Key Details About Colorado Commission Pay Laws

There are commission pay laws in Colorado and they are of utmost importance to both the employer and the employee. Such regulations ensure that employees earn reasonable income considering how hard they work especially on sales and performance based occupations. By going through these situations myself, I would say it is crucial to understand what your rights and responsibilities are. Also, commission plans differ immensely hence it is necessary to know the legal environment within which they operate.

In Colorado, you cannot say that commission pay is a bonus because it forms part of an employee’s wage. There are different regulations in the state that specify how commissions must be calculated and paid. Understanding this helps to avoid misunderstanding on payment structures leading to disputes. For instance, if a salesperson initiated a sale they might feel entitled to get commission even though the last arrangement was made by someone else within their team. Therefore, understanding this intricacy is important for fostering transparency in the workplace.

Who Is Covered Under These Laws

Colorado’s commission pay laws are applicable to many employees, mostly those employed in sales. This includes employees in the retail sector, real estate and any other industries where sales determine how much one earns. However, not all employees can be entitled to commission payment according to these laws.

Typically, the ensuing descriptions contain the following sections:

- Sales Representatives: Those whose primary role involves selling products or services.

- Real Estate Agents: Professionals earning commissions based on property sales.

- Retail Employees: Staff members whose compensation includes sales commissions.

But be aware that some of the workers including those whose jobs are mainly about administration or management might not be offered protection under the law. Being aware of these laws can help you fight for your rights besides negotiating decent pay.

How Commission Pay Works in Colorado

Fulfilling the requirements for commission payments depends on different businesses hence they differ widely. Colorado employers have to provide clear written terms on the commission payments so as to foster honesty and prevent misunderstandings in future. This involves understanding the manner in which they are calculated and when they should be given out.

Usually, compensation could rely on:

- Percentage of Sales: A common model where employees earn a percentage of the sales they generate.

- Tiered Structures: Employees may earn higher commission rates after reaching certain sales targets.

- Bonuses for Exceeding Quotas: Additional incentives for surpassing set sales goals.

An instance of my very own is: the time I worked in a sales job, wherein we had a tiered commission structure which meant that our percentages would get higher as our sales went up. Not only did this motivate us but it also created rivalry among us. However, it was important to be clear in these arrangements. At some points, indeterminate guidelines on how commission was calculated angered people. Therefore, employers should provide written and precise agreements regarding this matter in order for them to avoid similar situations and aid workers understand their pay plans.

Employer Responsibilities Regarding Commission Payments

The employers in Colorado have certain responsibilities in relation to commission payments. Indeed, being aware of these obligations is necessary in order to establish an equitable, honest and open workforce. I have personally observed that having well defined responsibilities communicated clearly will eliminate any ambiguity and at the same time create a good atmosphere at work.

To have a written contract of appointment is your main task. It must describe how commissions are calculated, when they are sent and any possible requirements that may be attached to them. This document is not merely a formality; it acts as a guide for both the parties involved. Failure to do so may lead to misunderstandings.

Otherwise, major duties will also include the following:

- Timely Payment: Employers must pay commissions on time as per the agreed schedule. Delays can lead to mistrust and dissatisfaction.

- Clear Calculation Methods: The methods used to calculate commissions should be straightforward and transparent, preventing any surprises at payday.

- Compliance with State Laws: Employers must ensure their commission structures comply with Colorado’s labor laws to avoid legal repercussions.

As an example, I recollect a colleague who was quite bothered because he was not receiving his commissions promptly. By discussing the payment delays, the employer was able to alleviate tensions and regain trust. By performing these duties, it not only safeguards the employer but also makes employees feel important and honored.

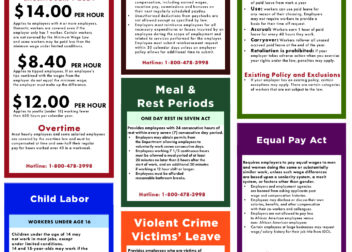

Employee Rights Related to Commission Pay

To protect the interests of workers when it comes to commission pay, Colorado has provided ways to seek these rights. This equips employees with the power necessary to defend themselves against unjust remunerations. As far as I am concerned, having knowledge about my rights has been very important during pay talks and negotiations.

Essential liberties involve:

- Right to Written Agreements: Employees should receive a written document outlining their commission structure. This clarity is essential for understanding how compensation works.

- Right to Timely Payments: Workers have the right to receive their commissions as scheduled in their agreements. Delayed payments are not acceptable.

- Right to Dispute Unfair Practices: Employees can voice concerns or disputes regarding commission calculations without fear of retaliation.

There was a time when I believed that my commissions were not properly counted. I used my written document as a reference to confront my boss on the matter. This goes to show that if you want things done correctly, you must know your rights. Information is strength, therefore workers must be brave enough to speak out if they notice anything that indicates disregard of their privileges.

Common Issues and Disputes Over Commission Pay

In Colorado, even though there are clear-cut regulations regarding commissions, arguments about pay can quickly come up. For both workers and their bosses this could be very frustrating just because of misinterpretations and lack of effective communication channels. Given that I’ve witnessed different disputes arising from this issue, I’m now aware that it is vital to confront these problems directly.

Some common problems are:

- Misunderstandings About Calculation: Employees may not fully grasp how their commissions are calculated, leading to disputes over expected versus received amounts.

- Delayed Payments: Late commission payments can cause financial strain and breed resentment among employees.

- Unclear Agreement Terms: Vague or poorly defined commission agreements can create confusion, leaving room for disputes.

One team member expected to get commissions for his own initiated sales even if others closed them which led to us heatedly discussing our contract terms. On a bright side we had clear documentation of it and that made us settle the matter fast. Thus in order to avoid this kind of unhappy incident should both sides have an open communication and reach agreements about the way commissions will be handled.

Legal Remedies Available for Employees

Provided there is commission pay dispute in Colorado, employees have legal remedies at their disposal. This is important for anyone who thinks that their rights have been violated. I have always thought that knowing the law, gives employees power; from feeling powerless to becoming sure of themselves.

There are various legal actions that can be taken if a worker thinks he/she has not been given their deserved share of commission.

- Filing a Complaint: Employees can file a complaint with the Colorado Department of Labor and Employment (CDLE). This formal process can initiate an investigation into wage disputes.

- Mediation: Many disputes can be resolved through mediation, a process where a neutral third party helps both sides come to an agreement. This approach is often less confrontational and can preserve working relationships.

- Litigation: If mediation fails, employees may choose to file a lawsuit. This is usually a last resort, as legal proceedings can be lengthy and costly.

I remember a chum of mine who had a comparable problem with delayed payments. She was able to handle the issue through mediation because she was informed about her rights and did what was required. This encounter taught me that it is important to defend yourself. Employees will have confidence and know how to manage commission disagreements effectively if they understand their legal options.

Future Trends in Commission Pay Laws in Colorado

In Colorado, the framework on commission-based remuneration is changing with the times as this mirrors a general trend of transformation in the world of work including employee aspirations. I have noted these changes and it is amazing to see the way laws tailor themselves to meet demands of both the workers and the employers.

Following are some of the expected directions:

- Increased Transparency: There’s a growing demand for transparent commission structures, where employees fully understand how their pay is calculated.

- Flexibility in Payment Structures: Companies may start to adopt more flexible commission models, catering to different sales strategies and employee preferences.

- Focus on Remote Work: As remote work becomes more common, laws may evolve to address commission structures for remote employees, ensuring fair treatment across various work settings.

Looking back at my past, I would say that these alterations were capable of making my professional life easier. Enhanced openness and versatility may avoid ambiguities and reinforce a better work setting. Being updated on such movements largely enables both bosses and subordinates move forward into tomorrow’s salary structure with greater ease.

Frequently Asked Questions

Colorados commission pay bill is the source of many queries. A guide on some related questions can serve both employees’ and employers’ interests. The following are among the frequently asked questions which might help:

- What is the difference between salary and commission pay?

Salary is a fixed amount paid regularly, while commission pay is variable and based on sales performance. - Can my employer change my commission structure?

Yes, but they must inform you in writing and provide sufficient notice before making any changes. - What should I do if I haven’t received my commission?

First, review your commission agreement. If issues persist, consider discussing the matter with your employer or seeking legal remedies.

It’s all about relieving ambiguity by addressing these questions early on and thereby maximising work relations. This will lead to clarity among everyone involved resulting in a safe and respected place for employees.

Conclusion

Understanding Colorado’s commission pay laws is crucial for both employees and employers. These laws are not simply legal terminology; rather, they reflect our value for equity and clearness at the workplace. In my working life, I have seen how coherent commission structures can help in building better relationships between workers and their bosses. When one knows his/her rights and responsibilities, it creates an atmosphere of honor and confidence among others. Whether you are an employee who wants to know about his/her entitlements or an employer striving to maintain a conducive working environment, adequate knowledge is essential. As the dynamics of work changes continuously, acceptance of these regulations can ensure fairness and peace at work for everyone.