Maryland Filial Responsibility Laws Explained

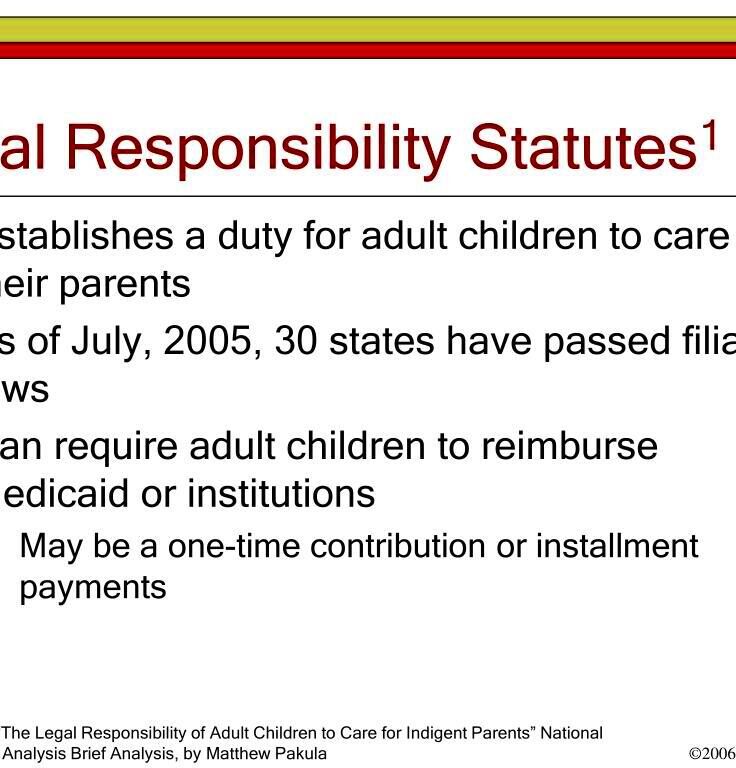

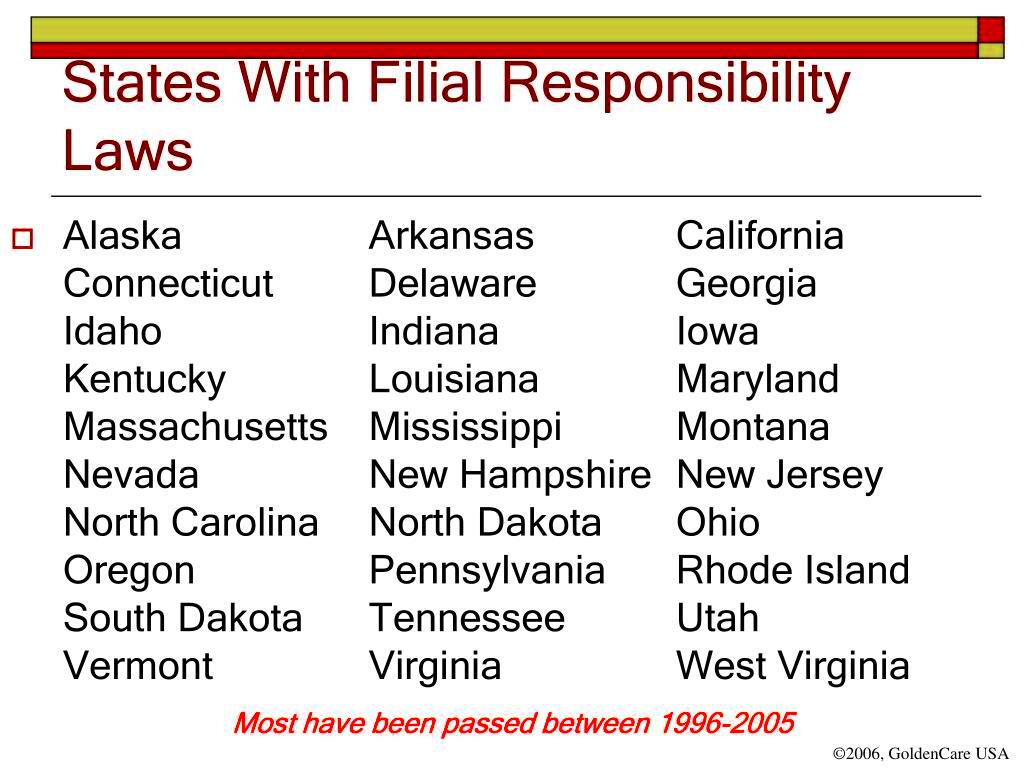

Filial responsibility laws require adult children to support their parents financially if they cannot afford their care. These laws are based on the idea that family members should help each other, especially in times of need. While these laws can vary by state, understanding them is crucial for ensuring compliance and knowing your rights and responsibilities. In Maryland, these laws have specific implications, especially for those facing long-term care costs for their elderly parents. This post will delve into the details of these laws and their effects on families.

History of Filial Responsibility in Maryland

The concept of filial responsibility has its roots in ancient laws and customs that emphasized family obligations. In the United States, these laws were once widely accepted but became less common throughout the 20th century as social welfare systems evolved. However, in Maryland, the law has remained in place to address the increasing costs of elderly care. Here’s a brief timeline of its development:

- 19th Century: Early laws focused on family obligations to support the elderly.

- 1970s: Many states, including Maryland, begin to formalize these obligations in law.

- 1990s: Filial responsibility laws are scrutinized, leading to debates about their relevance.

- Present Day: The laws continue to be enforced, particularly concerning nursing home care costs.

Understanding this history helps to contextualize why these laws exist today and how they impact families in Maryland.

Who is Covered Under These Laws

Filial responsibility laws in Maryland specifically address the obligations of adult children towards their parents. Here are the main groups covered:

- Biological Children: Adult children are primarily responsible for supporting their biological parents.

- Adoptive Children: Adopted children have the same obligations as biological children.

- Stepchildren: In some cases, stepchildren may also be held responsible if they were living with the parent before the parent required care.

It’s important to note that these laws typically do not apply to:

- Spouses

- Grandchildren

- Other relatives, such as siblings or cousins

Each situation can vary based on individual circumstances, so it’s advisable to consult with a legal expert for clarity on specific cases.

Financial Obligations of Adult Children

When it comes to filial responsibility laws in Maryland, adult children have specific financial obligations toward their parents. This responsibility is crucial, especially as parents age and may require assistance with care or living expenses. Understanding these obligations can help avoid misunderstandings and ensure that parents receive the care they need.

Here are the key financial responsibilities that adult children might face:

- Paying for Basic Needs: Adult children may be required to contribute to their parents’ housing, food, and medical expenses if the parents cannot afford them.

- Long-Term Care Costs: If a parent needs to enter a nursing home or requires other long-term care, the adult child might be responsible for these costs, particularly if the parents are on Medicaid.

- Legal Fees: If a legal action is necessary to enforce these obligations, the adult child may be responsible for covering the legal fees involved.

It’s essential to keep in mind that these obligations can vary based on individual circumstances and financial situations. Open communication between family members about these responsibilities can help avoid conflicts and ensure everyone is on the same page.

Exceptions to Filial Responsibility

While filial responsibility laws in Maryland establish clear obligations for adult children, there are exceptions where these responsibilities may not apply. Understanding these exceptions can help families navigate their obligations more effectively.

- Inability to Pay: If an adult child genuinely cannot afford to provide financial support due to their own financial difficulties, they may be exempt from these responsibilities.

- Estrangement: If an adult child has been estranged from their parent for a significant period, they might not be held responsible for support.

- Parent’s Assets: If the parent has sufficient assets or income to cover their care, the adult child may not be liable.

Understanding these exceptions is vital for adult children, as it can significantly influence their legal responsibilities and financial planning. Consulting with a legal expert can help clarify any specific situations.

Consequences of Not Complying with Filial Responsibility

Failure to comply with filial responsibility laws in Maryland can have serious repercussions for adult children. It’s essential to understand what these consequences may be to avoid unnecessary legal issues.

- Legal Action: Parents or caregivers may take legal action against adult children who fail to provide necessary support. This could result in lawsuits that may lead to financial penalties.

- Credit Impact: Unpaid debts related to a parent’s care can affect an adult child’s credit score, making it harder for them to secure loans or mortgages in the future.

- Increased Financial Burden: Not fulfilling obligations may lead to higher costs later on, as legal fees and other expenses can accumulate quickly.

Ultimately, understanding and adhering to these laws can prevent complications and ensure that parents receive the care they need. It’s always wise to consult with legal professionals to navigate these responsibilities effectively.

How to Navigate Filial Responsibility Cases

Navigating filial responsibility cases can be daunting for many adult children, especially when family dynamics and financial issues come into play. Knowing how to approach these situations can make the process smoother and less stressful. Here are some practical steps to help you navigate these cases effectively:

- Open Communication: Start by discussing financial obligations openly with your parents and siblings. Clear communication can help avoid misunderstandings and build a supportive environment.

- Gather Financial Information: Understand your parents’ financial situation, including their income, assets, and any expenses related to care. This information will help clarify what support they may need.

- Consult Legal Experts: If you’re uncertain about your obligations, consult a lawyer who specializes in family law or elder law. They can provide guidance tailored to your situation.

- Document Everything: Keep detailed records of any financial support provided or discussions held regarding responsibilities. This documentation can be invaluable if disputes arise.

- Explore Options: Look into local programs or services that may assist with elder care costs. Understanding available resources can ease the financial burden.

By following these steps, you can navigate filial responsibility cases more confidently, ensuring your parents receive the necessary care while protecting your interests.

Resources for Legal Assistance

Finding the right legal assistance is crucial when dealing with filial responsibility laws. There are various resources available to help adult children understand their rights and obligations, ensuring they make informed decisions. Here are some valuable resources:

- Local Bar Associations: Many local bar associations offer referral services to connect you with attorneys who specialize in family or elder law.

- Legal Aid Societies: Organizations like Legal Aid provide free or low-cost legal assistance to individuals who qualify based on income. They can help you navigate filial responsibility issues.

- Elder Law Resources: Websites such as the National Academy of Elder Law Attorneys (NAELA) offer directories of qualified attorneys and useful articles on elder law topics.

- Community Support Groups: Many communities have support groups for caregivers that can provide advice and share experiences related to filial responsibility.

Utilizing these resources can help you find the guidance you need to navigate the complexities of filial responsibility laws and ensure you’re fulfilling your obligations responsibly.

Frequently Asked Questions

Many people have questions about filial responsibility laws, especially as they relate to their financial obligations toward aging parents. Here are some frequently asked questions that can help clarify common concerns:

- What are filial responsibility laws? These laws require adult children to provide financial support for their parents if they cannot afford necessary care.

- How does Maryland enforce these laws? Maryland may take legal action against adult children who fail to provide support, potentially resulting in lawsuits or other penalties.

- Are there exceptions to these laws? Yes, exceptions can include financial inability, estrangement from the parent, or the parent having sufficient assets to cover their care.

- What should I do if I can’t afford to help my parents? Communicate openly with your parents about your situation and explore local resources or financial assistance programs.

- Can I be sued for not providing support? Yes, if you do not fulfill your obligations, your parents or their caregivers may pursue legal action against you.

These FAQs can provide clarity and help you better understand your responsibilities and rights regarding filial responsibility laws.

Conclusion

Understanding filial responsibility laws is crucial for adult children who may find themselves needing to support their aging parents financially. These laws are designed to ensure that families help each other in times of need, but navigating them can be complex. By being informed about your financial obligations, knowing the exceptions to these laws, and understanding the consequences of non-compliance, you can better prepare for the responsibilities that may arise. Open communication with family members, seeking legal guidance when necessary, and utilizing available resources can ease the burden of navigating filial responsibility cases. Ultimately, being proactive in addressing these responsibilities can lead to more harmonious family dynamics and ensure that your parents receive the care they need.