Michigan Repo Laws: What Lenders and Borrowers Should Know

Repossession laws in Michigan can be quite complex, but understanding them is essential for both lenders and borrowers. These laws dictate how and when a lender can reclaim a financed asset when the borrower defaults on payments. Knowing your rights and obligations can help avoid potential pitfalls during the repossession process. In this section, we’ll break down the essential aspects of repo laws to give you a clearer picture of what to expect in Michigan.

Definition of Repossession

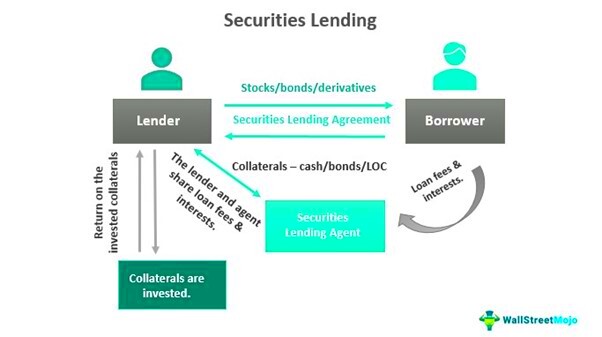

Repossession refers to the process where a lender takes back property that was used as collateral for a loan, typically because the borrower has failed to make required payments. Here are some key points to understand:

- Collateral: This is the asset (like a car or furniture) that secures the loan.

- Default: Defaulting occurs when the borrower fails to make payments as agreed in the loan contract.

- Repossession Process: Lenders may reclaim the asset without court intervention if certain conditions are met.

Repossession can occur in several ways, including voluntary repossession (where the borrower returns the item) and involuntary repossession (where the lender takes it back without consent).

Legal Requirements for Lenders

Lenders in Michigan must follow specific legal requirements when repossessing property. These regulations are designed to protect the rights of borrowers while ensuring that lenders can reclaim their collateral effectively. Here are the main legal requirements:

- Notice of Default: Before repossession, the lender must usually send a notice to the borrower stating that they are in default.

- Right to Cure: Borrowers may have a right to remedy the default by making the past-due payments before repossession occurs.

- Peaceful Repossession: Lenders must conduct repossession peacefully. They cannot use force or threats to reclaim the asset.

- Documentation: Lenders must keep accurate records of the repossession process to ensure compliance with state laws.

Failure to comply with these requirements can lead to legal repercussions for the lender and could invalidate the repossession.

Borrowers Rights During Repossession

When facing repossession, it’s crucial for borrowers to know their rights. In Michigan, various laws protect borrowers from unfair practices and help ensure they are treated fairly during this difficult time. Understanding these rights can empower borrowers to take appropriate action if they feel their rights are being violated. Let’s explore the key rights that borrowers have during repossession.

- Right to Receive Notice: Borrowers must be informed of their default status and any impending repossession actions.

- Right to Cure Default: Borrowers often have the opportunity to make overdue payments and prevent repossession.

- Right to Peaceful Repossession: Repossession must be carried out without breaching the peace. Lenders cannot use force or intimidation.

- Right to Retrieve Personal Items: Borrowers can retrieve personal belongings from the repossessed asset if it can be done safely.

- Right to Challenge Repossession: If borrowers believe the repossession was unlawful, they can contest it through legal channels.

Knowing these rights can help borrowers navigate the repossession process with more confidence and make informed decisions.

Process of Repossession in Michigan

The repossession process in Michigan typically follows specific steps that lenders must adhere to, ensuring that borrowers are treated fairly. While the exact process can vary based on the type of asset and the lender, here’s a general outline:

- Default on Payments: The process begins when a borrower misses payments as per the loan agreement.

- Notification: The lender sends a default notice to the borrower, informing them of their missed payments.

- Opportunity to Cure: Borrowers usually have a grace period to make the missed payments to avoid repossession.

- Repossession: If payments remain unpaid, the lender can repossess the asset, often without court involvement.

- Sale of Repossessed Asset: The lender may sell the asset to recover the loan balance. Borrowers should be notified of this sale.

Each step is designed to protect both the lender’s and the borrower’s rights, ensuring transparency and fairness throughout the process.

Effects of Repossession on Credit Scores

Repossession can have a significant impact on a borrower’s credit score, and understanding these effects is crucial for anyone facing the possibility of losing an asset. When a lender repossesses property, it is reported to credit bureaus, which can lead to negative consequences:

- Credit Score Decrease: A repossession can lower a borrower’s credit score by 100 points or more, depending on their previous credit history.

- Long-Term Impact: The repossession will stay on a credit report for up to seven years, affecting future borrowing opportunities.

- Higher Interest Rates: A lower credit score may lead to higher interest rates on future loans, increasing overall borrowing costs.

- Difficulty in Securing Loans: Borrowers may find it challenging to obtain loans or credit cards after a repossession, as lenders may view them as high-risk.

Being aware of these potential impacts can help borrowers take proactive steps to manage their credit and mitigate the damage after a repossession.

Steps to Take After Repossession

Facing repossession can be stressful and overwhelming, but knowing what to do afterward can help you regain control of your situation. After your asset has been repossessed, taking specific steps can protect your rights, improve your financial situation, and help you move forward. Here are some essential actions to consider:

- Assess Your Situation: Take a moment to review your financial situation and understand how the repossession affects you. This will help you make informed decisions moving forward.

- Retrieve Personal Belongings: If you had personal items in the repossessed asset, contact the lender to arrange for their safe retrieval.

- Review Loan Documents: Go over your loan agreement to understand the terms and any potential penalties for default.

- Check Your Credit Report: Obtain a copy of your credit report to see how the repossession is reflected and to ensure that all information is accurate.

- Consider Legal Options: If you believe the repossession was conducted unlawfully, consult a legal professional to discuss potential actions you can take.

- Develop a Financial Plan: Create a budget and plan to manage your finances after the repossession. This may include setting aside funds to rebuild your credit.

- Focus on Credit Repair: Work on rebuilding your credit by paying bills on time and considering secured credit cards to establish a positive payment history.

Taking these steps can help you navigate the aftermath of repossession and work toward a more stable financial future.

Frequently Asked Questions

Repossession can raise many questions, and it’s important to get the answers you need. Here are some of the most common questions borrowers have about repossession in Michigan:

- What is the timeline for repossession?

The timeline can vary, but lenders typically follow a series of steps, including notifying you of default before repossession occurs. - Can I stop the repossession?

Yes, if you are able to make the overdue payments before the lender repossesses the asset, you can stop the process. - What happens to my belongings in the repossessed item?

You have the right to retrieve personal items from the repossessed asset, provided it can be done safely. - How long will the repossession stay on my credit report?

A repossession can remain on your credit report for up to seven years, impacting your ability to secure future loans. - Can I negotiate with the lender after repossession?

Yes, you may be able to negotiate with your lender regarding the outstanding balance or discuss options for repayment.

If you have more specific questions, consulting a legal professional or financial advisor can provide clarity based on your unique situation.

Conclusion

Understanding Michigan’s repossession laws is essential for both lenders and borrowers. Knowing your rights and obligations can help prevent misunderstandings and ensure a smoother process. If you find yourself facing repossession, remember to assess your situation, retrieve personal belongings, and consider legal options if necessary. Although the impact on your credit score can be significant, taking proactive steps can help you rebuild and recover. By staying informed and taking appropriate actions, you can navigate the challenges of repossession and work towards a more secure financial future.