Navigating California’s Business Licensing Regulations

Starting a business in California requires understanding the regulations surrounding business licenses. It’s not just about setting up your office or launching your product. A business license is a legal requirement that allows you to operate your business within a specific location.

California’s business licensing rules vary by location and type of business. Local governments—cities and counties—set specific regulations, meaning that you need to check with local authorities for the exact requirements. Whether you’re a small business or a larger enterprise, having the right license helps you avoid legal troubles and ensures that you’re operating within the law.

Types of Business Licenses Required in California

California has several types of business licenses depending on the nature of your business. Understanding which license applies to your business is crucial for compliance. Below are some common types:

- General Business License: Required by most businesses. This is issued by the city or county where your business is located.

- Professional License: Needed for specific professions such as doctors, lawyers, and contractors. These are regulated by state boards.

- Sales Tax Permit: If you sell goods in California, you will need a seller’s permit issued by the California Department of Tax and Fee Administration.

- Home-Based Business License: If you’re running a business from home, this license may be necessary depending on your local zoning laws.

- Environmental and Health Permits: Certain businesses, especially those in food, healthcare, or waste management, need additional permits for compliance with environmental and health regulations.

In some cases, your business may require more than one type of license or permit, depending on its scope.

Steps to Apply for a California Business License

Getting a business license in California involves a series of steps, which may vary slightly depending on your business type and location. Below is a general process to help you navigate the application:

- Identify the License You Need: Start by determining what type of license your business requires. Contact your city or county’s business licensing department for specific information.

- Complete the Application: Most applications can be completed online, but you may need to visit a local office depending on your city or county’s procedures.

- Provide Required Documents: Be ready to submit necessary documents like business name registration, tax information, and proof of address. Certain industries may require additional documents, such as professional certifications.

- Pay Fees: Business license fees vary across different cities and counties. Make sure to check the fee structure beforehand to avoid surprises.

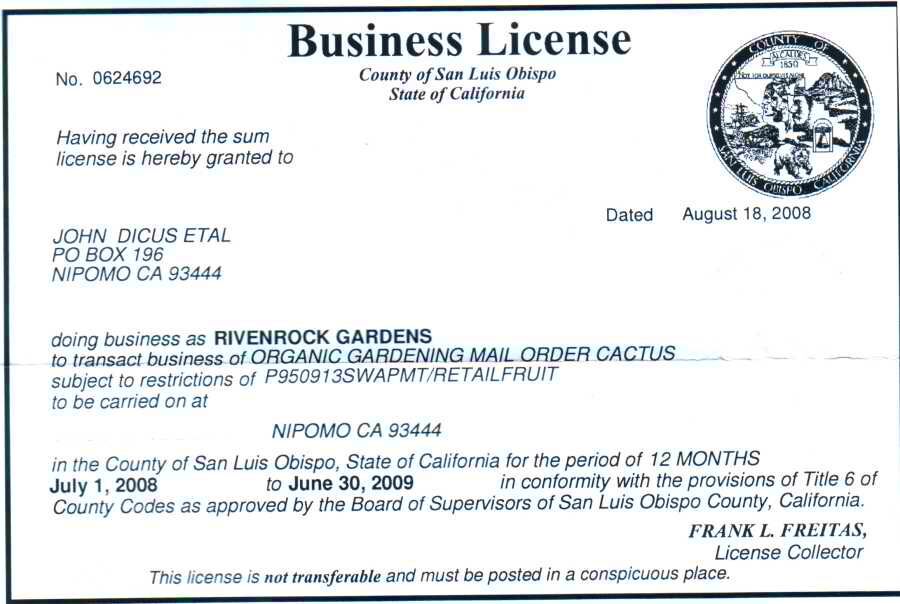

- Receive Your License: Once your application is approved and all fees are paid, you’ll receive your business license, which should be displayed in a prominent place at your business location.

It’s essential to keep your business license up to date and renew it as required. The renewal process usually involves paying a fee and confirming that your business information remains accurate.

Common Challenges in Obtaining a Business License

Obtaining a business license in California can sometimes feel like a daunting process. While the steps may seem straightforward, many business owners encounter challenges along the way. From unclear requirements to unexpected delays, knowing what to expect can help you navigate these obstacles more smoothly.

One common challenge is understanding which licenses and permits you need. With varying requirements depending on your business type, location, and industry, figuring out what applies to you can be confusing. Some businesses might need multiple licenses, and missing one can cause delays.

Another hurdle is gathering all the necessary documents. Depending on the type of license, you may need to provide proof of insurance, zoning approval, or other certifications. Missing paperwork can slow down the application process.

Additionally, processing times can vary significantly. Some cities and counties take longer than others to review and approve applications, especially during peak seasons. If you’re on a tight deadline, these delays can be frustrating.

For some industries, regulations change frequently, and keeping up with these updates can be challenging. Staying informed about changes in licensing requirements can prevent potential roadblocks in your application process.

Despite these challenges, being prepared and proactive can help you overcome obstacles when applying for your business license in California.

Renewing and Maintaining a California Business License

Once you’ve obtained your business license, the work doesn’t stop there. Keeping your business license up to date is essential for staying compliant with California law. Failing to renew it on time can result in penalties or even the suspension of your business activities.

Most California business licenses need to be renewed annually, although the exact renewal period can vary by location and industry. Cities and counties will typically send you a renewal notice, but it’s important not to rely solely on these reminders. Mark your calendar to stay ahead of deadlines.

The renewal process usually involves confirming that your business details are still accurate. You’ll need to submit updated information if anything has changed, such as your business address or ownership details. In some cases, you may need to provide additional documents or pay a renewal fee.

For businesses operating in regulated industries, maintaining your license might also require periodic inspections or adherence to specific compliance standards. For example, restaurants may need regular health inspections to maintain their operational permits.

Maintaining an active and valid business license ensures your business continues to operate legally, avoids fines, and keeps your operations running smoothly.

Penalties for Operating Without a Proper License

Operating a business without the proper license in California can lead to significant consequences. Whether intentional or accidental, failure to comply with licensing regulations can harm your business financially and legally.

The penalties for not having the correct license can include fines, which vary depending on the type of business and the length of time you’ve been operating without a license. In some cases, fines can accumulate quickly, leading to substantial costs that may be difficult for small businesses to manage.

Beyond financial penalties, running a business without the appropriate license can result in the suspension or closure of your business. Local authorities may issue a cease-and-desist order, which forces you to stop all operations until you obtain the correct licensing. This can disrupt your business and lead to loss of revenue and reputation.

In extreme cases, continued non-compliance can lead to criminal charges, especially if your business is found to be engaging in illegal activities or violating health and safety regulations.

To avoid these penalties, it’s crucial to ensure that your business is properly licensed and that all necessary permits are in place. Regularly review your licenses to make sure they are up to date and comply with any changes in local or state regulations.

FAQ: Answers to Common Questions About Business Licensing in California

When it comes to business licensing in California, there are many questions that business owners frequently ask. Below, we’ll address some of the most common ones to help you better understand the process.

1. Do all businesses in California need a business license?

Yes, nearly all businesses in California require some form of business license. Whether you operate a physical storefront, an online business, or even a home-based business, you will likely need a general business license from your local city or county. Certain professions and industries may also require additional permits or professional licenses.

2. How much does it cost to get a business license in California?

The cost of obtaining a business license varies depending on the city or county where your business is located. Fees can range from as low as $50 to several hundred dollars, depending on the size and type of your business. Additionally, some industries may require more expensive specialized licenses.

3. How long does it take to get a business license?

The time it takes to get a business license in California varies by location and type of license. In some areas, you can get a general business license within a few days, while others may take several weeks, especially if additional permits or inspections are required.

4. Can I operate my business while waiting for my license?

In most cases, you should wait until you receive your business license before starting operations. Operating without a license can lead to penalties, even if your application is pending.

5. What happens if I move my business to a new location?

If you move your business, you will likely need to update your business license with the new address. Some cities may require you to apply for a new license entirely, while others may allow you to transfer your existing license to the new location.

Conclusion on Navigating California’s Business Licensing Process

Navigating the business licensing process in California can seem complicated, but understanding the requirements and taking a proactive approach will ensure your business remains compliant. With the right knowledge and preparation, you can avoid potential delays, penalties, and keep your operations running smoothly. Remember to stay on top of renewals and any updates to regulations that may affect your business.