Law Enforcement Tax Deductions for 2023 and What to Include

For law enforcement officers tax season can be quite challenging. In addition to the demands of your job dealing with the intricacies of tax deductions adds an extra hurdle. Knowing which deductions you qualify for can greatly impact your tax return. Its not solely about saving money; it also involves making sure you receive the benefits that you deserve for your dedication and hard work. I recall a coworker who overlooked deductions simply because he was unaware of their existence. Lets explore these deductions together so that you dont miss out on potential savings.

Eligible Deductions for 2023

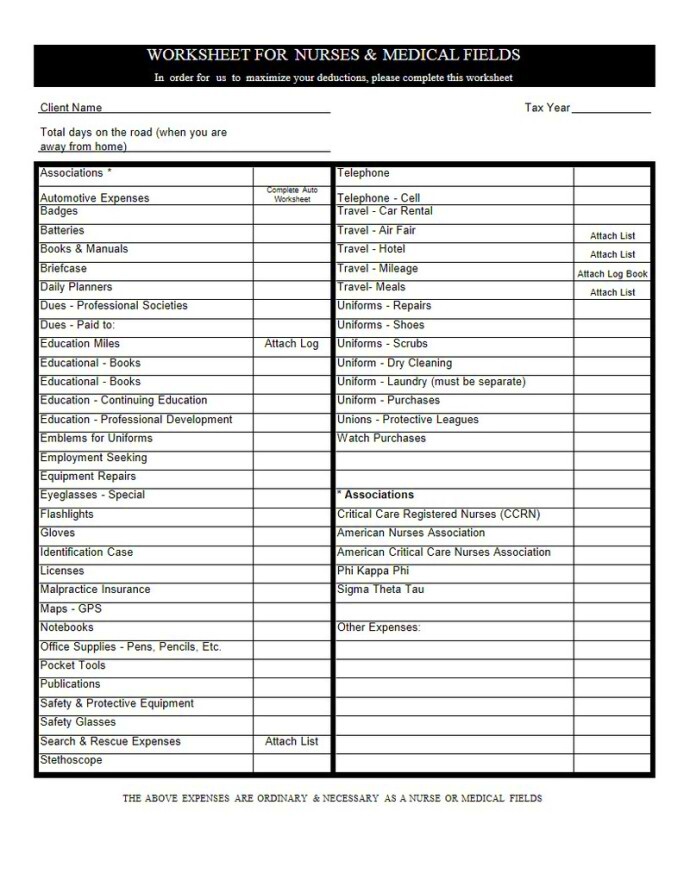

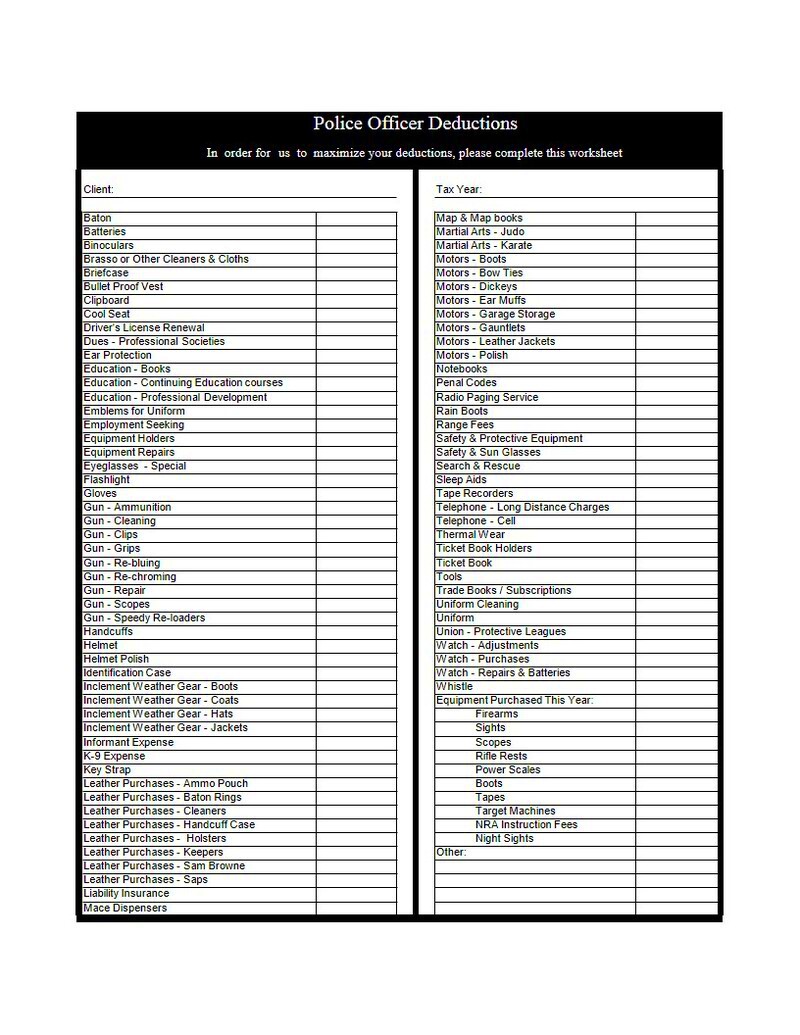

In the tax year 2023 law enforcement officers have access to various deductions tailored to their profession. Here are a few notable ones.

- Uniforms and Gear: The cost of uniforms, body armor, and other necessary gear that is not reimbursed by your department can be deducted.

- Training and Education: Expenses for training courses and educational programs directly related to your job are deductible. This includes certifications and advanced training that enhance your skills.

- Vehicle Expenses: If you use your personal vehicle for work-related duties, you can deduct mileage or a portion of vehicle expenses. Be sure to keep detailed records of mileage and expenses.

- Union Dues: Membership dues to law enforcement unions or professional organizations are tax-deductible.

Dont forget that in order to be eligible for these deductions your expenses need to be closely tied to your responsibilities as a police officer and shouldnt be covered by your employer. Its wise to maintain meticulous documentation and receipts to support your assertions.

Commonly Overlooked Deductions

Even experienced experts occasionally overlook specific deductions. Here are some frequently neglected aspects.

- Home Office Expenses: If you perform work-related duties from home, such as administrative tasks or report writing, you might be eligible for a home office deduction. This can include a portion of your rent or mortgage, utilities, and home office supplies.

- Special Equipment: Items like tactical flashlights, first aid kits, and even certain software used for work can be deducted. Often, officers overlook these smaller but essential items.

- Legal Fees: If you incur legal fees related to your job, such as defending yourself in job-related legal matters, these might be deductible.

To claim these deductions you need to have your paperwork in order. I remember an officer who missed out on a deduction because he forgot to save the receipts for his home office. It’s important to keep track of your records and seek advice from a tax professional to make sure you’re making the most of your eligible deductions.

How to Document Your Expenses

One of the most important things when it comes to claiming tax deductions is keeping detailed records. I recall a time when my cousin, who is a diligent officer ran into difficulties with his tax returns due to not maintaining proper documentation. Its not merely about holding onto receipts; it’s about establishing a system that suits your needs. By accurately tracking your expenses you can spare yourself from unnecessary stress during tax season.

Here are a few helpful suggestions to make sure you maintain thorough and accurate records.

- Keep Receipts: Always keep receipts for any work-related purchases. Whether it’s uniform repairs, training fees, or office supplies, these are your proof of expenditure.

- Use a Ledger: Maintain a detailed ledger or use an expense tracking app to log your expenditures. Record the date, amount, and purpose of each expense.

- Track Mileage: If you use your vehicle for work, keep a mileage log. Note down each trip’s date, destination, and mileage. Apps that track mileage can be very handy.

- Organize Documentation: Store your receipts and records in an organized manner. Use folders or digital tools to categorize and easily retrieve them when needed.

Investing effort into keeping track of your expenses meticulously can really impact whether your tax filing goes smoothly or becomes a source of stress and chaos. Trust me you’ll appreciate it later when you’re not frantically searching for that one stubborn receipt.

Filing Your Taxes with Deductions

Navigating the world of tax deductions might appear challenging at first glance but with some preparation it can turn into a smooth sailing experience. I remember a buddy of mine who used to be anxious about tax time until he discovered a system that suited him. So lets break down a few steps to help ease the process of filing your taxes with deductions.

- Gather Your Documents: Before you start, ensure you have all your documents in order, including your W-2s, 1099s, and any records of deductions. Organize them into categories for easy reference.

- Choose the Right Forms: Depending on your situation, you might need to use different tax forms. Typically, you’ll use Form 1040 along with Schedule A if you’re itemizing deductions.

- Enter Your Deductions: Fill out the relevant sections of your tax forms with your documented deductions. Be precise and make sure to include all eligible expenses.

- Double-Check Everything: Review your entries carefully. Verify that all amounts are correct and that you haven’t missed any deductions.

- Consider Professional Help: If you’re unsure about any aspect of filing, consider consulting a tax professional. Their expertise can help ensure you’re maximizing your deductions and complying with tax laws.

Keeping things tidy and following a plan can really help ease the stress of filing your taxes and ensure that you maximize your deductions.

Tax Benefits for Law Enforcement Professionals

Police officers often enjoy special tax advantages that can greatly affect their financial situation. In my experience working with numerous officers I’ve observed that these perks often fly under the radar. By recognizing and taking advantage of these benefits you can boost your savings and alleviate financial worries.

Here are some important tax advantages that law enforcement officers can take advantage of.

- Deductible Expenses: As mentioned earlier, expenses related to uniforms, gear, and training are deductible. These deductions can reduce your taxable income and, consequently, your tax liability.

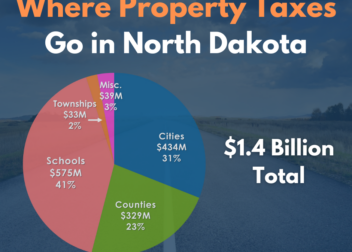

- Public Safety Officer Benefits: Some states offer additional tax benefits to public safety officers, including exemptions or reductions on property taxes.

- Retirement Contributions: Contributions to retirement plans for law enforcement officers might offer additional tax advantages. Check if your state provides specific retirement benefits for officers.

- Job-Related Education: If you pursue education to advance in your career, the cost may be deductible. This includes courses or degrees related to law enforcement.

Every little bit of support makes a difference, particularly considering the challenges that come with being in law enforcement. Utilizing these advantages to the fullest can enhance your financial situation and allow you to concentrate better on your crucial responsibilities. Make sure not to overlook these chances as every deduction matters!

Potential Pitfalls to Avoid

When it comes to tax deductions even a small mistake can cause problems. I have witnessed numerous police officers encounter issues due to missing an important detail. Steering clear of these missteps can greatly enhance your tax filing process and guarantee that you receive the deductions, that you deserve.

Here are a few mistakes to be cautious of:

- Failing to Keep Receipts: Without proper receipts, it’s difficult to prove your expenses. Even though it might seem tedious, keeping receipts for all deductible items is essential. I’ve had friends who struggled to claim deductions simply because they didn’t have their receipts in order.

- Mixing Personal and Business Expenses: Keep your personal and work-related expenses separate. If you use the same account or credit card for both, it can become confusing and lead to errors in your deductions.

- Neglecting Documentation: Detailed records are crucial. Document every deductible expense meticulously, including the purpose of each expenditure. I recall a colleague who missed out on deductions just because he hadn’t recorded the purpose of his expenses.

- Ignoring State-Specific Deductions: Different states have varying tax laws and deductions. Make sure you’re aware of any state-specific benefits for law enforcement officers in your area.

To steer clear of these traps, it’s important to stay focused and keep things in order. By keeping track of your paperwork and being aware of mistakes, you can make the tax filing process go more smoothly and make the most of your advantages.

Changes in Tax Laws for 2023

Tax regulations are constantly changing and it’s essential to keep up to date especially for those in law enforcement who might have specific deductions. The 2023 tax year has introduced some modifications that could affect your tax filings. Being aware of these changes can assist you in approaching the tax season with assurance.

Here are some notable changes for 2023:

- Increased Standard Deduction: The standard deduction has seen an increase this year. This means that even if you don’t itemize, you could benefit from a higher deduction amount.

- Adjustments for Inflation: Various deductions and tax brackets have been adjusted for inflation. This can affect the amount you can deduct and your overall tax liability.

- Changes to Education Credits: There have been updates to the education credits that may impact your eligibility for deducting training and education expenses.

- State-Specific Changes: Some states have introduced new tax benefits or changed existing ones. Be sure to check for any state-specific updates that could affect your deductions.

Grasping the intricacies of these shifts and their relevance to your circumstances can be challenging yet it’s a worthwhile endeavor. Seeking guidance from a tax professional well versed in the latest changes can prove to be a smart move to make sure you’re maximizing the benefits of these updated rules.

Frequently Asked Questions

Law enforcement officers often have questions about taxes and finding clear answers can really help. I’ve compiled responses to some frequently asked questions regarding tax deductions for law enforcement based on the common inquiries I come across.

- What expenses are deductible for law enforcement officers? Common deductions include uniforms, gear, training costs, vehicle expenses, and union dues. Ensure these expenses are directly related to your duties and not reimbursed by your employer.

- How do I prove my expenses? Keep detailed receipts, maintain a ledger of expenses, and track mileage if using your vehicle for work. Proper documentation is key to substantiating your claims.

- Are there any new deductions for 2023? Check for updates on the standard deduction, changes to education credits, and any state-specific deductions. Staying informed about these changes can benefit your tax return.

- Should I consult a tax professional? If you’re unsure about any deductions or how to apply new tax laws, consulting a tax professional can be beneficial. Their expertise can help ensure you’re maximizing your benefits and complying with regulations.

Getting responses to these queries can alleviate your concerns about taxes and assist you in handling the process more efficiently. Keep in mind that being well informed and organized is your greatest asset in effectively managing your tax deductions.

Conclusion

Navigating the world of tax deductions can be quite a task especially for law enforcement professionals who are already juggling a job. From figuring out what deductions you’re eligible for to steering clear of common mistakes every step is vital in making sure you maximize your tax return. I’ve witnessed how keeping records and staying updated on changes in tax laws can have an impact. Don’t let the complexities discourage you from claiming what you truly deserve. By maintaining detailed records staying informed about regulations and seeking advice when necessary you can simplify your tax process and ensure that you fully benefit from available deductions. Your commitment to your work deserves the same level of care and attention, in your financial matters. Take control of your tax deductions with confidence and ease.