Massachusetts Mileage Reimbursement Law for Employers

The Massachusetts Mileage Reimbursement Law is designed to ensure that employees are fairly compensated for using their personal vehicles for work-related tasks. This law sets specific guidelines for employers regarding how much they should reimburse employees for mileage. It’s important for both employers and employees to understand these regulations to avoid disputes and ensure compliance. Mileage reimbursement is not just about fairness; it’s also about maintaining a positive working relationship between employers and their staff.

Who Is Eligible for Mileage Reimbursement in Massachusetts

In Massachusetts, employees who use their personal vehicles for business purposes are generally eligible for mileage reimbursement. Here’s a breakdown of who qualifies:

- Full-time employees: Those who work regularly and are required to use their vehicles for job duties.

- Part-time employees: Employees who use their vehicles on a part-time basis for work-related tasks.

- Independent contractors: While they are not traditional employees, contractors using their vehicles for business may also seek reimbursement, depending on their agreement with the hiring company.

Employers must clearly communicate their reimbursement policies and ensure all eligible employees understand how to claim their mileage. It helps to have a written policy in place outlining eligibility, rates, and the process for submitting claims.

How Employers Calculate Mileage Reimbursement

Calculating mileage reimbursement in Massachusetts involves a few straightforward steps. Employers typically follow the IRS standard mileage rate, which is updated annually. Here’s how it works:

-

- Determine the total miles driven: Employees should keep accurate records of their business mileage, including dates, destinations, and purposes of travel.

- Apply the current mileage rate: Multiply the total business miles by the IRS standard mileage rate. For example, if the rate is $0.60 per mile and an employee drives 100 miles for work, the calculation would be:

| Total Miles | Mileage Rate | Reimbursement Amount |

|---|---|---|

| 100 miles | $0.60 | $60.00 |

- Submit reimbursement claims: Employees should submit their mileage logs along with any relevant documentation for reimbursement.

Employers must ensure that their reimbursement rates comply with the law and are communicated clearly to employees. Regular reviews of the mileage reimbursement policy can help maintain fairness and compliance.

Employer Obligations Under the Massachusetts Law

Employers in Massachusetts have specific obligations when it comes to mileage reimbursement. Understanding these responsibilities helps create a fair work environment and fosters trust between employers and employees. By adhering to the law, businesses can avoid potential disputes and ensure compliance. Here’s what employers need to know about their obligations:

- Reimburse at the appropriate rate: Employers must reimburse employees at least the standard mileage rate set by the IRS unless a different rate has been agreed upon.

- Provide clear reimbursement policies: It’s essential for employers to establish a written mileage reimbursement policy that outlines eligibility, rates, and the process for submitting claims.

- Keep accurate records: Employers should maintain records of reimbursements made, including mileage logs submitted by employees.

- Timely reimbursements: Employers must ensure that reimbursement requests are processed promptly to avoid financial strain on employees.

By fulfilling these obligations, employers can build a positive workplace culture and minimize the risk of legal complications related to mileage reimbursement.

Common Issues Faced by Employers and Employees

Despite clear laws, both employers and employees can encounter common issues related to mileage reimbursement. Being aware of these challenges can help both parties navigate the process more smoothly. Here are some frequent issues:

- Disputes over mileage logs: Employees may feel that their mileage claims are under-reimbursed, while employers might question the accuracy of submitted logs.

- Lack of awareness: Some employees may not fully understand their rights to reimbursement, leading to confusion and under-claiming.

- Inconsistent policies: If employers change reimbursement policies without proper communication, it can create frustration among employees.

- Tax implications: Employees may be uncertain about how reimbursement affects their taxes, leading to concerns over potential liabilities.

Open communication between employers and employees can help address these issues and promote a better understanding of the reimbursement process.

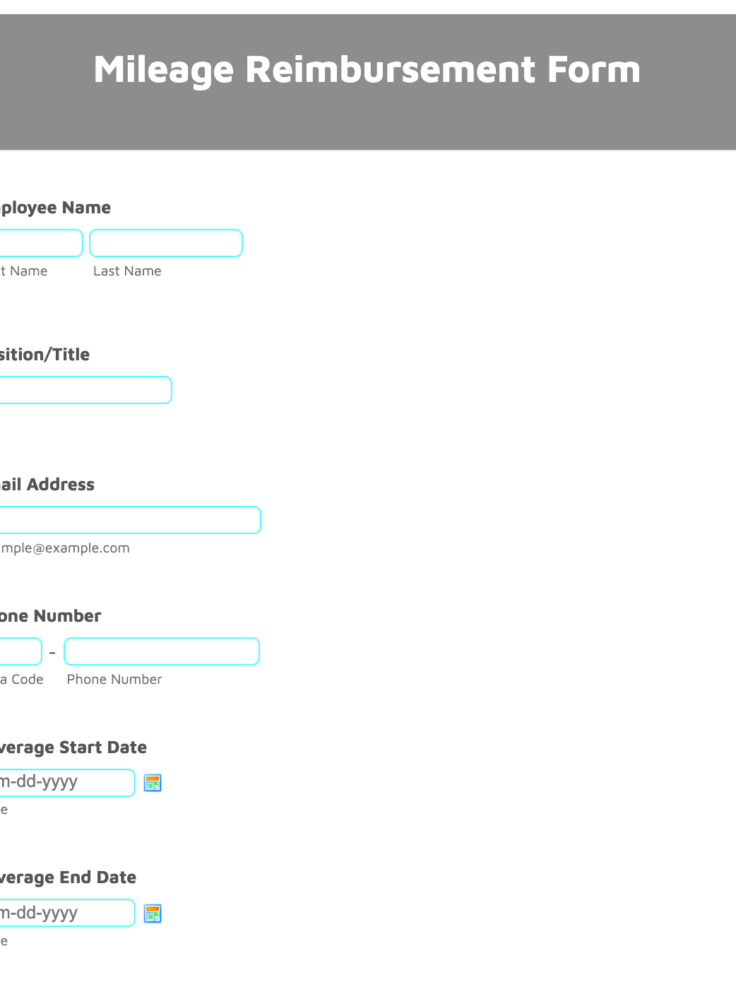

How to Track and Submit Mileage for Reimbursement

Tracking and submitting mileage for reimbursement can be simple if employees follow a systematic approach. Keeping accurate records ensures that reimbursement claims are valid and helps avoid disputes. Here’s how to effectively track and submit mileage:

- Maintain a mileage log: Employees should keep a detailed log of their business mileage. This can be done using a notebook or digital apps designed for tracking mileage. The log should include:

- Date of travel

- Starting and ending locations

- Purpose of the trip

- Total miles driven

- Use a mileage tracking app: There are various apps available that can help automate the tracking process. These apps often allow users to log trips and calculate reimbursements automatically.

- Submit reimbursement requests: Once the mileage log is complete, employees should submit their logs along with any other required documentation, such as receipts for tolls or parking.

- Follow up: After submission, employees should follow up with their employer to ensure the reimbursement is processed in a timely manner.

By following these steps, employees can ensure they receive the reimbursement they are entitled to without any unnecessary hassle.

Penalties for Non-Compliance with Mileage Reimbursement Rules

Non-compliance with the Massachusetts Mileage Reimbursement Law can have serious consequences for employers. It’s essential for businesses to understand these penalties to avoid potential legal troubles. By adhering to the law, employers not only protect themselves but also foster a fair and supportive work environment. Here’s a look at some of the key penalties associated with non-compliance:

- Financial penalties: Employers may be required to pay back the amount owed to employees if they fail to reimburse them adequately. This can also include interest on the unpaid amounts.

- Legal fees: If a dispute escalates and requires legal intervention, employers may incur substantial legal fees, regardless of the outcome.

- Damaged employee relationships: Failing to comply with reimbursement rules can lead to mistrust and dissatisfaction among employees, which may result in higher turnover rates.

- Potential lawsuits: Employees may file lawsuits for unpaid reimbursements, which can lead to costly settlements or court judgments against the employer.

To avoid these penalties, employers should stay informed about the law and maintain clear communication with employees regarding mileage reimbursement policies.

Conclusion on Massachusetts Mileage Reimbursement Law

The Massachusetts Mileage Reimbursement Law plays a vital role in ensuring employees are fairly compensated for using their personal vehicles for work-related tasks. Understanding the rules, obligations, and procedures surrounding mileage reimbursement can help both employers and employees maintain a positive working relationship. By adhering to the law, employers not only protect their businesses from legal issues but also promote a culture of fairness and respect. Employees should feel empowered to claim their mileage reimbursements, knowing their rights are protected. Ultimately, compliance with the mileage reimbursement law benefits everyone involved.

FAQs About Mileage Reimbursement in Massachusetts

Here are some frequently asked questions regarding mileage reimbursement in Massachusetts. These questions help clarify common concerns:

- What is the standard mileage reimbursement rate?The standard mileage reimbursement rate is typically set by the IRS and is updated annually. Employers may choose to match this rate or establish a different one, as long as it meets legal requirements.

- How do I submit a mileage reimbursement request?Employees should maintain a mileage log that details their business-related trips and submit it along with any required documentation, like receipts, to their employer for reimbursement.

- Are independent contractors eligible for mileage reimbursement?Independent contractors may be eligible for reimbursement, but it depends on their contractual agreement with the hiring company.

- What happens if my employer does not reimburse me?If an employer fails to reimburse you for business mileage, you can raise the issue directly with them. If the issue remains unresolved, you may consider seeking legal advice or filing a complaint with the appropriate labor authority.

- Can employers change the reimbursement rate?Employers can adjust the reimbursement rate, but they must communicate any changes clearly to their employees and ensure compliance with legal standards.

These FAQs aim to provide clarity on mileage reimbursement, ensuring that both employers and employees are well-informed about their rights and responsibilities.