Key Points of West Virginia Business Regulations

Starting a business in West Virginia is an exciting journey, but it’s important to understand the regulations that govern it. These rules ensure that businesses operate fairly and safely while protecting consumers and the environment. In this post, we will explore key aspects of West Virginia’s business regulations, helping you navigate the requirements for starting and running a successful business.

Types of Business Structures in West Virginia

Choosing the right business structure is crucial as it impacts your taxes, liability, and operations. Here are the most common types of business structures in West Virginia:

- Sole Proprietorship: This is the simplest form of business. It’s easy to set up and you have complete control. However, you’re personally liable for all debts.

- Partnership: In a partnership, two or more people share ownership. This structure allows for shared responsibility but can lead to disputes if not properly managed.

- Limited Liability Company (LLC): An LLC offers liability protection while allowing profits and losses to pass through to your personal income. It’s flexible and popular among small business owners.

- Corporation: A corporation is a more complex structure that provides the most liability protection. However, it comes with higher costs and more regulations.

Choosing the right structure involves considering factors like liability, taxation, and future business plans.

Licensing Requirements for Businesses

Before you start operating your business, you must obtain the necessary licenses and permits. Here’s a breakdown of what you need:

| Type of License | Description |

|---|---|

| Business License | Required for most businesses operating in West Virginia. It shows you comply with local regulations. |

| Occupational License | Specific to certain professions, like doctors or lawyers, requiring additional certification. |

| Health Permits | Needed for businesses that handle food or health services to ensure safety standards are met. |

It’s essential to check with your local government for specific licensing requirements. Failing to obtain the proper licenses can lead to fines or legal issues down the road. Be proactive and ensure you’re compliant before starting your business.

Tax Obligations for West Virginia Businesses

Understanding tax obligations is crucial for running a successful business in West Virginia. As a business owner, you need to be aware of various taxes that might affect your operations. The good news is that West Virginia has a range of resources to help you navigate your tax responsibilities.

Here’s a quick overview of the main types of taxes you might encounter:

- Business Franchise Tax: This tax is imposed on businesses operating in West Virginia, and it’s calculated based on your corporation’s net worth.

- Corporate Income Tax: Corporations must pay a tax on their net income. The rate is currently set at 6.5%.

- Sales and Use Tax: If you sell goods or services, you’re required to collect a 6% sales tax from your customers, with some exceptions for specific items.

- Personal Income Tax: If you’re a sole proprietor or a member of an LLC, your business income is reported on your personal tax return, and you’ll pay the state’s income tax rate.

It’s important to keep accurate records and consult with a tax professional to ensure you meet all your obligations. Taking proactive steps can save you from potential issues later on.

Employment Laws and Regulations

When it comes to hiring employees, understanding West Virginia’s employment laws is essential. These laws are designed to protect both employers and employees, creating a fair working environment. Here are some key regulations you should know:

- Minimum Wage: West Virginia’s minimum wage is $8.75 per hour, but certain industries may have different rates.

- Workers’ Compensation: All employers are required to have workers’ compensation insurance to protect employees who may get injured on the job.

- Anti-Discrimination Laws: It’s illegal to discriminate against employees based on race, gender, age, or disability. Employers must follow these laws to ensure a fair workplace.

- Family and Medical Leave Act (FMLA): Eligible employees are entitled to take unpaid leave for certain family and medical reasons, ensuring job protection during that time.

Being aware of these regulations not only helps you comply with the law but also fosters a positive work culture, which can enhance employee satisfaction and retention.

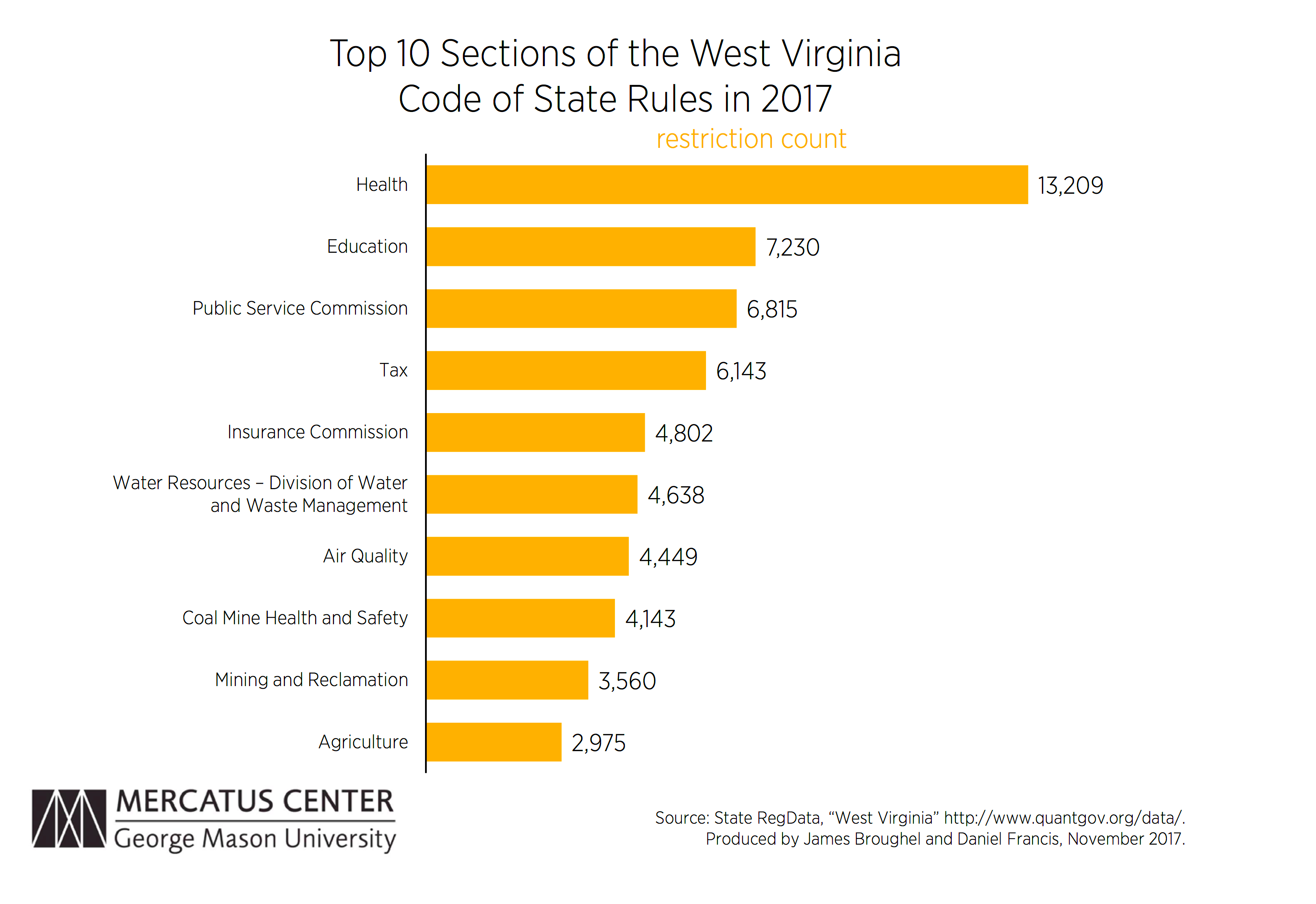

Environmental Regulations Impacting Businesses

Environmental regulations are increasingly important for businesses in West Virginia. These laws aim to protect the environment while ensuring that companies operate sustainably. Understanding these regulations can help you avoid fines and contribute to a healthier community.

Here are some key environmental regulations you should be aware of:

- Clean Air Act: This federal law requires businesses to limit emissions of pollutants into the air. Certain industries may need permits to operate.

- Clean Water Act: Businesses that discharge wastewater into rivers or lakes must comply with regulations to protect water quality.

- Hazardous Waste Regulations: If your business generates hazardous waste, you must follow strict disposal regulations to prevent environmental harm.

- Environmental Impact Assessments: For certain projects, businesses may need to conduct assessments to evaluate potential environmental impacts before proceeding.

Complying with environmental regulations not only helps protect the environment but can also improve your business reputation and attract environmentally conscious customers.

Resources for Business Owners

Starting and running a business can be overwhelming, but luckily, West Virginia offers a wealth of resources to support business owners. Whether you’re seeking guidance on compliance, funding, or networking, you can find helpful tools and services designed to make your entrepreneurial journey smoother.

Here are some valuable resources available to business owners in West Virginia:

- West Virginia Secretary of State: Their website provides information on business registration, licensing, and maintaining good standing.

- West Virginia Division of Labor: This office offers assistance with employment regulations, including wage laws and workplace safety requirements.

- Small Business Development Center (SBDC): The SBDC provides free business consulting services, helping you with everything from business plans to marketing strategies.

- West Virginia Economic Development Authority: This organization offers financing options, including loans and grants, to help you start or expand your business.

- Chambers of Commerce: Joining your local chamber can provide networking opportunities, resources, and support from fellow business owners.

Using these resources can save you time and help you make informed decisions as you navigate the world of business in West Virginia.

Frequently Asked Questions about Business Regulations

Starting a business can raise many questions, especially regarding regulations. Here are some frequently asked questions that can clarify common concerns:

| Question | Answer |

|---|---|

| What type of business license do I need? | It depends on your business structure and activities. Most businesses need a general business license. |

| Are there any zoning regulations? | Yes, check with your local zoning office to ensure your business complies with local zoning laws. |

| How do I report taxes? | You’ll need to register with the West Virginia State Tax Department and follow their guidelines for tax reporting. |

| What should I do if I have employees? | You must comply with employment laws, including worker’s compensation and payroll taxes. |

If you have more questions, don’t hesitate to consult local business resources or seek legal advice. It’s better to be informed than to make assumptions!

Conclusion on West Virginia Business Regulations

Understanding West Virginia’s business regulations is essential for any entrepreneur. By familiarizing yourself with licensing requirements, tax obligations, employment laws, and environmental regulations, you can set your business up for success. Utilizing the available resources can provide valuable support and guidance as you navigate these requirements.

Remember, staying informed and compliant not only helps you avoid legal issues but also fosters a positive business environment. As you embark on your business journey in West Virginia, keep these regulations in mind, and don’t hesitate to seek help when needed. Good luck!