Key Points of Alabama Mileage Reimbursement Law

The Alabama Mileage Reimbursement Law is designed to help employees get compensated for using their personal vehicles for work-related travel. This law sets guidelines on how employers should reimburse employees for mileage. It’s important for both employees and employers to understand these rules to ensure fair compensation and compliance with state regulations.

Understanding Mileage Reimbursement

Mileage reimbursement is the process where employers pay employees for the miles driven for business purposes. It’s essential for covering expenses that arise from using personal vehicles. Here are some key points to understand:

- Reimbursement Rate: This is typically based on the standard mileage rate set by the IRS. For 2024, this rate is $0.65 per mile, but it can vary based on changes in regulations.

- Business Purposes: This includes travel for meetings, client visits, or other work-related tasks. Personal trips are not covered.

- Documentation: Employees need to keep accurate records of their trips, including dates, destinations, and purposes to qualify for reimbursement.

Understanding these aspects helps employees accurately report their mileage and ensures employers follow the law correctly.

Who Qualifies for Mileage Reimbursement in Alabama

In Alabama, various categories of employees can qualify for mileage reimbursement. Here are some key groups:

- Full-Time Employees: Employees who use their vehicles regularly for work-related tasks.

- Part-Time Employees: Part-time staff may also qualify if they are required to travel for business purposes.

- Contract Workers: Independent contractors who use personal vehicles for business tasks can also seek reimbursement.

However, to qualify, the travel must be necessary for job functions, and employees must provide adequate documentation to support their claims. Understanding who qualifies is essential for ensuring that employees receive fair compensation for their travel expenses.

Rate of Mileage Reimbursement in Alabama

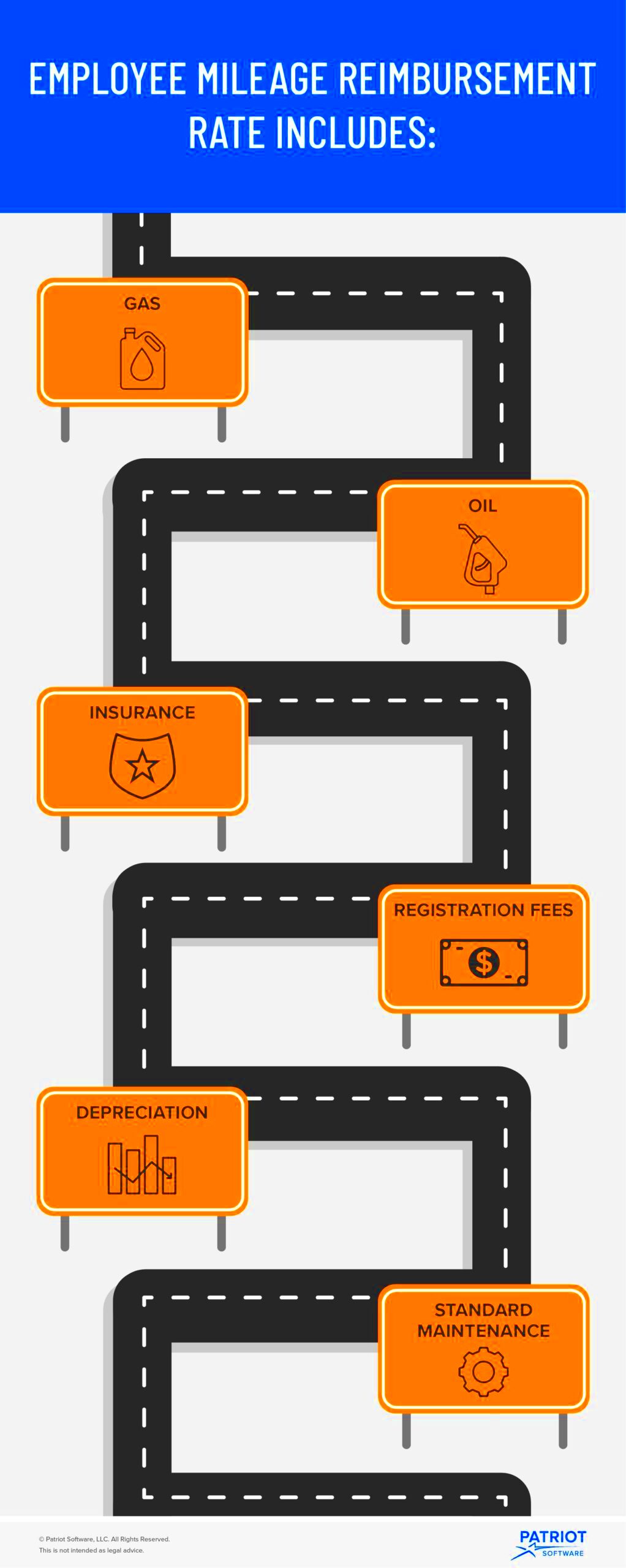

The rate of mileage reimbursement in Alabama is primarily based on the standard mileage rate set by the IRS. This rate can change annually, so it’s important for both employers and employees to stay updated. As of 2024, the reimbursement rate is $0.65 per mile. This figure is calculated to cover the costs associated with operating a vehicle, including gas, wear and tear, and maintenance.

Employers may choose to reimburse employees at a higher rate if they wish, but they cannot pay less than the IRS rate. Here’s a breakdown of what influences the mileage reimbursement rate:

- Fuel Prices: Fluctuations in fuel prices can impact the overall costs of using a vehicle for work.

- Vehicle Maintenance: Regular maintenance costs, including oil changes and repairs, are also factors considered when determining reimbursement rates.

- Insurance Costs: The cost of insuring a vehicle can vary, which may influence how employers set their reimbursement policies.

It’s essential for employees to communicate with their employers about any changes in rates and to keep up with IRS updates to ensure they are fairly compensated for their mileage.

Documentation Required for Mileage Reimbursement

When it comes to mileage reimbursement, keeping accurate documentation is crucial. Employers need proper records to verify claims, while employees must provide evidence of their travel for reimbursement. Here are the key documents typically required:

- Mileage Log: A detailed log of all business-related trips, including the date, starting and ending locations, total miles driven, and purpose of the trip.

- Receipts: Any receipts related to travel expenses, such as fuel purchases or tolls, should be kept as supporting documents.

- Approval Forms: Some companies may require pre-approval for trips that will be reimbursed, so employees should check with their employer’s policy.

Using a simple spreadsheet or mileage tracking apps can make logging trips easier. Having well-organized documentation ensures that claims are processed smoothly and reduces the chances of disputes over reimbursement amounts.

Employer Responsibilities Regarding Mileage Reimbursement

Employers in Alabama have specific responsibilities when it comes to mileage reimbursement. Understanding these duties ensures compliance with the law and promotes fair treatment of employees. Here’s what employers need to keep in mind:

- Reimbursement Policy: Employers should establish a clear mileage reimbursement policy that outlines the process for claiming reimbursements, the rate used, and the documentation required.

- Timely Payments: Once employees submit their mileage claims, employers are responsible for processing these claims promptly to ensure timely payments.

- Maintain Records: Employers must keep records of all mileage reimbursement claims for auditing purposes and to address any potential disputes.

- Provide Training: It’s beneficial for employers to train employees on the reimbursement process, including how to accurately document mileage and expenses.

By fulfilling these responsibilities, employers not only comply with Alabama law but also foster a positive work environment that values employee contributions and minimizes misunderstandings regarding travel expenses.

Common Mistakes to Avoid

When it comes to mileage reimbursement in Alabama, both employees and employers can make mistakes that lead to confusion and frustration. Here are some common pitfalls to avoid:

- Not Keeping Accurate Records: One of the biggest mistakes employees make is failing to maintain a detailed mileage log. Without accurate records, it’s hard to justify claims.

- Ignoring IRS Rate Changes: Many employees and employers forget to update reimbursement rates based on the IRS’s annual changes, which can lead to under or overpayment.

- Mixing Personal and Business Trips: It’s crucial to separate personal travel from business-related trips. Mixing the two can complicate reimbursement claims.

- Failing to Submit Claims on Time: Late submissions can lead to denied claims. Employees should be aware of their employer’s deadlines for reimbursement requests.

- Neglecting to Get Pre-Approval: Some companies require pre-approval for certain trips. Skipping this step can result in disqualification from reimbursement.

Avoiding these common mistakes not only streamlines the reimbursement process but also fosters better communication and trust between employees and employers.

Frequently Asked Questions

Here are some frequently asked questions regarding Alabama mileage reimbursement to clear up common uncertainties:

- What is the current mileage reimbursement rate in Alabama? The rate is generally aligned with the IRS standard mileage rate, which is $0.65 per mile as of 2024.

- Do I need to provide receipts for fuel purchases? While it’s not always necessary, providing receipts can help support your mileage claims and justify expenses.

- Can I claim mileage for commuting to my regular workplace? No, commuting from home to your regular workplace is generally not reimbursable.

- How long do I have to submit my mileage reimbursement request? This varies by employer, so it’s important to check your company’s policy regarding deadlines for submission.

These questions can guide employees in understanding their rights and responsibilities regarding mileage reimbursement.

Conclusion on Alabama Mileage Reimbursement Law

Understanding Alabama’s mileage reimbursement law is essential for both employees and employers. This law ensures that employees are fairly compensated for using their personal vehicles for work-related tasks, while also placing responsibilities on employers to maintain clear policies and procedures.

By knowing the reimbursement rate, the necessary documentation, and common pitfalls, employees can confidently submit their claims, while employers can foster a supportive work environment that complies with state regulations. Keeping open lines of communication about reimbursement policies can help avoid misunderstandings and ensure that everyone is on the same page. In the end, staying informed about these laws benefits everyone involved.