How Maritime Law Affects Taxes

Maritime law, often referred to as admiralty law, governs activities on navigable waters. It plays a crucial role in international trade and shipping. When it comes to taxes, maritime law introduces unique challenges and considerations. Understanding how these laws affect taxation is essential for shipping companies and maritime professionals. This blog post will explore the relationship between

Understanding Maritime Law Basics

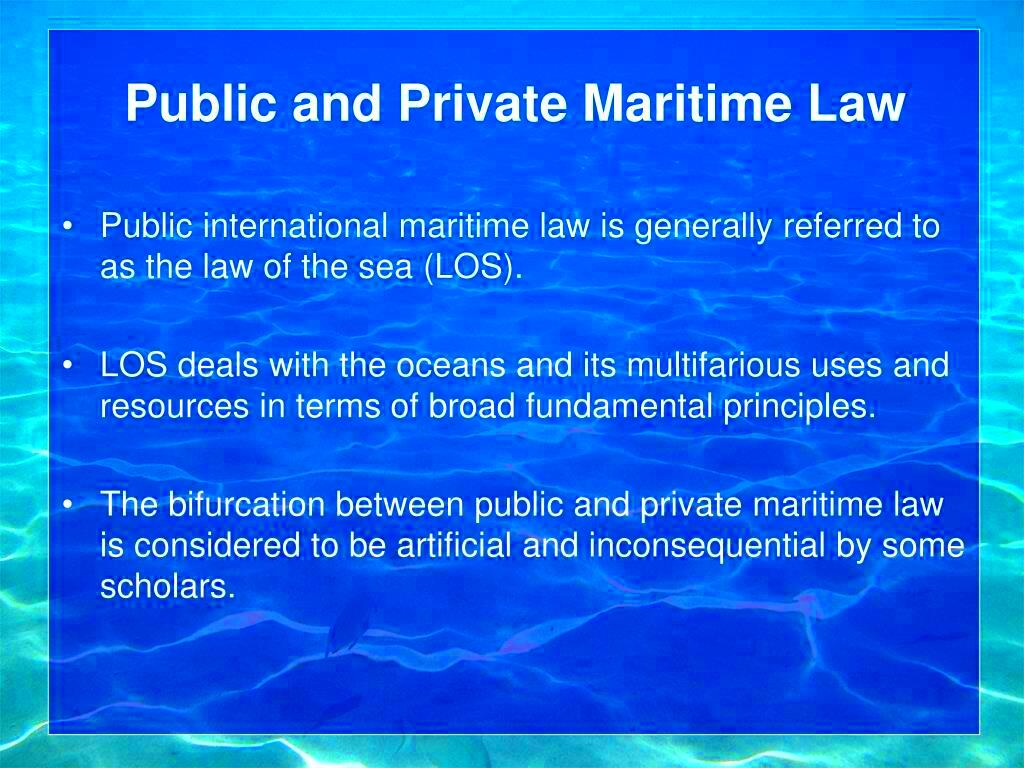

Maritime law is a specialized body of law that regulates maritime questions and offenses. It covers a wide range of topics, including shipping, navigation, and the conduct of seafarers. Here are some key aspects to understand:

- Jurisdiction: Maritime law can be federal or state law, depending on the situation and location.

- International Treaties: Treaties like the United Nations Convention on the Law of the Sea (UNCLOS) guide maritime law on a global scale.

- Maritime Liens: These are claims against a ship for debts related to the ship, affecting ownership and sale.

It is crucial for maritime professionals to have a solid understanding of these fundamentals as they can significantly impact various legal and tax issues.

Tax Implications for Maritime Activities

Taxation in the maritime industry can be complex due to the nature of international operations. Here are some tax implications to consider:

- Income Tax: Shipping companies may face income tax based on where their business is registered. This can vary significantly between jurisdictions.

- Sales and Use Tax: Many states impose sales tax on the purchase of vessels and equipment. However, certain exemptions may apply.

- Employment Tax: Companies must navigate the tax obligations for employees working on international waters, often leading to double taxation issues.

Additionally, understanding the tax treaties between countries can help minimize tax liabilities for international shipping operations.

International Maritime Tax Regulations

International maritime tax regulations are crucial for businesses operating across borders. These regulations help ensure that shipping companies comply with the tax obligations of different countries while navigating the complexities of international trade. Here’s what you need to know:

- Tax Treaties: Many countries have tax treaties that prevent double taxation. These treaties outline which country has the right to tax certain income. It’s essential for maritime companies to understand these treaties to optimize their tax liabilities.

- Value Added Tax (VAT): The VAT system is common in many countries. For example, in the European Union, shipping services may be subject to VAT, but exemptions can apply based on the nature of the service.

- International Shipping Registration: Registering a ship in a country with favorable tax laws can reduce tax burdens. Many countries offer tax incentives to attract foreign shipowners.

As you can see, understanding these international regulations can save maritime businesses significant amounts of money and help them stay compliant with the law.

Domestic Tax Laws Related to Maritime Operations

In addition to international regulations, domestic tax laws play a vital role in maritime operations. Each country has its own set of tax rules that can impact shipping companies. Here are some key points to consider:

- Corporate Tax Rates: Countries vary in their corporate tax rates. For example, some countries may offer reduced tax rates for shipping companies, encouraging businesses to operate within their jurisdiction.

- Tax Incentives: Some regions provide tax breaks or incentives for maritime businesses, such as exemptions on property tax for ships docked in their ports.

- Local Business Taxes: Companies must also account for local taxes, such as port fees and state-specific business taxes that could affect profitability.

Maritime businesses should conduct thorough research to understand the domestic tax landscape and explore opportunities for savings.

Impact of Maritime Law on Shipping Companies

The impact of maritime law on shipping companies is profound. It shapes how businesses operate and affects their bottom line. Here are some ways maritime law influences shipping companies:

- Liability and Insurance: Maritime law defines the liability of shipowners in case of accidents, which affects insurance costs and coverage. Understanding liability laws can lead to better risk management.

- Regulatory Compliance: Shipping companies must comply with various international and domestic regulations, which can be costly and time-consuming. Non-compliance can lead to fines and legal issues.

- Operational Costs: Factors like port fees, taxes, and legal obligations can significantly influence operational costs, impacting competitiveness in the market.

In summary, maritime law has a direct impact on shipping operations, and companies must stay informed about legal developments to remain competitive and compliant.

Tax Deductions for Maritime Industry Professionals

Tax deductions are a valuable way for maritime industry professionals to reduce their taxable income and save money. Understanding what expenses can be deducted is crucial for maximizing these benefits. Here are some common deductions available to maritime professionals:

- Travel Expenses: If you travel for work, you can deduct costs related to transportation, lodging, and meals. Keeping detailed records and receipts is essential.

- Training and Certification Costs: Expenses for training programs, courses, or certifications related to your maritime profession can often be deducted.

- Equipment and Supplies: Costs for tools, safety gear, and other supplies necessary for your job may qualify as deductions. This includes any necessary maintenance or repairs.

- Home Office Deduction: If you work from home and have a dedicated space for your maritime business, you may qualify for a home office deduction.

Always consult with a tax professional to ensure you’re claiming all eligible deductions, as this can significantly impact your financial situation. Taking advantage of these deductions can lead to substantial savings and a better overall understanding of your tax responsibilities.

Common Challenges in Maritime Taxation

Navigating the world of maritime taxation can be complex and full of pitfalls. Here are some common challenges that maritime professionals and companies often face:

- Multiple Jurisdictions: Operating in various countries can create confusion regarding which tax laws apply. Each jurisdiction may have different tax rates and regulations.

- Transfer Pricing Issues: Shipping companies with international operations need to be careful about how they price goods and services between subsidiaries to comply with tax laws.

- Double Taxation: Without proper tax treaties in place, businesses may face being taxed in both the country of operation and the country of registration, leading to higher costs.

- Changing Regulations: Maritime laws and tax regulations can change frequently, making it crucial for professionals to stay updated and compliant.

Understanding these challenges can help maritime professionals and businesses develop strategies to manage their tax obligations more effectively and avoid unnecessary penalties.

FAQs About Maritime Law and Taxes

When it comes to maritime law and taxes, many questions arise. Here are some frequently asked questions to provide clarity:

- What is maritime law? Maritime law governs activities on navigable waters, covering shipping, navigation, and the conduct of seafarers.

- How do taxes apply to shipping companies? Shipping companies must navigate both international and domestic tax laws, including income tax, sales tax, and employment tax.

- Can I deduct expenses as a maritime professional? Yes, maritime professionals can deduct various expenses related to travel, equipment, and training to reduce taxable income.

- What is double taxation? Double taxation occurs when the same income is taxed in two different countries, often addressed through tax treaties.

If you have more questions about maritime law and taxes, consulting a tax professional or maritime attorney can provide the guidance you need. Being informed is key to navigating the complexities of maritime taxation.

Conclusion on Maritime Law and Tax Effects

In summary, understanding maritime law and its tax implications is crucial for anyone involved in the maritime industry. With the interplay between international regulations and domestic tax laws, professionals and companies must navigate a complex landscape to remain compliant and financially sound. By staying informed about tax deductions available to maritime professionals and addressing common challenges like double taxation and jurisdictional complexities, businesses can optimize their tax liabilities. Ultimately, having a solid grasp of these concepts will empower maritime operators to make informed decisions, ensuring smoother operations and a healthier bottom line.