law

Trusts aren’t a solution; they come in different forms, each designed to meet specific needs and objectives. When I began my journey with trusts I was struck by how customizable these tools are seamlessly adapting to various family situations like puzzle pieces. For families navigating challenges it’s crucial to grasp the different types of trusts available as it can greatly impact effective planning.

Here’s a rundown of the most relevant types:

- Revocable Living Trusts: These are the most flexible. You can modify or dissolve the trust during your lifetime. They’re popular for avoiding probate, which can be a lengthy and costly process.

- Irrevocable Trusts: Once set up, these can’t be changed or dissolved easily. They offer tax benefits and asset protection but require a commitment to their terms.

- Testamentary Trusts: Created by a will and effective only after death, these trusts are often used to manage assets for beneficiaries who might not be capable of handling them outright.

- Special Needs Trusts: Designed to provide for a beneficiary with special needs without affecting their eligibility for government benefits.

- Charitable Trusts: These allow you to support a charity while potentially receiving tax benefits. They can be a way to make a lasting impact on causes you care about.

Based on what Ive seen selecting the trust can be a mix of personal and legal factors. Each trust type comes with its own benefits and grasping these nuances allows families to safeguard their assets in a manner that reflects their principles and objectives.

The Role of Trusts in Estate Planning

Creating an estate plan involves more than just writing a will; it’s about making sure your belongings are handed down the way you want and easing the legal burden on your family. Trusts are essential in this process as they offer a way to handle and pass on assets. I remember assisting a client in establishing a trust to ensure their grandchildren were taken care of. It was a reminder of how trusts can bring comfort and transparency.

Here’s why trusts hold significance in the realm of estate planning.

- Avoiding Probate: Trusts can help bypass the probate process, which can be lengthy and public. This means assets can be transferred more quickly and privately to beneficiaries.

- Asset Protection: Trusts can protect assets from creditors and legal judgments, ensuring that your estate is handled according to your wishes.

- Tax Benefits: Certain types of trusts can offer tax advantages, potentially reducing the estate tax burden on your heirs.

- Control Over Distribution: You can specify when and how beneficiaries receive their inheritance, which can be particularly useful for minor children or individuals who might need guidance.

In my view using trusts in estate planning is akin to creating a roadmap for what lies ahead. It serves as a means to protect your heritage and make sure that your family is taken care of in line with your preferences even when youre no longer around.

Trusts and Divorce Settlements

Going through a divorce can be tough and when trusts come into play it adds an extra layer of complexity. I’ve witnessed numerous couples navigating their financial arrangements during a divorce and trusts frequently take center stage in these conversations. It’s crucial to grasp how trusts interrelate with divorce settlements to ensure a fair outcome for everyone involved.

Here’s how trusts typically come into play:

- Asset Division: Trust assets might need to be divided between spouses. The nature of the trust—whether revocable or irrevocable—can impact how this division is handled.

- Spousal Support: If a trust was set up to provide for a spouse, it could be considered when determining spousal support obligations.

- Child Support: Trusts can be used to fund child support, ensuring that children’s needs are met even if their parents are no longer together.

- Modification of Trusts: A trust might need to be modified as part of the divorce settlement, especially if it was initially set up to benefit both spouses.

When dealing with divorce cases involving trusts in my work I pay close attention to the legal and emotional nuances. It’s crucial to strike a balance that honors the trusts conditions while considering the needs and entitlements of both parties. By taking this approach we can work towards a divorce settlement that is just and fair for all parties involved.

Impact of Trusts on Child Support and Custody

Trusts can have an impact on child support and custody issues offering a financial support system that prioritizes the welfare of children across different family scenarios. When I first came across this facet of family law it made me realize how trusts can serve as a protective measure while also potentially causing disputes in these delicate matters.

Here’s how trusts can affect child support and custody agreements:

- Funding Child Support: A trust might be established to ensure that funds are available for a child’s support. This can be particularly important if a parent’s financial situation is unstable or if the child has special needs that require ongoing financial support.

- Custody Arrangements: While trusts don’t directly influence custody decisions, they can affect how financial responsibilities are managed. For instance, a trust might ensure that the custodial parent has access to additional resources to support the child.

- Trust Funds for Education: Some trusts are set up specifically to fund educational expenses. This can be a point of negotiation in custody agreements, with one parent seeking assurance that educational needs will be met.

- Dispute Resolution: Trusts can sometimes become a point of contention in custody disputes, especially if there are disagreements about how the funds should be used or managed.

Through my experience I’ve witnessed the impact of establishing a trust as a means to safeguard children’s well being giving parents peace of mind that their child’s needs will be taken care of. However it is essential to proactively manage any potential disputes stemming from the trust’s provisions to ensure a fair and seamless arrangement, for everyone involved.

Recent Changes and Trends in Family Law and Trusts

Family law and trust matters are constantly evolving to adapt to shifts in societal norms and legal principles. Staying abreast of these developments can be quite a task but it plays a role in offering clients optimal guidance and solutions. I recall my initial experience with fresh regulations in family law and trusts it felt like assembling a jigsaw puzzle. Lets explore some of the recent trends and transformations that are influencing these areas.

Recent changes include:

- Increased Emphasis on Digital Assets: With the rise of digital assets like cryptocurrencies and online accounts, there’s a growing focus on how these assets are handled in trusts and estate planning.

- Stricter Regulations on Trusts: There have been more stringent rules regarding the transparency and management of trusts, aimed at preventing abuse and ensuring that trusts are used as intended.

- Family Law Reforms: Many jurisdictions are updating family law to better address modern family dynamics, including changes in how child support and custody are determined.

- Focus on Mediation and Alternative Dispute Resolution: There’s a growing trend towards resolving family disputes through mediation and other non-litigation methods, which can be less adversarial and more amicable.

Based on what I’ve seen keeping up with these changes is really important. It helps me give my clients advice and handle the ever changing world of family law and trusts with assurance. These trends show shifts in societal values and legal norms and by adjusting to them we can provide the best possible assistance to those we support.

FAQ

What is a trust?

A trust is a setup where one person keeps property or assets to benefit someone else. It helps manage and distribute things based on rules outlined in the trust agreement.

How does a trust help in estate planning?

Trusts play a role in estate planning by allowing you to handle and allocate your assets as you desire, bypassing the probate process and potentially providing advantages such as tax savings and safeguarding your assets.

Can trusts impact child support and custody decisions?

Certainly trusts can play a role in child support and custody matters by offering assistance for a childs requirements or influencing the distribution of resources between parents. That being said trusts do not have an impact on custody rulings.

What are some recent trends in family law and trusts?

Recent developments show a growing emphasis on digital assets tighter regulations for trusts updates in family law to reflect contemporary dynamics and a move towards mediation and alternative dispute resolution approaches.

How can I ensure my trust is set up correctly?

It’s essential to seek advice from a lawyer who focuses on estates and trust planning. They can assist you in navigating the process making sure you adhere to legal obligations and customizing the trust to align with your unique objectives and requirements.

Impact of Trusts on Child Support and Custody

Trusts play a role in shaping child support and custody decisions by offering a financial cushion to meet a child’s needs no matter the family’s situation. I recall a case where a trust was set up to cover a child’s education and healthcare costs. It brought comfort to all parties knowing that the child’s requirements were taken care of even amidst changing family dynamics.

Trusts usually have an impact on these aspects in the following ways

- Securing Financial Support: Trusts can be set up to guarantee that funds are available for child support, providing stability in case of fluctuating income or financial difficulties.

- Influencing Custody Arrangements: While trusts don’t directly affect custody decisions, they can influence the financial aspects of custody arrangements, such as ensuring that the custodial parent has the necessary resources to support the child.

- Educational and Special Needs: Trusts can allocate funds specifically for education or special needs, which can be a critical factor in custody and support discussions.

- Potential for Disputes: Disagreements about how trust funds should be used can arise, potentially complicating custody and support arrangements.

In my view, trusts offer a level of protection that proves to be invaluable when it comes to addressing a childs needs, particularly during periods of family transition. They play a role in ensuring that funds are allocated for their intended purposes and can bring reassurance to everyone involved.

Recent Changes and Trends in Family Law and Trusts

Family law and trusts are always adapting to align with societal shifts and legal norms. I have witnessed the impact of fresh rules and emerging trends on family planning and management. Staying informed about these developments is crucial to offering optimal guidance and solutions.

Recent developments include:

- Digital Assets: The growing importance of managing digital assets, such as cryptocurrencies and online accounts, in trusts and estate planning.

- Enhanced Trust Regulations: Stricter rules designed to ensure transparency and prevent misuse of trusts.

- Family Law Reforms: Updates to family law that better address modern family dynamics and needs.

- Mediation and Alternative Dispute Resolution: An increasing focus on resolving family disputes through mediation and other non-litigation methods.

Keeping up with these trends is crucial for navigating the intricacies of family law and trusts. It enables families to adjust to changing legal environments and make choices that reflect their evolving requirements and situations.

Conclusion

Grasping the interplay between trusts and family law is essential for navigating estate planning and handling family related legal issues. While trusts provide financial stability and adaptability their influence on matters like child support custody and more necessitates thorough examination. Keeping abreast of developments and shifts in this arena ensures that your perspective on trusts and family law remains well informed and pertinent offering reassurance and clarity when addressing these significant concerns.