Key Points of Alabama Debt Collection Laws

Dealing with debt collectors can be overwhelming, particularly when you’re not clear about your rights. In Alabama the regulations surrounding debt collection aim to strike a fair balance between the needs of creditors and debtors. While the state’s framework is shaped by federal guidelines it also has its own distinct features. Familiarizing yourself with these laws can empower you to handle this tough situation, more assuredly.

Alabama has laws in place to govern how creditors and debt collectors go about collecting unpaid debts. These laws address different aspects ranging from the tactics that collectors can employ to the rights and safeguards provided to consumers. Here’s a summary of the important elements.

- State vs. Federal Laws: Alabama follows federal guidelines under the Fair Debt Collection Practices Act (FDCPA) but also has specific state laws that might offer additional protections.

- Collection Methods: Debt collectors in Alabama must adhere to certain practices when trying to recover debts, including limits on communication and required disclosures.

- Consumer Rights: There are specific rights that consumers have, including the right to dispute debts and the right to seek legal recourse if they believe their rights have been violated.

Based on what I’ve been through dealing with debt collectors can take a toll on your emotions. Knowing your rights is crucial to make sure you’re treated and to help alleviate the stress that comes with debt collection.

Understanding Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act FDCPA is a law that aims to safeguard consumers against harsh and unjust methods of collecting debts. It establishes rules regarding the conduct of collectors providing a measure of security for people throughout the country, including Alabama.

Lets take a moment to examine the details of the Fair Debt Collection Practices Act FDCPA.

- Restrictions on Communication: Debt collectors are prohibited from contacting you at unreasonable hours or at work if you’ve requested them not to.

- Harassment Prohibited: Collectors cannot use threats, profane language, or continuous phone calls to intimidate you into paying.

- Validation of Debt: You have the right to request validation of the debt, meaning the collector must provide proof that you owe the amount they claim.

In my view being informed about the Fair Debt Collection Practices Act (FDCPA) can be quite empowering. It offers guidance on dealing with collectors and ensures that you don’t have to put up with harassment. When I encountered challenges I found that knowing about these safeguards boosted my confidence to assert myself and manage the situation more efficiently.

Rights of Debtors in Alabama

In Alabama, individuals with debts are granted certain rights to ensure they are treated fairly during the debt collection process. These rights play a role in safeguarding against aggressive collectors and prioritizing your overall financial and personal welfare.

As a debtor in Alabama you have several important rights such as

- Right to be Free from Harassment: You cannot be subjected to harassment, threats, or abusive language by debt collectors.

- Right to Privacy: Debt collectors must respect your privacy and are not allowed to disclose information about your debt to third parties.

- Right to Dispute Debts: You have the right to dispute the debt and request verification. Collectors must stop collection efforts until they provide proof of the debt.

- Right to Seek Legal Help: If you believe your rights have been violated, you can seek legal counsel and potentially take legal action against the collector.

Based on what I’ve seen being aware of these rights can really help alleviate the pressure that comes with dealing, with debt collectors. It’s comforting to know that there are laws designed to protect you and ensure fairness in how you’re treated. Having this knowledge empowers you to stand up for yourself, when it matters most.

Common Debt Collection Practices

Dealing with debt collection can be quite daunting, particularly when you’re uncertain about what lies ahead. Collectors employ different tactics to retrieve overdue payments and having insight into these methods can assist you in managing the situation more efficiently.

Here are a few common methods used in debt collection that you may come across:

- Frequent Calls: Collectors may call you multiple times a day, which can be stressful. They are permitted to contact you, but there are limits on how often and when they can call.

- Letters and Notices: Expect to receive written notices demanding payment. These letters should include information about the debt and instructions on how to respond.

- Threats of Legal Action: Some collectors may threaten to sue you or garnish your wages if you don’t pay. While they can take legal action, they must follow proper procedures.

- Negotiations: Collectors might offer to negotiate a reduced payment or a payment plan. This can be an opportunity to settle the debt for less than the full amount, but be sure to get any agreement in writing.

Based on what I’ve seen keeping a cool head and staying well informed is crucial when handling debt collectors. They stick to a routine but being aware of your rights empowers you to react with assurance and assertiveness. It’s similar to having a guide when exploring territory – it makes the process much more manageable.

Steps to Take if You’re Contacted by a Debt Collector

Getting a call from a debt collector can be quite distressing. However being aware of the actions to take can streamline the process and assist you in handling the situation efficiently.

If a debt collector reaches out to you keep these steps in mind.

- Verify the Debt: Ask for written verification of the debt. A legitimate collector will provide details about the debt, including the amount and the original creditor.

- Keep Records: Document all interactions with the collector. Note the date, time, and content of conversations. This can be valuable if disputes arise.

- Review Your Rights: Familiarize yourself with your rights under the Fair Debt Collection Practices Act (FDCPA). Knowing your rights can help you recognize if a collector is overstepping.

- Negotiate or Dispute: If you owe the debt, consider negotiating a payment plan. If you believe the debt is not yours, formally dispute it in writing.

- Seek Professional Help: If the situation becomes too complex or stressful, consult with a financial advisor or attorney for guidance.

Through my experiences I found that staying calm and approaching things in a way allowed me to regain control. It’s crucial to keep in mind that there are choices and support at your disposal so don’t hesitate to reach out for help when necessary.

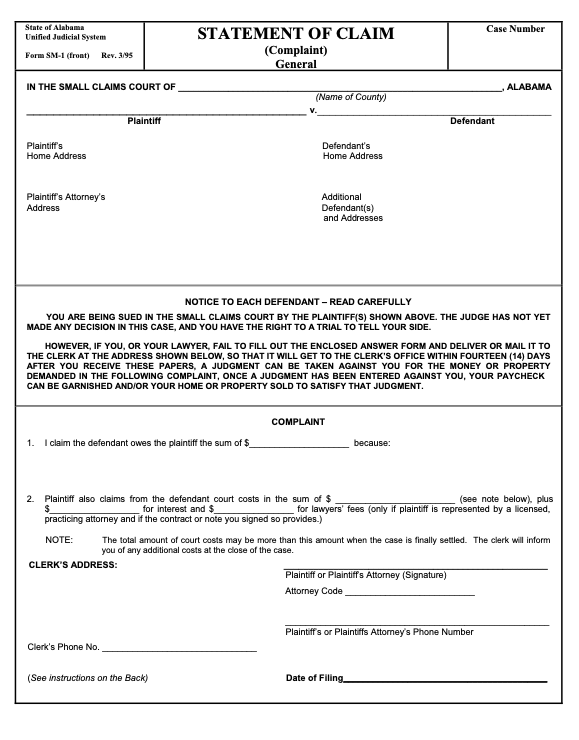

How to Dispute a Debt in Alabama

Challenging a debt can be an important move if you think there’s been an error or if the debt doesn’t belong to you. In Alabama the procedure for disputing a debt is relatively simple but it’s essential to pay close attention to the specifics.

Here’s a guide on how to challenge a debt effectively.

- Send a Written Dispute: Write a formal letter to the debt collector, clearly stating that you dispute the debt. Include your name, address, and account number, and request verification of the debt.

- Keep Copies: Maintain copies of all correspondence sent and received. This documentation is crucial if the dispute escalates or if you need to prove your case later.

- Wait for Verification: Once you’ve disputed the debt, the collector must cease collection efforts until they provide proof of the debt. They are required to send you a verification letter within a reasonable time frame.

- Check Your Credit Report: Review your credit report to ensure the disputed debt is not listed incorrectly. You can file a dispute with credit reporting agencies if necessary.

- Consult an Attorney: If the collector continues to pursue the debt despite your dispute, or if you encounter difficulties, seek legal advice from an attorney experienced in debt collection issues.

Based on my own journey challenging a debt feels like finding your way through a maze of regulations. Yet keeping things in order and being determined can really change the game. Its a boost to realize that you have the power to contest errors and make sure your financial records are spot on.

Impact of Bankruptcy on Debt Collection

Declaring bankruptcy can change the way debt collection works for you. Its a process that not only impacts your finances but also influences how creditors can go after what you owe them.

Filing for bankruptcy can have a significant impact on the process of collecting debts.

- Automatic Stay: The moment you file for bankruptcy, an automatic stay is put in place. This means creditors must halt all collection activities, including calls, letters, and legal actions, while your bankruptcy case is being processed.

- Discharge of Debts: Depending on the type of bankruptcy you file (Chapter 7 or Chapter 13), certain debts may be discharged, meaning you are no longer legally required to pay them. However, not all debts are dischargeable; for instance, student loans and certain tax obligations often remain intact.

- Impact on Credit Score: Bankruptcy will negatively affect your credit score and remain on your credit report for up to ten years. This can make it challenging to secure loans or credit in the future, though it can provide a fresh start in managing your finances.

- Negotiation and Reorganization: In Chapter 13 bankruptcy, you may negotiate a repayment plan to pay back a portion of your debts over time. This plan must be approved by the court and can provide a structured way to manage outstanding obligations.

Based on what I’ve seen and gone through bankruptcy can be a weighty burden but it also presents an opportunity for bouncing back financially. It’s essential to grasp the lasting impacts and strategize wisely to restore your economic well being.

Legal Remedies for Debt Collection Issues

When debt collectors go too far it’s important to be aware that there are legal options to safeguard your rights. If you believe you’re facing harassment or unfair treatment from collectors here are some steps you can take.

Consider these legal remedies:

- File a Complaint: You can file a complaint with the Consumer Financial Protection Bureau (CFPB) or the Alabama Attorney General’s office if you believe a collector is violating your rights. These agencies can investigate and take action on your behalf.

- Sue the Collector: If a debt collector’s actions are unlawful, you may have grounds to file a lawsuit. This can be for violations of the Fair Debt Collection Practices Act (FDCPA) or other state-specific laws. Compensation might include damages and legal fees.

- Seek Legal Counsel: Consulting with an attorney who specializes in consumer rights can help you understand your options. They can provide guidance on whether to pursue legal action and represent you in court if necessary.

- Request Mediation: Sometimes, mediation can help resolve disputes without going to court. It involves a neutral third party who helps both sides reach a fair agreement.

In my view seeking legal solutions can be an effective means to tackle unfair treatment. Its not solely focused on the aspect but also on defending your rights and ensuring fairness in all interactions with debt collectors.

FAQ

What should I do if a debt collector calls me?

To start stay composed. Inquire about the specifics of the debt and ask them to provide you with written proof. Make sure to document the conversation and familiarize yourself with your rights according to the FDCPA. If the debt is legitimate you could discuss setting up a payment arrangement or consider seeking legal counsel if needed.

Can debt collectors garnish my wages?

Certainly if a debt collector gets a court ruling in their favor they can pursue garnishing your wages. This involves taking out part of your salary to settle the outstanding debt. However they are required to adhere to protocols to carry this out.

How long can a debt collector pursue me for an old debt?

The time frame during which debt can be collected is typically restricted by a law that differs from state to state. In Alabama the time limit for collecting most debts is six years. Once this time has passed collectors cannot take legal action to recover the debt although it could still impact your credit history.

What is the best way to rebuild my credit after bankruptcy?

Restoring your credit requires actions such as timely bill payments, debt reduction keeping credit card balances low and potentially getting a secured credit card. While it takes time, regular positive financial habits can gradually improve your credit score.

Can I dispute a debt if I don’t recognize it?

If you come across a debt that you dont recognize you have the right to challenge it. Reach out to the debt collector through means ask them to provide proof of the debt and review your credit report for any discrepancies. Its important to follow up on the matter and maintain a record of all communications.

Conclusion

Dealing with laws and procedures can be quite a challenge. However knowing your rights and choices can greatly help you navigate through it. Whether it’s understanding the effects of bankruptcy or knowing the options for unfair practices being informed is key to managing and overcoming debt related obstacles. Personally I’ve discovered that staying updated and taking action gives you the strength to handle debt collection matters more efficiently and safeguard your financial health. Whether you’re facing persistent collectors contemplating bankruptcy or looking into legal solutions keep in mind that you’re not on this journey. With a strategy you can tackle debt issues and progress ahead with assurance.