Legal Requirements for Illinois Wage and Hour Laws

Illinois Wage and Hour Laws are designed to protect workers’ rights regarding their pay and working hours. These laws ensure that employees receive fair compensation for their work and that employers follow specific guidelines. It’s essential for both employees and employers to understand these laws to avoid disputes and ensure compliance. This blog post will cover the key aspects of these laws, including minimum wage, overtime pay, meal and rest breaks, record-keeping, and employee rights.

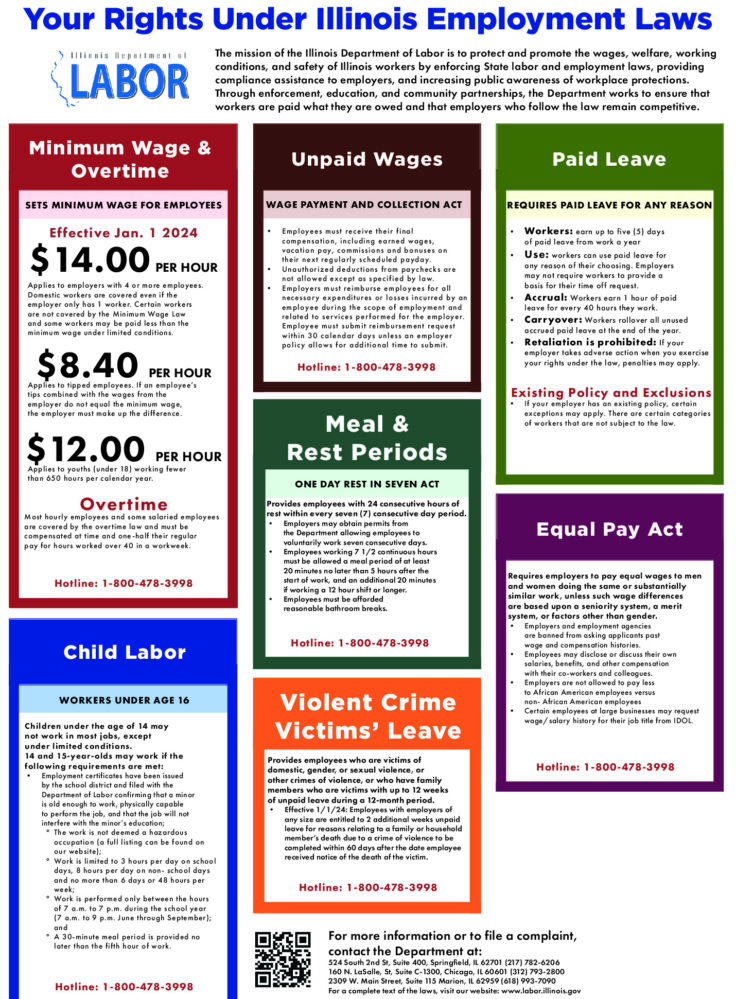

Overview of Minimum Wage in Illinois

In Illinois, the minimum wage is a vital aspect of wage laws. As of 2024, the minimum wage is set at $15.00 per hour for most employees. However, there are specific exceptions and conditions that apply. Here’s what you should know:

- Young Workers: Employees under 18 years old may be paid a minimum of $13.00 per hour.

- Tips: Employers can pay tipped employees a lower minimum wage, which is currently $6.60 per hour, provided their tips make up the difference.

- Exemptions: Certain workers, such as those in specific industries or with unique job roles, may not be covered by minimum wage laws.

Employers must post minimum wage notices in the workplace to inform employees of their rights. Regular updates to the law mean it’s essential for both employers and employees to stay informed about any changes.

Understanding Overtime Pay Regulations

Overtime pay is an important aspect of Illinois Wage and Hour Laws. Employees who work more than 40 hours in a workweek are typically entitled to overtime pay. Here are the key points to understand:

- Overtime Rate: Overtime must be paid at a rate of at least 1.5 times the employee’s regular hourly wage.

- Exempt Employees: Some employees, such as executive, administrative, and professional workers, may be exempt from overtime pay. To qualify, they must meet specific salary and job duty criteria.

- Workweek Definition: A workweek is defined as a fixed and regularly recurring period of 168 hours, which is seven consecutive 24-hour periods.

- Calculating Overtime: When calculating overtime, employers must consider all hours worked, including additional hours and specific tasks that may contribute to overtime eligibility.

It’s crucial for employers to track hours worked accurately and ensure that they are complying with overtime regulations. Employees should also be aware of their rights regarding overtime pay to ensure they are compensated fairly.

Meal and Rest Break Requirements

In Illinois, meal and rest breaks are essential for maintaining employee well-being and productivity. Understanding the specific requirements helps ensure both employees and employers follow the law. Here’s a breakdown of what you need to know:

- Meal Breaks: Employees who work more than 7.5 hours are entitled to a 30-minute meal break within the first 5 hours of their shift. This break can be unpaid if the employee is relieved of all duties during this time.

- Rest Breaks: Employees are entitled to a short break of 5 minutes for every 4 hours worked. While these breaks are not mandated by law, they are encouraged to ensure employee comfort and productivity.

- Scheduling: Employers should schedule breaks to ensure that employees can take them without affecting business operations. However, employees should be allowed to take their breaks when needed, as long as it aligns with the company policy.

- Record Keeping: It’s essential for employers to maintain records of break times to ensure compliance with these requirements.

By adhering to meal and rest break regulations, employers can create a more positive work environment, which can lead to increased morale and productivity among employees.

Record Keeping Obligations for Employers

Proper record-keeping is crucial for employers to comply with Illinois Wage and Hour Laws. Keeping accurate records not only protects employers but also ensures employees receive their rightful compensation. Here’s what you should know:

- Time Records: Employers must maintain detailed records of hours worked by employees, including regular hours and overtime hours. This includes tracking when employees clock in and out.

- Wage Records: Employers should keep records of wages paid to employees, including hourly rates, overtime pay, bonuses, and deductions.

- Meal and Break Records: It’s important to document when meal and rest breaks are taken, as this can help defend against claims of unpaid work time.

- Retention Period: Records must be kept for at least three years after the employee’s termination or the date of the last payment.

By maintaining these records, employers can protect themselves in case of disputes and ensure they comply with all wage and hour laws. This diligence not only fosters trust but also contributes to a smoother workplace environment.

Employee Rights Under Wage and Hour Laws

Understanding employee rights under Illinois Wage and Hour Laws is vital for protecting workers from unfair practices. Here’s an overview of the key rights every employee should be aware of:

- Right to Fair Pay: Employees have the right to receive at least the minimum wage for all hours worked. This includes overtime pay for hours exceeding 40 in a week.

- Right to Breaks: As discussed, employees are entitled to meal and rest breaks based on the hours they work, ensuring they have time to recharge.

- Right to Non-Discrimination: Employees cannot be discriminated against for exercising their rights under wage and hour laws. This includes reporting violations or discussing wages with coworkers.

- Right to Access Records: Employees have the right to request and review their work hours, wages, and break records from their employers.

It’s crucial for employees to know their rights and to speak up if they believe they are being violated. Reporting any issues to the Illinois Department of Labor can help resolve disputes and enforce the law, promoting fairness in the workplace.

Common Violations of Wage and Hour Laws

Understanding common violations of Illinois Wage and Hour Laws can help both employees and employers avoid costly mistakes. Here are some frequent violations that occur:

- Failure to Pay Minimum Wage: Some employers may mistakenly pay employees less than the mandated minimum wage, which is currently $15.00 per hour for most workers.

- Not Paying Overtime: Employers might fail to pay the correct overtime rate for hours worked beyond 40 in a week. Remember, overtime should be paid at 1.5 times the regular rate.

- Improper Breaks: Denying employees their entitled meal and rest breaks can lead to violations. It’s crucial for employers to schedule and allow these breaks as per the law.

- Misclassifying Employees: Some employers misclassify workers as independent contractors to avoid paying benefits and overtime. This can lead to significant legal repercussions.

- Failing to Keep Accurate Records: Not maintaining proper records of hours worked, wages paid, and breaks taken can result in penalties and disputes.

Being aware of these violations can help employees understand their rights and help employers maintain compliance with the law. Proactive measures can lead to a fairer workplace for everyone involved.

FAQs About Illinois Wage and Hour Laws

Many people have questions about Illinois Wage and Hour Laws. Here are some frequently asked questions that can provide clarity:

- What is the current minimum wage in Illinois?

As of 2024, the minimum wage is $15.00 per hour for most employees. - Am I entitled to overtime pay?

Yes, if you work more than 40 hours in a week, you should receive overtime pay at a rate of 1.5 times your regular hourly wage. - Are meal breaks mandatory?

Employees working more than 7.5 hours are entitled to a 30-minute meal break, which can be unpaid if relieved of all duties. - What should I do if I believe my rights have been violated?

You can report the issue to the Illinois Department of Labor or seek legal advice to explore your options. - How long do employers need to keep records?

Employers must keep records of hours worked and wages paid for at least three years.

These FAQs aim to empower employees with the knowledge they need to navigate wage and hour laws effectively.

Conclusion on Legal Compliance for Employers

Ensuring legal compliance with Illinois Wage and Hour Laws is vital for employers who want to foster a positive workplace environment. By adhering to these laws, employers not only protect themselves from potential lawsuits but also build trust and respect with their employees. Here are some key takeaways:

- Stay Informed: Keep updated on changes in wage and hour laws to ensure your business practices comply with the latest regulations.

- Train Your Staff: Educate management and HR personnel about wage and hour laws to ensure they can help enforce these regulations effectively.

- Maintain Accurate Records: Properly track employee hours, wages, and breaks to prevent disputes and violations.

- Encourage Open Communication: Create an environment where employees feel comfortable discussing their rights and concerns related to wages and hours.

By prioritizing compliance, employers can create a fair and productive workplace that benefits everyone involved. It’s a win-win for both employees and employers!