Michigan Repo Laws Explained

In Michigan, repossession laws are crucial for both lenders and borrowers to understand. These laws outline the rights and responsibilities of each party during the repossession process. When a borrower fails to make payments on a secured loan, such as a car loan, the lender has the right to repossess the vehicle. However, there are specific rules governing how this can be done to ensure fairness and transparency. Knowing these laws can help borrowers protect their rights and make informed decisions.

Understanding the Repossession Process

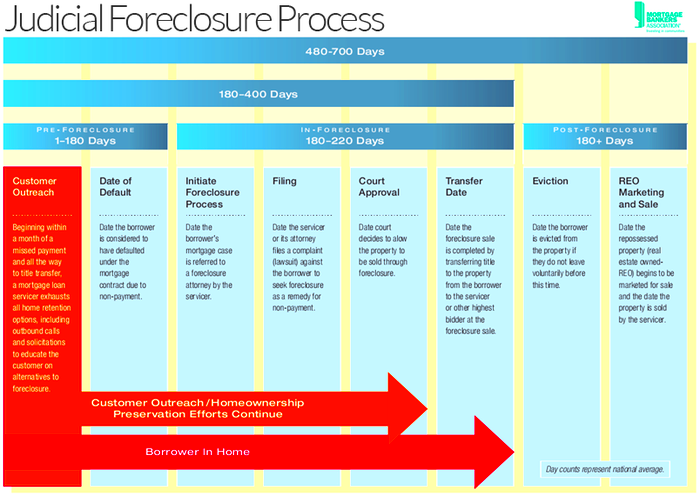

The repossession process in Michigan typically follows these steps:

- Default on Payments: When a borrower misses payments, the lender may initiate repossession.

- Notification: Although not required, lenders often notify borrowers of their intent to repossess the vehicle.

- Repossessing the Vehicle: Lenders can send a third party to take back the vehicle, but they must do so without breaching the peace. This means no threats or force can be used.

- Post-Repossession Procedures: After repossession, the lender must send a notice to the borrower, detailing the debt owed and the time frame to redeem the vehicle.

Borrowers can redeem their vehicle by paying the full amount owed, including any fees. If they don’t, the lender may sell the vehicle, usually at an auction. It’s important for borrowers to keep track of their payments to avoid this process.

Rights of the Borrower in Michigan

Borrowers in Michigan have several important rights during the repossession process:

- Right to Receive Notice: Borrowers must be notified after repossession and provided with details about the debt and how to retrieve their property.

- Right to Redeem the Vehicle: Borrowers can reclaim their repossessed vehicle by paying the total debt before it is sold.

- Right to Contest Repossession: If borrowers believe the repossession was unlawful, they can contest it in court.

- Protection from Harassment: Lenders and their agents cannot harass borrowers during the repossession process.

Understanding these rights can empower borrowers to take action and ensure their interests are protected.

Responsibilities of the Lender

Lenders in Michigan have specific responsibilities when it comes to repossession. Understanding these obligations is crucial for both lenders and borrowers. Here are some key responsibilities:

- Fair Notification: Lenders must notify borrowers of any default on payments. While they aren’t required by law to give a grace period, it’s common practice to reach out before taking action.

- Peaceful Repossession: Lenders must ensure that the repossession process does not involve any threats or force. This means they can’t break into your property or use physical intimidation.

- Post-Repossession Notification: After repossessing a vehicle, lenders are required to send a notice to the borrower detailing the amount owed and how they can reclaim their property.

- Proper Handling of the Sale: If the lender sells the repossessed vehicle, they must conduct the sale in a commercially reasonable manner. This means they should aim to get a fair price.

- Accounting for the Sale: Lenders must provide a clear accounting of the sale proceeds and any remaining balance owed by the borrower after the sale.

By fulfilling these responsibilities, lenders can maintain a fair and transparent process, helping to protect both their interests and those of borrowers.

How to Avoid Repossession

Repossession can be a stressful experience, but there are steps you can take to avoid it. Here are some effective strategies:

- Stay in Communication: If you’re having trouble making payments, contact your lender immediately. Many lenders offer hardship programs or can work out a payment plan.

- Make Payments on Time: Set reminders or automate payments to ensure you don’t miss any due dates. Consistent payments can keep you in good standing.

- Review Your Contract: Understand the terms of your loan agreement, including payment schedules and what happens in case of default.

- Consider Refinancing: If interest rates have dropped or your financial situation has changed, refinancing your loan may lower your monthly payments.

- Budget Wisely: Keep track of your finances and create a budget that includes your loan payments to prioritize your obligations.

By taking these proactive steps, you can greatly reduce the risk of repossession and maintain ownership of your vehicle.

Steps to Take After Repossession

Finding out your vehicle has been repossessed can be overwhelming, but there are specific steps you can take to address the situation:

- Stay Calm: It’s important to take a deep breath and assess the situation logically.

- Read the Notice: Review the notice you receive from the lender after repossession. It should detail how much you owe and your options for recovery.

- Contact the Lender: Reach out to your lender to discuss the situation. Ask about the possibility of redemption and any fees you may need to cover.

- Consider Your Options: You may be able to pay off the debt to recover your vehicle. If this isn’t feasible, inquire about the next steps and any alternatives available.

- Check Your Credit Report: Repossession can impact your credit score, so check your credit report for any inaccuracies. Dispute any errors you find.

- Seek Legal Advice: If you believe the repossession was handled unfairly or if you need help understanding your rights, consult with a legal professional who specializes in consumer law.

By following these steps, you can better navigate the aftermath of repossession and explore your options moving forward.

Impact of Repossession on Credit Score

Repossession can significantly impact your credit score, often leading to long-term financial consequences. When a vehicle is repossessed, it’s reported to credit bureaus, which can lower your score by several points, depending on your overall credit history. Here’s how repossession affects your credit:

- Immediate Impact: A repossession can drop your score by 100 points or more, making it harder to secure loans or credit in the future.

- Duration on Credit Report: Repossessions typically stay on your credit report for up to seven years, continuing to affect your creditworthiness during that time.

- Higher Interest Rates: With a lower credit score, lenders may view you as a higher risk, leading to higher interest rates on future loans.

- Difficulties in Renting: Landlords may check your credit score when you apply to rent, and a repossession can hinder your chances of securing a lease.

- Insurance Implications: Auto insurance companies may also review your credit history, and a poor score could lead to higher premiums.

To mitigate the damage, it’s important to take proactive steps like paying bills on time and addressing any inaccuracies on your credit report. With time and effort, you can rebuild your credit score and financial stability.

Frequently Asked Questions

Many borrowers have questions about repossession and its implications. Here are some common inquiries and their answers:

- Can a lender repossess my car without notice? Yes, in Michigan, lenders can repossess your vehicle without prior notice if you default on your payments.

- How long does a repossession stay on my credit report? A repossession can remain on your credit report for up to seven years.

- Can I get my car back after repossession? Yes, you may reclaim your vehicle by paying the total amount owed, including fees, within the redemption period.

- What if I believe the repossession was illegal? You can contest the repossession in court if you think it was handled unlawfully.

- Will my credit score recover after repossession? Yes, while repossession negatively impacts your credit, responsible financial behavior can help improve your score over time.

Understanding these FAQs can help borrowers navigate the complexities of repossession and protect their rights.

Conclusion

In summary, understanding Michigan’s repossession laws is essential for both borrowers and lenders. By knowing your rights and responsibilities, you can navigate the repossession process more effectively. Taking proactive steps to avoid repossession, and understanding its impact on your credit score, can help safeguard your financial future. If you find yourself facing repossession, remember to stay calm, explore your options, and consider seeking legal advice if needed. This knowledge not only empowers you but also promotes a fairer lending environment for everyone.