Massachusetts Conflict of Interest Compliance Requirements

Massachusetts has established conflict of interest laws to ensure transparency and integrity in public service. These laws aim to prevent situations where personal interests might interfere with the responsibilities of public employees. Understanding and adhering to these compliance requirements is crucial for maintaining public trust and accountability in government operations.

Understanding Conflict of Interest in Massachusetts

A conflict of interest arises when a public employee’s personal interests may influence their official duties. In Massachusetts, the State Ethics Commission outlines specific situations that can lead to conflicts. Here are some key points to consider:

- Definition: A conflict of interest typically occurs when an employee has a financial interest in a decision they are making on behalf of the state.

- Types of Conflicts:

- Financial Conflicts: Involves direct financial gain or loss.

- Personal Conflicts: Relates to relationships with family or friends that may affect decision-making.

- Examples:

- Participating in a decision where a relative stands to gain.

- Using state resources for personal business activities.

Understanding these definitions and examples can help public employees navigate their responsibilities without ethical pitfalls.

Key Compliance Requirements for Public Employees

To comply with Massachusetts conflict of interest laws, public employees must follow several key requirements. These ensure that their personal interests do not compromise their public duties:

- Annual Disclosure: Employees must file a disclosure statement detailing their financial interests.

- Training Programs: Participating in ethics training sessions is mandatory for understanding conflict regulations.

- Consultation: When in doubt, employees should consult with the State Ethics Commission to clarify potential conflicts.

- Recusal: If a conflict is identified, the employee must recuse themselves from the decision-making process.

- Record Keeping: Maintaining thorough records of disclosures and communications can provide legal protection.

By adhering to these requirements, public employees can ensure they uphold the integrity of their positions and protect the interests of the public they serve.

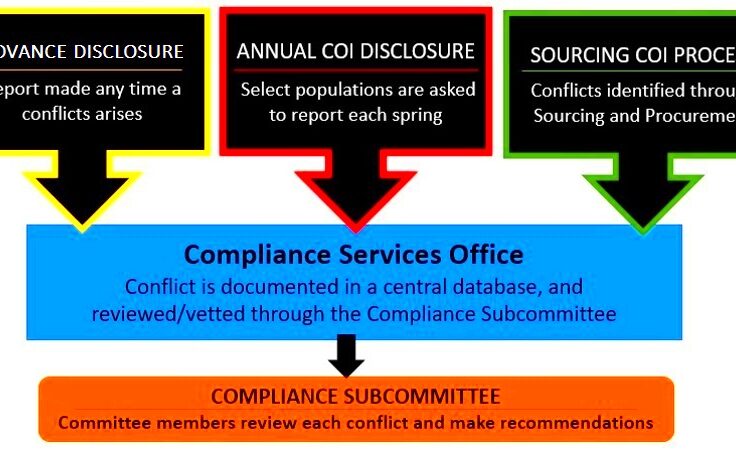

Disclosure Obligations for State Officials

In Massachusetts, state officials have specific disclosure obligations to maintain transparency and avoid conflicts of interest. These requirements ensure that the public can trust that decisions made by state officials are not influenced by personal interests. Here’s what you need to know:

- Who Must Disclose: All state officials, including legislators and public employees, are required to file disclosure statements.

- When to Disclose:

- Initial disclosures must be filed upon taking office.

- Annual updates are required to reflect any changes in financial interests.

- What to Disclose: The disclosure statement should include:

- Personal financial interests

- Ownership interests in businesses

- Positions held in outside organizations

- Filing Process: Disclosures must be submitted to the State Ethics Commission, which reviews the filings for compliance.

By fulfilling these disclosure obligations, state officials contribute to a culture of accountability, ensuring that their actions are guided by public interest rather than personal gain.

Penalties for Non-Compliance with Conflict of Interest Laws

Failure to comply with Massachusetts conflict of interest laws can result in serious consequences for public officials. Understanding these penalties is essential for fostering compliance and maintaining public trust. Here’s a closer look:

- Types of Penalties:

- Civil Penalties: Fines can be imposed for violations, often amounting to thousands of dollars.

- Criminal Penalties: In severe cases, officials may face criminal charges, which can lead to imprisonment.

- Examples of Violations:

- Failing to file required disclosure statements.

- Participating in decisions where a conflict exists without recusal.

- Enforcement: The State Ethics Commission actively investigates complaints and can take action against violators.

Understanding these penalties emphasizes the importance of adherence to conflict of interest laws, which not only protect public officials but also uphold the integrity of the governmental process.

Best Practices for Maintaining Compliance

To effectively navigate conflict of interest laws, state officials should adopt best practices that promote compliance and ethical behavior. Here are some practical strategies:

- Stay Informed: Regularly review the state’s conflict of interest laws and updates from the State Ethics Commission.

- Participate in Training: Attend workshops and training sessions focused on ethics and compliance.

- Document Everything: Keep detailed records of decisions, communications, and disclosures to provide clarity and accountability.

- Seek Guidance: When unsure, consult the State Ethics Commission for advice on potential conflicts and disclosure requirements.

- Foster a Culture of Transparency: Encourage open discussions about ethical dilemmas within your office to promote a culture of compliance.

By implementing these best practices, state officials can not only comply with the law but also enhance public confidence in their roles and the overall integrity of government operations.

Resources for Further Information

If you’re looking for more information on Massachusetts conflict of interest laws, there are several valuable resources available. These can help you better understand the regulations, requirements, and best practices associated with compliance. Here are some key resources:

- Massachusetts State Ethics Commission: The primary source for all regulations and guidelines. Their website offers detailed information about conflict of interest laws, disclosure requirements, and compliance guidelines.

- Online Training Modules: Many organizations, including the State Ethics Commission, provide free online training that covers the fundamentals of conflict of interest laws.

- Legal Counsel: Consulting with an attorney who specializes in ethics law can provide personalized guidance and ensure that you fully understand your obligations.

- Workshops and Seminars: Attend workshops and seminars hosted by professional associations or government agencies focused on ethics and compliance.

- Publications and Guides: Look for pamphlets, books, or online articles that explain conflict of interest laws in detail. Many universities and legal organizations publish comprehensive guides.

Using these resources can help you stay informed and compliant with Massachusetts conflict of interest laws, ensuring you fulfill your obligations effectively.

Frequently Asked Questions

When it comes to Massachusetts conflict of interest compliance, many questions often arise. Here are some frequently asked questions to clarify common concerns:

- What is a conflict of interest? A conflict of interest occurs when a public official’s personal interests interfere with their official duties.

- Who needs to file a disclosure statement? All public officials, including state employees and legislators, are required to file disclosure statements.

- What happens if I fail to comply? Penalties for non-compliance can include civil fines and, in severe cases, criminal charges.

- Can I seek advice on potential conflicts? Yes, you can consult the State Ethics Commission for guidance on how to handle potential conflicts.

- How often do I need to update my disclosure? You must file an initial disclosure upon taking office and update it annually or whenever there are changes in your financial interests.

These FAQs aim to demystify the compliance process, making it easier for public officials to navigate their responsibilities.

Conclusion on Massachusetts Conflict of Interest Compliance

Understanding and adhering to Massachusetts conflict of interest laws is essential for maintaining public trust and integrity in government. By being aware of your obligations, participating in required trainings, and utilizing available resources, you can navigate the complexities of compliance effectively. Remember, transparency is not just a legal requirement; it’s a cornerstone of ethical governance.

As you continue your public service journey, prioritize ethical practices and make a commitment to uphold the values of accountability and integrity. Your actions play a crucial role in fostering a culture of trust and respect within your community. With the right knowledge and tools, you can confidently fulfill your duties while avoiding conflicts of interest.