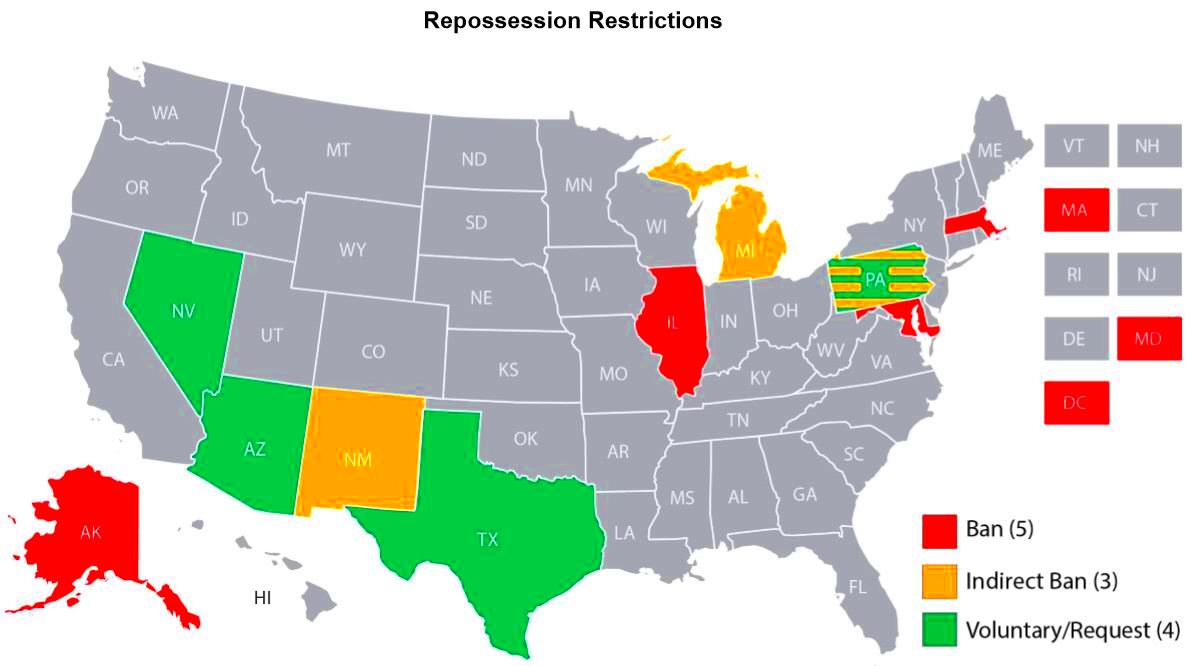

Michigan Repo Laws: What Car Owners Should Know

Michigan repo laws are designed to protect both lenders and car owners during the repossession process. If you fall behind on your car payments, a lender may have the right to repossess your vehicle. However, certain rules must be followed to ensure the process is fair. Whether you’re a car owner trying to avoid repossession or simply want to understand your rights, knowing these laws can help you navigate a difficult situation with confidence.

When Can a Lender Repossess Your Car in Michigan?

In Michigan, a lender can repossess your car if you default on your loan, meaning you’ve missed payments or violated the terms of your loan agreement. The lender doesn’t need to provide prior notice before repossessing the vehicle. However, there are some conditions that must be met:

- The repossession must occur without “breaching the peace” – this means they cannot use force, threats, or cause damage during the process.

- The lender cannot enter your home or enclosed garage without permission to repossess the car.

- If your car is on public property or easily accessible, the lender can take it at any time after default.

It’s important to carefully review your loan agreement to understand what constitutes a default and your rights under Michigan’s laws.

What Happens During the Repossession Process?

Once your car is repossessed, the lender typically follows a specific process. Here’s what happens:

- Car is taken: The lender or a third-party company will repossess the car, either from a public area or your driveway (without breaching the peace).

- Notice is sent: After repossession, the lender is required to send you a notice explaining the reason for the repossession and your rights.

- Opportunity to recover the car: You usually have a right to “redeem” your vehicle by paying off the overdue amounts, which may include additional repossession fees.

- Auction or sale: If you don’t redeem your vehicle within a specific time, the lender can sell it at an auction. The sale must be done in a commercially reasonable manner.

- Remaining debt: If the car sells for less than what you owe, you may still be responsible for the remaining balance, called a “deficiency balance.”

Understanding each step of this process can help you act quickly if you wish to recover your car.

Can You Stop a Repossession in Michigan?

Stopping a repossession in Michigan is possible, but it requires quick action. If you’ve fallen behind on payments and are worried about losing your car, you may have options. By knowing your rights and taking the right steps, you can potentially avoid repossession altogether.

Here are some ways you can stop a repossession:

- Bring the loan current: One of the most straightforward ways to stop a repossession is to catch up on missed payments. Contact your lender to discuss what you owe, including any late fees, and arrange a payment plan if possible.

- Negotiate with your lender: Many lenders are willing to work with borrowers to avoid repossession. This could involve restructuring your loan or allowing you to defer payments until you’re in a better financial situation.

- File for bankruptcy: Filing for Chapter 7 or Chapter 13 bankruptcy can temporarily stop the repossession process through an “automatic stay,” which halts collection actions while the bankruptcy is active.

- Voluntary surrender: If repossession is unavoidable, you may choose to voluntarily surrender your car. While this won’t stop the process entirely, it can reduce some of the fees and may be less damaging to your credit than a forced repossession.

By acting early and keeping an open line of communication with your lender, you may be able to prevent repossession and keep your car.

What Are Your Rights After Repossession?

After your car has been repossessed, it’s important to understand your rights as a Michigan car owner. The repossession process is not the end of the road, and you still have legal protections. Knowing your rights can help you make informed decisions about your next steps.

Here are your main rights after repossession:

- Notice of intent: The lender must send you a notice after the repossession. This notice should explain why the car was taken and provide details about how you can recover it.

- Right to redeem: You have the right to “redeem” your vehicle by paying off the amount you owe, including any fees related to the repossession. The lender must provide clear instructions on how to do this.

- Right to recover personal items: If you had personal belongings in the car, the lender must allow you to retrieve them. They cannot keep or sell your personal property.

- Right to receive notice of sale: Before your car is sold at auction, the lender must notify you of the sale date. This gives you an opportunity to redeem the vehicle before it’s sold.

- Fair sale practices: The lender must sell the car in a “commercially reasonable” way. If the car sells for less than it’s worth, and it wasn’t sold reasonably, you may have grounds to challenge the deficiency balance.

By understanding these rights, you can ensure that the repossession process is handled properly and legally.

How to Get Your Car Back After Repossession

Getting your car back after repossession in Michigan is possible, but it depends on your financial situation and how quickly you act. Once your car has been taken, there are several steps you can follow to recover it.

Here are the main ways to get your car back:

- Pay the redemption amount: The easiest way to get your car back is by paying the full amount owed on the loan, including any repossession fees. This is known as redeeming the vehicle. The lender must inform you of the exact amount and provide you a reasonable time frame to pay.

- Negotiate a reinstatement: Some lenders allow borrowers to reinstate their loans by paying past-due amounts rather than the full balance. This reinstatement brings the loan current, allowing you to recover the car and continue making payments.

- Buy the car back at auction: If the lender sells your car at auction, you may have the option to bid on it and buy it back. However, this may not always be the most financially viable option, as auction prices and fees can add up.

- Seek legal assistance: If you believe the repossession was handled improperly or your rights were violated, you can seek legal advice. In some cases, legal action can help you recover your car or reduce the amount you owe.

Recovering your car quickly after repossession requires understanding your financial options and acting within the given deadlines. Staying in touch with your lender and reviewing your rights can make the process smoother.

How Does Repossession Affect Your Credit?

Repossession can have a serious impact on your credit score, and the effects can last for several years. When a lender takes back your vehicle, it signals to future creditors that you’ve struggled to meet financial obligations, which can make it harder to get approved for loans or credit in the future. Understanding the full impact of repossession on your credit can help you plan your financial recovery.

Here’s how repossession affects your credit:

- Immediate drop in credit score: The repossession will be reported to the credit bureaus, typically leading to a significant drop in your credit score. The exact decrease depends on your credit history, but it can range from 50 to 150 points.

- Default and late payments: Missed payments leading up to the repossession are also reported, which further damages your credit. Each missed payment can have a cumulative negative effect.

- Repossessed status stays on your report: A repossession can remain on your credit report for up to seven years. During this time, it will be visible to lenders, potentially affecting your ability to qualify for new loans.

- Impact on future financing: After repossession, getting approved for a new car loan or other types of credit can be challenging. Lenders may offer higher interest rates or require a co-signer due to the repossession on your record.

To minimize the damage, consider focusing on improving your credit by making timely payments on other accounts and reducing your overall debt. Over time, your credit score can recover from the negative impact of repossession.

FAQ: Common Questions About Michigan Repo Laws

Here are some of the most frequently asked questions about Michigan repo laws and how they affect car owners:

| Question | Answer |

|---|---|

| Can a lender repossess my car without notice? | Yes, in Michigan, a lender can repossess your car without prior notice if you default on your loan. However, they must follow legal guidelines such as not breaching the peace during repossession. |

| Can I get my personal items back after repossession? | Yes, the lender is required to allow you to recover any personal belongings left in the car. They cannot sell or keep these items. |

| How long do I have to redeem my car? | After repossession, you typically have a limited period to redeem your car by paying off the full loan balance plus any repossession fees. The timeline varies, but lenders must provide a clear redemption period in the notice they send you. |

| Will repossession affect my credit score? | Yes, repossession will negatively impact your credit score and can stay on your credit report for up to seven years. It also affects your ability to get future loans. |

Conclusion: Key Takeaways for Car Owners in Michigan

Understanding Michigan’s repo laws is crucial if you’re facing financial difficulties and concerned about losing your vehicle. Here are some key takeaways:

- Lenders can repossess your car without notice if you default, but they must follow specific rules like avoiding breaches of the peace.

- You have rights after repossession, including the right to redeem your vehicle and retrieve personal items.

- Stopping repossession is possible by bringing your loan current or negotiating with your lender.

- Repossession will negatively affect your credit, but with time and proper financial management, you can recover from its impact.

By staying informed about your rights and responsibilities, you can better navigate the challenges of repossession and protect your financial future.