Idaho Business Laws Explained

Choosing the right business structure is one of the most important decisions you’ll make when starting a business in Idaho. The structure you select will affect everything from taxes to your personal liability, so it’s important to understand the options available.

In Idaho, business owners can choose from several structures, each with its own advantages and disadvantages. Below are the most common business structures:

- Sole Proprietorship: The simplest structure, where one person owns and operates the business. Personal liability is a major consideration.

- Partnership: Involves two or more people who share ownership. Idaho recognizes both general and limited partnerships, with varying degrees of liability.

- Limited Liability Company (LLC): Offers liability protection like a corporation but with simpler operational requirements. It’s popular due to its flexibility.

- Corporation: A separate legal entity that provides strong liability protection. However, it requires more paperwork and has more complex tax obligations.

- S Corporation: A variation of the traditional corporation that allows profits and losses to pass through to the owner’s personal income without being subject to corporate tax rates.

Each business structure has different implications for taxes, liability, and management, so it’s essential to carefully evaluate your options or consult with a legal expert to make the right choice for your Idaho-based business.

Starting a Business in Idaho: Key Legal Requirements

Starting a business in Idaho involves more than just a great idea—you’ll need to navigate several legal requirements to ensure you’re operating within state laws. These steps help protect your business and ensure it’s compliant with state regulations.

Below are some key legal requirements when starting a business in Idaho:

- Register Your Business Name: If you’re not operating under your legal name, you’ll need to file for a DBA (Doing Business As) name with the Idaho Secretary of State.

- Choose a Business Structure: Decide on a legal structure, such as an LLC, sole proprietorship, or corporation, based on your needs and goals.

- Obtain an Employer Identification Number (EIN): Most businesses will need an EIN, especially if they hire employees. You can obtain this through the IRS.

- File Formation Documents: If forming an LLC or corporation, you’ll need to file formation documents like Articles of Incorporation or Organization with the Secretary of State.

- Understand Zoning Laws: Ensure that the location of your business complies with local zoning regulations. Different areas have specific rules for business activities.

- Get Necessary Licenses and Permits: Depending on your industry, Idaho requires certain businesses to obtain state or local permits to operate legally.

By following these steps, you can establish a solid legal foundation for your Idaho business, allowing you to focus on growth and success.

Idaho Business Licensing and Permits: What You Need to Know

Getting the right licenses and permits is crucial for legally operating a business in Idaho. Failure to comply can result in fines or even the closure of your business. Different industries and business types require specific licenses and permits, so it’s important to know what applies to you.

Here are the common types of business licenses and permits needed in Idaho:

- State Business License: Idaho does not require a general business license, but specific industries like food services, healthcare, and construction may need state-level licensing.

- Local Business License: Some cities or counties in Idaho may require businesses to obtain local permits or licenses to operate. Check with your local government to ensure compliance.

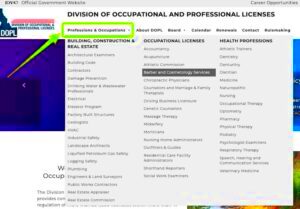

- Professional Licenses: Certain professions, such as real estate agents, lawyers, and doctors, require professional licenses from Idaho’s regulatory boards.

- Sales Tax Permit: If your business sells goods or taxable services, you’ll need to apply for a sales tax permit from the Idaho State Tax Commission.

- Health Permits: Businesses that handle food or beverages must obtain health permits from local health departments to ensure safety standards are met.

To stay compliant, it’s essential to research the specific permits and licenses your business needs based on its location and industry. Be sure to renew them regularly to avoid any legal complications.

Employment Laws for Idaho Businesses

Running a business in Idaho means understanding and complying with various employment laws. These laws govern the relationship between employers and employees, ensuring fair treatment and workplace safety. Idaho follows federal employment laws, but also has state-specific rules that businesses must follow.

Here are the key employment laws every Idaho business owner should be aware of:

- At-Will Employment: Idaho is an “at-will” state, meaning employers can terminate employees at any time for any reason, as long as it is not illegal (such as discrimination or retaliation).

- Minimum Wage: Idaho’s minimum wage matches the federal rate, currently set at $7.25 per hour. However, businesses should keep an eye on local changes or consider paying a competitive wage to attract talent.

- Overtime Pay: Non-exempt employees must be paid overtime at a rate of 1.5 times their regular pay for any hours worked over 40 in a week.

- Workers’ Compensation: Employers with one or more employees must provide workers’ compensation insurance, which covers workplace injuries and illnesses.

- Anti-Discrimination Laws: Both state and federal laws prohibit discrimination based on race, gender, age, religion, disability, and other protected categories. Employers should have clear anti-discrimination policies in place.

- Family and Medical Leave: Idaho businesses must comply with the Family and Medical Leave Act (FMLA), which requires employers to provide up to 12 weeks of unpaid leave for qualifying medical and family reasons.

Staying informed about Idaho’s employment laws helps protect your business from legal issues and fosters a positive work environment.

Taxation Rules for Businesses in Idaho

Understanding Idaho’s tax laws is essential for running a successful business. Taxation affects everything from day-to-day operations to long-term growth. Idaho has both state-specific taxes and federal obligations that business owners must manage carefully.

Below are the key tax rules that apply to Idaho businesses:

- State Income Tax: Idaho imposes a state income tax on businesses, ranging from 1% to 6.5%, depending on the taxable income. LLCs, partnerships, and sole proprietorships report business income on personal tax returns, while corporations file separately.

- Sales Tax: Idaho has a 6% sales tax on most goods and services. Businesses that sell taxable items must collect sales tax from customers and remit it to the Idaho State Tax Commission.

- Employer Payroll Taxes: Businesses with employees are responsible for paying federal and state payroll taxes, including Social Security, Medicare, and unemployment insurance taxes.

- Property Tax: Businesses owning property in Idaho are subject to property tax, which is assessed at the county level. The rate varies based on the property’s location and value.

- Business Personal Property Tax Exemption: Idaho offers an exemption on the first $250,000 of business personal property, reducing the tax burden for many small businesses.

By staying compliant with Idaho’s tax laws and keeping accurate financial records, businesses can avoid penalties and make informed financial decisions. It’s also a good idea to consult with a tax professional to ensure you’re taking advantage of all applicable deductions and credits.

Contract Laws Every Idaho Business Owner Should Understand

Contracts are a vital part of doing business in Idaho, as they legally bind agreements between parties. Understanding Idaho’s contract laws helps you draft, negotiate, and enforce contracts with confidence, reducing the risk of disputes.

Here are the key elements of contract law that Idaho business owners should be aware of:

- Offer and Acceptance: For a contract to be valid, there must be an offer by one party and acceptance by the other. Both parties must agree to the terms in the same sense, without misinterpretation.

- Consideration: Contracts must involve something of value, known as consideration. This can be money, services, or goods exchanged between the parties.

- Capacity: All parties entering a contract must have the legal capacity to do so, meaning they are of legal age and sound mind.

- Legality: The contract’s purpose must be legal. Any contract that involves illegal activities is void and unenforceable in Idaho courts.

- Written vs. Oral Contracts: While many contracts can be oral, certain agreements must be in writing to be enforceable in Idaho, such as real estate contracts or those that cannot be performed within one year.

Idaho follows the Uniform Commercial Code (UCC) for contracts involving the sale of goods. This ensures that businesses across the state operate under consistent contract laws. However, it’s always wise to have a legal professional review any contracts before signing to avoid legal issues down the road.

Business Dispute Resolution in Idaho

Disputes are an inevitable part of running a business, whether they involve contracts, employees, or partnerships. Fortunately, Idaho offers several mechanisms to resolve business disputes efficiently. Knowing how to handle these conflicts can save you time, money, and preserve relationships.

Here are common methods for resolving business disputes in Idaho:

- Mediation: This is a voluntary process where a neutral third party, known as a mediator, helps both sides reach a mutually beneficial agreement. Mediation is often less formal and less expensive than going to court.

- Arbitration: In arbitration, a neutral arbitrator reviews the evidence and makes a binding decision. This process is faster than a trial and can be more cost-effective. Some contracts may require arbitration before going to court.

- Small Claims Court: For disputes involving smaller amounts (up to $5,000), Idaho businesses can use small claims court. This process is designed to be straightforward, often without the need for legal representation.

- Civil Litigation: If informal methods don’t work, businesses can file a lawsuit in civil court. This is typically the most time-consuming and costly option, but may be necessary for more complex or high-stakes disputes.

Choosing the right resolution method depends on the nature of the dispute and the potential outcomes. In many cases, businesses prefer to settle issues out of court to avoid lengthy litigation. Having a clear dispute resolution clause in your contracts can also make the process smoother and more predictable.

Common Legal Mistakes Idaho Business Owners Should Avoid

Even seasoned business owners can make legal mistakes that could put their company at risk. Understanding common pitfalls can help you avoid costly errors and ensure that your business operates smoothly and within the bounds of Idaho law.

Here are some of the most common legal mistakes Idaho business owners should avoid:

- Not Forming the Right Business Structure: Many entrepreneurs stick with a sole proprietorship because it’s easy to set up, but this decision can expose personal assets to liability. Consider forming an LLC or corporation for better protection.

- Failing to Register a Business Name: If you operate under a name other than your own, you need to register a DBA (Doing Business As) with the Idaho Secretary of State to avoid legal complications.

- Overlooking Employment Laws: Misclassifying employees as independent contractors or failing to comply with wage and hour laws can lead to penalties and lawsuits. Always ensure your employment practices follow state and federal regulations.

- Ignoring Contracts: Verbal agreements might seem convenient, but they are hard to enforce in legal disputes. Always draft clear, written contracts for business dealings and partnerships.

- Not Obtaining Proper Licenses and Permits: Operating without the necessary licenses can result in fines and even business closure. Make sure to research and apply for all required local, state, and federal permits.

- Failing to Protect Intellectual Property: If your business has a unique brand, product, or process, failing to secure patents, trademarks, or copyrights can leave you vulnerable to theft or misuse.

Avoiding these common legal mistakes will help safeguard your business and prevent unnecessary legal headaches in the future.

FAQs About Idaho Business Laws

Starting and running a business in Idaho can raise many legal questions. Below are some frequently asked questions to help guide you through the complexities of Idaho business laws.

-

- Do I need a general business license to operate in Idaho?

No, Idaho does not require a general business license. However, certain industries may need specific licenses or permits, and some local governments may require businesses to obtain a local license.

-

- What is the minimum wage in Idaho?

Idaho follows the federal minimum wage, which is currently $7.25 per hour. Some businesses, however, may choose to pay more to stay competitive in the labor market.

-

- How do I register my business in Idaho?

To register a business in Idaho, you must file formation documents with the Idaho Secretary of State. This includes filing for an LLC, corporation, or registering a DBA (Doing Business As) if you’re using a name other than your own.

-

- Do Idaho businesses need to collect sales tax?

Yes, if your business sells goods or taxable services, you must collect a 6% sales tax from customers. This tax must be reported and remitted to the Idaho State Tax Commission.

-

- What are Idaho’s laws regarding employee termination?

Idaho is an at-will employment state, which means you can terminate an employee at any time, for any legal reason. However, termination based on discrimination or retaliation is illegal.

These FAQs address some of the most common concerns for business owners in Idaho. If you have more specific questions, consulting with a legal professional is always a good idea.

Conclusion: Navigating Idaho Business Laws for Success

Successfully navigating Idaho’s business laws requires a clear understanding of the legal frameworks that govern everything from choosing the right business structure to resolving disputes. Whether you’re a new entrepreneur or a seasoned business owner, compliance with state regulations is essential for long-term success. Taking the time to understand key areas like employment laws, taxation, contracts, and licensing can prevent legal issues and foster a smooth operational environment for your business. If you’re unsure about any legal matters, consulting with a legal professional can help ensure your business stays on the right track in Idaho’s competitive marketplace.